Schriftsteller:ChaoZhang, Datum: 2024-01-25 12:54:16

Tags:

Tags:

Übersicht

Diese Strategie ist eine zusammengesetzte Strategie, die auf EMA-Differenz und MACD-Indikator für den kurzfristigen BTC-Handel basiert. Sie kombiniert die Signale von EMA und MACD, um Kauf- und Verkaufssignale unter bestimmten Bedingungen zu generieren.

Strategie Logik

Durch die Kombination der Signale sowohl von EMA Differenz als auch von MACD können einige gefälschte Signale herausgefiltert und die Zuverlässigkeit der Signale verbessert werden.

Analyse der Vorteile

- Verwendet zusammengesetzte Indikatoren, zuverlässigere Signale

- Hat Stop-Loss- und Take-Profit-Einstellungen zur Risikokontrolle

Risikoanalyse

- Der Stop-Loss kann während großer Marktschwankungen gebrochen werden

- Die Parameter müssen für verschiedene Marktbedingungen optimiert werden

- Wirkungen müssen auf verschiedenen Münzen und Börsen getestet werden

Optimierungsrichtlinien

- Ergänzung von Positionsgrößen und Pyramidenstrategien zur Verbesserung der Kapitaleffizienz

- Hinzufügen von Stop-Loss-Methoden wie Trailing-Stop-Loss, um Risiken zu reduzieren

- Testeffekte auf verschiedenen Börsen und Münzen

Schlussfolgerung

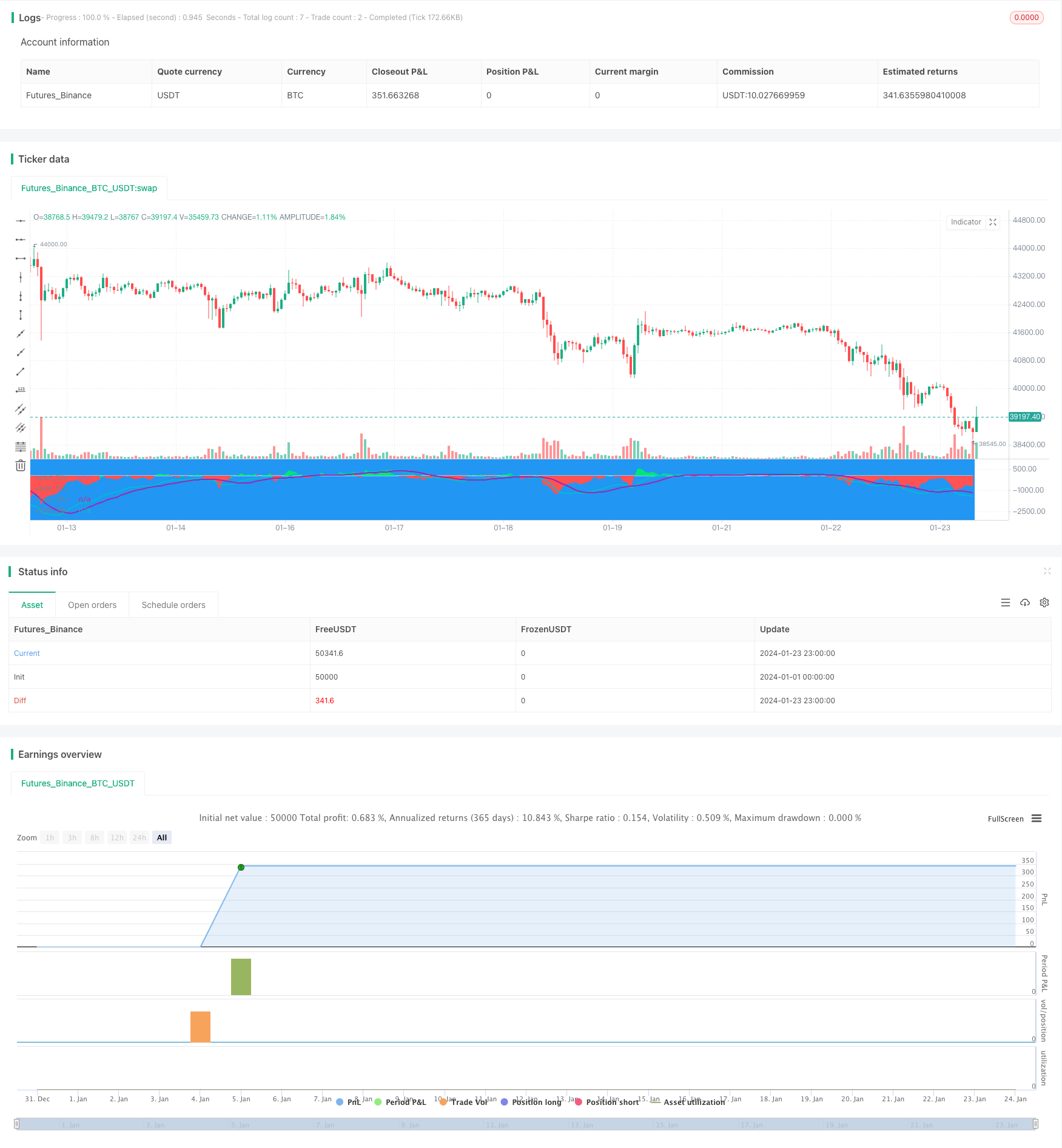

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("EMA50Diff & MACD Strategy", overlay=false)

EMA = input(18, step=1)

MACDfast = input(12)

MACDslow = input(26)

EMADiffThreshold = input(8)

MACDThreshold = input(80)

TargetValidityThreshold = input(65, step=5)

Target = input(120, step=5)

StopLoss = input(650, step=5)

ema = ema(close, EMA)

hl = plot(0, color=white, linewidth=1)

diff = close - ema

clr = color(blue, transp=100)

if diff>0

clr := lime

else

if diff<0

clr := red

fastMA = ema(close, MACDfast)

slowMA = ema(close, MACDslow)

macd = (fastMA - slowMA)*3

signal = sma(macd, 9)

plot(macd, color=aqua, linewidth=2)

plot(signal, color=purple, linewidth=2)

macdlong = macd<-MACDThreshold and signal<-MACDThreshold and crossover(macd, signal)

macdshort = macd>MACDThreshold and signal>MACDThreshold and crossunder(macd, signal)

position = 0.0

position := nz(strategy.position_size, 0.0)

long = (position < 0 and close < strategy.position_avg_price - TargetValidityThreshold and macdlong) or

(position == 0.0 and diff < -EMADiffThreshold and diff > diff[1] and diff[1] < diff[2] and macdlong)

short = (position > 0 and close > strategy.position_avg_price + TargetValidityThreshold and macdshort) or

(position == 0.0 and diff > EMADiffThreshold and diff < diff[1] and diff[1] > diff[2] and macdshort)

amount = (strategy.equity / close) //- ((strategy.equity / close / 10)%10)

bgclr = color(blue, transp=100) //#0c0c0c

if long

strategy.entry("long", strategy.long, amount)

bgclr := green

if short

strategy.entry("short", strategy.short, amount)

bgclr := maroon

bgcolor(bgclr, transp=20)

strategy.close("long", when=close>strategy.position_avg_price + Target)

strategy.close("short", when=close<strategy.position_avg_price - Target)

strategy.exit("STOPLOSS", "long", stop=strategy.position_avg_price - StopLoss)

strategy.exit("STOPLOSS", "short", stop=strategy.position_avg_price + StopLoss)

//plotshape(long, style=shape.labelup, location=location.bottom, color=green)

//plotshape(short, style=shape.labeldown, location=location.top, color=red)

pl = plot(diff, style=histogram, color=clr)

fill(hl, pl, color=clr)

Mehr

- Diese Strategie trifft Handelsentscheidungen basierend auf dem Trend des MACD Histogramms

- Momentum-Oszillator & 123 Musterstrategie

- Backteststrategie auf Basis des Fisher-Transformationsindikators

- Schwankungsspektrum gleitender Durchschnittshandelsstrategie

- Umkehrhandelsstrategie auf der Grundlage eines gleitenden Durchschnittsbereichs

- Kalman-Filter-basierte Trendverfolgungsstrategie

- Saisonumkehrung zwischenzeitliche Handelsstrategie

- Dual Exponential Moving Average Crossover Algorithmische Handelsstrategie

- Quantitative Handelsstrategie mit mehreren Faktoren

- Verzögerung der Handelsstrategie für die Nachverfolgung von Span 2-Linien

- Adaptiver Volatilitätsbruch

- Strategie zur Dynamikfindung

- Strategie zur Umkehrung der Piercing Pin Bar

- Nifty-Handelsstrategie auf Basis des RSI-Indikators

- RSI- und EMA-basierte Trendstrategie

- Trendbestätigungs-Verfolgungsstrategie

- Die Strategie für die RSI-Divergenzindikatoren

- Momentum Moving Average Konsolidierungsstrategie

- Schnelle QQE-Crossover-Handelsstrategie basierend auf dem Trendfilter