Descripción general

La estrategia cuantitativa utiliza principalmente la señal de cruce de la SAR paralela (PSAR) y el promedio móvil del índice (EMA) para generar señales de compra y venta, junto con una serie de condiciones personalizadas. La idea principal de la estrategia es: generar una señal de compra cuando el PSAR rompe la EMA desde abajo y cumple ciertas condiciones; generar una señal de venta cuando el PSAR rompe la EMA desde arriba y cumple ciertas condiciones.

Principio de estrategia

- Cálculo de las PSAR y las EMA de 30 ciclos

- Determinar la relación cruzada entre el PSAR y el EMA y establecer el punto de referencia correspondiente

- Combinando la relación de posición de los PSAR con los EMA, el color de la línea K, y otras condiciones, define IGC (Ideal Green Candle) e IRC (Ideal Red Candle)

- La aparición de IGC e IRC para juzgar las señales de compra y venta

- Establezca un stop y un stop loss, el stop es el 8%, 16% y 32% del precio de compra, el stop es el 16% del precio de compra y el stop es el 8%, 16% y 32% del precio de venta, el stop es el 16% del precio de venta

- Ejecutar operaciones de compra, venta o liquidación de acuerdo con el momento de la transacción y el estado de la posición

Ventajas estratégicas

- Combinación de varios indicadores y condiciones para mejorar la fiabilidad de la señal

- Establece múltiples paradas y paradas de pérdidas para un control flexible de riesgos y ganancias

- Se establecen condiciones de filtración de compra y venta para diferentes condiciones de mercado, aumentando la adaptabilidad de la estrategia

- Código altamente modular, fácil de entender y modificar

Riesgo estratégico

- La configuración de los parámetros de la estrategia puede no ser adecuada para todos los entornos de mercado y debe ajustarse a las circunstancias reales.

- En un mercado convulso, la estrategia puede generar señales de negociación frecuentes, lo que aumenta el costo de las transacciones.

- La estrategia carece de juicio sobre las tendencias del mercado y puede perder oportunidades en un mercado de fuerte tendencia

- La configuración de los puntos de parada puede no evitar por completo el riesgo de los extremos

Dirección de optimización de la estrategia

- Introducción de más indicadores técnicos o de sentimiento de mercado para mejorar la precisión y fiabilidad de las señales

- Optimizar la configuración de los paradas y paradas de pérdidas, se puede considerar la introducción de paradas de paradas dinámicas o paradas de paradas basadas en la volatilidad

- Adaptabilidad de las estrategias para diferentes estados de mercado, configuración de diferentes parámetros y reglas de negociación

- Agrega un módulo de administración de fondos para ajustar dinámicamente las posiciones y la exposición al riesgo en función de factores como el balance de la relación de equidad de la cuenta

Resumir

La estrategia cuantitativa se basa en los indicadores PSAR y EMA, que generan señales de compra y venta a través de una serie de condiciones y reglas personalizadas. La estrategia tiene cierta adaptabilidad y flexibilidad, y también establece un punto de parada y pérdida para controlar el riesgo. Sin embargo, hay espacio para la optimización en la configuración de los parámetros de la estrategia y el control del riesgo. En general, la estrategia puede servir como un modelo básico y, con mayor optimización y mejora, tiene posibilidades de convertirse en una estrategia de negociación sólida.

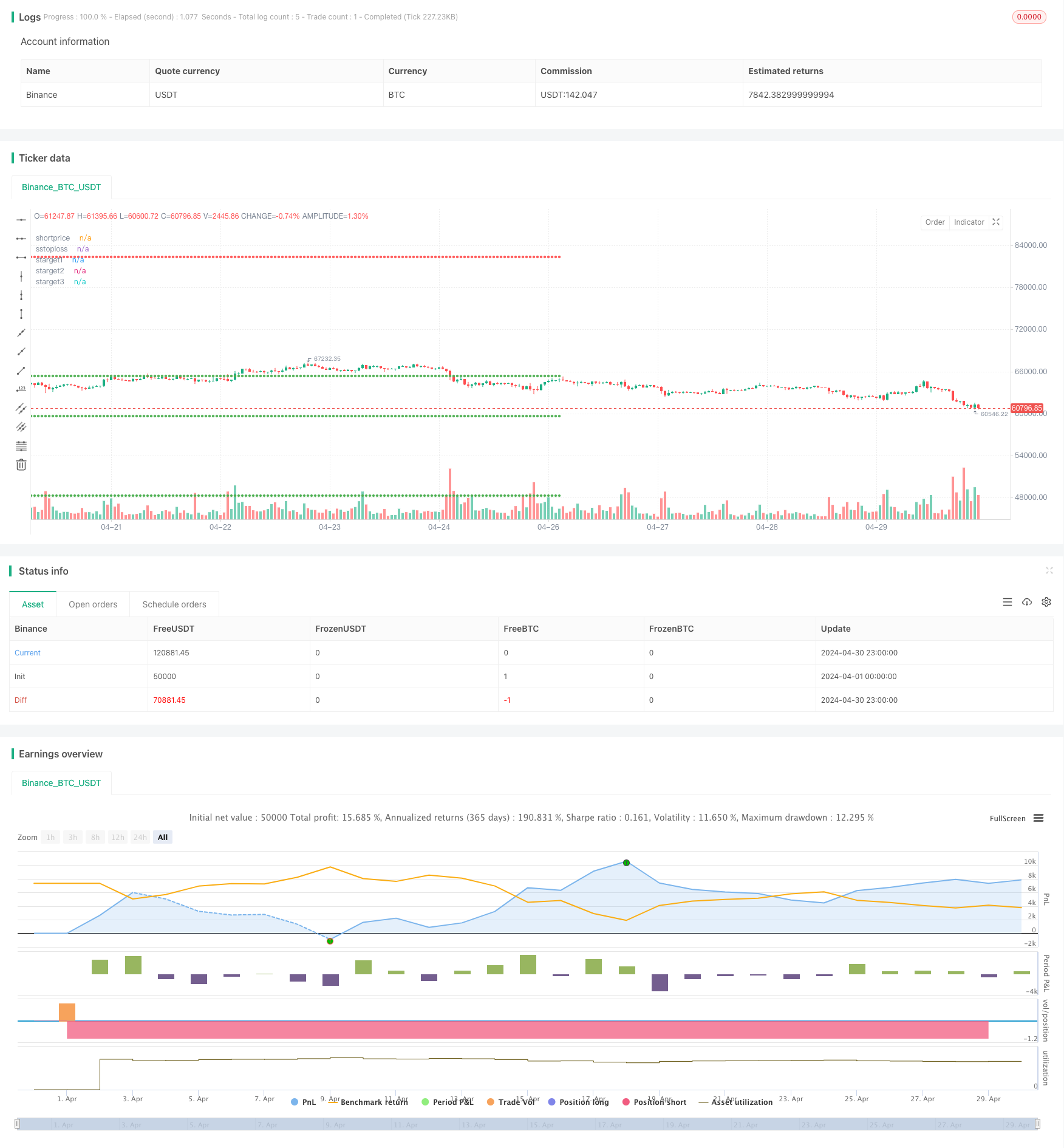

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SwapnilRaykar

//@version=5

strategy("aj sir second project", overlay=true, margin_long=100, margin_short=100)

start=input("0915-1515","session time")

st11=time(timeframe.period,start)

st=st11>0

et= not st

psar=ta.sar(0.02,0.02,0.2)

emared=ta.ema(close,30)

//plot(psar,"psar",color.yellow,style = plot.style_cross)

//plot(emared,"emared",color.red)

var crodownflag=0

var croupflag=0

var igcflag=0

var ircflag=0

cdown1=ta.crossunder(psar,emared) and not (psar<close and psar[1]>close[1])

cup1=ta.crossover(psar,emared) and not (psar>close and psar[1]<close[1])

cdown=ta.crossunder(psar,emared)

cup=ta.crossover(psar,emared)

green_candle=close>open

red_candle=close<open

if ta.crossunder(psar,emared) and crodownflag==0 and not (psar<close and psar[1]>close[1])

crodownflag:=1

else if cdown and crodownflag==1

crodownflag:=0

if crodownflag==1 and green_candle and igcflag==0

igcflag:=1

else if cdown and igcflag==1

igcflag:=0

//plot(igcflag,"igcflag",color.lime)

if ta.crossover(psar,emared) and croupflag==0 and not (psar>close and psar[1]<close[1])

croupflag:=1

else if cdown and croupflag==1

croupflag:=0

//plot(crodownflag,"crodownflag",color.white)

irc_cond=croupflag==1 or cup

if (croupflag==1 and red_candle and ircflag==0)

ircflag:=1

else if cup and croupflag==1

ircflag:=0

igc_candle1=(igcflag==1 and igcflag[1]==0) or (cdown1 and green_candle)

irc_candle1=(ircflag==1 and ircflag[1]==0) or (cup1 and red_candle)

///////////////////////////

dm=dayofmonth(time)

newday=dm!=dm[1]

dmc=dm==ta.valuewhen(bar_index==last_bar_index,dm,0)

///////////////////////////////////////////

var irc_there=0

if irc_candle1[1] and irc_there==0

irc_there:=1

else if cdown and irc_there==1

irc_there:=0

irc_candle=irc_candle1 and irc_there==0// and dmc

var igc_there=0

if igc_candle1[1] and igc_there==0

igc_there:=1

else if cup and igc_there ==1

igc_there:=0

igc_candle=igc_candle1 and igc_there==0// and dmc

/////////// to get rid of irc being valid even after crossdown

var valid_igc_low=0

var valid_irc_high=0

if irc_candle[1] and valid_irc_high==0

valid_irc_high:=1

else if igc_candle and valid_irc_high==1

valid_irc_high:=0

if igc_candle and valid_igc_low==0

valid_igc_low:=1

else if irc_candle and valid_igc_low==1

valid_igc_low:=0

igc_low=ta.valuewhen(igc_candle,low,0)

irc_high=ta.valuewhen(irc_candle,high,0)

//////////////////////////////

//plot(irc_high,"irc_high",color.red)

//plot(valid_irc_high,"valid_irc_high",color.purple)

buy12=ta.crossunder(close,igc_low) and valid_igc_low==1

buy1=buy12[1]

short12=ta.crossover(close,irc_high) and valid_irc_high==1

short1=short12[1]

//plotshape(short12,"short12",shape.arrowdown,color=color.purple)

// plotshape(igc_candle,"igc_candle",shape.arrowdown,color=color.green)

// plotshape(irc_candle,"irc_candle",shape.arrowdown,color=color.red)

//plotshape((psar<close and psar[1]>close[1]) ,"croup",shape.arrowdown,color=color.red)

//plotshape(cup ,"croup",shape.arrowdown,color=color.orange)

buyprice=ta.valuewhen(buy1 and strategy.position_size[1]==0,open,0)

shortprice=ta.valuewhen(short1 and strategy.position_size[1]==0,open,0)

btarget1=buyprice+(buyprice*0.08)

btarget2=buyprice+(buyprice*0.16)

btarget3=buyprice+(buyprice*0.32)

bstoploss=buyprice-(buyprice*0.16)

starget1=shortprice-(shortprice*0.08)

starget2=shortprice-(shortprice*0.16)

starget3=shortprice-(shortprice*0.32)

sstoploss=shortprice+(shortprice*0.16)

if buy12 and strategy.position_size==0 and st11

strategy.entry("buy",strategy.long)

if strategy.position_size >0

strategy.exit("sell",from_entry = "buy",stop=bstoploss,limit=btarget3)

if short12 and strategy.position_size==0 and st11

strategy.entry("short",strategy.short)

if strategy.position_size<0

strategy.exit("cover",from_entry = "short",stop = sstoploss,limit = starget3)

if et

strategy.close_all(comment = "timeover")

plot(strategy.position_size>0?buyprice:na,"buyprice",color.white, style=plot.style_circles )

plot(strategy.position_size>0?bstoploss:na,"bstoploss",color.red, style=plot.style_circles )

plot(strategy.position_size>0?btarget1:na,"btarget1",color.green, style=plot.style_circles )

plot(strategy.position_size>0?btarget2:na,"btarget2",color.green, style=plot.style_circles )

plot(strategy.position_size>0?btarget3:na,"btarget3",color.green, style=plot.style_circles )

plot(strategy.position_size<0?shortprice:na,"shortprice",color.white, style=plot.style_circles )

plot(strategy.position_size<0?sstoploss:na,"sstoploss",color.red, style=plot.style_circles )

plot(strategy.position_size<0?starget1:na,"starget1",color.green, style=plot.style_circles )

plot(strategy.position_size<0?starget2:na,"starget2",color.green, style=plot.style_circles )

plot(strategy.position_size<0?starget3:na,"starget3",color.green, style=plot.style_circles )