基于ATR的多重趋势跟踪策略与止盈止损优化系统

Author: ChaoZhang, Date: 2024-11-12 16:14:11Tags: ATRSMATP/SLOHLCMA

概述

本策略是一个基于平均真实波幅(ATR)指标的趋势跟踪交易系统,通过动态计算价格波动范围来识别市场趋势,并结合自适应的止盈止损机制进行风险管理。策略采用多周期分析方法,通过ATR乘数动态调整交易信号的触发条件,实现对市场波动的精确跟踪。

策略原理

策略核心基于ATR指标的动态计算,通过设定的周期参数(默认10期)计算市场真实波幅。使用ATR乘数(默认3.0)构建上下轨道线,当价格突破轨道线时触发交易信号。具体包括: 1. 使用SMA或标准ATR计算波幅基准 2. 动态计算上下轨道线作为趋势跟踪基准 3. 通过价格与轨道线的交叉确定趋势方向 4. 在趋势转换点位触发交易信号 5. 实现基于百分比的动态止盈止损系统

策略优势

- 自适应性强:通过ATR动态调整对市场波动的反应

- 风险可控:内置百分比止盈止损机制,有效控制每笔交易风险

- 参数灵活:关键参数如ATR周期、乘数等可根据市场特征调整

- 视觉清晰:提供完善的图形界面,包括趋势标记和信号提示

- 时间管理:支持自定义交易时间窗口,提高策略适用性

策略风险

- 趋势反转风险:在震荡市场可能产生频繁假信号

- 参数敏感性:ATR周期和乘数的选择对策略表现影响较大

- 市场环境依赖:在高波动期间可能出现滑点较大的情况

- 止损设置:固定百分比止损可能不适合所有市场条件

策略优化方向

- 引入多重时间框架分析,提高趋势判断准确性

- 添加成交量指标确认,增强信号可靠性

- 开发自适应止盈止损机制,根据市场波动动态调整

- 增加趋势强度过滤器,减少假信号

- 结合波动率指标优化入场时机

总结

这是一个设计完善的趋势跟踪策略,通过ATR指标实现对市场波动的精确跟踪,并结合止盈止损机制进行风险管理。策略的优势在于其适应性强、风险可控,但仍需注意市场环境对策略表现的影响。通过建议的优化方向,策略的稳定性和盈利能力有望进一步提升。

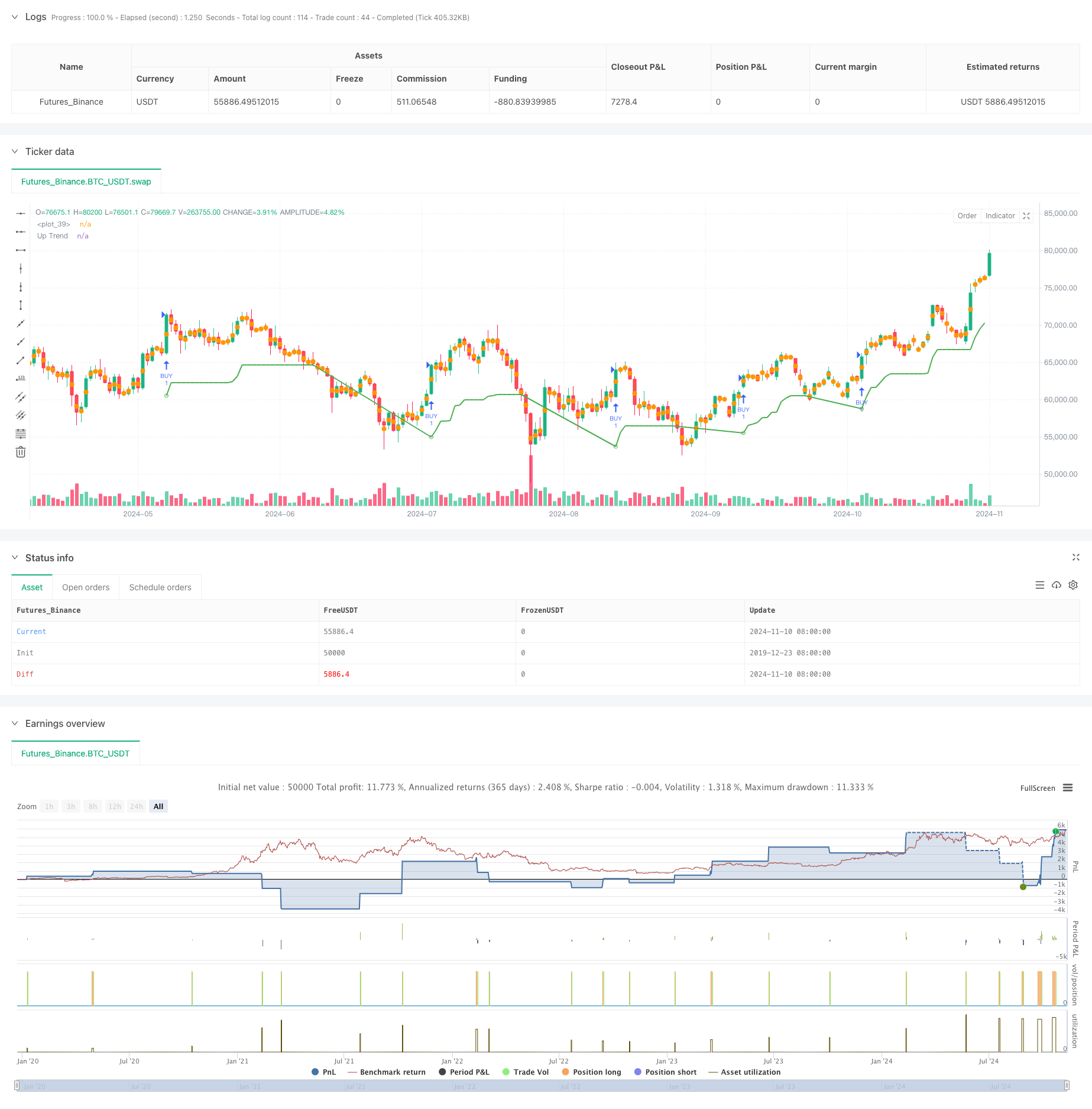

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Custom Buy BID Strategy", overlay=true, shorttitle="Buy BID by MR.STOCKVN")

// Cài đặt chỉ báo

Periods = input.int(title="ATR Period", defval=10)

src = input.source(hl2, title="Source")

Multiplier = input.float(title="ATR Multiplier", step=0.1, defval=3.0)

changeATR = input.bool(title="Change ATR Calculation Method?", defval=true)

showsignals = input.bool(title="Show Buy Signals?", defval=false)

highlighting = input.bool(title="Highlighter On/Off?", defval=true)

barcoloring = input.bool(title="Bar Coloring On/Off?", defval=true)

// Tính toán ATR

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

// Tính toán mức giá mua bán dựa trên ATR

up = src - (Multiplier * atr)

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + (Multiplier * atr)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Vẽ xu hướng

upPlot = plot(trend == 1 ? up : na, title="Up Trend", style=plot.style_line, linewidth=2, color=color.green)

buySignal = trend == 1 and trend[1] == -1

// Hiển thị tín hiệu mua

plotshape(buySignal ? up : na, title="UpTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(buySignal and showsignals ? up : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

// Cài đặt màu cho thanh nến

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? (trend == 1 ? color.green : color.white) : color.white

fill(mPlot, upPlot, title="UpTrend Highlighter", color=longFillColor)

// Điều kiện thời gian giao dịch

FromMonth = input.int(defval=9, title="From Month", minval=1, maxval=12)

FromDay = input.int(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input.int(defval=2018, title="From Year", minval=999)

ToMonth = input.int(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input.int(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input.int(defval=9999, title="To Year", minval=999)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

// Cửa sổ thời gian giao dịch

window() => (time >= start and time <= finish)

// Điều kiện vào lệnh Buy

longCondition = buySignal

if (longCondition)

strategy.entry("BUY", strategy.long, when=window())

// Điều kiện chốt lời và cắt lỗ có thể điều chỉnh

takeProfitPercent = input.float(5, title="Take Profit (%)") / 100

stopLossPercent = input.float(2, title="Stop Loss (%)") / 100

// Tính toán giá trị chốt lời và cắt lỗ dựa trên giá vào lệnh

if (strategy.position_size > 0)

strategy.exit("Take Profit", "BUY", limit=strategy.position_avg_price * (1 + takeProfitPercent), stop=strategy.position_avg_price * (1 - stopLossPercent))

// Màu nến theo xu hướng

buy1 = ta.barssince(buySignal)

color1 = buy1[1] < na ? color.green : na

barcolor(barcoloring ? color1 : na)

相关内容

- 均线,简单移动平均线,均线斜率,追踪止损,重新进场

- 动态ATR止盈止损移动均线交叉策略

- 动态波动率指标(VIDYA)结合ATR趋势跟踪反转策略

- 三重探底反弹突破动量策略

- 基于ATR波动率和均线的自适应趋势跟踪退出策略

- 早晨蜡烛突破与反转策略

- 高低突破策略结合Alpha趋势和移动平均线过滤

- 双指标动量趋势量化策略系统

- 双均线交叉自适应动态止盈止损策略

- 动态均线交叉趋势跟踪策略结合ATR风险管理系统

更多内容

- 双均线交叉自适应动态止盈止损策略

- 双平台对冲平衡策略

- 双均线交叉动态止盈止损量化策略

- 多重均线趋势强度捕捉与波动获利策略

- 多策略自适应趋势跟踪与突破交易系统

- 多级均线结合蜡烛图形态识别交易系统

- 多周期均线趋势动量跟踪交易策略

- 智能时间周期多空轮动均衡交易策略

- MACD动态趋势量化交易策略进阶版

- 趋势突破交易系统(移动平均线突破策略)

- 基于 RSI 动量和多层级止盈止损的智能自适应交易系统

- 自适应RSI震荡阈值动态交易策略

- RSI与AO协同趋势追踪型量化交易策略

- 适应性趋势动量RSI策略结合均线过滤系统

- 双均线交叉RSI动量策略与风险收益优化系统

- 多重指标交叉动态策略系统:基于EMA、RVI和交易信号的量化交易模型

- RSI动态区间反转量化策略与波动率优化模型

- 布林带动量趋势跟踪量化策略

- 多周期技术分析与市场情绪结合的交易策略

- 基于123点位反转的动态持仓期策略