Crossover EMA Short-term Trading Strategy

Author: ChaoZhang, Date: 2024-01-29 10:01:10Tags:

Overview

This is a short-term trading strategy that utilizes golden cross of moving average lines to generate buy and sell signals. It employs two exponential moving average (EMA) lines with different periods as trading signals. When the short period EMA line crosses above the long period EMA line, a golden cross is formed and a buy signal is triggered. When the short period EMA crosses below the long period EMA, a death cross occurs and a sell signal is generated.

Strategy Logic

The core logic of this strategy is to compute two EMA lines, one being a 55-period short term EMA, and the other a 34-period long term EMA. When the short term EMA crosses over the long term EMA, it is believed that the price uptrend has occurred, hence a buy signal is triggered. When the short term EMA crosses below the long term EMA, it is regarded as a price downtrend, so a sell signal is generated.

In the code, two EMA parameters are input first, based on which two EMA lines are calculated. When buy or sell signals occur, corresponding markings are plotted accordingly. Meanwhile, both EMA lines are plotted on the candlestick chart for intuitive trend judgment.

Advantages

- Simple to operate, easy to understand, suitable for beginners;

- Sensitive response, short-term operations, quick profits;

- Using EMA can effectively filter abnormal price fluctuations and generate reliable signals;

- Customizable EMA parameters, optimizable strategy;

- Applicable in various products.

Risks and Solutions

- Frequent trading is likely to increase costs and slippage risks. Tuning EMA cycle parameters properly helps filter overly frequent signals.

- Certain time lags exist, possibly missing early opportunities. Other indicators like BOLL can aid in complementing the judgment.

- Improper EMA parameter settings may lead to incorrect trading signals. Adequate backtesting and parameter optimization are necessary.

Optimization

- Incorporate more indicators e.g. BOLL, MACD to establish threshold conditions to avoid false signals.

- Add position sizing module to better control risks.

- Design adaptive EMA tuning mechanism according to different products and cycle differences.

- Employ stop loss strategies to effectively limit per trade loss.

Summary

In general, this is a very simple and practical short-term trading strategy, especially suitable for beginners to learn and adopt for its ease of use and considerable efficacy. As long as parameters are continuously optimized with complement from other judgment tools, the strategy will become increasingly robust. The underlying idea possesses high value and deserves further research going forward.

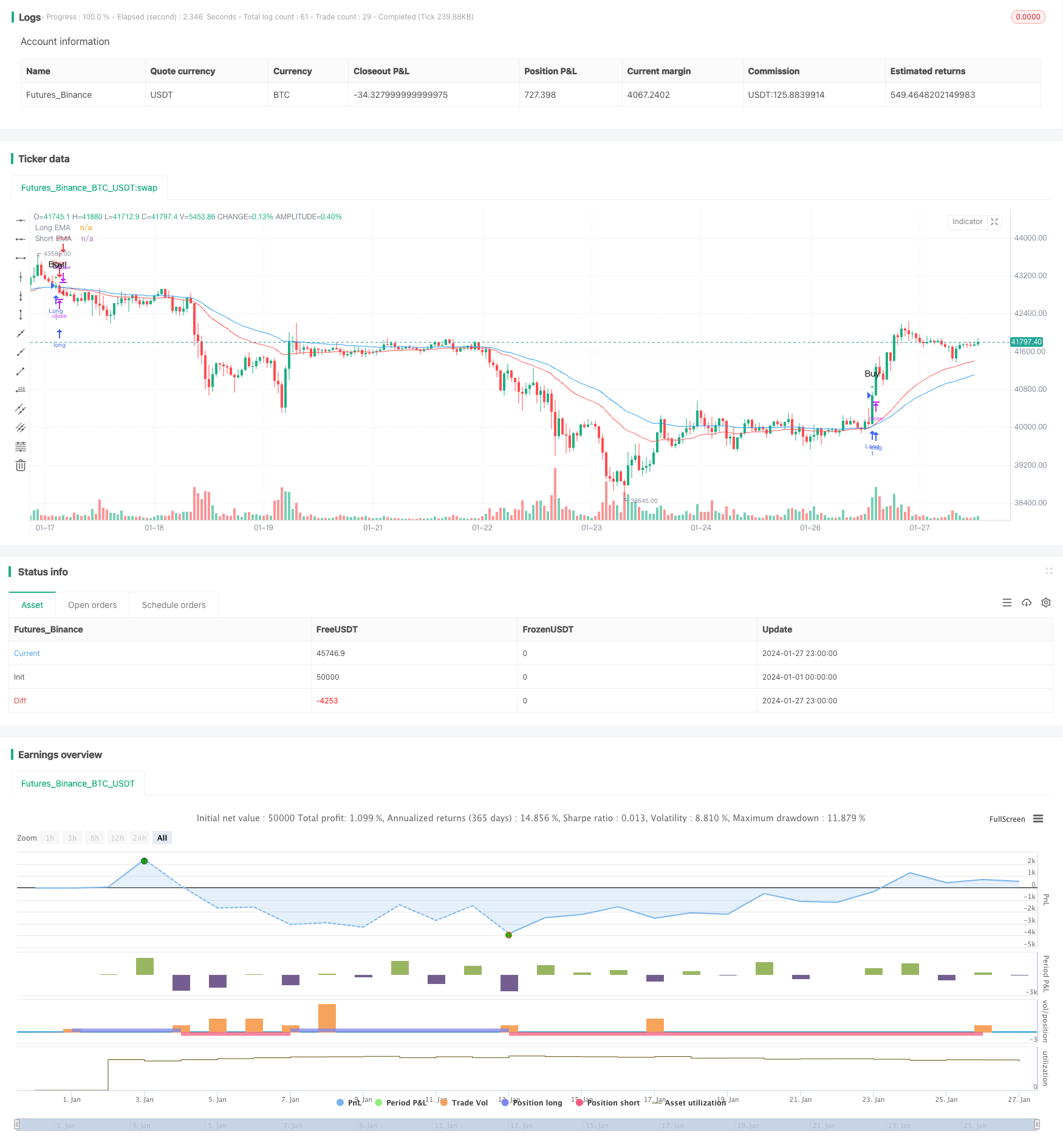

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("mohammad tork strategy", overlay=true)

// Input parameters

lengthShortEMA = input(55, title="Short EMA Length")

lengthLongEMA = input(34, title="Long EMA Length")

// Calculate EMAs

emaShort = ta.ema(close, lengthShortEMA)

emaLong = ta.ema(close, lengthLongEMA)

// Conditions for Long Signal

longCondition = ta.crossover(emaLong, emaShort)

// Conditions for Short Signal

shortCondition = ta.crossunder(emaLong, emaShort)

// Execute Long Signal

strategy.entry("Long", strategy.long, when = longCondition)

// Execute Short Signal

strategy.entry("Short", strategy.short, when = shortCondition)

// Plot EMAs on the chart

plot(emaShort, color=color.blue, title="Short EMA")

plot(emaLong, color=color.red, title="Long EMA")

// Plot Long Signal Icon with Buy Label

plotshape(series=longCondition, title="Long Signal", color=color.green, style=shape.triangleup, location=location.abovebar, size=size.small, text="Buy")

// Plot Short Signal Icon with Sell Label

plotshape(series=shortCondition, title="Short Signal", color=color.red, style=shape.triangledown, location=location.abovebar, size=size.small, text="Sell")

- Moving Average Turning Point Crossover Trading Strategy

- Cross-Cycle Arbitrage Strategy Based on Multiple Indicators

- The Bollinger Band breakout strategy is a long-only momentum chasing strategy

- Flawless Victory Quantitative Trading Strategy Based on Double BB Indicators and RSI

- RSI-based Stop Loss and Take Profit Strategy

- Moving Average Channel Breakout Strategy

- Fixed Time Breakback Testing Strategy

- Time and Space Optimized Multi Timeframe MACD Strategy

- Quantitative Trading Strategy Based on Stoch RSI and MFI

- Multi-indicator Composite Trading Strategy

- Trend Following Strategy Based on Dynamic Stop Loss of Dual EMA Crossover

- Bull Market Breakout Darvas Box Buy Strategy

- The relative momentum strategy

- Wave Trend and VWMA Based Trend Following Quant Strategy

- Dual Moving Average and Williams Average Combination Strategy

- Adaptive Triple Supertrend Strategy

- Moving Average Crossover Strategy

- Multiple Indicator Quantitative Trading Strategy

- Market Cypher Wave B Automated Trading Strategy

- Key Reversal Backtest Strategy