Stratégie de rejet de la MA avec filtre ADX

Auteur:ChaoZhang est là., Date: 2024-05-17 10h35 et 58 minLes étiquettes:ADX- Je vous en prie.La WMA

Résumé

Cette stratégie utilise plusieurs moyennes mobiles (MA) comme principaux signaux de négociation et intègre l'indice de direction moyen (ADX) comme filtre. L'idée principale derrière la stratégie est d'identifier les opportunités potentielles longues et courtes en comparant les relations entre le MA rapide, le MA lent et le MA moyen. Simultanément, l'indicateur ADX est utilisé pour filtrer les environnements de marché avec une force de tendance suffisante, améliorant la fiabilité des signaux de négociation.

Principe de stratégie

- Calculez la moyenne de la vitesse, la moyenne de la vitesse et la moyenne de la vitesse.

- Identifier les niveaux longs et courts potentiels en comparant le prix de clôture avec le MA lent.

- Confirmer les niveaux longs et courts en comparant le prix de clôture avec le MA rapide.

- Calculer manuellement l'indicateur ADX pour mesurer la force de la tendance.

- Générer un signal d'entrée long lorsque le MA rapide dépasse le MA moyen, que l'ADX dépasse un seuil fixé et qu'un niveau long est confirmé.

- Générer un signal d'entrée court lorsque le MA rapide dépasse le MA moyen, que l'ADX dépasse un seuil fixé et qu'un niveau court est confirmé.

- Générer un signal de sortie long lorsque le prix de clôture dépasse le niveau de l'AM lent; générer un signal de sortie court lorsque le prix de clôture dépasse le niveau de l'AM lent.

Les avantages de la stratégie

- L'utilisation de plusieurs indicateurs de marché permet une capture plus complète des tendances du marché et des changements de dynamique.

- En comparant les relations entre l'AM rapide, l'AM lent et l'AM moyen, les opportunités commerciales potentielles peuvent être identifiées.

- L'utilisation de l'indicateur ADX comme filtre permet d'éviter la génération de faux signaux excessifs sur les marchés agités, améliorant ainsi la fiabilité des signaux de négociation.

- La logique de la stratégie est claire et facile à comprendre et à mettre en œuvre.

Risques stratégiques

- Dans les situations où la tendance n'est pas claire ou où le marché est instable, la stratégie peut générer de nombreux faux signaux, conduisant à des transactions et des pertes fréquentes.

- La stratégie repose sur des indicateurs à la traîne tels que le MA et l'ADX, qui pourraient manquer des opportunités de formation de tendances précoces.

- Le rendement de la stratégie est fortement influencé par les paramètres définis (par exemple, longueur des MA et seuil ADX), ce qui nécessite une optimisation en fonction des différents marchés et instruments.

Directions d'optimisation de la stratégie

- Considérez l'incorporation d'autres indicateurs techniques, tels que le RSI et le MACD, afin d'améliorer la fiabilité et la diversité des signaux de trading.

- Définir différentes combinaisons de paramètres pour différents environnements de marché afin de s'adapter aux changements du marché.

- Mettre en place des mesures de gestion des risques, telles que le stop-loss et le dimensionnement des positions, pour contrôler les pertes potentielles.

- Combiner l'analyse fondamentale, telle que les données économiques et les changements de politique, pour obtenir une perspective de marché plus complète.

Résumé

La stratégie de rejet de MA avec le filtre ADX utilise plusieurs MA et l'indicateur ADX pour identifier les opportunités de trading potentielles et filtrer les signaux de trading de mauvaise qualité.

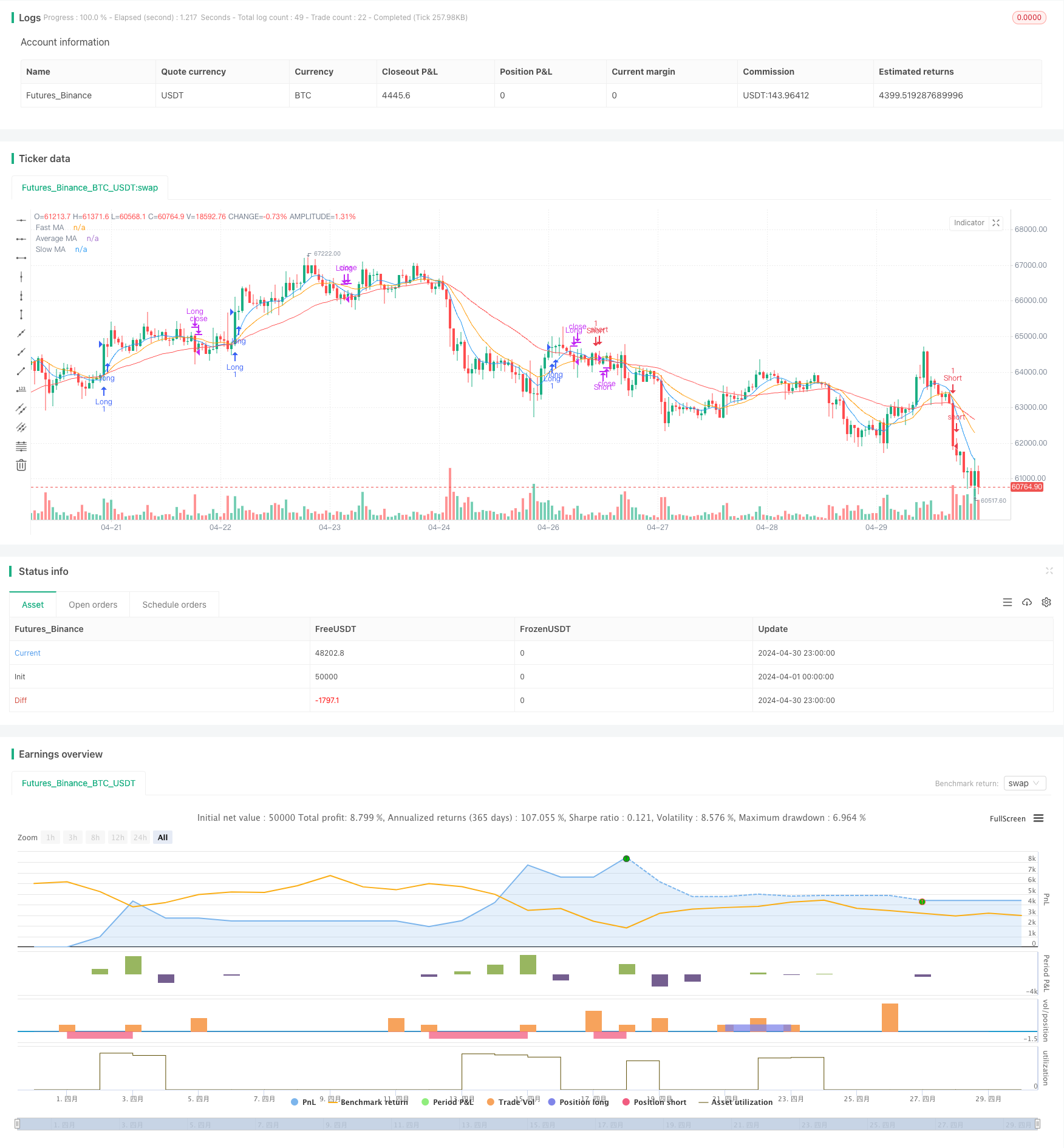

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gavinc745

//@version=5

strategy("MA Rejection Strategy with ADX Filter", overlay=true)

// Input parameters

fastMALength = input.int(10, title="Fast MA Length", minval=1)

slowMALength = input.int(50, title="Slow MA Length", minval=1)

averageMALength = input.int(20, title="Average MA Length", minval=1)

adxLength = input.int(14, title="ADX Length", minval=1)

adxThreshold = input.int(20, title="ADX Threshold", minval=1)

// Calculate moving averages

fastMA = ta.wma(close, fastMALength)

slowMA = ta.wma(close, slowMALength)

averageMA = ta.wma(close, averageMALength)

// Calculate ADX manually

dmPlus = high - high[1]

dmMinus = low[1] - low

trueRange = ta.tr

dmPlusSmoothed = ta.wma(dmPlus > 0 and dmPlus > dmMinus ? dmPlus : 0, adxLength)

dmMinusSmoothed = ta.wma(dmMinus > 0 and dmMinus > dmPlus ? dmMinus : 0, adxLength)

trSmoothed = ta.wma(trueRange, adxLength)

diPlus = dmPlusSmoothed / trSmoothed * 100

diMinus = dmMinusSmoothed / trSmoothed * 100

adx = ta.wma(math.abs(diPlus - diMinus) / (diPlus + diMinus) * 100, adxLength)

// Identify potential levels

potentialLongLevel = low < slowMA and close > slowMA

potentialShortLevel = high > slowMA and close < slowMA

// Confirm levels

confirmedLongLevel = potentialLongLevel and close > fastMA

confirmedShortLevel = potentialShortLevel and close < fastMA

// Entry signals

longEntry = confirmedLongLevel and ta.crossover(fastMA, averageMA) and adx > adxThreshold

shortEntry = confirmedShortLevel and ta.crossunder(fastMA, averageMA) and adx > adxThreshold

// Exit signals

longExit = ta.crossunder(close, slowMA)

shortExit = ta.crossover(close, slowMA)

// Plot signals

plotshape(longEntry, title="Long Entry", location=location.belowbar, style=shape.triangleup, size=size.small, color=color.green)

plotshape(shortEntry, title="Short Entry", location=location.abovebar, style=shape.triangledown, size=size.small, color=color.red)

// Plot moving averages and ADX

plot(fastMA, title="Fast MA", color=color.blue)

plot(slowMA, title="Slow MA", color=color.red)

plot(averageMA, title="Average MA", color=color.orange)

// plot(adx, title="ADX", color=color.purple)

// hline(adxThreshold, title="ADX Threshold", color=color.gray, linestyle=hline.style_dashed)

// Execute trades

if longEntry

strategy.entry("Long", strategy.long)

else if longExit

strategy.close("Long")

if shortEntry

strategy.entry("Short", strategy.short)

else if shortExit

strategy.close("Short")

Relationnée

- Système de négociation de moyennes mobiles multiples avec confirmation de l'élan et du volume Stratégie de tendance quantitative

- La valeur de l'indice de change est la valeur de la valeur de l'indice de change.

- Capture de la force de la tendance multi-MA avec stratégie de prise de bénéfices

- Stratégie quantitative de croisement de la moyenne mobile à double coque

- Opérations en ligne de tendance en temps réel basées sur les points pivots et les pentes

- Stratégie de croisement des moyennes mobiles de la coque sur plusieurs périodes

- Stratégie de négociation de la tendance de rupture de l'ADX

- Stratégie de négociation quantitative multi-indicateur technique croisé de dynamique - analyse d'intégration basée sur EMA, RSI et ADX

- Stratégie de négociation dynamique croisée de moyenne mobile multi-adaptative

- Système de tendance historique de rupture avec filtre de moyenne mobile (HBTS)

Plus de

- Stratégie améliorée d'évolution de la hausse/baisse avec des tendances haussières et baissières

- RSI Laguerre avec stratégie de signaux de trading filtrés ADX

- Stratégie d'achat par rupture de prix et de volume

- K bougies consécutives

- Stratégie de croisement des moyennes mobiles et des bandes supérieures

- Tendance multifactorielle suivant une stratégie de négociation quantitative basée sur RSI, ADX et Ichimoku Cloud

- RSI et MACD combiné stratégie longue courte

- Nuage d' Ichimoku et stratégie de moyenne mobile

- William Alligator Stratégie de capteur de tendance moyenne mobile

- Dynamique MACD et stratégie de négociation dans le cloud Ichimoku

- Stratégie Bollinger Bands: négociation de précision pour des gains maximaux

- Stratégie de rupture moyenne ATR

- Stratégie d'apprentissage automatique KNN: Système de trading de prédiction de tendance basé sur l'algorithme K-Nearest Neighbors

- La valeur de l'échange est la valeur de l'échange à l'échelle de l'échange.

- Stratégie de rupture du BMSB

- Stratégie de rupture de la SR

- Stratégie de rupture dynamique des bandes de Bollinger

- 8 heures de travail

- RSI Stratégie de négociation quantitative

- La tendance ATR de la bande de Bollinger suivant la stratégie