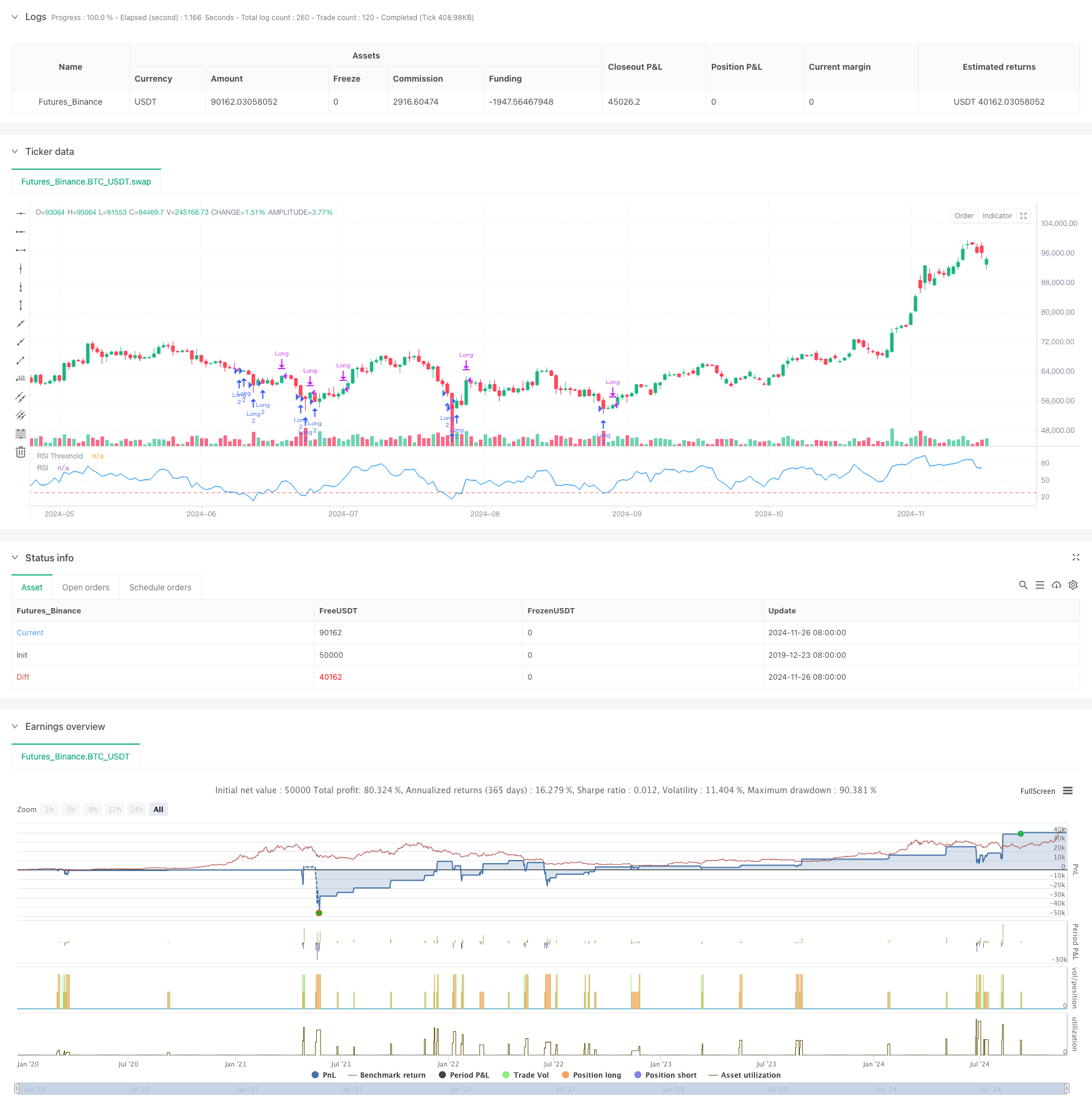

概述

这是一个基于相对强弱指标(RSI)的动态交易策略,结合了灵活的止损机制。该策略主要针对市场超卖区域进行交易,通过捕捉价格的反弹机会来获取收益。策略的核心在于通过RSI指标识别潜在的超卖状态,并在建仓后使用百分比止损来控制风险,同时结合前期高点突破作为获利了结的信号。

策略原理

策略的运作基于以下几个关键要素: 1. RSI指标计算采用8周期作为默认值,这个周期设置较短,能够更快地捕捉到市场的超卖状态。 2. 入场条件设定为RSI低于28的阈值,这表明市场可能处于严重超卖状态。 3. 止损机制采用基于入场价格的百分比方式,默认设置为5%,这提供了明确的风险控制边界。 4. 出场信号基于价格突破前期高点,这种方式能够让盈利继续延伸。 5. 策略在资金管理上采用固定持仓量和允许最多2倍的金字塔加仓。

策略优势

- 风险控制机制完善,通过百分比止损提供了明确的风险边界。

- 入场逻辑清晰,RSI超卖判断具有较强的市场适应性。

- 出场机制能够让盈利充分发展,避免过早了结有潜力的交易。

- 策略参数可调整性强,便于根据不同市场条件进行优化。

- 考虑了交易成本和滑点因素,更接近实际交易环境。

策略风险

- RSI指标可能出现假信号,特别是在震荡市场中。

- 固定百分比止损可能在波动较大的市场中过于僵化。

- 突破前期高点的出场方式可能在剧烈波动时错过最佳获利机会。

- 允许2倍金字塔加仓可能在市场持续下跌时增加风险暴露。

策略优化方向

- 可以考虑引入波动率指标来动态调整止损百分比。

- 增加趋势过滤器,避免在强势下跌趋势中频繁入场。

- 优化出场机制,可以结合RSI超买区域作为辅助出场参考。

- 加入成交量确认机制,提高入场信号的可靠性。

- 开发动态的仓位管理系统,根据市场状况调整持仓量。

总结

这是一个设计完善的交易策略,通过RSI超卖判断和止损机制的结合,在风险控制和盈利机会把握之间取得了较好的平衡。策略的可调整性强,适合在不同市场环境下通过参数优化来提升性能。虽然存在一些潜在风险,但通过建议的优化方向可以进一步提升策略的稳定性和盈利能力。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI Strategy with Adjustable RSI and Stop-Loss", overlay=false,

default_qty_type=strategy.fixed, default_qty_value=2,

initial_capital=10000, pyramiding=2,

commission_type=strategy.commission.percent, commission_value=0.05,

slippage=1)

// Input fields for RSI parameters

rsi_length = input.int(8, title="RSI Length", minval=1)

rsi_threshold = input.float(28, title="RSI Threshold", minval=1, maxval=50)

// Input for Stop-Loss percentage

stop_loss_percent = input.float(5, title="Stop-Loss Percentage", minval=0.1, maxval=100)

// Calculate the RSI

rsi = ta.rsi(close, rsi_length)

// Condition for buying: RSI below the defined threshold

buyCondition = rsi < rsi_threshold

// Condition for selling: Close price higher than yesterday's high

sellCondition = close > ta.highest(high, 1)[1]

// Calculate the Stop-Loss level based on the entry price

var float stop_loss_level = na

if (buyCondition)

stop_loss_level := close * (1 - stop_loss_percent / 100)

strategy.entry("Long", strategy.long)

// Create Stop-Loss order

strategy.exit("Stop-Loss", from_entry="Long", stop=stop_loss_level)

// Selling signal

if (sellCondition)

strategy.close("Long")

// Optional: Plot the RSI for visualization

plot(rsi, title="RSI", color=color.blue)

hline(rsi_threshold, "RSI Threshold", color=color.red)

相关推荐