CVD-Divergenz-quantitative Handelsstrategie

Strategie im Überblick: Die CVD-Abweichungs-Quantitative-Trading-Strategie nutzt die CVD-Anzeige und die Abweichung der Preisbildung, um potenzielle Trendwende-Signale zu erfassen. Die Strategie berechnet die CVD-Anzeige und beurteilt, ob eine bullish oder bearish Abweichung gebildet wird, indem sie mit dem Preis verglichen wird.

Die Strategie:

- Berechnung des CVD-Wertes: Berechnung des CVD-Wertes und des Moving Averages anhand des Mehr- und des Leerhandels.

- Abweichungen erkennen: Vergleichen Sie die Höhe und Tiefe der CVD-Indikatoren mit den Höhe und Tiefe der Preise, um zu beurteilen, ob Abweichungen entstanden sind.

- Abweichung von der üblichen Sichtweise: Preisinnovation niedrig, aber die CVD-Indikatoren bilden einen höheren Tiefpunkt

- Verborgene Pessimisten abweichen: Preise sind innovativ hoch, aber die CVD-Indikatoren bilden niedrigere Tiefs

- Abweichung von den üblichen Beobachtungen: Preise sind neu hoch, aber die CVD-Indikatoren bilden niedrigere Höchststände

- Verborgener Rückgang: Preisinnovation niedrig, aber die CVD-Indikatoren bilden höhere Höhen

- Positionseröffnung: Wenn ein Abweichsignal erkannt wird, wird die Position nach Abweichungstyp über- oder leer gemacht.

- Stop-Loss-Stop: Verwendung von beweglichen Stop-Loss- und Fix-Prozent-Stop-Stops. Der Stop-Loss-Preis wird berechnet anhand des Eröffnungspreises multipliziert mit dem Stop-Loss-Prozent. Der Stop-Loss-Preis wird berechnet anhand des Eröffnungspreises multipliziert mit dem Stopp-Prozent.

- Pyramiden: Die Strategie erlaubt Pyramiden mit maximal drei Positionen.

Strategische Vorteile:

- Trendwechselsignal: Die CVD-Abweichung ist ein wirksames Trendwechselsignal, das dazu beiträgt, eine Trendwechselchance zu erfassen.

- Trend-Fortsetzung-Signal: Verborgene Abweichungen können als Trend-Fortsetzung-Signal dienen und helfen, die Strategie in der richtigen Richtung im Trend zu halten.

- Risikokontrolle: Die Verwendung von mobilen Stop-Loss- und Fix-Prozent-Stopps ermöglicht eine effektive Risikokontrolle.

- Pyramide-Haufen: Ermöglicht es, viele Positionen zu erhöhen, um Trends besser zu nutzen.

Strategische Risiken:

- Signalwirksamkeit: Abweichende Signale sind nicht vollständig zuverlässig, manchmal gibt es falsche Signale.

- Parameterkonfiguration: Strategieergebnisse sind auf Parameter-Einstellungen empfindlich, wobei unterschiedliche Parameter unterschiedliche Ergebnisse ergeben können.

- Stop-Loss-Slipping-Punkt: In extremen Situationen kann ein Stop-Loss-Order nicht zum Standardpreis ausgeführt werden, was zusätzliche Risiken mit sich bringt.

- Handelskosten: Häufige Off-Positions können zu hohen Handelskosten führen, die sich auf die strategischen Erträge auswirken.

Optimierung:

- Dynamische Parameteroptimierung: Anpassung von Parametern an unterschiedliche Marktbedingungen, um die Signalwirksamkeit zu verbessern.

- In Kombination mit anderen Indikatoren: In Kombination mit anderen technischen Indikatoren wie RSI, MACD usw. erhöht sich die Signalsicherheit.

- Verbesserte Stop-Loss-Strategie: Die Verwendung von erweiterten Stop-Loss-Strategien wie Tracking-Stops, Stop-Rate-Stops usw.

- Positionsgrößenverwaltung: Anpassung der Positionsgröße an die Dynamik der Marktfluktuation, des Kontobetrags usw.

Zusammenfassung: Die CVD-Abweichungs-Quantifizierungsstrategie identifiziert potenzielle Trendwende-Gelegenheiten, indem sie die Abweichung zwischen dem CVD-Indikator und dem Preis erfasst. Die Hauptvorteile der Strategie bestehen darin, dass sie Trendwende- und Fortsetzungssignale effektiv erfasst und die Trendlage durch Pyramidenpositionen besser erfasst. Die Strategie birgt jedoch auch Risiken wie Signalwirksamkeit, Parameterkonfiguration, Stop-Loss-Rutschpunkte und Handelsgebühren.

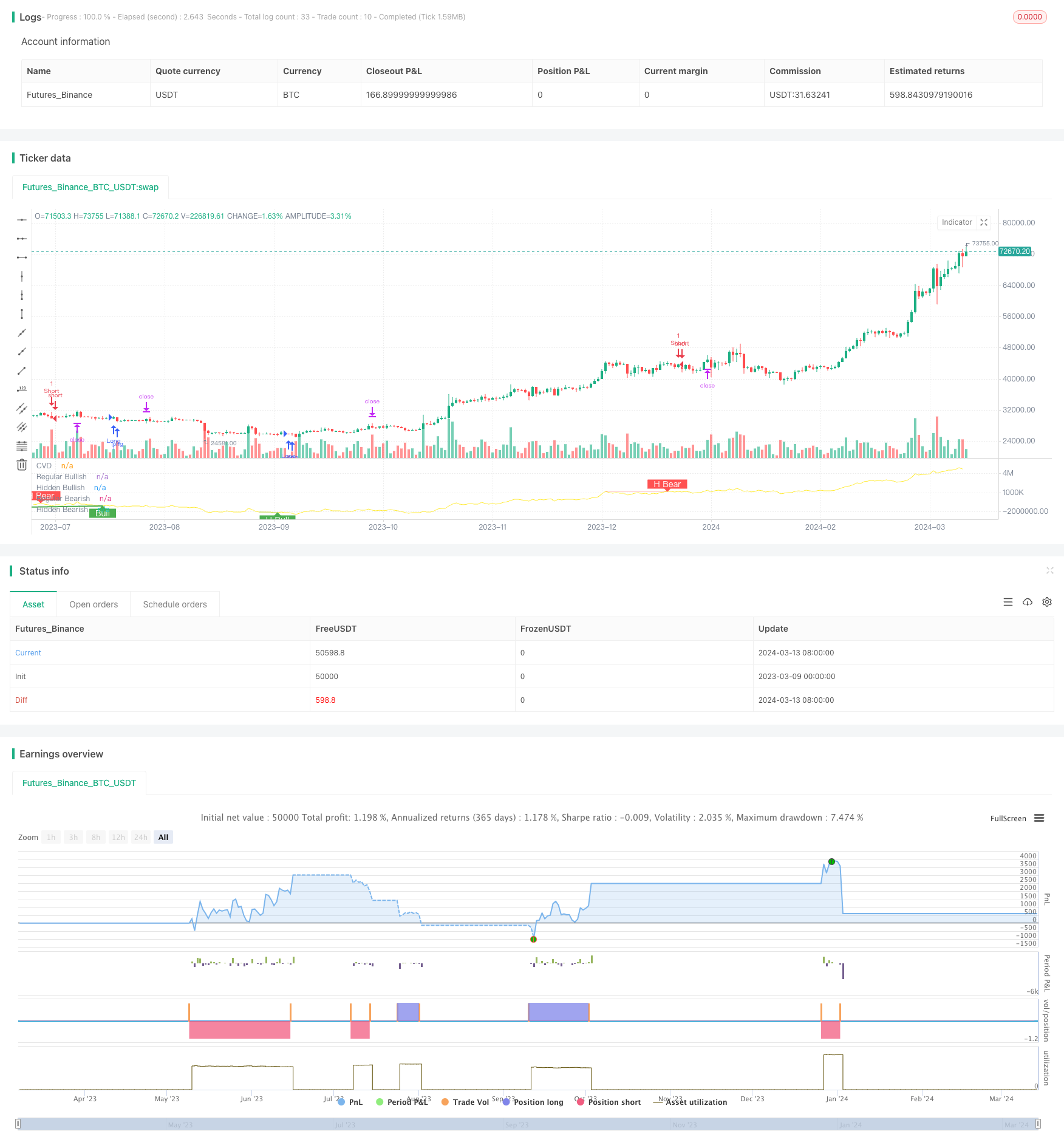

/*backtest

start: 2023-03-09 00:00:00

end: 2024-03-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//@ mmattman

//Thank you to @ contrerae and Tradingview each for parts of the code to make

//this indicator and matching strategy and also theCrypster for the clean concise TP/SL code.

// indicator(title="CVD Divergence Indicator 1", shorttitle='CVD Div1', format=format.price, timeframe="", timeframe_gaps=true)

strategy("CVD Divergence Strategy.1.mm", shorttitle = 'CVD Div Str 1', overlay=false)

//..................................................................................................................

// Inputs

periodMa = input.int(title='MA Length', minval=1, defval=20)

plotMa = input(title='Plot MA?', defval=false)

// Calculations (Bull & Bear Balance Indicator by Vadim Gimelfarb)

iff_1 = close[1] < open ? math.max(high - close[1], close - low) : math.max(high - open, close - low)

iff_2 = close[1] > open ? high - low : math.max(open - close[1], high - low)

iff_3 = close[1] < open ? math.max(high - close[1], close - low) : high - open

iff_4 = close[1] > open ? high - low : math.max(open - close[1], high - low)

iff_5 = close[1] < open ? math.max(open - close[1], high - low) : high - low

iff_6 = close[1] > open ? math.max(high - open, close - low) : iff_5

iff_7 = high - close < close - low ? iff_4 : iff_6

iff_8 = high - close > close - low ? iff_3 : iff_7

iff_9 = close > open ? iff_2 : iff_8

bullPower = close < open ? iff_1 : iff_9

iff_10 = close[1] > open ? math.max(close[1] - open, high - low) : high - low

iff_11 = close[1] > open ? math.max(close[1] - low, high - close) : math.max(open - low, high - close)

iff_12 = close[1] > open ? math.max(close[1] - open, high - low) : high - low

iff_13 = close[1] > open ? math.max(close[1] - low, high - close) : open - low

iff_14 = close[1] < open ? math.max(open - low, high - close) : high - low

iff_15 = close[1] > open ? math.max(close[1] - open, high - low) : iff_14

iff_16 = high - close < close - low ? iff_13 : iff_15

iff_17 = high - close > close - low ? iff_12 : iff_16

iff_18 = close > open ? iff_11 : iff_17

bearPower = close < open ? iff_10 : iff_18

// Calculations (Bull & Bear Pressure Volume)

bullVolume = bullPower / (bullPower + bearPower) * volume

bearVolume = bearPower / (bullPower + bearPower) * volume

// Calculations Delta

delta = bullVolume - bearVolume

cvd = ta.cum(delta)

cvdMa = ta.sma(cvd, periodMa)

// Plotting

customColor = cvd > cvdMa ? color.new(color.teal, 50) : color.new(color.red, 50)

plotRef1 = plot(cvd, style=plot.style_line, linewidth=1, color=color.new(color.yellow, 0), title='CVD')

plotRef2 = plot(plotMa ? cvdMa : na, style=plot.style_line, linewidth=1, color=color.new(color.white, 0), title='CVD MA')

fill(plotRef1, plotRef2, color=customColor)

//..................................................................................................................

// len = input.int(title="RSI Period", minval=1, defval=14)

// src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=3)

lbL = input(title="Pivot Lookback Left", defval=7)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=true)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = cvd

// plot(osc, title="CVD", linewidth=2, color=#2962FF)

// hline(50, title="Middle Line", color=#787B86, linestyle=hline.style_dotted)

// obLevel = hline(70, title="Overbought", color=#787B86, linestyle=hline.style_dotted)

// osLevel = hline(30, title="Oversold", color=#787B86, linestyle=hline.style_dotted)

// fill(obLevel, osLevel, title="Background", color=color.rgb(33, 150, 243, 90))

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

bullCondAlert = priceLL and oscHL and plFound

bullCond = plotBull and bullCondAlert

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor)

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCondAlert = priceHL and oscLL and plFound

hiddenBullCond = plotHiddenBull and hiddenBullCondAlert

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

bearCondAlert = priceHH and oscLH and phFound

bearCond = plotBear and bearCondAlert

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor)

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCondAlert = priceLH and oscHH and phFound

hiddenBearCond = plotHiddenBear and hiddenBearCondAlert

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

// alertcondition(bullCondAlert, title='Regular Bullish CVD Divergence', message="Found a new Regular Bullish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar")

// alertcondition(hiddenBullCondAlert, title='Hidden Bullish CVD Divergence', message='Found a new Hidden Bullish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

// alertcondition(bearCondAlert, title='Regular Bearish CVD Divergence', message='Found a new Regular Bearish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

// alertcondition(hiddenBearCondAlert, title='Hidden Bearisn CVD Divergence', message='Found a new Hidden Bearisn Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

le = bullCondAlert or hiddenBullCondAlert

se = bearCondAlert or hiddenBearCondAlert

ltp = se

stp = le

// Check if the entry conditions for a long position are met

if (le) //and (close > ema200)

strategy.entry("Long", strategy.long, comment="EL")

// Check if the entry conditions for a short position are met

if (se) //and (close < ema200)

strategy.entry("Short", strategy.short, comment="ES")

// Close long position if exit condition is met

if (ltp) // or (close < ema200)

strategy.close("Long", comment="XL")

// Close short position if exit condition is met

if (stp) //or (close > ema200)

strategy.close("Short", comment="XS")

// The Fixed Percent Stop Loss Code

// User Options to Change Inputs (%)

stopPer = input.float(5.0, title='Stop Loss %') / 100

takePer = input.float(10.0, title='Take Profit %') / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

if strategy.position_size > 0

strategy.exit("Close Long", "Long", stop=longStop, limit=longTake)

if strategy.position_size < 0

strategy.exit("Close Short", "Short", stop=shortStop, limit=shortTake)