Résistance de soutien dynamique et bandes de Bollinger Stratégie croisée multi-indicateurs

Auteur:ChaoZhang est là., Date: 2025-01-17 14h24 et 33 minLes étiquettes:R.R.BBLe taux d'intérêtLe pivotLes produits

Résumé

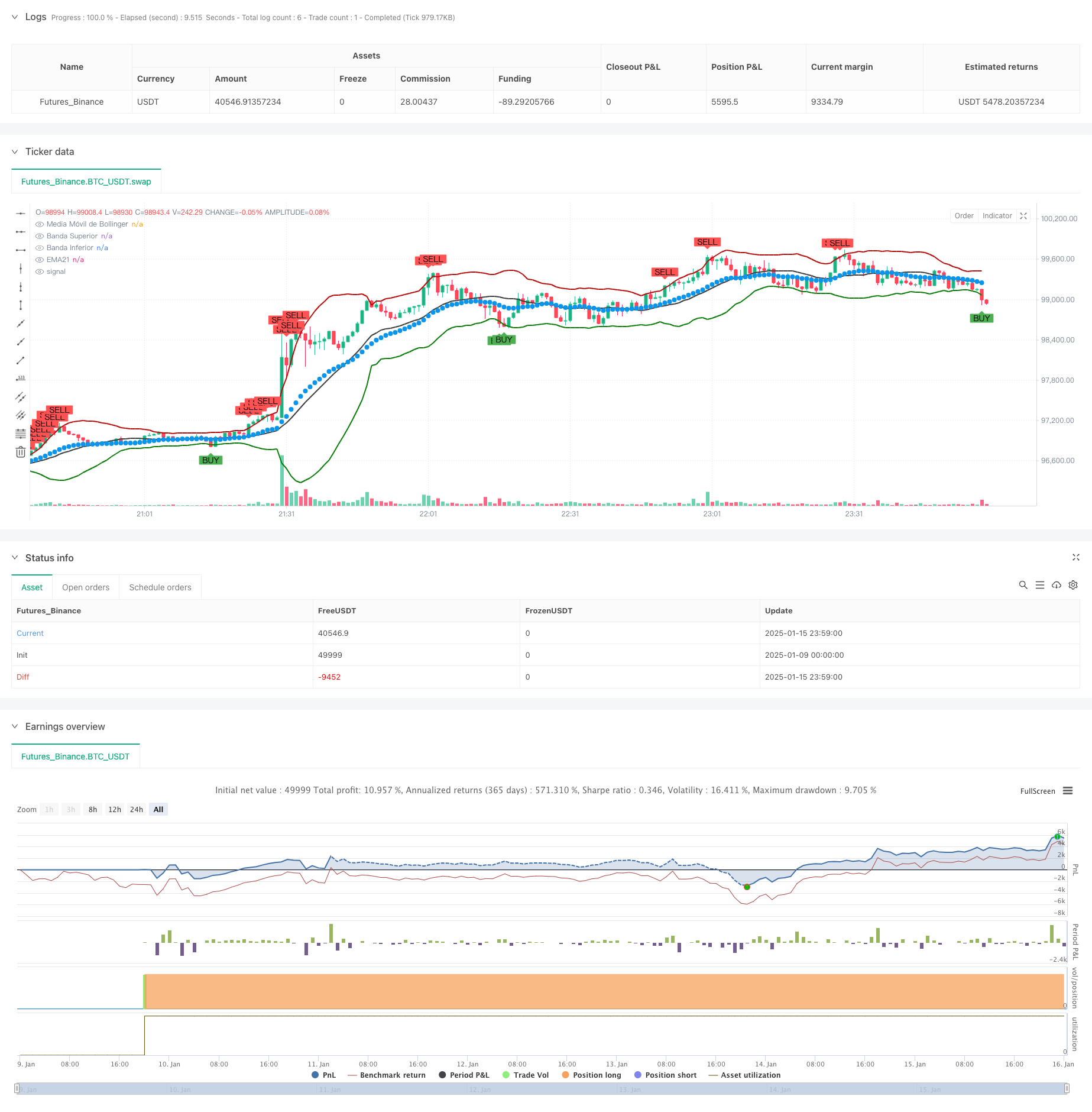

Cette stratégie combine des niveaux de support/résistance dynamiques avec les bandes de Bollinger et l'EMA21 pour une approche de négociation croisée multi-indicateurs. Elle identifie les écarts des niveaux de prix clés tout en utilisant des croisements d'indicateurs techniques pour prendre des décisions de négociation. La stratégie identifie non seulement dynamiquement les niveaux de support/résistance importants dans la structure du marché, mais confirme également les signaux de négociation grâce à la coordination des bandes de Bollinger et des moyennes mobiles.

Principes de stratégie

La stratégie repose sur plusieurs éléments essentiels: 1. Calcul dynamique de support/résistance: utilise la méthode des points pivots pour calculer dynamiquement les niveaux de support/résistance du marché, en filtrant les zones de prix efficaces à travers la largeur du canal et les exigences de résistance minimale. 2. Bandes de Bollinger: utilise des bandes de Bollinger à 20 périodes et 2 écarts types pour définir les plages de volatilité des prix. 3. EMA21: sert de ligne de référence pour le jugement des tendances à moyen terme. Génération de signaux commerciaux: exécute les transactions lorsque le prix franchit les niveaux de support/résistance tout en déclenchant simultanément des signaux de bande de Bollinger.

Les avantages de la stratégie

- Confirmation multidimensionnelle: améliore la fiabilité des signaux de négociation en combinant plusieurs indicateurs techniques.

- Adaptation dynamique: les niveaux de support/résistance s'ajustent automatiquement aux changements de la structure du marché.

- Gestion des risques: les bandes de Bollinger fournissent des définitions claires des limites de surachat/survente.

- Confirmation de la tendance: l'EMA21 aide à confirmer l'orientation de la tendance à moyen terme.

- Visualisation: la stratégie fournit un retour visuel clair pour l'analyse et l'optimisation.

Risques stratégiques

- Risque de choc du marché: peut générer des signaux de rupture fausses excessifs sur les marchés latéraux.

- Risque de retard: les indicateurs techniques présentent des retards de calcul inhérents, ce qui pourrait entraîner une absence de points d'entrée optimaux.

- Sensibilité aux paramètres: la performance de la stratégie est sensible aux paramètres, ce qui nécessite une optimisation pour différents environnements de marché.

- Risque de fausse rupture: les ruptures de support/résistance peuvent être fausses et nécessiter une confirmation par d'autres indicateurs.

Directions d'optimisation

- Incorporer des indicateurs de volume: ajouter une analyse de volume pour la confirmation de la rupture afin d'améliorer la fiabilité du signal.

- Optimiser l'adaptation des paramètres: développer des mécanismes d'adaptation des paramètres pour une meilleure adaptation à l'environnement du marché.

- Améliorer les mécanismes d'arrêt des pertes: concevoir des stratégies d'arrêt des pertes plus complètes pour contrôler le risque de retrait.

- Ajouter des filtres de tendance: augmenter l'évaluation de la force de la tendance pour éviter de négocier dans des environnements de tendance faibles.

- Optimisation des délais: étudier différentes combinaisons de délais pour trouver des configurations optimales.

Résumé

Cette stratégie construit un système de trading relativement complet en combinant le support/résistance dynamique, les bandes de Bollinger et l'EMA21. Ses atouts résident dans la confirmation de signaux multidimensionnels et l'adaptation dynamique du marché, tout en faisant face à des défis en matière d'optimisation des paramètres et de faux risques de rupture.

//@version=5

strategy("Support Resistance & Bollinger & EMA21", overlay=true)

// Parámetros de S/R

prd = input.int(defval=10, title='Pivot Period', minval=4, maxval=30, group='Setup')

ppsrc = input.string(defval='High/Low', title='Source', options=['High/Low', 'Close/Open'], group='Setup')

maxnumpp = input.int(defval=20, title='Maximum Number of Pivot', minval=5, maxval=100, group='Setup')

ChannelW = input.int(defval=10, title='Maximum Channel Width %', minval=1, group='Setup')

maxnumsr = input.int(defval=5, title='Maximum Number of S/R', minval=1, maxval=10, group='Setup')

min_strength = input.int(defval=2, title='Minimum Strength', minval=1, maxval=10, group='Setup')

labelloc = input.int(defval=20, title='Label Location', group='Colors', tooltip='Positive numbers reference future bars, negative numbers reference historical bars')

linestyle = input.string(defval='Solid', title='Line Style', options=['Solid', 'Dotted', 'Dashed'], group='Colors')

linewidth = input.int(defval=2, title='Line Width', minval=2, maxval=2, group='Colors')

resistancecolor = input.color(defval=color.black, title='Resistance Color', group='Colors')

supportcolor = input.color(defval=color.black, title='Support Color', group='Colors')

showpp = input(false, title='Show Point Points')

// Parámetros de Bandas de Bollinger y EMA21

periodo_bollinger = input.int(title="Periodo de Bollinger", defval=20)

multiplicador_bollinger = input.float(title="Multiplicador de Bollinger", defval=2.0)

periodo_ema21 = input.int(title="Periodo EMA21", defval=21)

// Cálculo de las Bandas de Bollinger y EMA21

[middle, superior, inferior] = ta.bb(close, periodo_bollinger, multiplicador_bollinger)

ema21 = ta.ema(close, periodo_ema21)

// Ploteo de las Bandas de Bollinger y EMA21

plot(middle, color=color.rgb(60, 60, 60), linewidth=2, title="Media Móvil de Bollinger")

plot(superior, color=color.rgb(184, 11, 8), linewidth=2, title="Banda Superior")

plot(inferior, color=color.rgb(6, 124, 4), linewidth=2, title="Banda Inferior")

plot(ema21, color=color.rgb(6, 150, 240), linewidth=1, style=plot.style_circles, title="EMA21")

// Condiciones para señales de compra y venta

senal_compra = close <= inferior

senal_venta = close >= superior

// Mostrar señales en el gráfico

plotshape(senal_compra, title="Compra", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(senal_venta, title="Venta", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Código de soporte y resistencia

float src1 = ppsrc == 'High/Low' ? high : math.max(close, open)

float src2 = ppsrc == 'High/Low' ? low : math.min(close, open)

float ph = ta.pivothigh(src1, prd, prd)

float pl = ta.pivotlow(src2, prd, prd)

plotshape(ph and showpp, text='H', style=shape.labeldown, color=na, textcolor=color.new(color.red, 0), location=location.abovebar, offset=-prd)

plotshape(pl and showpp, text='L', style=shape.labelup, color=na, textcolor=color.new(color.lime, 0), location=location.belowbar, offset=-prd)

// Calcular ancho máximo del canal S/R

prdhighest = ta.highest(300)

prdlowest = ta.lowest(300)

cwidth = (prdhighest - prdlowest) * ChannelW / 100

var pivotvals = array.new_float(0)

if ph or pl

array.unshift(pivotvals, ph ? ph : pl)

if array.size(pivotvals) > maxnumpp // Limitar el tamaño del array

array.pop(pivotvals)

get_sr_vals(ind) =>

float lo = array.get(pivotvals, ind)

float hi = lo

int numpp = 0

for y = 0 to array.size(pivotvals) - 1 by 1

float cpp = array.get(pivotvals, y)

float wdth = cpp <= lo ? hi - cpp : cpp - lo

if wdth <= cwidth // Ajusta al ancho máximo del canal?

if cpp <= hi

lo := math.min(lo, cpp)

else

hi := math.max(hi, cpp)

numpp += 1

[hi, lo, numpp]

var sr_up_level = array.new_float(0)

var sr_dn_level = array.new_float(0)

sr_strength = array.new_float(0)

find_loc(strength) =>

ret = array.size(sr_strength)

for i = ret > 0 ? array.size(sr_strength) - 1 : na to 0 by 1

if strength <= array.get(sr_strength, i)

break

ret := i

ret

check_sr(hi, lo, strength) =>

ret = true

for i = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

if array.get(sr_up_level, i) >= lo and array.get(sr_up_level, i) <= hi or array.get(sr_dn_level, i) >= lo and array.get(sr_dn_level, i) <= hi

if strength >= array.get(sr_strength, i)

array.remove(sr_strength, i)

array.remove(sr_up_level, i)

array.remove(sr_dn_level, i)

ret

else

ret := false

break

ret

// var sr_lines = array.new_line(11, na)

// var sr_labels = array.new_label(11, na)

// for x = 1 to 10 by 1

// rate = 100 * (label.get_y(array.get(sr_labels, x)) - close) / close

// label.set_text(array.get(sr_labels, x), text=str.tostring(label.get_y(array.get(sr_labels, x))) + '(' + str.tostring(rate, '#.##') + '%)')

// label.set_x(array.get(sr_labels, x), x=bar_index + labelloc)

// label.set_color(array.get(sr_labels, x), color=label.get_y(array.get(sr_labels, x)) >= close ? color.red : color.lime)

// label.set_textcolor(array.get(sr_labels, x), textcolor=label.get_y(array.get(sr_labels, x)) >= close ? color.white : color.black)

// label.set_style(array.get(sr_labels, x), style=label.get_y(array.get(sr_labels, x)) >= close ? label.style_label_down : label.style_label_up)

// line.set_color(array.get(sr_lines, x), color=line.get_y1(array.get(sr_lines, x)) >= close ? resistancecolor : supportcolor)

if ph or pl

// Debido a los nuevos cálculos, eliminar niveles S/R antiguos

array.clear(sr_up_level)

array.clear(sr_dn_level)

array.clear(sr_strength)

// Encontrar zonas S/R

for x = 0 to array.size(pivotvals) - 1 by 1

[hi, lo, strength] = get_sr_vals(x)

if check_sr(hi, lo, strength)

loc = find_loc(strength)

// Si la fuerza está en los primeros maxnumsr sr, entonces insértala en los arrays

if loc < maxnumsr and strength >= min_strength

array.insert(sr_strength, loc, strength)

array.insert(sr_up_level, loc, hi)

array.insert(sr_dn_level, loc, lo)

// Mantener el tamaño de los arrays = 5

if array.size(sr_strength) > maxnumsr

array.pop(sr_strength)

array.pop(sr_up_level)

array.pop(sr_dn_level)

// for x = 1 to 10 by 1

// line.delete(array.get(sr_lines, x))

// label.delete(array.get(sr_labels, x))

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

rate = 100 * (mid - close) / close

// array.set(sr_labels, x + 1, label.new(x=bar_index + labelloc, y=mid, text=str.tostring(mid) + '(' + str.tostring(rate, '#.##') + '%)', color=mid >= close ? color.red : color.lime, textcolor=mid >= close ? color.white : color.black, style=mid >= close ? label.style_label_down : label.style_label_up))

// array.set(sr_lines, x + 1, line.new(x1=bar_index, y1=mid, x2=bar_index - 1, y2=mid, extend=extend.both, color=mid >= close ? resistancecolor : supportcolor, style=line.style_solid, width=2))

f_crossed_over() =>

ret = false

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

if close[1] <= mid and close > mid

ret := true

ret

f_crossed_under() =>

ret = false

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

if close[1] >= mid and close < mid

ret := true

ret

crossed_over = f_crossed_over()

crossed_under = f_crossed_under()

alertcondition(crossed_over, title='Resistance Broken', message='Resistance Broken')

alertcondition(crossed_under, title='Support Broken', message='Support Broken')

alertcondition(crossed_over or crossed_under, title='Support or Resistance Broken', message='Support or Resistance Broken')

// Estrategia de compra y venta basada en el cruce de niveles S/R

if (crossed_over and senal_compra)

strategy.entry("Compra", strategy.long)

if (crossed_under and senal_venta)

strategy.close("Compra")

- Les bandes de Bollinger triplées touchent la tendance suite à une stratégie de négociation quantitative

- Dépassement du support-résistance

- Système de négociation dynamique de support ou de résistance

- Stratégie de tendance quantitative de la moyenne mobile double basée sur le cloud Bollinger Bands

- Stratégie de rupture dynamique des bandes de Bollinger

- Indicateur de support technique et de résistance Stratégie de trading de précision

- Stratégie de rupture de l' EMA et des bandes de Bollinger

- Retours mensuels dans les stratégies PineScript

- Points de pivotement haut bas multi-temps

- Maxima et minima de suivi basés sur pivot

- Tendance multi-indicateurs suivie par la stratégie quantitative de négociation suracheté/survendu du RSI

- Stratégie de négociation efficace sur les canaux de prix basée sur une rupture de 15 minutes

- Stratégie de rupture de l'écart de juste valeur sur plusieurs délais avec test historique

- Tendance dynamique de la QQE suivie par la stratégie de négociation quantitative de gestion des risques

- Stratégie de négociation de confirmation de tendance double basée sur des moyennes mobiles et un modèle hors barre

- Tendance dynamique à la suite de la stratégie de triple amélioration de la SuperTrend

- La stratégie de négociation de retracement de la rupture dynamique de l'indice des changes

- Stratégie optimisée de suivi des tendances à double T3

- Stratégie de rupture de dynamique du canal de Donchian à conditions multiples

- L'indicateur technique à plusieurs périodes

- Stratégie de négociation de confirmation de la tendance de rupture de prix dans le nuage Ichimoku multidimensionnel

- Stratégie de négociation dynamique en fonction de la tendance de l'indice RSI neural

- Tendance croisée multi-EMA à la suite d'une stratégie de négociation quantitative

- Stratégie de négociation de l'indicateur RSI se chevauchant à plusieurs niveaux

- Les bandes de Bollinger et la tendance intraday de Fibonacci suivant la stratégie

- Tendance dynamique à la suite d'une stratégie de double canal de moyenne mobile avec système de gestion des risques

- Tendance multi-mode de prise de profit/arrêt de perte suivant une stratégie basée sur l'EMA, le ruban de Madrid et le canal de Donchian

- Stratégie de négociation de l'élan de tendance multi-indicateur: un système de négociation quantitatif optimisé basé sur les bandes de Bollinger, Fibonacci et ATR

- Système dynamique de détection des divergences de prix RSI et de stratégie de négociation adaptative

- Tendance multidimensionnelle suivant la stratégie de négociation pyramidale