概述

本策略是一个基于双均线交叉的智能交易系统,采用9周期和21周期的指数移动平均线(EMA)作为核心指标。该策略集成了动态止损止盈机制,通过对EMA指标的交叉信号进行实时监测,自动执行交易指令。系统采用百分比跟踪止损和固定比例止盈方案,既保证了交易的安全性,又确保了盈利的可能性。

策略原理

策略运行的核心逻辑基于快速EMA(9周期)与慢速EMA(21周期)的交叉关系。当快线向上穿越慢线时,系统识别为看涨信号,自动平掉空仓并开立多仓;当快线向下穿越慢线时,系统识别为看跌信号,自动平掉多仓并开立空仓。同时,系统还设置了动态的止损止盈机制:多仓持仓期间,止损价位设定在开仓价格下方5%处,止盈价位设定在开仓价格上方10%处;空仓持仓期间,止损价位设定在开仓价格上方5%处,止盈价位设定在开仓价格下方10%处。

策略优势

- 指标选择科学合理:EMA对市场变化的反应更加敏感,能够及时捕捉市场趋势

- 止损止盈机制完善:采用百分比设置方式,可以根据不同市场环境灵活调整

- 自动化程度高:从信号识别到交易执行全程自动化,减少人为干预

- 风险控制到位:每次交易都设有明确的止损和止盈点位

- 代码结构清晰:变量命名规范,逻辑层次分明,便于后期维护和优化

策略风险

- 震荡市场风险:在横盘震荡市场中可能频繁产生交叉信号,导致频繁交易

- 滑点风险:在市场波动剧烈时可能面临实际成交价格与理论价格存在差异的情况

- 资金管理风险:固定比例的仓位管理方式可能在某些市况下不够灵活

- 系统性风险:若市场出现极端情况,止损或止盈指令可能无法及时执行

策略优化方向

- 引入趋势过滤器:可以添加ADX或者ATR指标来判断趋势强度,避免在震荡市场频繁交易

- 优化止损止盈机制:可以考虑使用ATR动态调整止损止盈距离,使其更适应市场波动

- 增加交易时间过滤:可以添加具体的交易时间段限制,避开波动较大的时段

- 完善仓位管理:可以根据市场波动率动态调整开仓数量

- 添加市场情绪指标:可以结合RSI或MACD等指标进行交易确认

总结

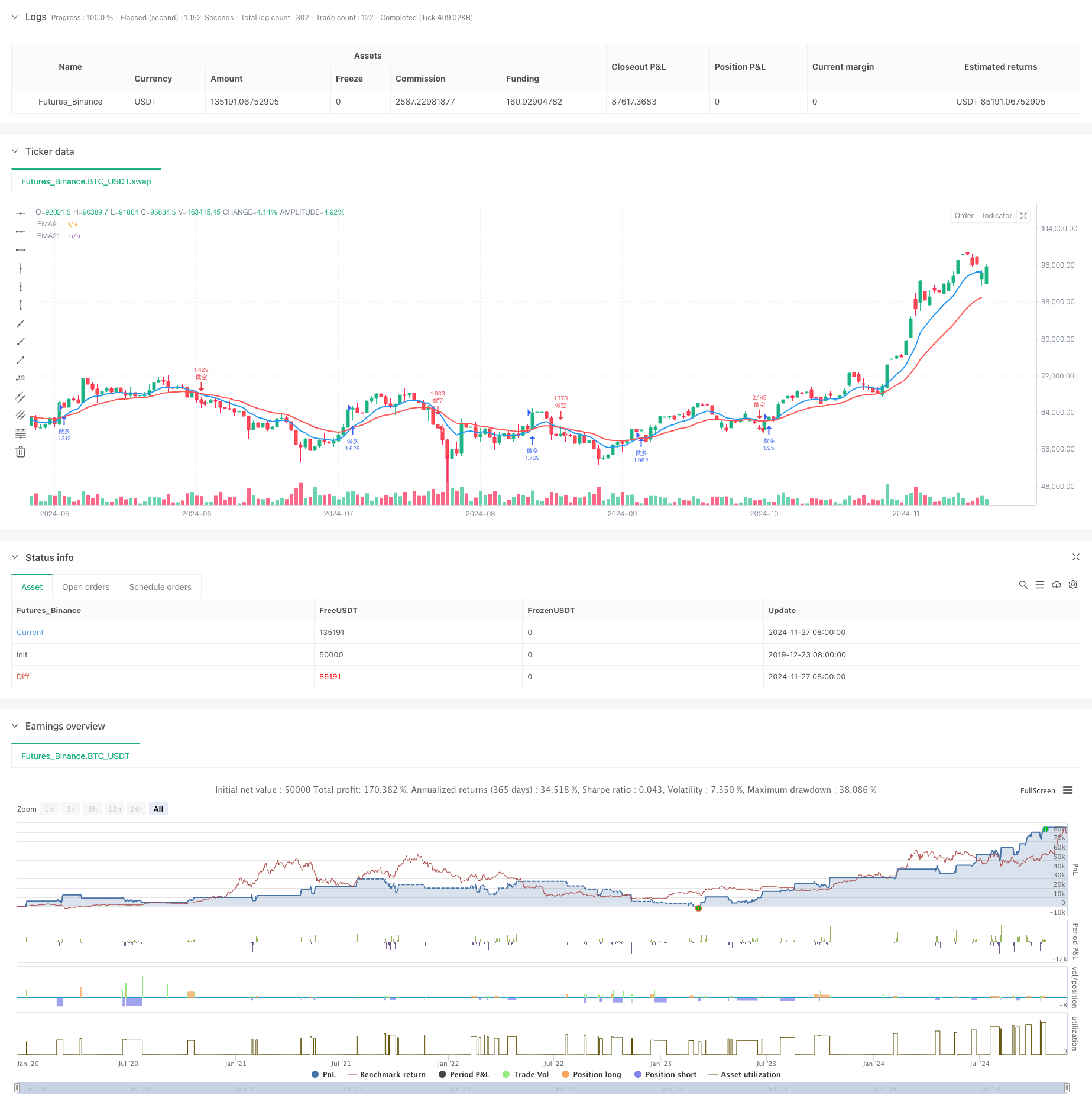

该策略是一个结构完整、逻辑清晰的自动化交易系统。通过EMA交叉信号进行交易决策,配合动态止损止盈机制,能够在趋势市场中获得较好的表现。但在使用过程中需要注意市场环境的变化,适时调整参数设置,并做好风险控制。通过不断优化和完善,该策略有望成为一个稳定可靠的交易工具。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Cross Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// 添加策略参数设置

var showLabels = input.bool(true, "显示标签")

var stopLossPercent = input.float(5.0, "止损百分比", minval=0.1, maxval=20.0, step=0.1)

var takeProfitPercent = input.float(10.0, "止盈百分比", minval=0.1, maxval=50.0, step=0.1)

// 计算EMA

ema9 = ta.ema(close, 9)

ema21 = ta.ema(close, 21)

// 绘制EMA线

plot(ema9, "EMA9", color=color.blue, linewidth=2)

plot(ema21, "EMA21", color=color.red, linewidth=2)

// 检测交叉

crossOver = ta.crossover(ema9, ema21)

crossUnder = ta.crossunder(ema9, ema21)

// 格式化时间显示 (UTC+8)

utc8Time = time + 8 * 60 * 60 * 1000

timeStr = str.format("{0,date,MM-dd HH:mm}", utc8Time)

// 计算止损止盈价格

longStopLoss = strategy.position_avg_price * (1 - stopLossPercent / 100)

longTakeProfit = strategy.position_avg_price * (1 + takeProfitPercent / 100)

shortStopLoss = strategy.position_avg_price * (1 + stopLossPercent / 100)

shortTakeProfit = strategy.position_avg_price * (1 - takeProfitPercent / 100)

// 交易逻辑

if crossOver

if strategy.position_size < 0 // 如果持有空仓

strategy.close("做空") // 先平掉空仓

strategy.entry("做多", strategy.long) // 开多仓

if showLabels

label.new(bar_index, high, text="做多入场\n" + timeStr, color=color.green, textcolor=color.white, style=label.style_label_down, yloc=yloc.abovebar)

if crossUnder

if strategy.position_size > 0 // 如果持有多仓

strategy.close("做多") // 先平掉多仓

strategy.entry("做空", strategy.short) // 开空仓

if showLabels

label.new(bar_index, low, text="做空入场\n" + timeStr, color=color.red, textcolor=color.white, style=label.style_label_up, yloc=yloc.belowbar)

// 设置止损止盈

if strategy.position_size > 0 // 多仓止损止盈

strategy.exit("多仓止损止盈", "做多", stop=longStopLoss, limit=longTakeProfit)

if strategy.position_size < 0 // 空仓止损止盈

strategy.exit("空仓止损止盈", "做空", stop=shortStopLoss, limit=shortTakeProfit)

相关推荐