Momentum Indicator Oscillation Threshold Enhanced Trading Strategy

Author: ChaoZhang, Date: 2024-11-29 15:40:08Tags: CCISMA

Overview

This strategy is a momentum trading system based on the Commodity Channel Index (CCI), designed to capture trading opportunities in oversold areas by monitoring price deviations from the mean. The strategy uses a 12-period lookback, enters long positions when CCI drops below -90 threshold, exits when closing price breaks above previous highs, and includes optional stop-loss and take-profit mechanisms.

Strategy Principles

The core principle utilizes CCI to measure price deviation from its mean. CCI calculation involves: first computing typical price (arithmetic mean of high, low and close prices), then calculating Simple Moving Average (SMA) of typical price, finally deriving CCI by subtracting SMA from typical price, dividing by mean deviation and multiplying by 0.015. Long positions are entered when CCI falls below -90, indicating possible oversold conditions; positions are closed when price breaks above previous highs, confirming upward trend. The strategy offers customizable stop-loss and take-profit parameters to accommodate different risk preferences.

Strategy Advantages

- Clear Signals: Uses fixed CCI thresholds for entry signals, avoiding indecision from subjective judgment

- Controlled Risk: Achieves precise risk control through optional stop-loss and take-profit mechanisms

- Flexible Parameters: Traders can adjust CCI lookback period and entry threshold for different market conditions

- Simple Execution: Clear strategy logic, easy to understand and implement, suitable for all trader types

- Cost Efficient: Event-driven trading approach reduces costs from overtrading

Strategy Risks

- False Breakout Risk: CCI crossing threshold may result in false breakouts leading to unnecessary trades

- Slippage Impact: May face significant slippage losses during high market volatility

- Trend Dependency: Strategy may generate frequent false signals in ranging markets

- Parameter Sensitivity: CCI period and threshold choices significantly impact strategy performance

- Delay Risk: As a lagging indicator, CCI may miss optimal entry points

Strategy Optimization Directions

- Signal Filtering: Additional technical indicators like RSI or MACD can be introduced to filter false signals

- Dynamic Thresholds: Replace fixed CCI thresholds with volatility-based dynamic thresholds

- Time-based Optimization: Adjust strategy parameters based on different time period characteristics

- Money Management: Add dynamic position sizing mechanisms to improve capital efficiency

- Multi-timeframe Analysis: Incorporate longer-term trend analysis to optimize entry timing

Conclusion

This strategy captures market oversold opportunities through CCI indicator, combined with stop-loss and take-profit mechanisms to create a complete trading system. The strategy features clear logic, easy execution, and good risk control capabilities. Through optimization measures like signal filtering and dynamic thresholds, the strategy’s stability and profitability can be further improved. Traders are advised to conduct thorough backtesting and adjust parameters according to specific market characteristics before live implementation.

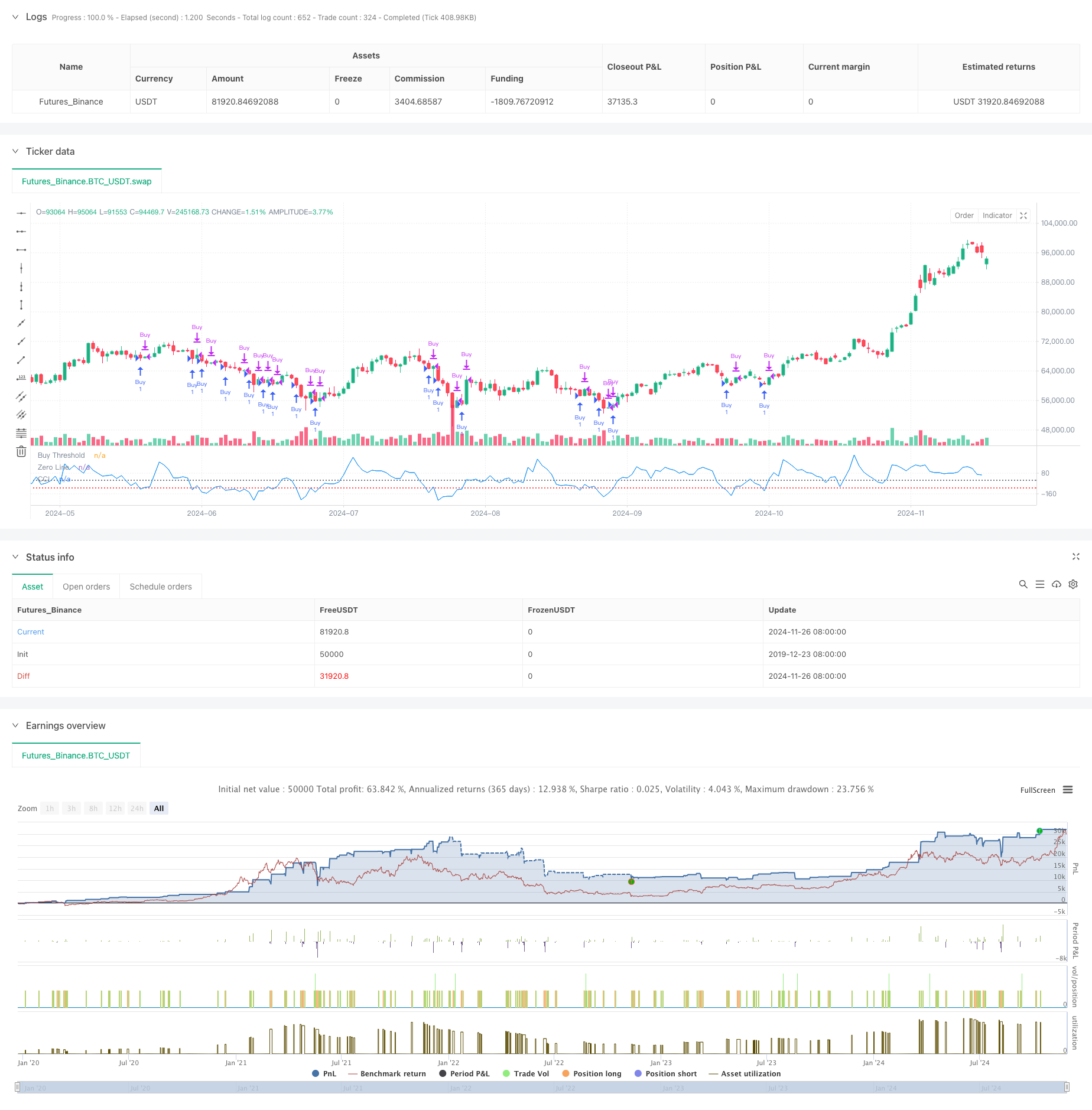

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CCI Threshold Strategy", overlay=false, initial_capital=50000, pyramiding=0, commission_type=strategy.commission.cash_per_contract, commission_value=0.05, slippage=1)

// --- Input Parameters ---

// Lookback period for CCI calculation

lookbackPeriod = input.int(12, minval=1, title="CCI Lookback Period")

// Buy threshold for CCI; typically represents an oversold condition

buyThreshold = input.int(-90, title="CCI Buy Threshold")

// Stop loss and take profit settings

stopLoss = input.float(100.0, minval=0.0, title="Stop Loss in Points")

takeProfit = input.float(150.0, minval=0.0, title="Take Profit in Points")

// Checkboxes to enable/disable SL and TP

useStopLoss = input.bool(false, title="Enable Stop Loss")

useTakeProfit = input.bool(false, title="Enable Take Profit")

// --- Calculate CCI ---

// CCI (Commodity Channel Index) is used as a momentum indicator to identify oversold and overbought conditions

cci = ta.cci(close, length=lookbackPeriod)

// --- Define Buy and Sell Conditions ---

// Buy condition: CCI drops below -90, indicating potential oversold levels

longCondition = cci < buyThreshold

// Sell condition: Close price crosses above the previous day's high, signaling potential exit

sellCondition = close > ta.highest(close[1], 1)

// --- Strategy Execution ---

// Buy entry based on the long condition

if (longCondition)

strategy.entry("Buy", strategy.long)

// Close the long position based on the sell condition

if (sellCondition)

strategy.close("Buy")

// Optional: Add stop loss and take profit for risk management

if (longCondition)

strategy.exit("Sell", from_entry="Buy", loss=useStopLoss ? stopLoss : na, profit=useTakeProfit ? takeProfit : na)

// --- Plotting for Visualization ---

// Plot CCI with threshold levels for better visualization

plot(cci, title="CCI", color=color.blue)

hline(buyThreshold, "Buy Threshold", color=color.red, linestyle=hline.style_dotted)

hline(0, "Zero Line", color=color.gray, linestyle=hline.style_dotted)

- EMA, SMA, CCI, ATR, Perfect Order Moving Average Strategy with Trend Magic Indicator Auto-Trading System

- MOST Indicator Dual Position Adaptive Strategy

- Dual EMA Indicator Smart Crossing Trading System with Dynamic Stop-Loss and Take-Profit Strategy

- EMA/SMA Multi-Indicator Comprehensive Trend Following Strategy

- Multi-Indicator Filtered Trading Strategy with Bollinger Bands and Woodies CCI

- CCI+RSI+KC Trend Filter Bi-Directional Trading Strategy

- Dual Timeframe Momentum Strategy

- Mobo Bands

- Dynamic Market Regime Identification Strategy Based on Linear Regression Slope

- Z Score with Signals

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Advanced Fair Value Gap Detection Strategy with Dynamic Risk Management and Fixed Take Profit

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Dynamic ATR Stop-Loss RSI Oversold Rebound Quantitative Strategy

- Advanced Dual EMA Strategy with ATR Volatility Filter System

- Dual EMA Dynamic Zone Trend Following Strategy

- Multi-MA Crossover with RSI Dynamic Trailing Stop Loss Quantitative Trading Strategy

- Dual EMA Trend Momentum Trading Strategy

- Multi-Trend Momentum Crossover Strategy with Volatility Optimization System

- Multi-Indicator Trend Breakout Quantitative Trading Strategy

- Multi-Zone SMC Theory Based Intelligent Trend Following Strategy

- Dynamic Multi-Period Quantitative Trading Strategy Combining RSI and EMA

- Multi-Dimensional Technical Indicator Trend Following Quantitative Strategy

- Dual Moving Average Crossover Adaptive Parameter Trading Strategy

- Multi-Trend Following and Structure Breakout Strategy

- TRAMA Dual Moving Average Crossover Intelligent Quantitative Trading Strategy

- Multi-Timeframe RSI-EMA Momentum Trading Strategy with Position Scaling

- Multi-MA Trend Following with RSI Momentum Strategy

- Multi-Level Fibonacci EMA Trend Following Strategy

- Trend-Following Gap Breakout Trading System with SMA Filter