Estrategia de rechazo de MA con filtro ADX

El autor:¿ Qué pasa?, Fecha: 2024-05-17 10:35:58Las etiquetas:ADX- ¿Qué es?La WMA

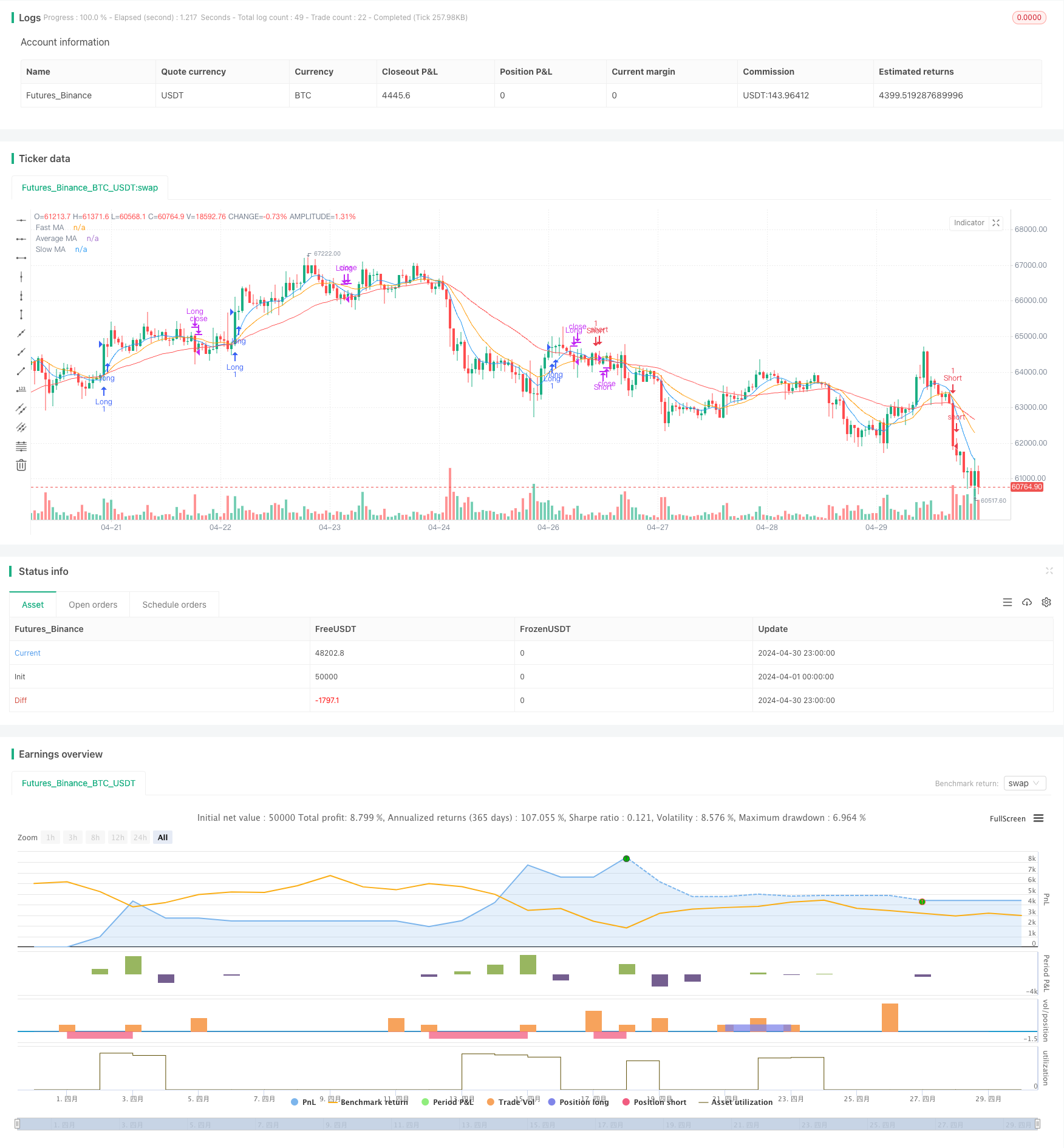

Resumen general

Esta estrategia utiliza múltiples promedios móviles (MA) como las señales comerciales principales e incorpora el índice direccional promedio (ADX) como un filtro. La idea principal detrás de la estrategia es identificar oportunidades potenciales largas y cortas comparando las relaciones entre el MA rápido, el MA lento y el MA promedio. Al mismo tiempo, el indicador ADX se utiliza para filtrar entornos de mercado con suficiente fuerza de tendencia, mejorando la confiabilidad de las señales comerciales.

Principio de la estrategia

- Calcule el MA rápido, lento y promedio.

- Identificar los posibles niveles largos y cortos comparando el precio de cierre con el MA lento.

- Confirmar los niveles largos y cortos comparando el precio de cierre con el MA rápido.

- Calcular manualmente el indicador ADX para medir la fuerza de la tendencia.

- Se generará una señal de entrada larga cuando el MA rápido se cruce por encima del MA medio, el ADX esté por encima de un umbral establecido y se confirme un nivel largo.

- Generar una señal de entrada corta cuando el MA rápido se cruce por debajo del MA medio, el ADX está por encima de un umbral establecido y se confirma un nivel corto.

- Generar una señal de salida larga cuando el precio de cierre se cruza por debajo del MA lento; generar una señal de salida corta cuando el precio de cierre se cruza por encima del MA lento.

Ventajas estratégicas

- El uso de múltiples MAs permite una captura más completa de las tendencias del mercado y los cambios de impulso.

- Al comparar las relaciones entre el MA rápido, el MA lento y el MA promedio, se pueden identificar oportunidades comerciales potenciales.

- El uso del indicador ADX como filtro ayuda a evitar la generación de señales falsas excesivas en mercados agitados, mejorando la fiabilidad de las señales comerciales.

- La lógica de la estrategia es clara y fácil de entender e implementar.

Riesgos estratégicos

- En situaciones en las que la tendencia no es clara o el mercado es inestable, la estrategia puede generar numerosas señales falsas, lo que conduce a operaciones y pérdidas frecuentes.

- La estrategia se basa en indicadores con retraso, como el MA y el ADX, que pueden perder oportunidades de formación temprana de tendencias.

- El rendimiento de la estrategia está significativamente influenciado por la configuración de parámetros (por ejemplo, longitudes MA y umbral ADX), lo que requiere una optimización basada en diferentes mercados e instrumentos.

Direcciones para la optimización de la estrategia

- Considere la posibilidad de incorporar otros indicadores técnicos, como el RSI y el MACD, para mejorar la fiabilidad y la diversidad de las señales comerciales.

- Establecer diferentes combinaciones de parámetros para diversos entornos de mercado para adaptarse a los cambios del mercado.

- Introducir medidas de gestión de riesgos, como el stop-loss y el dimensionamiento de las posiciones, para controlar las pérdidas potenciales.

- Combinar análisis fundamentales, tales como datos económicos y cambios en las políticas, para obtener una perspectiva de mercado más completa.

Resumen de las actividades

La estrategia de rechazo de MA con filtro ADX utiliza múltiples MA y el indicador ADX para identificar oportunidades comerciales potenciales y filtrar señales comerciales de baja calidad. La lógica de la estrategia es clara y fácil de entender e implementar.

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gavinc745

//@version=5

strategy("MA Rejection Strategy with ADX Filter", overlay=true)

// Input parameters

fastMALength = input.int(10, title="Fast MA Length", minval=1)

slowMALength = input.int(50, title="Slow MA Length", minval=1)

averageMALength = input.int(20, title="Average MA Length", minval=1)

adxLength = input.int(14, title="ADX Length", minval=1)

adxThreshold = input.int(20, title="ADX Threshold", minval=1)

// Calculate moving averages

fastMA = ta.wma(close, fastMALength)

slowMA = ta.wma(close, slowMALength)

averageMA = ta.wma(close, averageMALength)

// Calculate ADX manually

dmPlus = high - high[1]

dmMinus = low[1] - low

trueRange = ta.tr

dmPlusSmoothed = ta.wma(dmPlus > 0 and dmPlus > dmMinus ? dmPlus : 0, adxLength)

dmMinusSmoothed = ta.wma(dmMinus > 0 and dmMinus > dmPlus ? dmMinus : 0, adxLength)

trSmoothed = ta.wma(trueRange, adxLength)

diPlus = dmPlusSmoothed / trSmoothed * 100

diMinus = dmMinusSmoothed / trSmoothed * 100

adx = ta.wma(math.abs(diPlus - diMinus) / (diPlus + diMinus) * 100, adxLength)

// Identify potential levels

potentialLongLevel = low < slowMA and close > slowMA

potentialShortLevel = high > slowMA and close < slowMA

// Confirm levels

confirmedLongLevel = potentialLongLevel and close > fastMA

confirmedShortLevel = potentialShortLevel and close < fastMA

// Entry signals

longEntry = confirmedLongLevel and ta.crossover(fastMA, averageMA) and adx > adxThreshold

shortEntry = confirmedShortLevel and ta.crossunder(fastMA, averageMA) and adx > adxThreshold

// Exit signals

longExit = ta.crossunder(close, slowMA)

shortExit = ta.crossover(close, slowMA)

// Plot signals

plotshape(longEntry, title="Long Entry", location=location.belowbar, style=shape.triangleup, size=size.small, color=color.green)

plotshape(shortEntry, title="Short Entry", location=location.abovebar, style=shape.triangledown, size=size.small, color=color.red)

// Plot moving averages and ADX

plot(fastMA, title="Fast MA", color=color.blue)

plot(slowMA, title="Slow MA", color=color.red)

plot(averageMA, title="Average MA", color=color.orange)

// plot(adx, title="ADX", color=color.purple)

// hline(adxThreshold, title="ADX Threshold", color=color.gray, linestyle=hline.style_dashed)

// Execute trades

if longEntry

strategy.entry("Long", strategy.long)

else if longExit

strategy.close("Long")

if shortEntry

strategy.entry("Short", strategy.short)

else if shortExit

strategy.close("Short")

- Sistema de negociación de media móvil múltiple con confirmación de impulso y volumen Estrategia de tendencia cuantitativa

- Se trata de la suma de las pérdidas de los valores de los valores de las pérdidas de los valores de las pérdidas de los valores de las pérdidas de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de los valores de los valores de los valores de los valores de los valores de las

- Captura de la fortaleza de la tendencia multi-MA con una estrategia de obtención de beneficios de impulso

- Estrategia cuantitativa de doble casco de media móvil cruzada

- Comercio de tendencias en tiempo real basado en puntos de pivote y pendiente

- Estrategia de cruce de la media móvil del casco de varios marcos de tiempo

- Estrategia de negociación de impulso de ruptura de tendencia de ADX

- Indicador multi-técnico de impulso cruzado Estrategia de negociación cuantitativa - Análisis de integración basado en EMA, RSI y ADX

- Estrategia de negociación dinámica de media móvil multi-adaptiva

- Sistema de tendencia de ruptura histórica con filtro de media móvil (HBTS)

- Estrategia de ruptura de fluctuación alta/baja mejorada con patrones alcistas y bajistas de absorción

- RSI de Laguerre con la estrategia de señales comerciales filtradas ADX

- Estrategia de compra de ruptura de precio y volumen

- K Velas consecutivas Estrategia Bull Bear

- Estrategia de cruce de la media móvil súper y la banda superior

- Tendencia de múltiples factores siguiendo una estrategia de negociación cuantitativa basada en RSI, ADX e Ichimoku Cloud

- Estrategia combinada de largo y corto plazo del RSI y del MACD

- Nube de Ichimoku y estrategia de promedio móvil

- William Alligator Moving Average Tendencia de la estrategia de captura

- Dinámico MACD y estrategia de negociación en la nube de Ichimoku

- Estrategia de bandas de Bollinger: Negociación de precisión para obtener ganancias máximas

- Estrategia de escape promedio de ATR

- Estrategia de aprendizaje automático KNN: Sistema de negociación de predicción de tendencias basado en el algoritmo de vecinos más cercanos K

- En el caso de las entidades financieras, el valor de la inversión se calcula de acuerdo con el método de cálculo de la rentabilidad.

- Estrategia de salida de BMSB

- Estrategia de ruptura de la SR

- Estrategia de ruptura dinámica de las bandas de Bollinger

- 8 horas de ema

- Estrategia de negociación cuantitativa del RSI

- Tendencia de Bollinger Band ATR Siguiendo la estrategia