Gem Forest 1 Minute Breakout Strategy

Author: ChaoZhang, Date: 2024-02-19 10:56:07Tags:

Overview

The Gem Forest 1 Minute Breakout Strategy is a quantitative trading strategy that aims to capture breakout signals within a 1-minute timeframe to realize quick profits. This strategy incorporates multiple indicators like moving averages, ATR, RSI to generate trading signals and achieve higher risk-reward ratios over short holding periods.

Strategy Logic

This strategy mainly uses the following elements to form trade signals:

- ATR Indicator - Calculates average true range to set price channels;

- Moving Average Indicators - Compute fast EMA and slow EMA to generate golden cross/dead cross signals;

- RSI Indicator - Calculate fast and slow RSI to determine overbought/oversold area;

- Price-Channel Relationship - Generates trade signals when price breaks out of the channels.

Specifically, the strategy computes N-period average of ATR, fast EMA, slow EMA, fast RSI and slow RSI. Combining the conditions of price breaking ATR channel, EMA golden cross, and RSI reaching extreme levels, the strategy sends out buy or sell signals.

Advantage Analysis

The main advantages of this strategy are:

- Captures short-term price trends;

- Responds swiftly, suitable for high frequency trading;

- More reliable with multiple filtered indicators;

- Parametric for users to optimize.

Risk Analysis

There are also some risks:

- High risks in short-term trading, strict stop loss needed;

- Improper parameter optimization leads to overfitting;

- High trading frequency increases costs.

To control risks, stop loss should be implemented, and parameters need proper backtests to avoid overfitting. Moreover, adjusting trade frequency to control costs.

Optimization Directions

The strategy can be optimized through:

-

Test parameters settings over shorter periods (5-min, 15-min);

-

Add more filtering indicators like volume to improve signal quality;

-

Optimize ATR channel and moving average parameters to find best parameter combinations.

Conclusion

The Gem Forest 1 Minute Breakout Strategy focuses on capturing short-term trends by filtering with multiple indicators, featuring fast response and high risk-reward characteristics. It can be adapted to users’ risk preferences through parameter optimization for better results. However, users should control trading risks via strict stop loss, reasonable trade frequencies etc. Overall, this strategy suits investors with certain quant trading knowledge and risk tolerance for short-term trading.

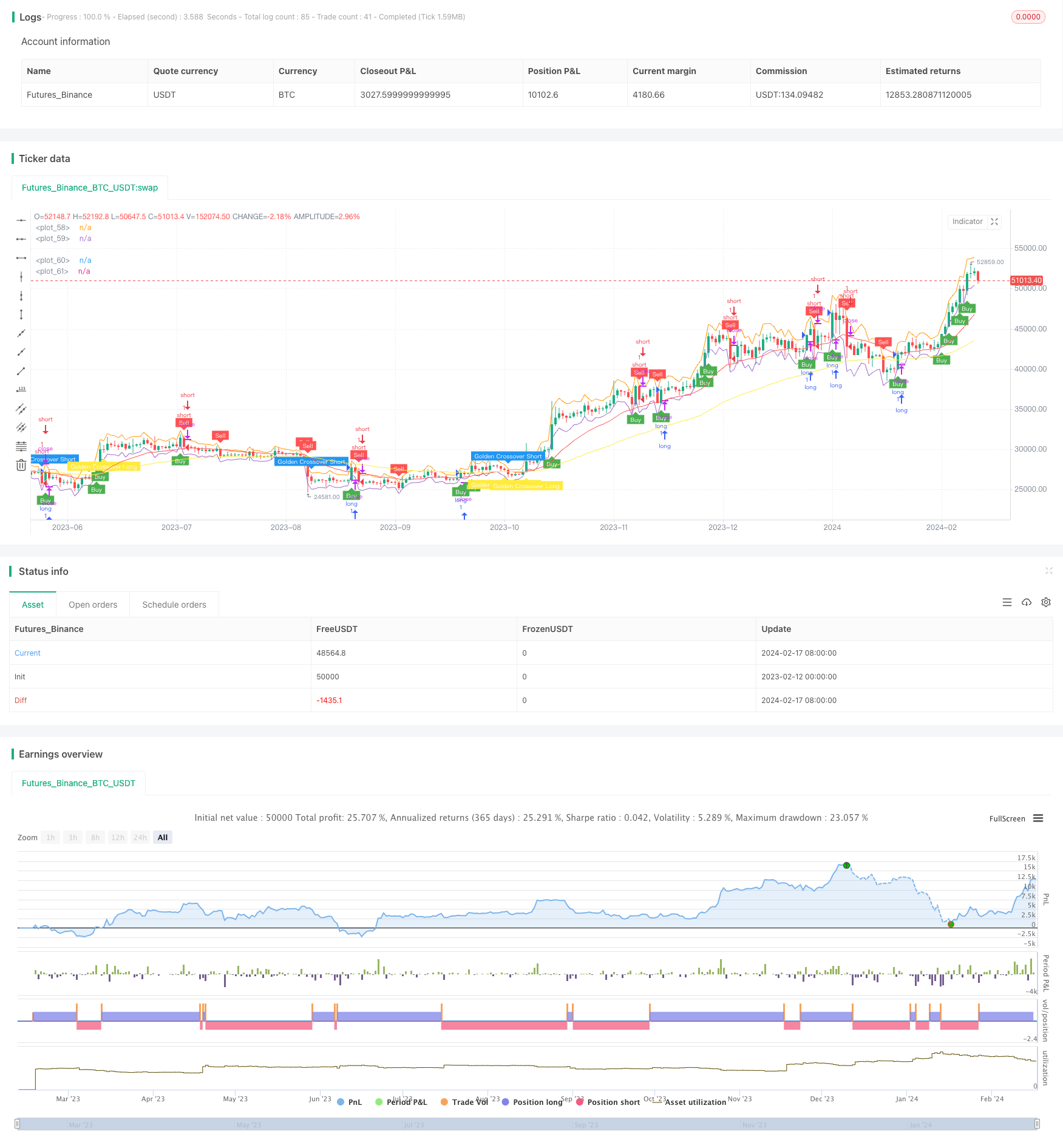

/*backtest

start: 2023-02-12 00:00:00

end: 2024-02-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Gem Forest 1 Dakika Scalp", overlay=true)

source = close

atrlen = input.int(14, "ATR Period")

mult = input.float(1, "ATR Multi", step=0.1)

smoothing = input.string(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

ta.rma(source, atrlen)

else

if smoothing == "SMA"

ta.sma(source, atrlen)

else

if smoothing == "EMA"

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

ShortEMAlen = input.int(21, "Fast EMA")

LongEMAlen = input.int(65, "Slow EMA")

shortSMA = ta.ema(close, ShortEMAlen)

longSMA = ta.ema(close, LongEMAlen)

RSILen1 = input.int(25, "Fast RSI Length")

RSILen2 = input.int(100, "Slow RSI Length")

rsi1 = ta.rsi(close, RSILen1)

rsi2 = ta.rsi(close, RSILen2)

atr = ta.atr(atrlen)

RSILong = rsi1 > rsi2

RSIShort = rsi1 < rsi2

longCondition = open < lower_band

shortCondition = open > upper_band

GoldenLong = ta.crossover(shortSMA,longSMA)

Goldenshort = ta.crossover(longSMA,shortSMA)

plotshape(shortCondition, title="Sell Label", text="Sell", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.white)

plotshape(longCondition, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.white)

plotshape(Goldenshort, title="Golden Sell Label", text="Golden Crossover Short", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.new(color.blue, 0), textcolor=color.white)

plotshape(GoldenLong, title="Golden Buy Label", text="Golden Crossover Long", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.new(color.yellow, 0), textcolor=color.white)

if (longCondition)

stopLoss = low - atr * 2

takeProfit = high + atr * 5

strategy.entry("long", strategy.long)

if (shortCondition)

stopLoss = high + atr * 2

takeProfit = low - atr * 5

strategy.entry("short", strategy.short)

plot(upper_band)

plot(lower_band)

plot(shortSMA, color = color.red)

plot(longSMA, color = color.yellow)

- Dual Trend Breakout Strategy

- SSL Channel and Wave Trend Quantitative Trading Strategy

- Super ATR Trend Following Strategy

- Trading-oriented Ichimoku Cloud Nine Strategy

- LPB Microcycles Adaptive Oscillation Contour Tracking Strategy

- Best ABCD Pattern Trading Strategy with Stop Loss and Take Profit Tracking

- Major Trend Indicator Long

- Multi Timeframe Strategy

- Dynamic Balancing Leveraged ETF Investment Strategy

- Multi-timeframe MACD Indicator Crossover Trading Strategy

- Three High Candle Reversal Strategy

- MACD Moving Average Combination Cross-Period Dynamic Trend Strategy

- Gem Forest One Minute Scalping Strategy

- Signal Smoothing Ehlers Cyber Cycle Strategy

- EMA Crossover Trend Following Trading Strategy

- Trend Following Strategy Based on Candlestick Direction

- Dual Confirmation MACD and RSI Strategy

- Williams Double Exponential Moving Average and Ichimoku Kinkou Hyo Strategy

- 3 10 Oscillator Profile Flagging Strategy

- Multi Timeframe RSI-SRSI Trading Strategy