কে-লাইনের উপর ভিত্তি করে দ্বি-মুখী যুগান্তকারী ট্রেডিং কৌশল

ওভারভিউ

এটি একটি K-লাইন ভিত্তিক দ্বি-মুখী ব্রেকিং ট্রেডিং কৌশল। এটি একটি ট্রেডিং সংকেত তৈরি করে যখন বর্তমান K-লাইন বন্ধের দাম পূর্ববর্তী দুটি K-লাইনের সর্বোচ্চ এবং সর্বনিম্ন মূল্যের সাথে সম্পর্কিত হয়।

কৌশল নীতি

এই কৌশলটির মূল যুক্তি হল:

বোর সিগন্যালের সংজ্ঞাঃ

bull = close > open and close > math.max(close[2], open[2]) and low[1] < low[2] and high[1] < high[2]অর্থাৎ, বর্তমান K লাইনের বন্ধের মূল্য খোলা মূল্যের চেয়ে বড় এবং পূর্ববর্তী দুটি K লাইনের সর্বোচ্চ মূল্যের চেয়ে বড়, এবং বর্তমান K লাইনের সর্বনিম্ন মূল্য পূর্ববর্তী একটি K লাইনের সর্বনিম্ন মূল্যের চেয়ে কম।বিয়ার সিগন্যালের সংজ্ঞাঃ

bear = close < open and close < math.min(close[2], open[2]) and low[1] > low[2] and high[1] > high[2]অর্থাৎ, বর্তমান K লাইনের বন্ধের মূল্য খোলার মূল্যের চেয়ে কম এবং পূর্ববর্তী দুটি K লাইনের সর্বনিম্ন মূল্যের চেয়ে কম, এবং বর্তমান K লাইনের সর্বোচ্চ মূল্য পূর্ববর্তী একটি K লাইনের সর্বোচ্চ মূল্যের চেয়ে বেশি।যখন ষাঁড়ের সংকেত দেওয়া হয়, তখন বেশি কাজ করুন; যখন ভাল্লুকের সংকেত দেওয়া হয়, তখন খালি করুন।

স্টপ লস এবং স্টপ স্টপ সেট করা যায়।

এই কৌশলটি দ্বি-দিকের ব্রেকিংয়ের বৈশিষ্ট্য ব্যবহার করে, যা মূল মূল্যের ব্যাপ্তিকে ভেঙে ট্রেন্ডের পরিবর্তনের বিচার করে, যার ফলে একটি ট্রেডিং সিগন্যাল তৈরি হয়।

সামর্থ্য বিশ্লেষণ

এটি একটি অপেক্ষাকৃত সহজ এবং স্বজ্ঞাত কৌশল যা নিম্নলিখিত সুবিধাগুলি নিয়ে আসেঃ

এটা খুবই সহজ, সহজেই বোঝা যায়, এবং বাস্তবায়ন করা যায়।

ট্রেডিং সিগন্যালের মধ্যে ব্রেকিং একটি সাধারণ ট্রেডিং সিগন্যাল, যা প্রবণতা তৈরি করতে পারে।

একই সময়ে, আপনি আরও কভারেজ করতে পারেন, যা আপনার ট্রেডিংকে দ্বি-মুখী করে তোলে এবং আপনার লাভের সম্ভাবনা বাড়ায়।

নমনীয়ভাবে স্টপ লস স্টপ সেট করুন এবং ঝুঁকি নিয়ন্ত্রণ করুন।

ঝুঁকি বিশ্লেষণ

এই কৌশলটির কিছু ঝুঁকিও রয়েছেঃ

এই দুই ধরনের লেনদেনের ঝুঁকি অনেক বেশি এবং এগুলোর উপর নজরদারি প্রয়োজন।

এদিকে, বিক্ষোভকারীরা বলছেন যে, এই ধরনের হামলার ফলে ভুয়া সংকেত তৈরি হতে পারে।

প্যারামিটার সেটিং ভুল হলে, এটি অতিরিক্ত লেনদেন হতে পারে।

স্টপ লস ফ্রিজের ভুল সেটআপও মুনাফা অর্জনের সুযোগকে প্রভাবিত করে।

প্যারামিটারগুলিকে অপ্টিমাইজ করা যায়, ঝুঁকি হ্রাস করার জন্য উপযুক্ত জাতগুলি নির্বাচন করা যায়।

অপ্টিমাইজেশান দিক

এই কৌশলটি নিম্নলিখিত দিকগুলি থেকে উন্নত করা যেতে পারেঃ

অপ্টিমাইজেশান প্যারামিটার, যেমন ব্রেক-আউট প্যারামিটার, স্টপ-ডোজ স্টপ-এম্পিরিটি ইত্যাদি।

এফআইআর-এর মাধ্যমে, আপনি আপনার অ্যাকাউন্টের নাম পরিবর্তন করতে পারবেন এবং আপনার অ্যাকাউন্টের নাম পরিবর্তন করতে পারবেন।

প্রবণতা সূচকগুলির সাথে একত্রিত করে, ডাইভারশন পরিসীমা এড়ানো।

তহবিল ব্যবস্থাপনা অপ্টিমাইজ করা, পজিশন অ্যালগরিদম উন্নত করা।

বিভিন্ন জাতের জন্য বিভিন্ন পরামিতি রয়েছে, যা পৃথকভাবে পরীক্ষিত এবং অপ্টিমাইজ করা যায়।

সারসংক্ষেপ

এটি একটি সহজ কৌশল যা দ্বিমুখী চিন্তাধারার উপর ভিত্তি করে তৈরি করা হয়েছে। এটির সুস্পষ্টতা এবং সহজ বাস্তবায়নের সুবিধাগুলি রয়েছে, তবে এটির কিছু নজরদারি ঝুঁকিও রয়েছে। প্যারামিটার এবং শর্তাদির অপ্টিমাইজেশনের মাধ্যমে এটি আরও ভাল কৌশলগত ফলাফল অর্জন করতে পারে।

/*backtest

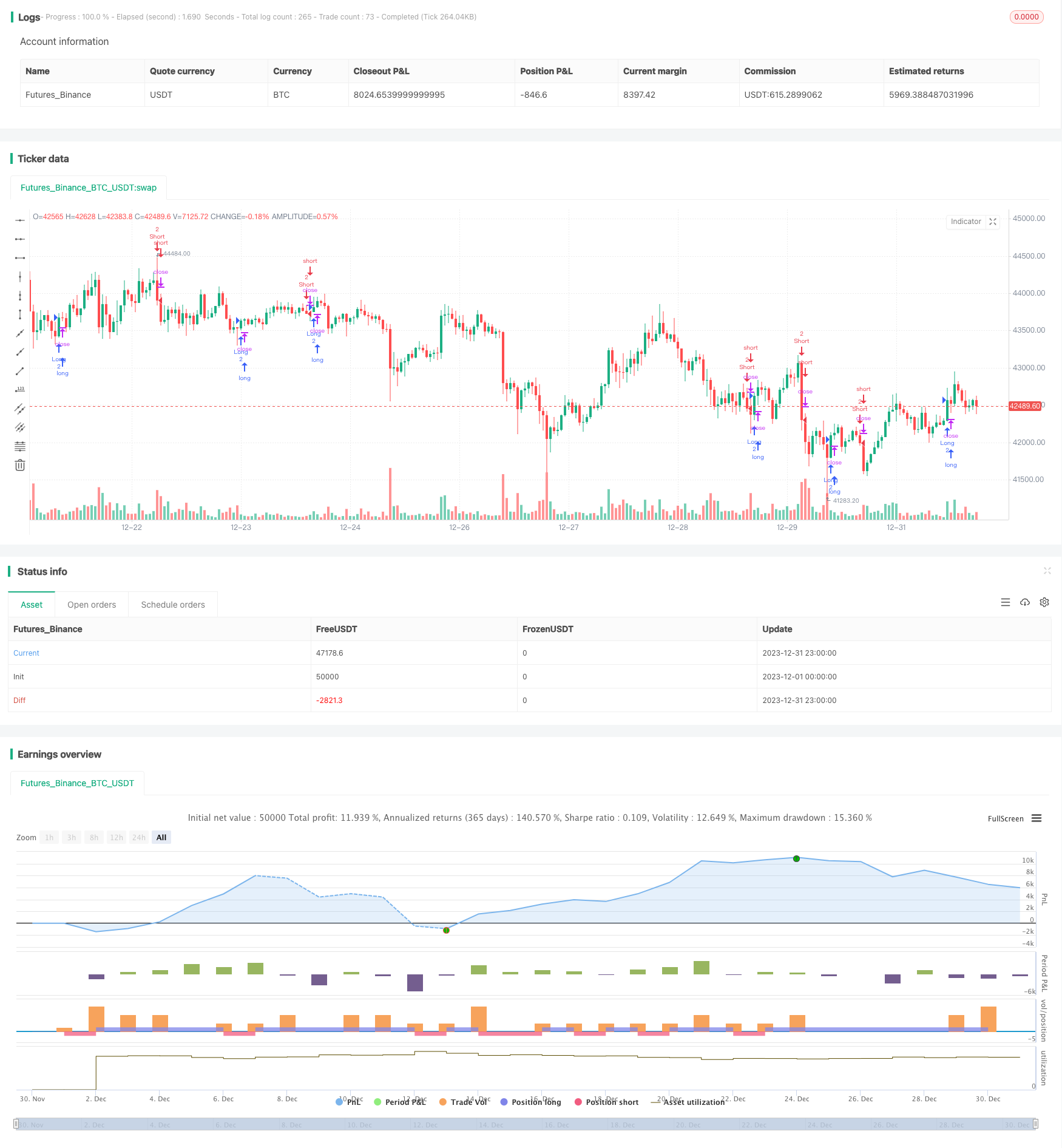

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// # ========================================================================= #

// # | Strategy |

// # ========================================================================= #

SystemName = "Strategy Template Autoview"

TradeId = "S"

// These values are used both in the strategy() header and in the script's relevant inputs as default values so they match.

// Unless these values match in the script's Inputs and the TV backtesting Properties, results between them cannot be compared.

InitCapital = 1000000

InitPosition = 2

InitCommission = 0.075

InitPyramidMax = 1

CalcOnorderFills = false

ProcessOrdersOnClose = true // display the signals one candle earlier

CalcOnEveryTick = true // forward testing

//CloseEntriesRule = "ANY"

strategy(title=SystemName, shorttitle=SystemName,

overlay=true, pyramiding=InitPyramidMax, initial_capital=InitCapital, default_qty_type=strategy.fixed, process_orders_on_close=ProcessOrdersOnClose,

default_qty_value=InitPosition, commission_type=strategy.commission.percent, commission_value=InitCommission, calc_on_order_fills=CalcOnorderFills,

calc_on_every_tick=CalcOnEveryTick,

precision=6, max_lines_count=500, max_labels_count=500)

// # ========================================================================= #

// # ========================================================================= #

// # || Alerts ||

// # ========================================================================= #

// # ========================================================================= #

show_alerts_debug = input.bool(true, title = "Show Alerts Debug Label?", group = "Debug")

//i_alert_txt_entry_long = input.text_area(defval = "", title = "Long Entry Message", group = "Alerts")

//i_alert_txt_entry_short = input.text_area(defval = "", title = "Short Entry Message", group = "Alerts")

//i_alert_txt_exit_long = input.text_area(defval = "", title = "Long Exit Message", group = "Alerts")

//i_alert_txt_exit_short = input.text_area(defval = "", title = "Short Exit Message", group = "Alerts")

i_broker_mode = input.string("DEMO", title = "Use Demo or Live Broker", options=["DEMO", "LIVE"], group = "Automation")

i_broker_name = input.string("Tradovate", title = "Broker Name", options=["Tradovate", "AscendEX", "Binance", "Binance Futures", "Binance US", "Binance Delivery", "Kraken", "Deribit", "Poloniex", "Okcoin", "Bitfinex", "Oanda", "Kucoin", "Okex", "Bybit", "FTX", "Bitmex", "Alpaca", "Gemini"], group = "Automation")

i_enable_trades = input.bool(true, title = "Enable trades?", group = "Automation", tooltip = "If not enabled, disables live trades, but more importantly, it will output what Autoview is going to do when you go live.")

i_account_name = input.string("*", title = "Account Name", group = "Automation")

i_symbol_name = input.string("btcusd_perp", title = "Symbol Name", group = "Automation")

nb_contracts = input.int(2, title = "Nb Contracts", group = "Automation")

use_delay = input.bool(false, title = "Use Delay between orders", group = "Automation", inline = "delay")

i_delay_qty = input.int(1, title = "Delay in seconds", group = "Automation", inline = "delay")

i_use_borrow_repay = input.bool(false, title = "Use Borrow/Repay Mode?", group = "Binance Automation")

i_asset_borrow_repay = input.string("BTC", title = "Asset to Borrow/Repay", group = "Binance Automation")

i_qty_borrow_repay = input.float(1., title = "Quantity of assets to borrow?", group = "Binance Automation")

// # ========================================================================= #

// # ========================================================================= #

// # || Dates Range Filtering ||

// # ========================================================================= #

// # ========================================================================= #

DateFilter = input(false, "Date Range Filtering", group="Date")

// ————— Syntax coming from https://www.tradingview.com/blog/en/new-parameter-for-date-input-added-to-pine-21812/

i_startTime = input(defval = timestamp("01 Jan 2019 13:30 +0000"), title = "Start Time", group="Date")

i_endTime = input(defval = timestamp("30 Dec 2021 23:30 +0000"), title = "End Time", group="Date")

TradeDateIsAllowed() => true

// # ========================================================================= #

// # | Custom Exits |

// # ========================================================================= #

//use_custom_exit = input.bool(true, title = "Use Custom Exits?", group = "Custom Exits")

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

use_sl = input.string("None", title = "Select Stop Loss Mode", options=["None", "Percent", "Price"], group = "Stop Loss")

sl_input_perc = input.float(3, minval = 0, title = "Stop Loss (%)", group = "Stop Loss (%)") * 0.01

sl_input_pips = input.float(30, minval = 0, title = "Stop Loss (USD)", group = "Stop Loss (USD)")

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

use_tp = input.string("None", title = "Select Take Profit Mode", options=["None", "Percent", "Price"], group = "Take Profit")

tp_input_perc = input.float(3, minval = 0, title = "Take Profit (%)", group = "Take Profit (%)") * 0.01

tp_input_pips = input.float(30, minval = 0, title = "Take Profit (USD)", group = "Take Profit (USD)")

// # ========================================================================= #

// # | Consolidated Entries |

// # ========================================================================= #

bull = close > open and close > math.max(close[2], open[2]) and low[1] < low[2] and high[1] < high[2] // low < low[1] and low[1] < low[2]

bear = close < open and close < math.min(close[2], open[2]) and low[1] > low[2] and high[1] > high[2] // low < low[1] and low[1] < low[2]

// # ========================================================================= #

// # | Entry Price |

// # ========================================================================= #

entry_long_price = ta.valuewhen(condition=bull and strategy.position_size[1] <= 0, source=close, occurrence=0)

entry_short_price = ta.valuewhen(condition=bear and strategy.position_size[1] >= 0, source=close, occurrence=0)

var float entry_price = 0.

if bull

entry_price := entry_long_price

if bear

entry_price := entry_short_price

// # ========================================================================= #

// # || Global Trend Variables ||

// # ========================================================================= #

T1_sinceUP = ta.barssince(bull)

T1_sinceDN = ta.barssince(bear)

T1_nUP = ta.crossunder(T1_sinceUP,T1_sinceDN)

T1_nDN = ta.crossover(T1_sinceUP,T1_sinceDN)

T1_sinceNUP = ta.barssince(T1_nUP)

T1_sinceNDN = ta.barssince(T1_nDN)

T1_BuyTrend = T1_sinceDN > T1_sinceUP

T1_SellTrend = T1_sinceDN < T1_sinceUP

T1_SellToBuy = T1_BuyTrend and T1_SellTrend[1]

T1_BuyToSell = T1_SellTrend and T1_BuyTrend[1]

T1_ChangeTrend = T1_BuyToSell or T1_SellToBuy

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

var float final_SL_Long = 0.

var float final_SL_Short = 0.

if use_sl == "Percent"

final_SL_Long := entry_long_price * (1 - sl_input_perc)

final_SL_Short := entry_short_price * (1 + sl_input_perc)

else if use_sl == "Price"

final_SL_Long := entry_long_price - (sl_input_pips)

final_SL_Short := entry_short_price + (sl_input_pips)

plot(strategy.position_size > 0 and use_sl != "None" ? final_SL_Long : na, title = "SL Long", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 and use_sl != "None" ? final_SL_Short : na, title = "SL Short", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

var float final_TP_Long = 0.

var float final_TP_Short = 0.

if use_tp == "Percent"

final_TP_Long := entry_long_price * (1 + tp_input_perc)

final_TP_Short := entry_short_price * (1 - tp_input_perc)

else if use_tp == "Price"

final_TP_Long := entry_long_price + (tp_input_pips)

final_TP_Short := entry_short_price - (tp_input_pips)

plot(strategy.position_size > 0 and use_tp != "None" ? final_TP_Long : na, title = "TP Long", color = color.orange, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 and use_tp != "None" ? final_TP_Short : na, title = "TP Short", color = color.orange, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | AutoView Calls |

// # ========================================================================= #

float quantity = nb_contracts

string product_type_ticker = i_symbol_name

var string broker_mode = ""

if i_broker_mode == "DEMO"

broker_mode := switch i_broker_name

"Tradovate" => "tradovatesim"

"Ascendex" => "ascendex-sandbox"

"Binance Futures" => "binancefuturestestnet"

"Binance Delivery" => "binancedeliverytestnet"

"Oanda" => "oandapractice"

"Bitmex" => "bitmextestnet"

"Bybit" => "bybittestnet"

"Alpaca" => "alpacapaper"

"Kucoin" => "kucoinsandbox"

"Deribit" => "deribittestnet"

"Gemini" => "gemini-sandbox"

=> i_broker_name

else // "LIVE"

broker_mode := switch i_broker_name

"Tradovate" => "tradovate"

"Ascendex" => "ascendex"

"Binance Futures" => "binancefutures"

"Binance Delivery" => "binancedelivery"

"Binance" => "binance"

"Oanda" => "oanda"

"Kraken" => "kraken"

"Deribit" => "deribit"

"Bitfinex" => "bitfinex"

"Poloniex" => "poloniex"

"Bybit" => "bybit"

"Okcoin" => "okcoin"

"Kucoin" => "kucoin"

"FTX" => "ftx"

"Bitmex" => "bitmex"

"Alpaca" => "alpaca"

"Gemini" => "gemini"

=> i_broker_name

enable_trades = i_enable_trades ? "" : " d=1"

string delay_qty = use_delay ? " delay=" + str.tostring(i_delay_qty) : ""

i_alert_txt_entry_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=short c=position t=market" +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty

i_alert_txt_entry_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=long c=position t=market" +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty

var string temp_txt_SL_long = ""

var string temp_txt_SL_short = ""

var string temp_txt_TP_long = ""

var string temp_txt_TP_short = ""

if use_sl == "Percent"

temp_txt_SL_long := "sl=-" + str.tostring(sl_input_perc * 100) + "%"

temp_txt_SL_short := "sl=" + str.tostring(sl_input_perc * 100) + "%"

else if use_sl == "Price"

temp_txt_SL_long := "fsl=" + str.tostring(final_SL_Long)

temp_txt_SL_short := "fsl=" + str.tostring(final_SL_Short)

if use_tp == "Percent"

temp_txt_TP_long := "p=" + str.tostring(tp_input_perc * 100) + "%"

temp_txt_TP_short := "p=-" + str.tostring(tp_input_perc * 100) + "%"

else if use_tp == "Price"

temp_txt_TP_long := "fpx=" + str.tostring(final_TP_Long)

temp_txt_TP_short := "fpx=" + str.tostring(final_TP_Short)

i_alert_txt_exit_SL_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long c=position t=market " + temp_txt_SL_long + enable_trades

i_alert_txt_exit_SL_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short c=position t=market " + temp_txt_SL_short + enable_trades

i_alert_txt_exit_TP_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long c=position t=market " + temp_txt_TP_long + enable_trades

i_alert_txt_exit_TP_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short c=position t=market " + temp_txt_TP_short + enable_trades

string final_alert_txt_entry_long = i_alert_txt_entry_long

string final_alert_txt_entry_short = i_alert_txt_entry_short

if i_use_borrow_repay and i_broker_name == "Binance"

final_alert_txt_entry_long := "a=" + i_account_name + " e=" + broker_mode + "y=borrow w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=short c=position t=market" + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + "y=repay w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades

final_alert_txt_entry_short := "a=" + i_account_name + " e=" + broker_mode + "y=borrow w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=long c=position t=market" + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + "y=repay w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades

//i_alert_txt_entry_long := final_alert_txt_entry_long

//i_alert_txt_entry_short := final_alert_txt_entry_short

if show_alerts_debug and barstate.islastconfirmedhistory

var label lblTest = na

label.delete(lblTest)

string label_txt = i_alert_txt_entry_long

if use_sl != "None"

label_txt := label_txt + "\n" + i_alert_txt_exit_SL_long

if use_tp != "None"

label_txt := label_txt + "\n" + i_alert_txt_exit_TP_long

t = time + (time - time[1]) * 25

lblTest := label.new(

x = t,

y = ta.highest(50),

text = label_txt,

xloc = xloc.bar_time,

yloc = yloc.price,

color = color.new(color = color.gray, transp = 0),

style = label.style_label_left,

textcolor = color.new(color = color.white, transp = 0),

size = size.large

)

// # ========================================================================= #

// # | Strategy Calls and Alerts |

// # ========================================================================= #

if bull and TradeDateIsAllowed()

strategy.entry(id = "Long", direction = strategy.long, comment = "Long", alert_message = i_alert_txt_entry_long, qty = nb_contracts)

alert(i_alert_txt_entry_long, alert.freq_once_per_bar)

else if bear and TradeDateIsAllowed()

strategy.entry(id = "Short", direction = strategy.short, comment = "Short", alert_message = i_alert_txt_entry_short, qty = nb_contracts)

alert(i_alert_txt_entry_short, alert.freq_once_per_bar)

//quantity := quantity * 2

strategy.exit(id = "Exit Long", from_entry = "Long", stop = (use_sl != "None") ? final_SL_Long : na, comment_loss = "Long Exit SL", alert_loss = (use_sl != "None") ? i_alert_txt_exit_SL_long : na, limit = (use_tp != "None") ? final_TP_Long : na, comment_profit = "Long Exit TP", alert_profit = (use_tp != "None") ? i_alert_txt_exit_TP_long : na)

strategy.exit(id = "Exit Short", from_entry = "Short", stop = (use_sl != "None") ? final_SL_Short : na, comment_loss = "Short Exit SL", alert_loss = (use_sl != "None") ? i_alert_txt_exit_SL_short : na, limit = (use_tp != "None") ? final_TP_Short : na, comment_profit = "Short Exit TP", alert_profit = (use_tp != "None") ? i_alert_txt_exit_TP_short : na)

if strategy.position_size > 0 and low < final_SL_Long and use_sl != "None"

alert(i_alert_txt_exit_SL_long, alert.freq_once_per_bar)

else if strategy.position_size < 0 and high > final_SL_Short and use_sl != "None"

alert(i_alert_txt_exit_SL_short, alert.freq_once_per_bar)

if strategy.position_size > 0 and high > final_TP_Long and use_tp != "None"

alert(i_alert_txt_exit_TP_long, alert.freq_once_per_bar)

else if strategy.position_size < 0 and low < final_TP_Short and use_tp != "None"

alert(i_alert_txt_exit_TP_short, alert.freq_once_per_bar)

// # ========================================================================= #

// # | Reset Variables |

// # ========================================================================= #