自适应RSI震荡阈值动态交易策略

Author: ChaoZhang, Date: 2024-11-12 16:07:32Tags: RSIATRBATLRSD

概述

该策略是一个基于RSI(相对强弱指标)的自适应交易系统,通过动态调整超买超卖阈值来优化交易信号的生成。策略的核心创新在于引入了Bufi自适应阈值(BAT)方法,该方法根据市场趋势和价格波动性动态调整RSI的触发阈值,从而提高了传统RSI策略的有效性。

策略原理

策略的核心是将传统固定阈值RSI系统升级为动态阈值系统。具体实现方式如下: 1. 使用短周期RSI计算市场超买超卖状态 2. 通过线性回归计算价格趋势斜率 3. 利用标准差衡量价格波动程度 4. 将趋势和波动信息整合,动态调整RSI阈值 5. 在上升趋势中提高阈值,下降趋势中降低阈值 6. 当价格偏离均值较大时降低阈值敏感度

策略还包含两个风险控制机制: - 固定周期平仓机制 - 最大损失止损机制

策略优势

- 动态适应性强:

- 能够根据市场状态自动调整交易阈值

- 避免在不同市场环境下使用固定参数的弊端

- 风险控制完善:

- 设有最大持仓时间限制

- 包含资金止损保护机制

- 使用百分比仓位管理

- 信号质量提升:

- 减少震荡市场的假信号

- 提高趋势市场的捕获能力

- 平衡了灵敏度和稳定性

策略风险

- 参数敏感性:

- BAT系数的选择影响策略表现

- RSI周期设置需要充分测试

- 自适应长度参数需要优化

- 市场环境依赖:

- 在高波动市场可能错失机会

- 剧烈波动时止损可能滑点较大

- 需要根据不同市场调整参数

- 技术局限性:

- 依赖历史数据计算阈值

- 可能存在滞后性

- 需要考虑交易成本影响

策略优化方向

- 参数优化:

- 引入自适应参数选择机制

- 根据不同市场周期动态调整参数

- 增加参数自动优化功能

- 信号优化:

- 结合其他技术指标验证

- 添加市场周期识别功能

- 优化入场时机判断

- 风险控制优化:

- 引入动态止损机制

- 优化仓位管理策略

- 增加回撤控制机制

总结

这是一个创新性的自适应交易策略,通过动态阈值优化解决了传统RSI策略的局限性。策略综合考虑了市场趋势和波动性,具有较强的适应性和风险控制能力。虽然存在参数优化等挑战,但通过持续改进和优化,该策略有望在实际交易中取得稳定表现。建议交易者在实盘使用前进行充分的回测和参数优化,并根据具体市场特点进行适当调整。

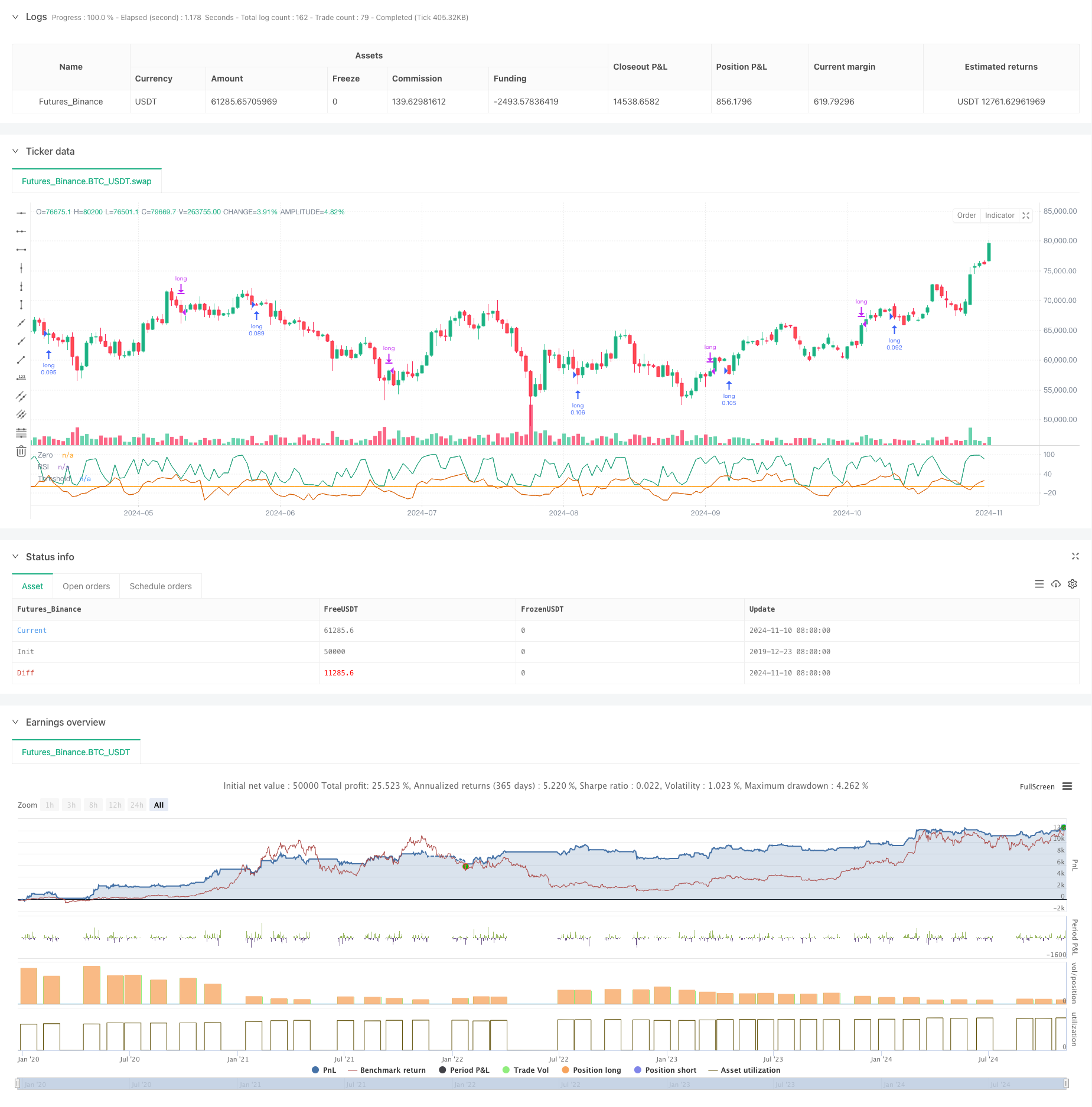

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PineCodersTASC

// TASC Issue: October 2024

// Article: Overbought/Oversold

// Oscillators: Useless Or Just Misused

// Article By: Francesco P. Bufi

// Language: TradingView's Pine Script™ v5

// Provided By: PineCoders, for tradingview.com

//@version=5

title ='TASC 2024.10 Adaptive Oscillator Threshold'

stitle = 'AdapThrs'

strategy(title, stitle, false, default_qty_type = strategy.percent_of_equity,

default_qty_value = 10, slippage = 5)

// --- Inputs ---

string sys = input.string("BAT", "System", options=["Traditional", "BAT"])

int rsiLen = input.int(2, "RSI Length", 1)

int buyLevel = input.int(14, "Buy Level", 0)

int adapLen = input.int(8, "Adaptive Length", 2)

float adapK = input.float(6, "Adaptive Coefficient")

int exitBars = input.int(28, "Fixed-Bar Exit", 1, group = "Strategy Settings")

float DSL = input.float(1600, "Dollar Stop-Loss", 0, group = "Strategy Settings")

// --- Functions ---

// Bufi's Adaptive Threshold

BAT(float price, int length) =>

float sd = ta.stdev(price, length)

float lr = ta.linreg(price, length, 0)

float slope = (lr - price[length]) / (length + 1)

math.min(0.5, math.max(-0.5, slope / sd))

// --- Calculations ---

float osc = ta.rsi(close, rsiLen)

// Strategy entry rules

// - Traditional system

if sys == "Traditional" and osc < buyLevel

strategy.entry("long", strategy.long)

// - BAT system

float thrs = buyLevel * adapK * BAT(close, adapLen)

if sys == "BAT" and osc < thrs

strategy.entry("long", strategy.long)

// Strategy exit rules

// - Fixed-bar exit

int nBar = bar_index - strategy.opentrades.entry_bar_index(0)

if exitBars > 0 and nBar >= exitBars

strategy.close("long", "exit")

// - Dollar stop-loss

if DSL > 0 and strategy.opentrades.profit(0) <= - DSL

strategy.close("long", "Stop-loss", immediately = true)

// Visuals

rsiColor = #1b9e77

thrsColor = #d95f02

rsiLine = plot(osc, "RSI", rsiColor, 1)

thrsLine = plot(sys == "BAT" ? thrs : buyLevel, "Threshold", thrsColor, 1)

zeroLine = plot(0.0, "Zero", display = display.none)

fill(zeroLine, thrsLine, sys == "BAT" ? thrs : buyLevel, 0.0, color.new(thrsColor, 60), na)

相关内容

- 多重指标智能金字塔策略

- 多重技术指标动态适应性交易策略(MTDAT)

- 双时间周期超趋势RSI智能交易策略

- RSI趋势反转策略

- 基于ATR止损和交易区间控制的RSI趋势反转交易策略

- 双时间周期超级趋势与RSI策略优化系统

- 基于布林带和RSI交叉的动态趋势量化策略

- 多重动量线性回归交叉策略

- RSI-ATR动量波动组合交易策略

- 多层级动态趋势跟随系统

更多内容

- 双均线交叉动态止盈止损量化策略

- 多重均线趋势强度捕捉与波动获利策略

- 多策略自适应趋势跟踪与突破交易系统

- 多级均线结合蜡烛图形态识别交易系统

- 多周期均线趋势动量跟踪交易策略

- 智能时间周期多空轮动均衡交易策略

- MACD动态趋势量化交易策略进阶版

- 趋势突破交易系统(移动平均线突破策略)

- 基于ATR的多重趋势跟踪策略与止盈止损优化系统

- 基于 RSI 动量和多层级止盈止损的智能自适应交易系统

- RSI与AO协同趋势追踪型量化交易策略

- 适应性趋势动量RSI策略结合均线过滤系统

- 双均线交叉RSI动量策略与风险收益优化系统

- 多重指标交叉动态策略系统:基于EMA、RVI和交易信号的量化交易模型

- RSI动态区间反转量化策略与波动率优化模型

- 布林带动量趋势跟踪量化策略

- 多周期技术分析与市场情绪结合的交易策略

- 基于123点位反转的动态持仓期策略

- 多重技术指标交叉动量量化交易策略-基于EMA、RSI和ADX的整合分析

- 抛物线SAR指标背离交易策略