Three High Candle Reversal Strategy

Author: ChaoZhang, Date: 2024-02-19 10:51:40Tags:

Overview

The Three High Candle Reversal strategy is a short-term trading strategy based on candlestick patterns. It utilizes the features of three consecutive yang lines to obtain relatively high-success-rate short-term trading opportunities during the session.

This strategy is mainly used for short-term trading. Its advantage is that the rules are simple and clear, easy to operate. At the same time, it incorporates stop loss and take profit mechanisms to control risks. However, the strategy also has certain risks, such as divergence in consecutive bull markets in trend markets.

Principles

The strategy judges whether the last three candlesticks are all yang lines, and whether the daily closing price is higher than the opening price. If the conditions are met, you can go long, with a target profit of 50% of the difference between the opening price and closing price.

Specifically, the strategy judges the latest 3 candlesticks, namely the 1st, 2nd and 3rd candlestick, whether their opening prices are lower than the closing prices. If this condition is met, it indicates a potential opportunity.

In addition, the strategy also calculates the percentage difference between the current price and the lowest opening price and the highest closing price in the last three days. If this percentage is higher than 20% but lower than 50%, it proves that the current reversal space is not large and it is a suitable time to intervene.

When all the above conditions are met, you can intervene to go long. At this point, the stop loss price is near the entry price, and the take profit target is 1.5 times the entry price.

Advantage Analysis

The strategy has the following advantages:

- The rules are simple and clear, easy to understand and operate

- It utilizes the trading signals provided by candlestick patterns

- It combines stop loss and take profit mechanisms to effectively control risks

- It has a certain win rate and profit level

Risk Analysis

The strategy also has the following risks:

- In trend markets, candlesticks tend to show a pattern of three consecutive increases, so going long based on the strategy is contrary to the trend, with greater risk

- Failed reversal is the biggest risk, facing greater stop loss

- Improper parameter settings also affect strategy performance

To address the risks, optimization can be done in the following ways:

- Combine trend indicators to avoid reversals against the trend

- Optimize stop loss mechanism to reduce single loss

- Test and optimize key parameters such as profit targets, stop loss percentage, etc.

Optimization Directions

The strategy can be optimized in the following directions:

- Optimize entry conditions to avoid wrong signals and improve win rate

- Combine trend indicators to avoid opening positions against trends

- Optimize stop loss mechanism to maximize control over single losses

- Optimize take profit mechanism to pursue greater profits while ensuring win rate

- Parameter optimization to find the optimal parameter combination

- Incorporate other factors such as changes in volume to improve system performance

Summary

In summary, the Three High Candle Reversal Strategy is a simple and practical short-term trading strategy. It has the advantages of clear rules, easy operation, use of candlestick patterns, as well as risks such as reversal against trends and stop loss trigger. We can optimize this strategy in many ways to make it perform better for short-term trading use.

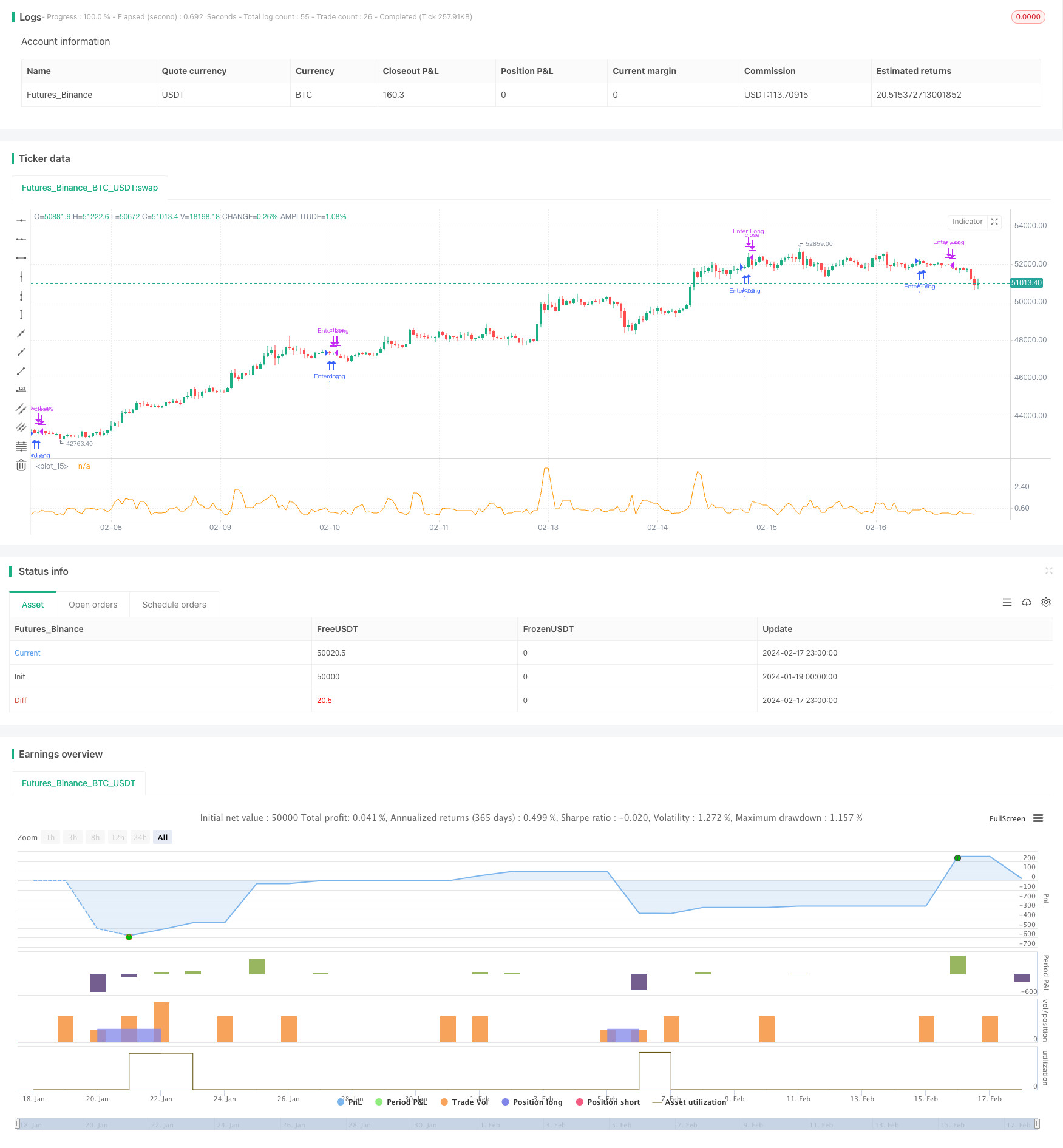

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nonametr

//@version=5

strategy("3 high candle test")

cond2 = open[3] < close[3]

cond1 = open[2] < close[2]

cond0 = open[1] < close[1]

targetPercent = 0.5

currentPercent = 100 -(( math.min(open[3],open[2],open[1]) / math.max(close[3],close[2],close[1])) * 100)

longExitPrice = strategy.position_avg_price * ((100 + 1) * 0.01)

shortExitPrice = strategy.position_avg_price * ((100 - 0.4) * 0.01)

plot(currentPercent)

if cond2 == true and cond1 == true and cond0 == true and currentPercent > 0.2 and currentPercent < 0.5

strategy.entry("Enter Long", strategy.long, qty=1)

if close <= shortExitPrice

strategy.close("Enter Long")

closeToReduceRisk = close[1] < open[1] and strategy.openprofit > 0.47

if closeToReduceRisk or close >= longExitPrice

strategy.close("Enter Long")

- SSL Channel and Wave Trend Quantitative Trading Strategy

- Super ATR Trend Following Strategy

- Trading-oriented Ichimoku Cloud Nine Strategy

- LPB Microcycles Adaptive Oscillation Contour Tracking Strategy

- Best ABCD Pattern Trading Strategy with Stop Loss and Take Profit Tracking

- Major Trend Indicator Long

- Multi Timeframe Strategy

- Dynamic Balancing Leveraged ETF Investment Strategy

- Multi-timeframe MACD Indicator Crossover Trading Strategy

- Gem Forest 1 Minute Breakout Strategy

- MACD Moving Average Combination Cross-Period Dynamic Trend Strategy

- Gem Forest One Minute Scalping Strategy

- Signal Smoothing Ehlers Cyber Cycle Strategy

- EMA Crossover Trend Following Trading Strategy

- Trend Following Strategy Based on Candlestick Direction

- Dual Confirmation MACD and RSI Strategy

- Williams Double Exponential Moving Average and Ichimoku Kinkou Hyo Strategy

- 3 10 Oscillator Profile Flagging Strategy

- Multi Timeframe RSI-SRSI Trading Strategy

- A Combined Strategy with MACD and RSI