Overview

This strategy designs an automated stop loss and take profit trading strategy based on the Relative Strength Index (RSI) indicator. When the RSI indicator crosses above the overbought line or crosses below the oversold line, the strategy will open long or short positions respectively. At the same time, the strategy will automatically set the stop loss price and take profit price based on the opening price and the preset stop loss percentage and take profit percentage.

Strategy Logic

This strategy uses the RSI indicator to determine overbought and oversold conditions in the market. When the RSI drops below the lower point (default 30), the market is considered oversold and a long position is opened. When the RSI rises above the upper point (default 70), the market is considered overbought and a short position is opened.

After opening long or short, the strategy automatically sets the stop loss price and take profit price based on the stop loss percentage (default 5%) and take profit percentage (default 10%). For example, after opening long, the stop loss price is (1 - stop loss percentage) * entry price, and take profit price is (1 + take profit percentage) * entry price.

Advantage Analysis

The biggest advantage of this strategy is that it can automatically set stop loss and take profit to mitigate trading risks. Stop loss helps limit losses and take profit allows locking in profits. At the same time, RSI is a mature technical indicator that can effectively identify overbought and oversold conditions.

Risk Analysis

There are also some risks with this strategy. RSI signals may be wrong sometimes, leading to unnecessary losses. In addition, triggered stop loss or take profit could also result in losing some profits. The stop loss and take profit percentages need to be set carefully - too loose may fail to control risks effectively while too tight may result in unnecessary stop loss.

These risks could be reduced by optimizing RSI parameters or adjusting stop loss/take profit percentages. Also, incorporating other indicators to confirm signals can improve accuracy of trading decisions.

Strategy Optimization

The strategy can be optimized in the following aspects:

Optimize RSI parameters to find the best combination

Test different stop loss and take profit percentage settings

Add other indicators to filter trading signals

Incorporate trend determination rules to avoid false signals in ranging markets

Optimize entry timing, set up a trailing stop to lock in profits

Conclusion

This strategy designs a simple and practical stop loss and take profit strategy based on the RSI indicator. The logic is clear and easy to implement, with automated stop loss and take profit to control risks. Attention is needed on parameters and rules optimization to prevent risks associated with incorrect RSI signals. Overall, it provides a good idea for quantitative trading and is worth further research and optimization.

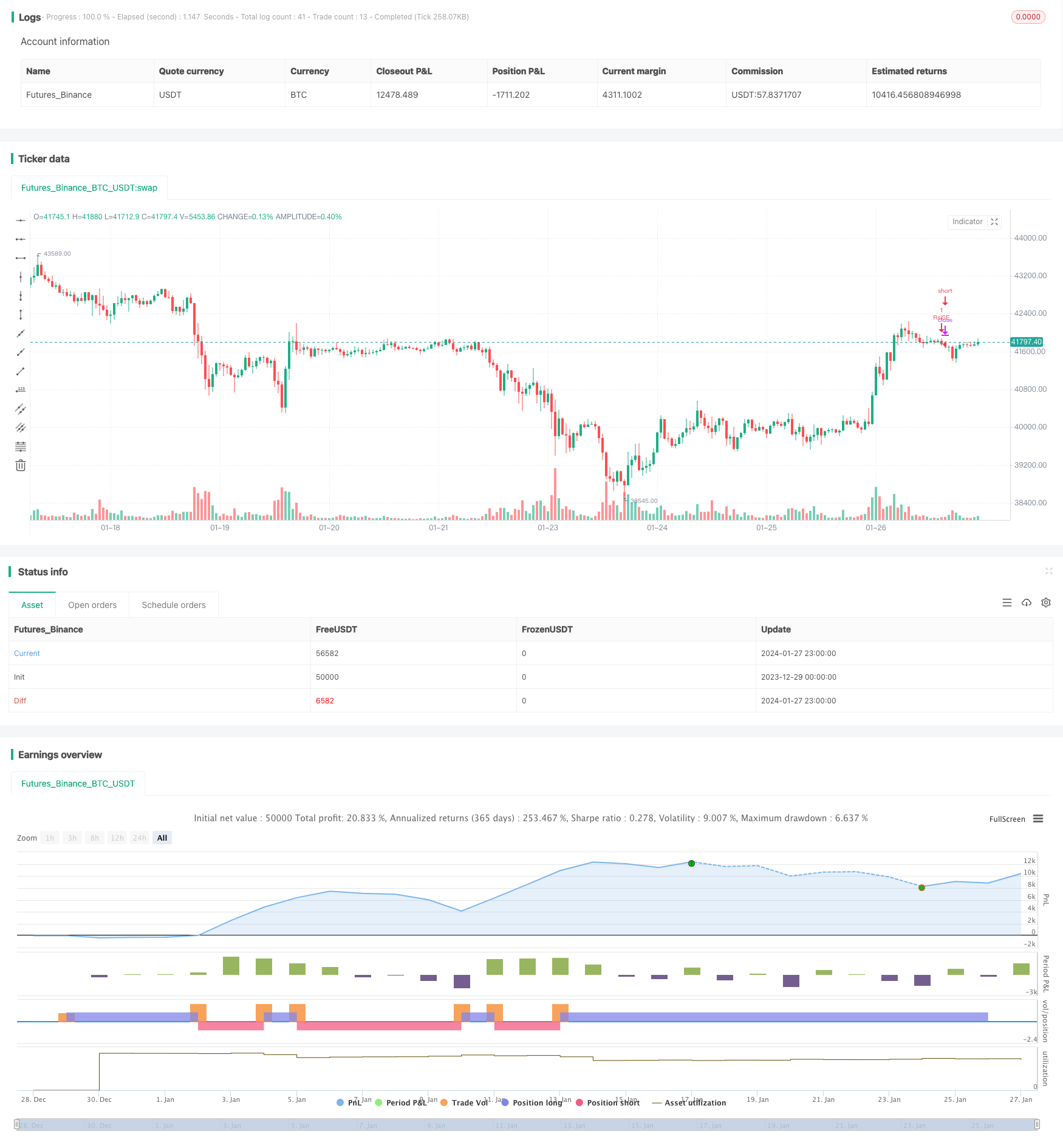

/*backtest

start: 2023-12-29 00:00:00

end: 2024-01-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("twelve12 first RSI remix", overlay=true)

length = input(14)

overSold = input(35)

overBought = input(65)

stopLossPercent = input(5, title="Stop Loss (%)") / 100

takeProfitPercent = input(10, title="Take Profit (%)") / 100

price = close

vrsi = ta.rsi(price, length)

co = ta.crossover(vrsi, overSold)

cu = ta.crossunder(vrsi, overBought)

if (not na(vrsi))

if (co)

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

if (cu)

strategy.entry("RsiSE", strategy.short, comment="RsiSE")

// Calculate stop loss and take profit levels for long and short positions

longStopLoss = strategy.position_avg_price * (1 - stopLossPercent)

longTakeProfit = strategy.position_avg_price * (1 + takeProfitPercent)

shortStopLoss = strategy.position_avg_price * (1 + stopLossPercent)

shortTakeProfit = strategy.position_avg_price * (1 - takeProfitPercent)

// Set stop loss and take profit for long position