Multi-MA Crossover with RSI Dynamic Trailing Stop Loss Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-11-29 16:10:35Tags: MARSISMASLTS

Overview

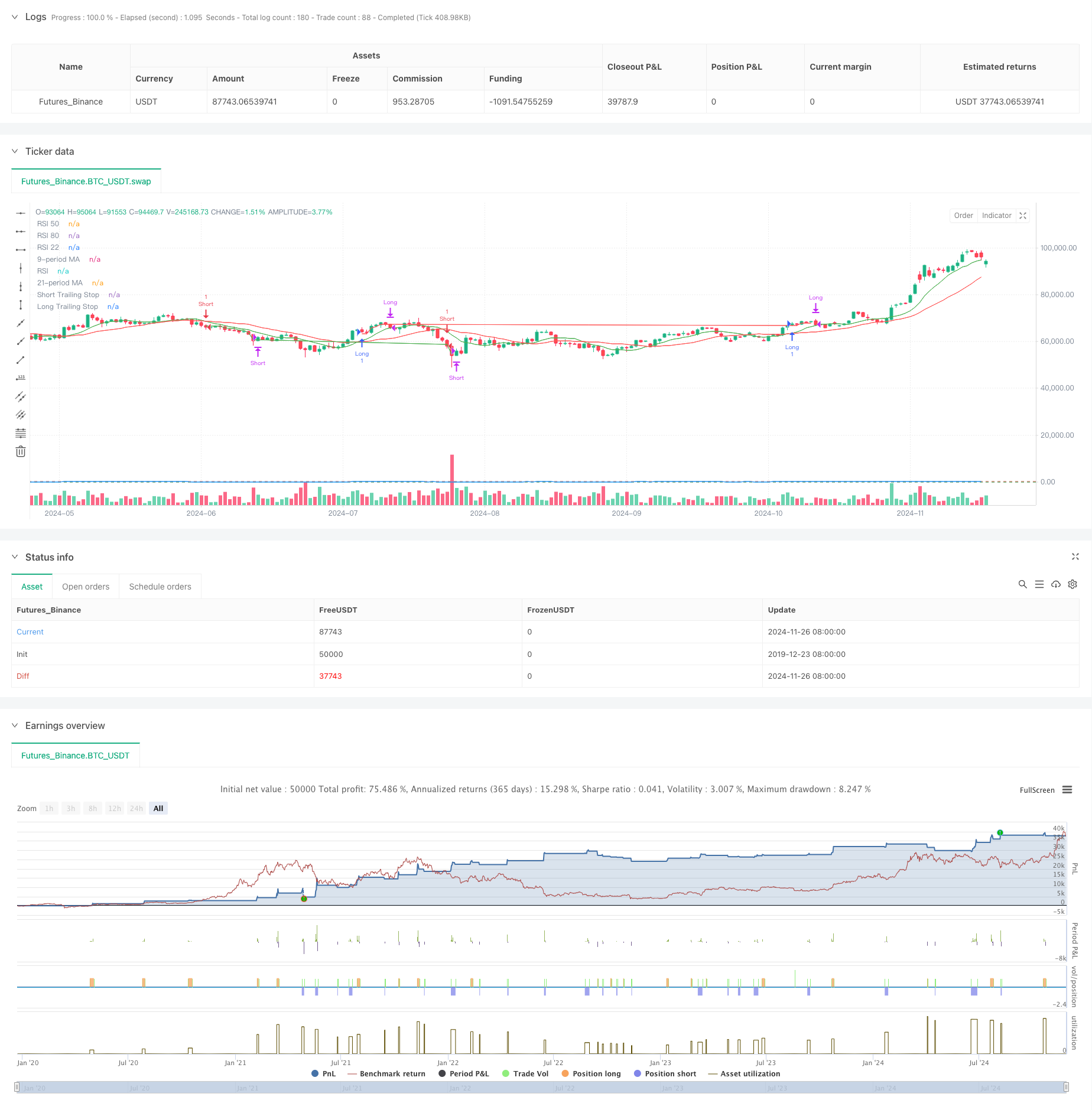

This strategy is a quantitative trading system that combines Moving Average crossover with the Relative Strength Index (RSI), integrated with a trailing stop loss function. The strategy utilizes two moving averages - 9-period and 21-period - as primary trend indicators, coupled with RSI for trade signal confirmation, and implements dynamic trailing stops for profit protection and risk control. The strategy design comprehensively considers market trends, momentum, and risk management dimensions to form a complete trading system.

Strategy Principles

The core logic of the strategy is based on the following key elements:

- Trend Identification: Recognizes market trend changes through crossovers of fast (9-period) and slow (21-period) moving averages. Long signals are generated when the fast MA crosses above the slow MA with RSI above 55, while short signals occur when the fast MA crosses below with RSI below 45.

- Signal Confirmation: Uses RSI as a signal filter, enhancing trade signal reliability through RSI threshold settings.

- Risk Control: Employs a 1% trailing stop loss, dynamically adjusting stop positions to protect profits. Also includes RSI-based profit-taking conditions, closing long positions when RSI exceeds 80 and short positions when RSI falls below 22.

- Stop Loss Mechanism: Combines fixed and trailing stops, automatically closing positions when price breaches preset percentage levels from entry points or hits trailing stop levels.

Strategy Advantages

- Multi-dimensional Signal Verification: Improves trading signal accuracy through dual confirmation of MA crossover and RSI.

- Comprehensive Risk Management: Implements dynamic trailing stops for both profit protection and risk control.

- Flexible Entry Mechanism: Effectively captures market turning points by combining trend and momentum indicators.

- High Automation Level: Clear strategy logic facilitates automated trading implementation.

- Strong Adaptability: Can be adapted to different market environments through parameter adjustment.

Strategy Risks

- Sideways Market Risk: May generate frequent false breakout signals in range-bound markets.

- Slippage Risk: Potential slippage losses during trailing stop execution.

- Parameter Sensitivity: Strategy performance significantly affected by MA period and RSI threshold settings.

- Systemic Risk: Stop losses may not execute timely in extreme market conditions.

Strategy Optimization Directions

- Signal Enhancement: Consider incorporating volume indicators as additional confirmation conditions.

- Stop Loss Refinement: Implement volatility-based dynamic stop loss adjustment mechanisms.

- Position Management: Add dynamic position sizing system based on risk assessment.

- Market Adaptability: Include market environment recognition mechanism for different parameter settings in various market states.

- Signal Filtering: Add time filters to avoid trading during volatile market opening and closing periods.

Summary

This strategy constructs a trading system combining trend-following and momentum characteristics through classic technical analysis indicators. Its core strengths lie in multi-dimensional signal confirmation mechanisms and comprehensive risk management systems. Through continuous optimization and improvement, the strategy shows promise for maintaining stable performance across different market environments. Traders are advised to conduct thorough backtesting before live implementation and adjust parameters according to specific trading instrument characteristics.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ojha's Intraday MA Crossover + RSI Strategy with Trailing Stop", overlay=true)

// Define Moving Averages

fastLength = 9

slowLength = 21

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Define RSI

rsiPeriod = 14

rsiValue = ta.rsi(close, rsiPeriod)

// Define Conditions for Long and Short

longCondition = ta.crossover(fastMA, slowMA) and rsiValue > 55

shortCondition = ta.crossunder(fastMA, slowMA) and rsiValue < 45

// Define the trailing stop distance (e.g., 1% trailing stop)

trailingStopPercent = 1.0

// Variables to store the entry candle high and low

var float longEntryLow = na

var float shortEntryHigh = na

// Variables for trailing stop levels

var float longTrailingStop = na

var float shortTrailingStop = na

// Exit conditions

exitLongCondition = rsiValue > 80

exitShortCondition = rsiValue < 22

// Stop-loss conditions (price drops below long entry candle low * 1% or exceeds short entry candle high * 1%)

longStopLoss = longEntryLow > 0 and close < longEntryLow * 0.99

shortStopLoss = shortEntryHigh > 0 and close > shortEntryHigh * 1.01

// Execute Buy Order and store the entry candle low for long stop-loss

if (longCondition)

strategy.entry("Long", strategy.long)

longEntryLow := low // Store the low of the candle where long entry happened

longTrailingStop := close * (1 - trailingStopPercent / 100) // Initialize trailing stop at entry

// Execute Sell Order and store the entry candle high for short stop-loss

if (shortCondition)

strategy.entry("Short", strategy.short)

shortEntryHigh := high // Store the high of the candle where short entry happened

shortTrailingStop := close * (1 + trailingStopPercent / 100) // Initialize trailing stop at entry

// Update trailing stop for long position

if (strategy.opentrades > 0 and strategy.position_size > 0)

longTrailingStop := math.max(longTrailingStop, close * (1 - trailingStopPercent / 100)) // Update trailing stop as price moves up

// Update trailing stop for short position

if (strategy.opentrades > 0 and strategy.position_size < 0)

shortTrailingStop := math.min(shortTrailingStop, close * (1 + trailingStopPercent / 100)) // Update trailing stop as price moves down

// Exit Buy Position when RSI is above 80, Stop-Loss triggers, or trailing stop is hit

if (exitLongCondition or longStopLoss or close < longTrailingStop)

strategy.close("Long")

longEntryLow := na // Reset the entry low after the long position is closed

longTrailingStop := na // Reset the trailing stop

// Exit Sell Position when RSI is below 22, Stop-Loss triggers, or trailing stop is hit

if (exitShortCondition or shortStopLoss or close > shortTrailingStop)

strategy.close("Short")

shortEntryHigh := na // Reset the entry high after the short position is closed

shortTrailingStop := na // Reset the trailing stop

// Plot Moving Averages on the Chart

plot(fastMA, color=color.green, title="9-period MA")

plot(slowMA, color=color.red, title="21-period MA")

// Plot RSI on a separate panel

rsiPlot = plot(rsiValue, color=color.blue, title="RSI")

hline(50, "RSI 50", color=color.gray)

hline(80, "RSI 80", color=color.red)

hline(22, "RSI 22", color=color.green)

// Plot Trailing Stop for Visualization

plot(longTrailingStop, title="Long Trailing Stop", color=color.red, linewidth=1, style=plot.style_line)

plot(shortTrailingStop, title="Short Trailing Stop", color=color.green, linewidth=1, style=plot.style_line)

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System

- Moving Average Crossover with RSI Trend Momentum Tracking Strategy

- Smooth Moving Average Stop Loss & Take Profit Strategy with Trend Filter and Exception Exit

- Dynamic Trend Following Strategy - Multi-Indicator Integrated Momentum Analysis System

- Multi-Technical Indicator Trend Following Trading Strategy

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Multi-Timeframe Bitcoin, Binance Coin, and Ethereum Pullback Trading Strategy

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Multi-Moving Average Momentum Trend Following Strategy

- Multi-Period Moving Average and RSI Momentum Cross Trend Following Strategy

- Smoothed Heikin-Ashi with SMA Crossover Trend Following Strategy

- Reflected EMA Trend Determination Strategy Based on Hull Moving Averages

- Dual EMA Indicator Smart Crossing Trading System with Dynamic Stop-Loss and Take-Profit Strategy

- OBV-SMA Crossover with RSI Filter Multi-Dimensional Momentum Trading Strategy

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Advanced Fair Value Gap Detection Strategy with Dynamic Risk Management and Fixed Take Profit

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Dynamic ATR Stop-Loss RSI Oversold Rebound Quantitative Strategy

- Advanced Dual EMA Strategy with ATR Volatility Filter System

- Dual EMA Dynamic Zone Trend Following Strategy

- Dual EMA Trend Momentum Trading Strategy

- Multi-Trend Momentum Crossover Strategy with Volatility Optimization System

- Multi-Indicator Trend Breakout Quantitative Trading Strategy

- Momentum Indicator Oscillation Threshold Enhanced Trading Strategy

- Multi-Zone SMC Theory Based Intelligent Trend Following Strategy

- Dynamic Multi-Period Quantitative Trading Strategy Combining RSI and EMA

- Multi-Dimensional Technical Indicator Trend Following Quantitative Strategy

- Dual Moving Average Crossover Adaptive Parameter Trading Strategy

- Multi-Trend Following and Structure Breakout Strategy

- TRAMA Dual Moving Average Crossover Intelligent Quantitative Trading Strategy