Long-Short Linear Regression Crossover Strategy

Author: ChaoZhang, Date: 2024-03-27 17:52:02Tags:

Overview

The Long-Short Linear Regression Crossover Strategy is a technical analysis strategy that uses a linear regression model to predict the future price movements of a stock. The basic principle of the strategy is: stock price movements often follow a certain linear trend, and by calculating the linear regression of the price, the future price can be predicted. The strategy goes long when the predicted price crosses above the current price, and exits the position when it crosses below.

Strategy Principles

The strategy first calculates the linear regression of the stock price over a certain period of time. Linear regression fits a straight line using the least squares method, which represents the trend of price changing over time. The strategy then plots the predicted price line and the current price on the chart.

The strategy defines two signals:

- Long signal: triggered when the predicted price crosses above the current price

- Short signal: triggered when the predicted price crosses below the current price

When the long signal appears, the strategy opens a long position; when the short signal appears, it closes the position.

The key steps of the strategy are as follows:

- Calculate the linear regression of the price over a period of time

- Plot the predicted price line and the current price on the chart

- Define the long and short signals

- Open a long position when the long signal is triggered

- Close the position when the short signal is triggered

Advantages Analysis

The Long-Short Linear Regression Crossover Strategy has the following advantages:

- Simple and effective: The logic of the strategy is clear and easy to implement, and it can capture the linear trend of the price.

- Wide applicability: The strategy can generate trading signals in both trending and ranging markets.

- Strong optimizability: The strategy contains some key parameters, such as linear regression period, moving averages, etc., which can be optimized to improve the performance.

Risk Analysis

Despite its many advantages, the Long-Short Linear Regression Crossover Strategy also has some risks:

- Trend recognition risk: When the price movement does not follow a linear trend, such as in a ranging market, the strategy may generate false signals. This risk can be reduced by combining with other indicators such as MACD.

- Parameter setting risk: The performance of the strategy is sensitive to parameter settings, and inappropriate parameters may lead to losses. Therefore, sufficient backtesting and optimization of parameters are necessary before live trading.

- Overfitting risk: If the parameters are over-optimized, it may cause the strategy to overfit the historical data and perform poorly in the future. Methods to avoid overfitting include keeping it simple, out-of-sample testing, etc.

Optimization Directions

- Combine with other indicators: The linear regression signal can be combined with other technical indicators such as MACD, Bollinger Bands, etc., to improve the accuracy of the signals.

- Dynamic parameter optimization: An adaptive mechanism for parameters can be designed to dynamically adjust parameters according to market conditions, improving adaptability.

- Add a risk control module: Incorporate risk control measures such as stop-loss and money management into the strategy to reduce the risk of a single transaction and increase cumulative returns.

- Machine learning optimization: Machine learning algorithms can be used to continuously optimize the linear regression model to make its predictions more accurate.

Summary

The Long-Short Linear Regression Crossover Strategy generates trading signals based on the comparison of the predicted price from linear regression and the current price. The logic of the strategy is simple and clear, and it can capture the linear trend of the price and is applicable to various market conditions. At the same time, the strategy is easy to implement and optimize, and parameters can be flexibly adjusted, combined with other indicators, risk control modules can be added, etc., to continuously improve the performance of the strategy. However, the strategy also has risks such as inaccurate trend recognition, inappropriate parameter settings, and overfitting of historical data, so caution is needed in practical application. Overall, the Long-Short Linear Regression Crossover Strategy is a simple and effective quantitative trading strategy that is worth further exploration and optimization.

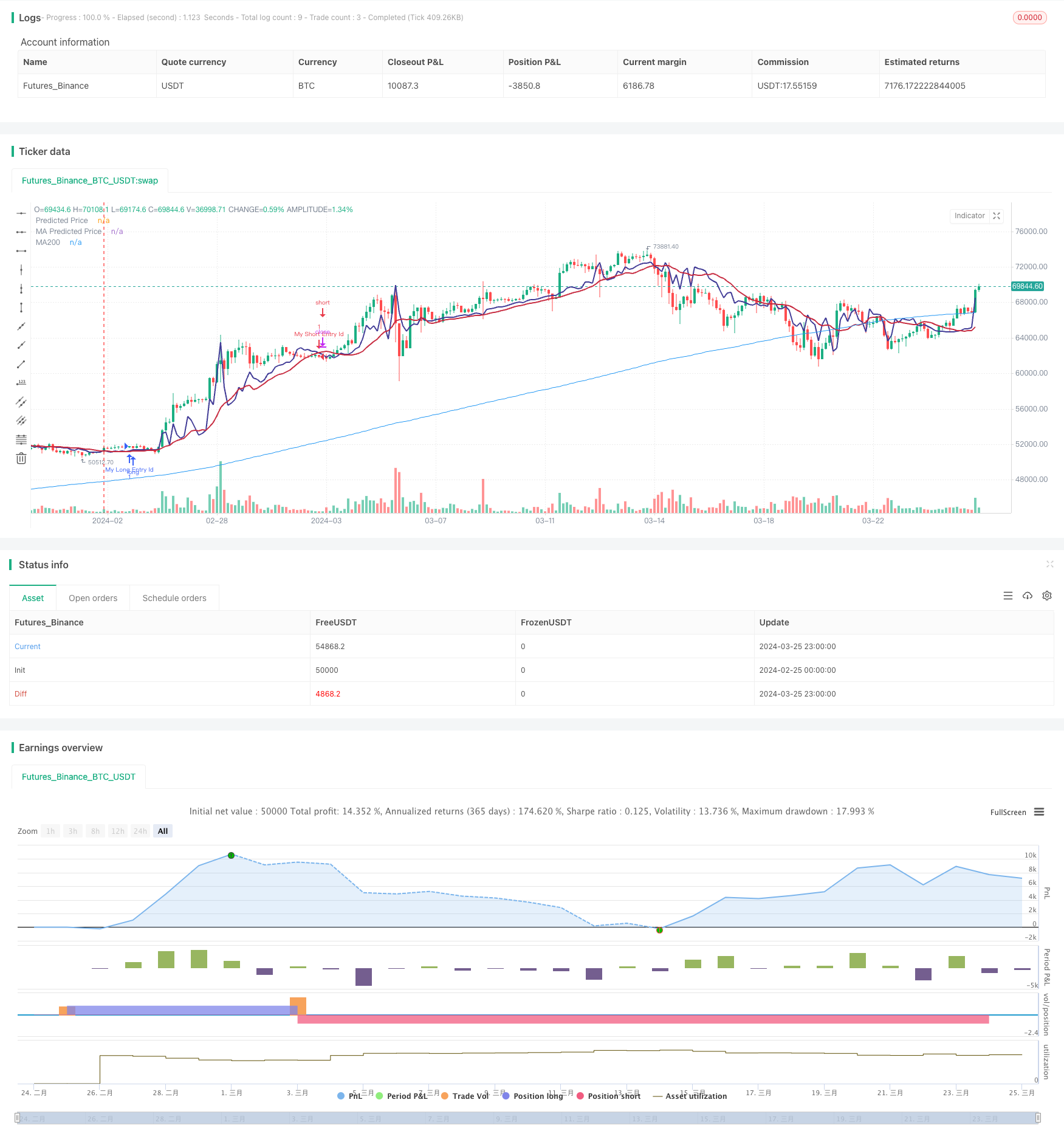

/*backtest

start: 2024-02-25 00:00:00

end: 2024-03-26 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © stocktechbot

//@version=5

strategy("Linear Cross", overlay=true, margin_long=100, margin_short=0)

//Linear Regression

vol = volume

// Function to calculate linear regression

linregs(y, x, len) =>

ybar = math.sum(y, len)/len

xbar = math.sum(x, len)/len

b = math.sum((x - xbar)*(y - ybar),len)/math.sum((x - xbar)*(x - xbar),len)

a = ybar - b*xbar

[a, b]

// Historical stock price data

price = close

// Length of linear regression

len = input(defval = 21, title = 'Strategy Length')

linearlen=input(defval = 9, title = 'Linear Lookback')

[a, b] = linregs(price, vol, len)

// Calculate linear regression for stock price based on volume

//eps = request.earnings(syminfo.ticker, earnings.actual)

//MA For double confirmation

out = ta.sma(close, 200)

outf = ta.sma(close, 50)

outn = ta.sma(close, 90)

outt = ta.sma(close, 21)

outthree = ta.sma(close, 9)

// Predicted stock price based on volume

predicted_price = a + b*vol

// Check if predicted price is between open and close

is_between = open < predicted_price and predicted_price < close

//MACD

//[macdLine, signalLine, histLine] = ta.macd(close, 12, 26, 9)

// Plot predicted stock price

plot(predicted_price, color=color.rgb(65, 59, 150), linewidth=2, title="Predicted Price")

plot(ta.sma(predicted_price,linearlen), color=color.rgb(199, 43, 64), linewidth=2, title="MA Predicted Price")

//offset = input.int(title="Offset", defval=0, minval=-500, maxval=500)

plot(out, color=color.blue, title="MA200")

[macdLine, signalLine, histLine] = ta.macd(predicted_price, 12, 26, 9)

//BUY Signal

longCondition=false

mafentry =ta.sma(close, 50) > ta.sma(close, 90)

//matentry = ta.sma(close, 21) > ta.sma(close, 50)

matwohun = close > ta.sma(close, 200)

twohunraise = ta.rising(out, 2)

twentyrise = ta.rising(outt, 2)

macdrise = ta.rising(macdLine,2)

macdlong = ta.crossover(predicted_price, ta.wma(predicted_price,linearlen)) and (signalLine < macdLine)

if macdlong and macdrise

longCondition := true

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

//Sell Signal

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

daysSinceEntry = len

daysSinceEntry := int((time - strategy.opentrades.entry_time(strategy.opentrades - 1)) / (24 * 60 * 60 * 1000))

percentageChange = (close - lastEntryPrice) / lastEntryPrice * 100

//trailChange = (ta.highest(close,daysSinceEntry) - close) / close * 100

//label.new(bar_index, high, color=color.black, textcolor=color.white,text=str.tostring(int(trailChange)))

shortCondition=false

mafexit =ta.sma(close, 50) < ta.sma(close, 90)

matexit = ta.sma(close, 21) < ta.sma(close, 50)

matwohund = close < ta.sma(close, 200)

twohunfall = ta.falling(out, 3)

twentyfall = ta.falling(outt, 2)

shortmafall = ta.falling(outthree, 1)

macdfall = ta.falling(macdLine,1)

macdsell = macdLine < signalLine

if macdfall and macdsell and (macdLine < signalLine) and ta.falling(low,2)

shortCondition := true

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)

- EMA Cross ADR Strategy - A Multidimensional Technical Indicator-Based Trading Method with Strict Risk Management

- Bullish and Bearish Engulfing Strategy Based on Candlestick Patterns

- Bollinger Bands Long Only Strategy

- AlphaTrend and Bollinger Bands Combined Mean Reversion + Trend Following Strategy

- Grid Dollar-Cost Averaging Strategy

- Quantitative Trading Strategy Based on Three Consecutive Bullish/Bearish Candles and Dual Moving Averages

- Multi-EMA, RSI and Standard Deviation-Based Exit Candlestick Height Breakout Trading Strategy

- Binance accounts can be redirected

- Grid Trading Risk Hedging Strategy

- EMA-Parabolic Trend Following Strategy

- Trend Momentum-Based Multi-Indicator Moving Average Crossover Strategy

- Donchian Channel Breakout Strategy with ATRSL Trailing Stop

- Dynamic Grid Trend-Following Quantitative Trading Strategy

- Bollinger Band Dynamic Take Profit and Dynamic Position Adding Strategy

- High-Frequency Cryptocurrency Trading Strategy Combining TrippleMACD Crossover and Relative Strength Index

- RSI and EMA Dual Filter Strategy

- Grid-based Long Martingale Dynamic Position Grid Trading Strategy

- Dual Exponential Moving Average Cloud Crossover Automated Trading Strategy

- Dual-Timeframe EMA Crossover Long-Short Strategy

- Hull Moving Average Crossover Strategy