Strategi Perdagangan Kuantitatif Divergensi CVD

Penulis:ChaoZhang, Tanggal: 2024-03-15 16:47:47Tag:

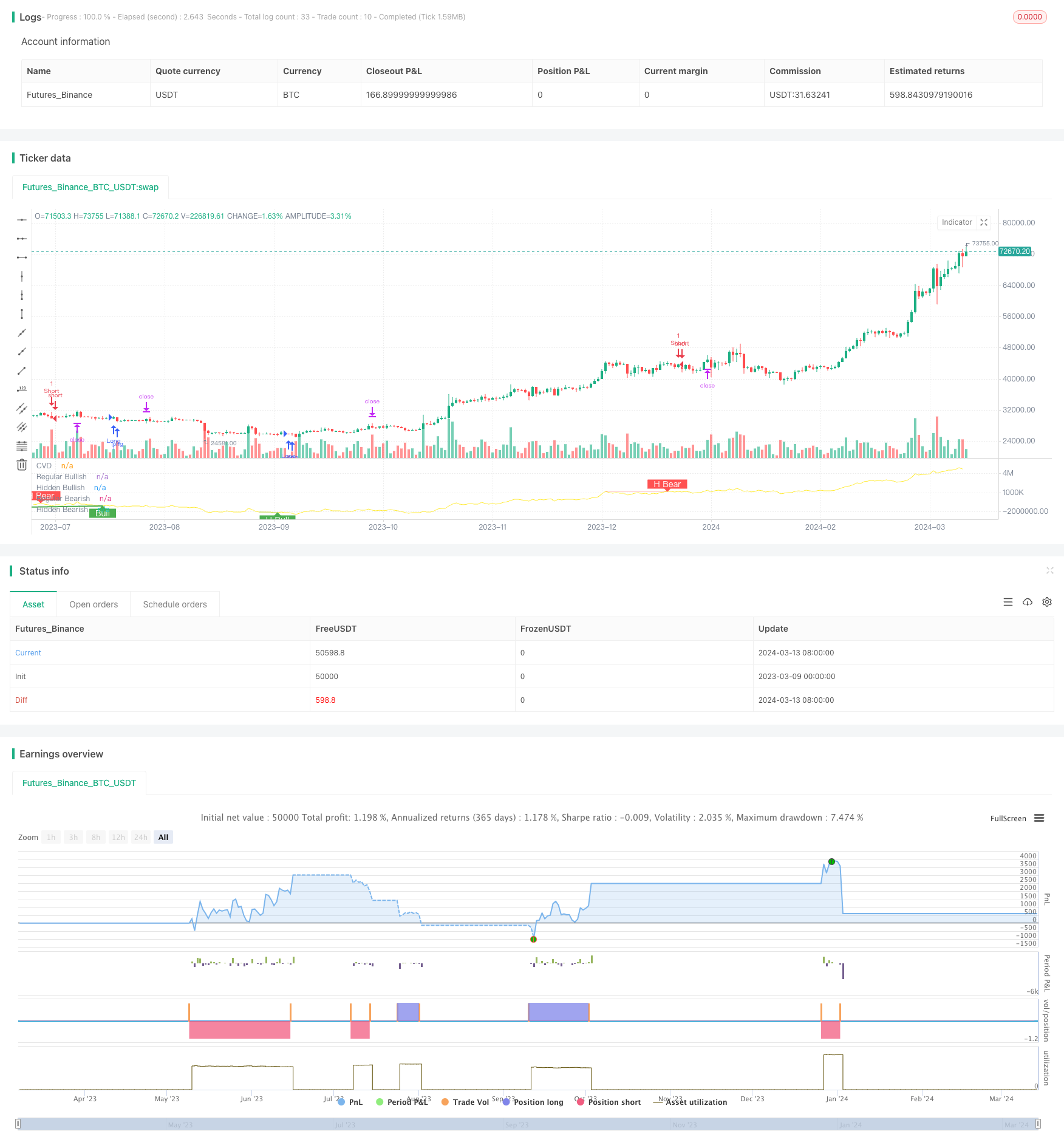

Ringkasan Strategi: Strategi perdagangan kuantitatif divergensi CVD menggunakan divergensi antara indikator CVD dan harga untuk menangkap sinyal pembalikan tren potensial. Strategi menghitung indikator CVD dan membandingkannya dengan harga untuk menentukan apakah divergensi bullish atau bearish terbentuk. Ketika sinyal divergensi terdeteksi, strategi membuka posisi panjang atau pendek.

Prinsip Strategi:

- Menghitung indikator CVD: Menghitung indikator CVD dan rata-rata bergeraknya berdasarkan volume bullish dan bearish.

- Mengidentifikasi divergensi: Bandingkan puncak dan terendah indikator CVD dengan puncak dan terendah harga untuk menentukan apakah divergensi terbentuk.

- Divergensi bullish reguler: Harga membuat rendah lebih rendah, tetapi CVD membentuk rendah lebih tinggi.

- Perbedaan bullish tersembunyi: Harga membuat lebih rendah, tetapi CVD membentuk lebih rendah.

- Divergensi bearish reguler: Harga membuat tinggi yang lebih tinggi, tetapi CVD membentuk tinggi yang lebih rendah.

- Divergensi bearish tersembunyi: Harga membuat tinggi yang lebih rendah, tetapi CVD membentuk tinggi yang lebih tinggi.

- Posisi terbuka: Ketika sinyal divergen diidentifikasi, buka posisi panjang atau pendek berdasarkan jenis divergen.

- Stop loss dan take profit: Gunakan trailing stop loss dan fixed percentage take profit. Harga stop loss dihitung dengan mengalikan harga masuk dengan persentase stop loss, dan harga take profit dihitung dengan mengalikan harga masuk dengan persentase take profit.

- Pyramiding: Strategi ini memungkinkan maksimal 3 posisi untuk pyramiding.

Keuntungan Strategi:

- Sinyal pembalikan tren: Divergensi CVD adalah sinyal pembalikan tren yang efektif yang dapat membantu menangkap peluang pembalikan tren.

- Sinyal kelanjutan tren: Perbedaan tersembunyi dapat berfungsi sebagai sinyal kelanjutan tren, membantu strategi mempertahankan arah yang benar selama tren.

- Pengendalian risiko: Dengan menggunakan stop loss trailing dan persentase tetap mengambil keuntungan, risiko dikelola secara efektif.

- Pyramiding: Mengizinkan beberapa posisi untuk pyramiding memungkinkan kapitalisasi yang lebih baik pada pasar tren.

Risiko Strategi:

- Validitas sinyal: Sinyal divergensi tidak sepenuhnya dapat diandalkan dan kadang-kadang sinyal palsu dapat terjadi.

- Konfigurasi parameter: Hasil strategi sensitif terhadap pengaturan parameter, dan parameter yang berbeda dapat menyebabkan hasil yang berbeda.

- Stop loss slippage: Di pasar yang tidak stabil, perintah stop loss mungkin tidak diisi pada harga yang telah ditentukan sebelumnya, yang memperkenalkan risiko tambahan.

- Biaya transaksi: Pembukaan dan penutupan posisi yang sering dapat mengakibatkan biaya transaksi yang tinggi, yang berdampak pada profitabilitas strategi.

Arahan Optimasi:

- Optimasi parameter dinamis: Gunakan parameter adaptif untuk kondisi pasar yang berbeda untuk meningkatkan validitas sinyal.

- Kombinasi dengan indikator lain: Mengintegrasikan dengan indikator teknis lainnya seperti RSI, MACD, dll, untuk meningkatkan keandalan sinyal.

- Memperbaiki stop loss dan mengambil keuntungan: Mengadopsi strategi stop loss dan mengambil keuntungan yang lebih maju, seperti trailing stop loss atau stop loss berbasis volatilitas.

- Ukuran posisi: Sesuaikan ukuran posisi secara dinamis berdasarkan volatilitas pasar, ekuitas akun, dll.

Kesimpulan: Strategi perdagangan kuantitatif divergensi CVD bertujuan untuk mengidentifikasi peluang pembalikan tren potensial dengan menangkap divergensi antara indikator CVD dan harga. Ini menggunakan stop loss trailing dan persentase tetap mengambil keuntungan untuk mengelola risiko. Keuntungan utama dari strategi terletak pada kemampuannya untuk secara efektif menangkap sinyal pembalikan tren dan kelanjutan tren, dan memanfaatkan pasar tren dengan lebih baik melalui piramida. Namun, strategi ini juga menghadapi risiko seperti validitas sinyal, konfigurasi parameter, slip stop loss, dan biaya transaksi. Peningkatan masa depan dapat dilakukan melalui optimasi parameter dinamis, kombinasi dengan indikator lain, peningkatan mekanisme stop loss dan take profit, dan manajemen ukuran posisi. Secara keseluruhan, strategi perdagangan kuantitatif divergensi CVD adalah strategi tren yang efektif dan dapat dioptimalkan yang sesuai untuk pedagang yang bertujuan untuk menangkap risiko kuantitatif sambil mengelola peluang tren.

/*backtest

start: 2023-03-09 00:00:00

end: 2024-03-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//@ mmattman

//Thank you to @ contrerae and Tradingview each for parts of the code to make

//this indicator and matching strategy and also theCrypster for the clean concise TP/SL code.

// indicator(title="CVD Divergence Indicator 1", shorttitle='CVD Div1', format=format.price, timeframe="", timeframe_gaps=true)

strategy("CVD Divergence Strategy.1.mm", shorttitle = 'CVD Div Str 1', overlay=false)

//..................................................................................................................

// Inputs

periodMa = input.int(title='MA Length', minval=1, defval=20)

plotMa = input(title='Plot MA?', defval=false)

// Calculations (Bull & Bear Balance Indicator by Vadim Gimelfarb)

iff_1 = close[1] < open ? math.max(high - close[1], close - low) : math.max(high - open, close - low)

iff_2 = close[1] > open ? high - low : math.max(open - close[1], high - low)

iff_3 = close[1] < open ? math.max(high - close[1], close - low) : high - open

iff_4 = close[1] > open ? high - low : math.max(open - close[1], high - low)

iff_5 = close[1] < open ? math.max(open - close[1], high - low) : high - low

iff_6 = close[1] > open ? math.max(high - open, close - low) : iff_5

iff_7 = high - close < close - low ? iff_4 : iff_6

iff_8 = high - close > close - low ? iff_3 : iff_7

iff_9 = close > open ? iff_2 : iff_8

bullPower = close < open ? iff_1 : iff_9

iff_10 = close[1] > open ? math.max(close[1] - open, high - low) : high - low

iff_11 = close[1] > open ? math.max(close[1] - low, high - close) : math.max(open - low, high - close)

iff_12 = close[1] > open ? math.max(close[1] - open, high - low) : high - low

iff_13 = close[1] > open ? math.max(close[1] - low, high - close) : open - low

iff_14 = close[1] < open ? math.max(open - low, high - close) : high - low

iff_15 = close[1] > open ? math.max(close[1] - open, high - low) : iff_14

iff_16 = high - close < close - low ? iff_13 : iff_15

iff_17 = high - close > close - low ? iff_12 : iff_16

iff_18 = close > open ? iff_11 : iff_17

bearPower = close < open ? iff_10 : iff_18

// Calculations (Bull & Bear Pressure Volume)

bullVolume = bullPower / (bullPower + bearPower) * volume

bearVolume = bearPower / (bullPower + bearPower) * volume

// Calculations Delta

delta = bullVolume - bearVolume

cvd = ta.cum(delta)

cvdMa = ta.sma(cvd, periodMa)

// Plotting

customColor = cvd > cvdMa ? color.new(color.teal, 50) : color.new(color.red, 50)

plotRef1 = plot(cvd, style=plot.style_line, linewidth=1, color=color.new(color.yellow, 0), title='CVD')

plotRef2 = plot(plotMa ? cvdMa : na, style=plot.style_line, linewidth=1, color=color.new(color.white, 0), title='CVD MA')

fill(plotRef1, plotRef2, color=customColor)

//..................................................................................................................

// len = input.int(title="RSI Period", minval=1, defval=14)

// src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=3)

lbL = input(title="Pivot Lookback Left", defval=7)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=true)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = cvd

// plot(osc, title="CVD", linewidth=2, color=#2962FF)

// hline(50, title="Middle Line", color=#787B86, linestyle=hline.style_dotted)

// obLevel = hline(70, title="Overbought", color=#787B86, linestyle=hline.style_dotted)

// osLevel = hline(30, title="Oversold", color=#787B86, linestyle=hline.style_dotted)

// fill(obLevel, osLevel, title="Background", color=color.rgb(33, 150, 243, 90))

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

bullCondAlert = priceLL and oscHL and plFound

bullCond = plotBull and bullCondAlert

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor)

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCondAlert = priceHL and oscLL and plFound

hiddenBullCond = plotHiddenBull and hiddenBullCondAlert

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

bearCondAlert = priceHH and oscLH and phFound

bearCond = plotBear and bearCondAlert

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor)

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCondAlert = priceLH and oscHH and phFound

hiddenBearCond = plotHiddenBear and hiddenBearCondAlert

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

// alertcondition(bullCondAlert, title='Regular Bullish CVD Divergence', message="Found a new Regular Bullish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar")

// alertcondition(hiddenBullCondAlert, title='Hidden Bullish CVD Divergence', message='Found a new Hidden Bullish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

// alertcondition(bearCondAlert, title='Regular Bearish CVD Divergence', message='Found a new Regular Bearish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

// alertcondition(hiddenBearCondAlert, title='Hidden Bearisn CVD Divergence', message='Found a new Hidden Bearisn Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

le = bullCondAlert or hiddenBullCondAlert

se = bearCondAlert or hiddenBearCondAlert

ltp = se

stp = le

// Check if the entry conditions for a long position are met

if (le) //and (close > ema200)

strategy.entry("Long", strategy.long, comment="EL")

// Check if the entry conditions for a short position are met

if (se) //and (close < ema200)

strategy.entry("Short", strategy.short, comment="ES")

// Close long position if exit condition is met

if (ltp) // or (close < ema200)

strategy.close("Long", comment="XL")

// Close short position if exit condition is met

if (stp) //or (close > ema200)

strategy.close("Short", comment="XS")

// The Fixed Percent Stop Loss Code

// User Options to Change Inputs (%)

stopPer = input.float(5.0, title='Stop Loss %') / 100

takePer = input.float(10.0, title='Take Profit %') / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

if strategy.position_size > 0

strategy.exit("Close Long", "Long", stop=longStop, limit=longTake)

if strategy.position_size < 0

strategy.exit("Close Short", "Short", stop=shortStop, limit=shortTake)

- Strategi Perdagangan XAUUSD yang Berbasis Multi-SMA dan MACD Dinamis

- Strategi perdagangan kuantitatif lintas rata-rata bergerak ganda

- EMA 200 Crossover dengan Strategi Volume dan Tren

- RSI Strategi Stop Loss dan Take Profit Dinamis

- Strategi Identifikasi Tren Lokal Awan Ichimoku

- 9EMA Dinamis Posisi Sizing Strategi dengan Dua 5-Minutes Dekat Breakouts

- Strategi Jaringan Dinamis Adaptif Pendek dan Panjang

- ATR Chandelier exit strategy dengan indeks kekuatan relatif

- Strategi Peramalan dan Perdagangan Otomatis Tinggi/Rendah

- Intraday Hammer Reversal Pattern Strategi panjang

- Bollinger Bands & Strategi Kombinasi RSI

- Ichimoku Oscillator dengan Strategi Indeks Momentum Stochastic

- Strategi perdagangan AI Trend Predictor

- TrendHunter w/MF Strategi Tren Multi-Timeframe

- Bollinger Bands dan Strategi Retracement Fibonacci

- Strategi RSI dan MACD Crossover

- Strategi perdagangan berdasarkan crossover rata-rata bergerak ganda

- RSI Dinamis dan Strategi Beli/Jual Rata-rata Bergerak Ganda

- Strategi Perdagangan Rata-rata Bergerak Eksponensial Berganda

- Strategi Perdagangan RSI Crossover