Tendencia de Bollinger Band ATR Siguiendo la estrategia

El autor:¿ Qué pasa?, Fecha: 2024-05-15 10:50:14Las etiquetas:- ¿ Qué?La SMAEl ATR

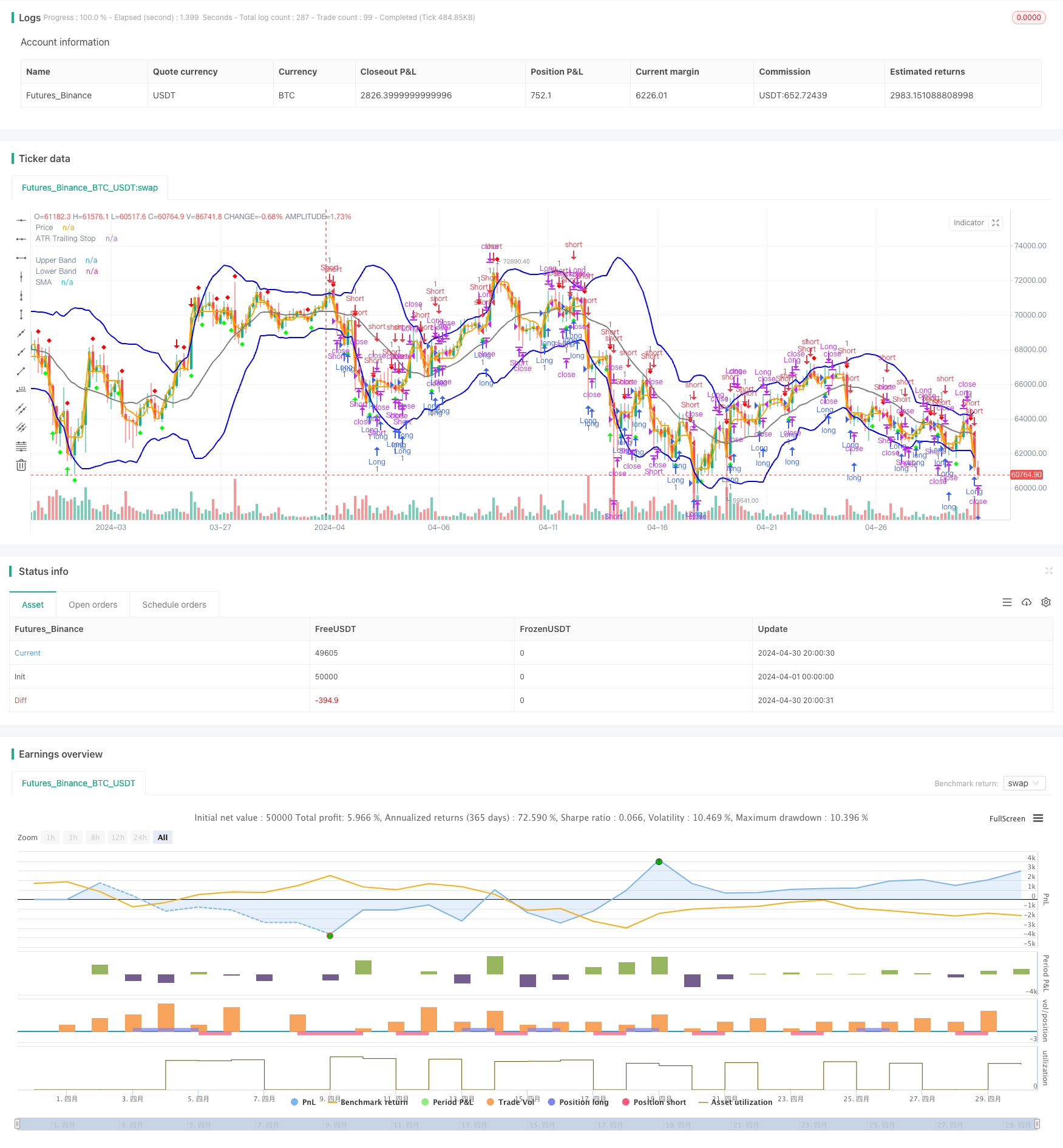

Resumen general

Esta estrategia se basa en las bandas de Bollinger y el indicador ATR. Captura las fluctuaciones de precios utilizando las bandas de Bollinger, utiliza las rupturas de precios por encima o por debajo de las bandas como señales de entrada y emplea ATR como un stop loss trasero. La estrategia cierra posiciones cuando el precio cruza el promedio móvil simple.

Principios de estrategia

- Calcular bandas de Bollinger: utilizar el precio de cierre para calcular la media móvil simple (SMA) como banda media, y calcular las bandas superior e inferior en función de la volatilidad (desviación estándar).

- Calcular el ATR: utilizar la media móvil del rango verdadero (TR) para calcular el ATR como base para la pérdida de detención posterior.

- Generar señales comerciales: Cuando el precio se rompe por debajo de la banda inferior de Bollinger, generar una señal larga; cuando se rompe por encima de la banda superior de Bollinger, generar una señal corta. Cuando el precio se rompe por encima de la parada de seguimiento ATR, generar una señal larga; cuando se rompe por debajo de la parada de seguimiento ATR, generar una señal corta.

- Posiciones cerradas: para las posiciones largas, si el precio supera la media móvil simple, se cierra la posición larga; para las posiciones cortas, si el precio supera la media móvil simple, se cierra la posición corta.

Ventajas estratégicas

- Seguimiento de tendencias: Captura las tendencias de los mercados mediante el uso de bandas de Bollinger y ATR trailing stop, adaptándose a diferentes entornos de mercado.

- Posiciones de suspensión de pérdidas en tiempo oportuno: utiliza el ATR como una posición de suspensión de pérdidas posterior, ajustando dinámicamente la posición de suspensión de pérdidas según la volatilidad del mercado para controlar el riesgo.

- Sencilla y fácil de usar: La lógica de la estrategia es clara, con pocos parámetros, lo que hace que sea fácil de entender y aplicar.

Riesgos estratégicos

- Sensibilidad de parámetros: el rendimiento de la estrategia se ve afectado por la elección de parámetros para las bandas de Bollinger y el ATR, lo que requiere una optimización para diferentes mercados e instrumentos.

- Mercados agitados: en condiciones de mercado agitadas, las señales de negociación frecuentes pueden conducir a una frecuencia y costos de negociación excesivos.

- Inversión de tendencia: cuando una tendencia se invierte, la estrategia puede experimentar importantes bajadas.

Direcciones para la optimización de la estrategia

- Optimización de parámetros: Optimizar los parámetros de las bandas de Bollinger y ATR para encontrar la mejor combinación para diferentes mercados e instrumentos.

- Filtros: añadir otros indicadores técnicos o patrones de comportamiento de precios como filtros para reducir los errores de juicio y mejorar la calidad de la señal.

- Gestión de posiciones: ajuste dinámico de las posiciones en función de la volatilidad del mercado o del riesgo de la cuenta para mejorar la eficiencia de la utilización del capital y los rendimientos ajustados al riesgo.

Resumen de las actividades

La estrategia Bollinger Band ATR Trend Following captura los mercados de tendencia utilizando Bollinger Bands y el indicador ATR. Tiene las ventajas de seguir la tendencia, detener la pérdida oportuna y la simplicidad. Sin embargo, también enfrenta riesgos como sensibilidad de parámetros, mercados agitados e inversiones de tendencia.

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands and ATR Strategy", overlay=true)

// Veri Çekme

symbol = "AAPL"

timeframe = "D"

src = close

// Bollinger Bantları Hesaplama

len = 20

mult = 2

sum1 = 0.0, sum2 = 0.0

for i = 0 to len - 1

sum1 += src[i]

basis = sum1 / len

for i = 0 to len - 1

diff = src[i] - basis

sum2 += diff * diff

dev = math.sqrt(sum2 / len)

upper_band = basis + dev * mult

lower_band = basis - dev * mult

// ATR Hesaplama

atr_period = input(10, title="ATR Period")

atr_value = 0.0

for i = 0 to atr_period - 1

atr_value += math.abs(src[i] - src[i + 1])

atr_value /= atr_period

loss = input(1, title="Key Value (Sensitivity)")

atr_trailing_stop = src[1]

if src > atr_trailing_stop[1]

atr_trailing_stop := math.max(atr_trailing_stop[1], src - loss * atr_value)

else if src < atr_trailing_stop[1]

atr_trailing_stop := math.min(atr_trailing_stop[1], src + loss * atr_value)

else

atr_trailing_stop := src - loss * atr_value

// Sinyal Üretme

long_condition = src < lower_band and src[1] >= lower_band[1]

short_condition = src > upper_band and src[1] <= upper_band[1]

close_long = src > basis

close_short = src < basis

buy_signal = src > atr_trailing_stop[1] and src[1] <= atr_trailing_stop[1]

sell_signal = src < atr_trailing_stop[1] and src[1] >= atr_trailing_stop[1]

if (long_condition)

strategy.entry("Long", strategy.long, comment="Long Signal")

if (short_condition)

strategy.entry("Short", strategy.short, comment="Short Signal")

if (close_long)

strategy.close("Long", comment="Close Long")

if (close_short)

strategy.close("Short", comment="Close Short")

if (buy_signal)

strategy.entry("Long", strategy.long, comment="Buy Signal")

if (sell_signal)

strategy.entry("Short", strategy.short, comment="Sell Signal")

// Çizim

plot(upper_band, color=#0000FF, linewidth=2, title="Upper Band")

plot(lower_band, color=#0000FF, linewidth=2, title="Lower Band")

plot(basis, color=#808080, linewidth=2, title="SMA")

plot(atr_trailing_stop, color=#FFA500, linewidth=2, title="ATR Trailing Stop")

plot(src, color=#FFA500, linewidth=2, title="Price")

// Sinyal İşaretleri

plotshape(long_condition, style=shape.arrowup, color=#00FF00, location=location.belowbar, size=size.small, title="Long Signal")

plotshape(short_condition, style=shape.arrowdown, color=#FF0000, location=location.abovebar, size=size.small, title="Short Signal")

plotshape(buy_signal, style=shape.diamond, color=#00FF00, location=location.belowbar, size=size.small, title="Buy Signal")

plotshape(sell_signal, style=shape.diamond, color=#FF0000, location=location.abovebar, size=size.small, title="Sell Signal")

Relacionados

- Estrategia de ruptura de RSI y bandas de Bollinger de alta precisión con relación riesgo-rendimiento optimizada

- Estrategia de optimización del impulso de las bandas de Bollinger

- Estrategia de negociación equilibrada de rotación larga y corta basada en el tiempo

- Estrategia cuantitativa mejorada de reversión de la media de Bollinger

- Tendencia de alta tasa de ganancia significa estrategia de negociación de inversión

- No hay estrategia de ruptura de vela alcista de parche superior

- Estrategia de venta excesiva de la banda de Bollinger

- Estrategia de ruptura dinámica de las bandas de Bollinger

- Indicador de soporte técnico y resistencia Estrategia de negociación de precisión

- Estrategia de ruptura de bandas de Bollinger

Más.

- Estrategia de rechazo de MA con filtro ADX

- Estrategia de bandas de Bollinger: Negociación de precisión para obtener ganancias máximas

- Estrategia de escape promedio de ATR

- Estrategia de aprendizaje automático KNN: Sistema de negociación de predicción de tendencias basado en el algoritmo de vecinos más cercanos K

- En el caso de las entidades financieras, el valor de la inversión se calcula de acuerdo con el método de cálculo de la rentabilidad.

- Estrategia de salida de BMSB

- Estrategia de ruptura de la SR

- Estrategia de ruptura dinámica de las bandas de Bollinger

- 8 horas de ema

- Estrategia de negociación cuantitativa del RSI

- Estrategia de negociación de volumen delta con niveles de Fibonacci

- Estrategia diferencial RSI doble

- Crypto Big Move Estrategia de RSI estocástica

- Indice de fuerza relativa triple Estrategia de negociación cuantitativa

- Estrategia de optimización MACD doble que combina el seguimiento de tendencias y el comercio de impulso

- Estrategia de negociación basada en tres velas bajistas consecutivas y medias móviles dobles

- Estrategia de ruptura de la sesión DZ

- Han Yue - Tendencia siguiendo la estrategia de negociación basada en múltiples EMA, ATR y RSI

- 200 EMA, VWAP, FMI Tendencia de la estrategia

- Estrategia cruzada de la EMA con divergencia del RSI, identificación de tendencias de 30 minutos y agotamiento de precios