Moving Average Channel Breakout Strategy

Author: ChaoZhang, Date: 2024-01-29 10:26:25Tags:

Overview

This strategy calculates the middle, upper and lower rails of the Keltner Channel. It fills the color ABOVE the middle and lower rails. After determining the direction of the channel, it breaks through and buys and sells. It is a kind of trend tracking strategy.

Strategy Principle

The core indicator is the Keltner Channel. The middle rail of the channel is the N-day weighted moving average of the typical price (highest price + lowest price + closing price)/3. The upper and lower rail lines of the channel are respectively one trading range N-day weighted moving average away from the middle rail line. Where the trading range can choose the true volatility ATR, or directly take the amplitude (highest price - lowest price). The latter is adopted in this strategy.

Specifically, the strategy mainly judges whether the price breaks through the upper rail or the lower rail, and makes long or short decisions with the middle rail as the boundary. If the closing price is greater than the upper rail, go long; if the closing price is less than the lower rail, go short. The stop loss line is the MA value of the middle rail.

Advantage Analysis

- Using the Keltner Channel indicator, it has a good judgment on the price fluctuation range, avoiding false breakthroughs.

- Using the middle rail moving average as support can reduce losses.

- Breaking through the upper rail for long and the lower rail for short belongs to the trend tracking strategy, which is in line with the price change law of most stocks.

Risk Analysis

- Breakthrough channel strategies are very sensitive to parameters and require repeated testing to find the best parameter combination.

- When stock prices fluctuate sharply in the short term, trading risks will increase. Appropriately relax the channel width to reduce the risk of erroneous transactions.

- The effect has a high correlation with parameter settings and varieties, and adjustments are required to adapt to different varieties.

Optimization Directions

- Combine other indicators to filter signals and avoid erroneous transactions. Such as momentum indicator, volatility indicator, etc.

- Optimize parameters to find the best parameter combination. Mainly adjust the moving average parameter and the channel multiple.

- There will be considerable differences in parameter settings for different varieties, which need to be optimized separately.

Summary

In general, this strategy is relatively simple and direct, and it is a common price breakthrough strategy. The advantage is that the idea is clear and easy to understand and implement, which is suitable for beginners to learn. But there are also certain limitations. It is sensitive to parameters, the results are uneven, and repeated testing and optimization are required. If it can be combined with more complex judgment indicators, it can form a more powerful trading strategy.

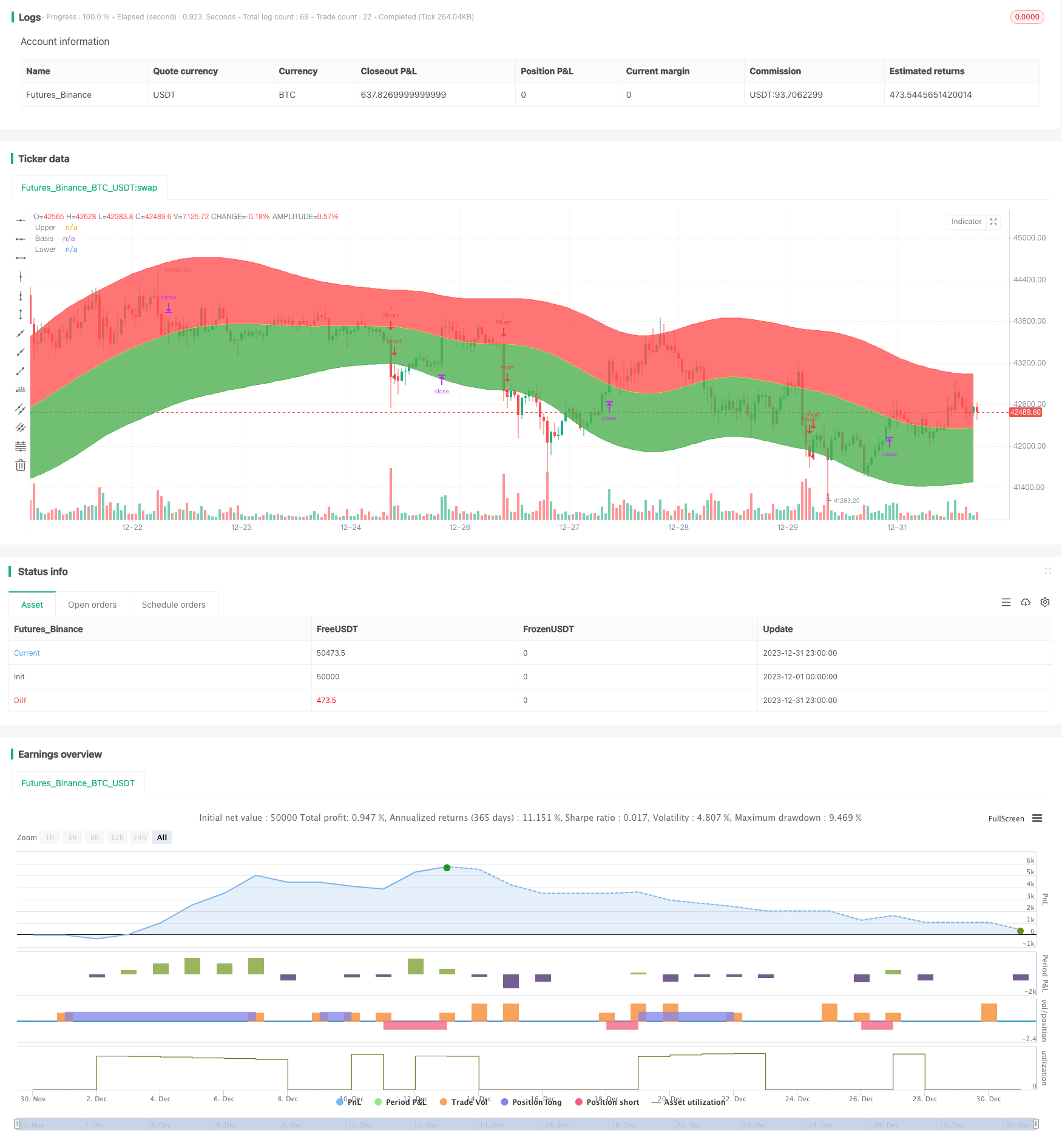

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © WMX_Q_System_Trading

//@version=3

strategy(title = "WMX Keltner Channels strategy", shorttitle = "WMX Keltner Channels strategy", overlay = true)

useTrueRange = input(true)

length = input(20, minval=5)

mult = input(2.618, minval=0.1)

mah =ema(ema( ema(high, length),length),length)

mal =ema(ema( ema(low, length),length),length)

range = useTrueRange ? tr : high - low

rangema =ema(ema( ema(range, length),length),length)

upper = mah + rangema * mult

lower = mal - rangema * mult

ma=(upper+lower)/2

uc = red

lc=green

u = plot(upper, color=uc, title="Upper")

basis=plot(ma, color=yellow, title="Basis")

l = plot(lower, color=lc, title="Lower")

fill(u, basis, color=uc, transp=95)

fill(l, basis, color=lc, transp=95)

strategy.entry("Long", strategy.long, stop = upper, when = strategy.position_size <= 0 and close >upper)

strategy.entry("Short", strategy.short, stop = lower, when = strategy.position_size >= 0 and close<lower)

if strategy.position_size > 0

strategy.exit("Stop Long", "Long", stop = ma)

if strategy.position_size < 0

strategy.exit("Stop Short", "Short", stop = ma)

- Scalping Strategy with Volume and VWAP Confirmation

- ADX, MA and EMA Long Only Trend Tracking Strategy

- Momentum Breakthrough Golden Cross Strategy

- Triple Indicator Collision Strategy

- Out-of-the-box Machine Learning Trading Strategy

- Moving Average Turning Point Crossover Trading Strategy

- Cross-Cycle Arbitrage Strategy Based on Multiple Indicators

- The Bollinger Band breakout strategy is a long-only momentum chasing strategy

- Flawless Victory Quantitative Trading Strategy Based on Double BB Indicators and RSI

- RSI-based Stop Loss and Take Profit Strategy

- Fixed Time Breakback Testing Strategy

- Time and Space Optimized Multi Timeframe MACD Strategy

- Quantitative Trading Strategy Based on Stoch RSI and MFI

- Multi-indicator Composite Trading Strategy

- Crossover EMA Short-term Trading Strategy

- Trend Following Strategy Based on Dynamic Stop Loss of Dual EMA Crossover

- Bull Market Breakout Darvas Box Buy Strategy

- The relative momentum strategy

- Wave Trend and VWMA Based Trend Following Quant Strategy

- Dual Moving Average and Williams Average Combination Strategy