Dynamic Filtering EMA Cross Strategy for Daily Trend Analysis

Author: ChaoZhang, Date: 2025-01-06 11:16:35Tags: EMAMACROSSTrend

Overview

This strategy employs a dual moving average system for trend determination and trading decisions, utilizing the relative position of fast and slow exponential moving averages (EMAs) at specific time points to identify trend initiation, continuation, or termination. The strategy checks the relationship between fast and slow EMAs at a fixed time daily, establishing long positions when the fast line is above the slow line and short positions when it’s below.

Strategy Principle

The core of the strategy is based on two EMAs with different periods for trend determination. The fast EMA (default period 10) is more sensitive to price changes, capable of capturing market movements quickly; the slow EMA (default period 50) reflects longer-term trends. The strategy checks the position relationship between these two lines at a specified time each trading day (default 9:00), using EMA crossover signals to determine market trend direction and execute trades. A long position is entered when the fast EMA crosses above the slow EMA, indicating strengthening upward momentum, while a short position is entered when the fast EMA crosses below the slow EMA, indicating strengthening downward momentum.

Strategy Advantages

- Clear and simple trading logic, easy to understand and execute

- Filters noise signals through daily fixed-time checks, reducing false trades

- Employs percentage-based position sizing for effective risk control

- Combines fast and slow moving averages to effectively capture trend initiation and reversal

- Highly adjustable strategy parameters, suitable for different market environments

- High degree of automation, requiring no manual intervention

Strategy Risks

- May generate frequent trades in choppy markets, increasing transaction costs

- Fixed entry timing might miss important price movements

- Moving average systems have inherent lag, potentially causing delayed entries or exits

- May experience significant drawdowns in highly volatile markets

- Improper parameter selection can affect strategy performance

Strategy Optimization Directions

- Incorporate volatility indicators to adjust position sizing during high volatility periods

- Add trend confirmation indicators like MACD or RSI to improve signal reliability

- Optimize entry timing mechanism, considering dynamic time checks based on market characteristics

- Add stop-loss and take-profit mechanisms for better risk control

- Consider incorporating volume analysis to improve signal quality

- Develop adaptive parameter mechanisms for increased flexibility

Summary

The strategy achieves a simple yet effective trend-following trading system by combining a dual EMA system with fixed-time check mechanisms. Its strengths lie in clear logic and high automation, though it faces limitations from moving average lag and fixed entry timing. There remains significant room for improvement through the introduction of additional technical indicators, optimization of parameter selection mechanisms, and enhanced risk control measures. Overall, this represents a practical basic strategy framework that can be further refined and optimized according to specific requirements.

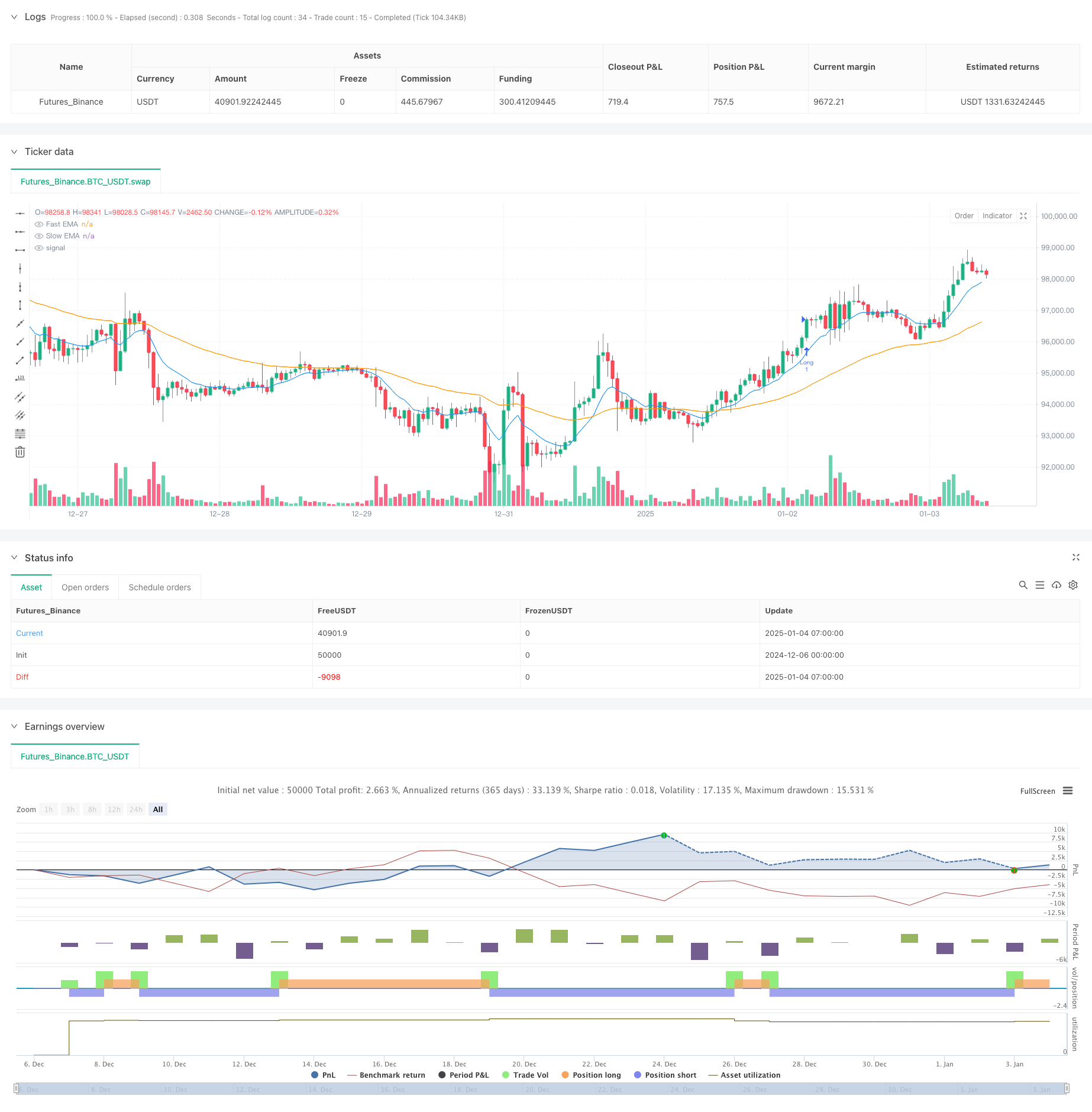

/*backtest

start: 2024-12-06 00:00:00

end: 2025-01-04 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Daily EMA Comparison Strategy", shorttitle="Daily EMA cros Comparison", overlay=true)

//------------------------------------------------------------------------------

// Inputs

//------------------------------------------------------------------------------

fastEmaLength = input.int(10, title="Fast EMA Length", minval=1) // Fast EMA period

slowEmaLength = input.int(50, title="Slow EMA Length", minval=1) // Slow EMA period

checkHour = input.int(9, title="Check Hour (24h format)", minval=0, maxval=23) // Hour to check

checkMinute = input.int(0, title="Check Minute", minval=0, maxval=59) // Minute to check

//------------------------------------------------------------------------------

// EMA Calculation

//------------------------------------------------------------------------------

fastEMA = ta.ema(close, fastEmaLength)

slowEMA = ta.ema(close, slowEmaLength)

//------------------------------------------------------------------------------

// Time Check

//------------------------------------------------------------------------------

// Get the current bar's time in the exchange's timezone

currentTime = timestamp("GMT-0", year, month, dayofmonth, checkHour, checkMinute)

// Check if the bar's time equals or passes the daily check time

isCheckTime = (time >= currentTime and time < currentTime + 60 * 1000) // 1-minute tolerance

//------------------------------------------------------------------------------

// Entry Conditions

//------------------------------------------------------------------------------

// Buy if Fast EMA is above Slow EMA at the specified time

buyCondition = isCheckTime and fastEMA > slowEMA

// Sell if Fast EMA is below Slow EMA at the specified time

sellCondition = isCheckTime and fastEMA < slowEMA

//------------------------------------------------------------------------------

// Strategy Execution

//------------------------------------------------------------------------------

// Enter Long

if buyCondition

strategy.entry("Long", strategy.long)

// Enter Short

if sellCondition

strategy.entry("Short", strategy.short)

//------------------------------------------------------------------------------

// Plot EMAs

//------------------------------------------------------------------------------

plot(fastEMA, color=color.blue, title="Fast EMA")

plot(slowEMA, color=color.orange, title="Slow EMA")

- MACD Crossover Strategy

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- Multi-EMA Automated Trading System with Trailing Profit Lock

- EMA Momentum Trading Strategy

- Multi-EMA Crossover Momentum Trend Following Strategy

- Multi-EMA Crossover Trend Following Strategy

- Cross-Market Overnight Position Strategy with EMA Filter

- EMA Dual Moving Average Crossover Strategy

- Intraday Breakout Strategy Based on 3-Minute Candle High Low Points

- G-Channel and EMA Trend Filter Trading System

- Dual EMA Crossover Dynamic Trend Following Quantitative Trading Strategy

- Adaptive Trend Flow Multiple Filter Trading Strategy

- Dynamic Dual Technical Indicator Oversold-Overbought Confirmation Trading Strategy

- Multi-Indicator Dynamic Trailing Stop Trading Strategy

- Dual EMA Stochastic Oscillator System: A Quantitative Trading Model Combining Trend Following and Momentum

- Multi-Indicator Dynamic Volatility Trading Strategy

- Dynamic Trading Theory: Exponential Moving Average and Cumulative Volume Period Crossover Strategy

- Dynamic EMA Crossover Strategy with ADX Trend Strength Filtering System

- Multi-Period Trend Linear Engulfing Pattern Quantitative Trading Strategy

- Adaptive Channel Breakout Strategy with Dynamic Support and Resistance Trading System

- Multi-EMA Crossover with Camarilla Support/Resistance Trend Trading System

- Enhanced Trend Multi-Signal Dynamic Trading Strategy

- Adaptive Momentum Martingale Trading System

- Trend Following RSI and Moving Average Combined Quantitative Trading Strategy

- Advanced Quantitative Trend Following and Cloud Reversal Composite Trading Strategy

- 5-Day EMA Based Trend Following Strategy Optimization Model

- Multi-Level Multi-Period EMA Crossover Dynamic Take-Profit Optimization Strategy

- Multi-Technical Indicator Synergistic Trading System

- Multi-Technical Indicator Based High-Frequency Dynamic Optimization Strategy

- Triple Supertrend and Exponential Moving Average Trend Following Quantitative Trading Strategy