Tren Saluran Gaussian Mengikuti Strategi

Penulis:ChaoZhang, Tanggal: 2024-03-29 16:26:26Tag:

Gambaran umum

Gaussian Channel Trend Following Strategy adalah strategi perdagangan yang mengikuti tren berdasarkan indikator Gaussian Channel. Strategi ini bertujuan untuk menangkap tren utama di pasar, membeli dan memegang posisi selama tren naik dan menutup posisi selama tren turun. Ini menggunakan indikator Gaussian Channel untuk mengidentifikasi arah dan kekuatan tren dengan menganalisis hubungan antara harga dan pita atas dan bawah saluran. Tujuan utama strategi adalah untuk memaksimalkan keuntungan selama tren berkelanjutan sambil meminimalkan frekuensi perdagangan selama pasar yang terikat jangkauan.

Prinsip Strategi

Inti dari Gaussian Channel Trend Following Strategy adalah Gaussian Channel indicator, yang diusulkan oleh Ehlers. Ini menggabungkan teknik penyaringan Gaussian dengan True Range untuk menganalisis aktivitas tren. Indikator pertama menghitung nilai beta dan alpha berdasarkan periode pengambilan sampel dan jumlah kutub, kemudian menerapkan filter ke data untuk mendapatkan kurva halus (garis tengah). Selanjutnya, strategi mengalikan True Range halus dengan pengganda untuk menghasilkan saluran atas dan bawah. Ketika harga melintasi di atas / di bawah saluran atas / bawah, itu menghasilkan sinyal beli / jual.

Keuntungan Strategi

- Mengikuti tren: Strategi ini unggul dalam menangkap tren utama di pasar, berinvestasi ke arah tren, yang membantu mencapai pengembalian stabil jangka panjang.

- Mengurangi Frekuensi Perdagangan: Strategi hanya memasuki posisi ketika tren dikonfirmasi dan mempertahankan posisi selama tren, sehingga mengurangi biaya perdagangan dan transaksi yang tidak perlu.

- Pengurangan Lag: Melalui mode lag yang berkurang dan mode respon cepat, strategi dapat bereaksi lebih cepat terhadap perubahan pasar.

- Parameter Fleksibel: Pengguna dapat menyesuaikan parameter strategi sesuai dengan kebutuhan mereka, seperti periode pengambilan sampel, jumlah tiang, pengganda True Range, dll., Untuk mengoptimalkan kinerja strategi.

Risiko Strategi

- Risiko Optimasi Parameter: Pengaturan parameter yang tidak benar dapat menyebabkan kinerja strategi yang buruk.

- Risiko Pembalikan Tren: Ketika tren pasar tiba-tiba berbalik, strategi dapat mengalami penurunan yang signifikan. Hal ini dapat dikurangi dengan menetapkan stop-loss atau memperkenalkan indikator lain untuk mengendalikan risiko.

- Risiko Pasar Berbatas Jangkauan: Di pasar berbatas jangkauan, strategi dapat menghasilkan sinyal perdagangan yang sering, yang mengarah pada penurunan pengembalian.

Arah Optimasi Strategi

- Menggabungkan Indikator Teknis Lainnya: Menggabungkan dengan indikator tren atau osilator lainnya, seperti MACD, RSI, dll., Untuk meningkatkan akurasi dan keandalan sinyal.

- Optimasi Parameter Dinamis: Mengatur secara dinamis parameter strategi berdasarkan perubahan kondisi pasar untuk beradaptasi dengan lingkungan pasar yang berbeda.

- Tambahkan Modul Kontrol Risiko: Tetapkan aturan stop loss dan take profit yang wajar untuk mengendalikan risiko perdagangan individu dan tingkat penarikan keseluruhan.

- Multi-Timeframe Analysis: Menggabungkan sinyal dari kerangka waktu yang berbeda, seperti grafik harian dan 4 jam, untuk mendapatkan informasi pasar yang lebih komprehensif.

Ringkasan

Gaussian Channel Trend Following Strategy adalah strategi trading trend-following yang didasarkan pada teknik penyaringan Gaussian, yang bertujuan untuk menangkap tren pasar utama untuk pengembalian stabil jangka panjang. Strategi ini menggunakan indikator Gaussian Channel untuk mengidentifikasi arah dan kekuatan tren sambil menawarkan fitur untuk mengurangi lag dan memberikan respons cepat. Keuntungan dari strategi terletak pada kemampuan trend-following yang kuat dan frekuensi perdagangan yang rendah. Namun, strategi ini juga menghadapi risiko seperti optimasi parameter, pembalikan tren, dan pasar range-bound. Optimasi masa depan dapat mencakup penggabungan indikator teknis lainnya, optimasi parameter dinamis, menambahkan modul kontrol risiko, dan analisis multi-frame waktu untuk lebih meningkatkan ketahanan dan profitabilitas strategi.

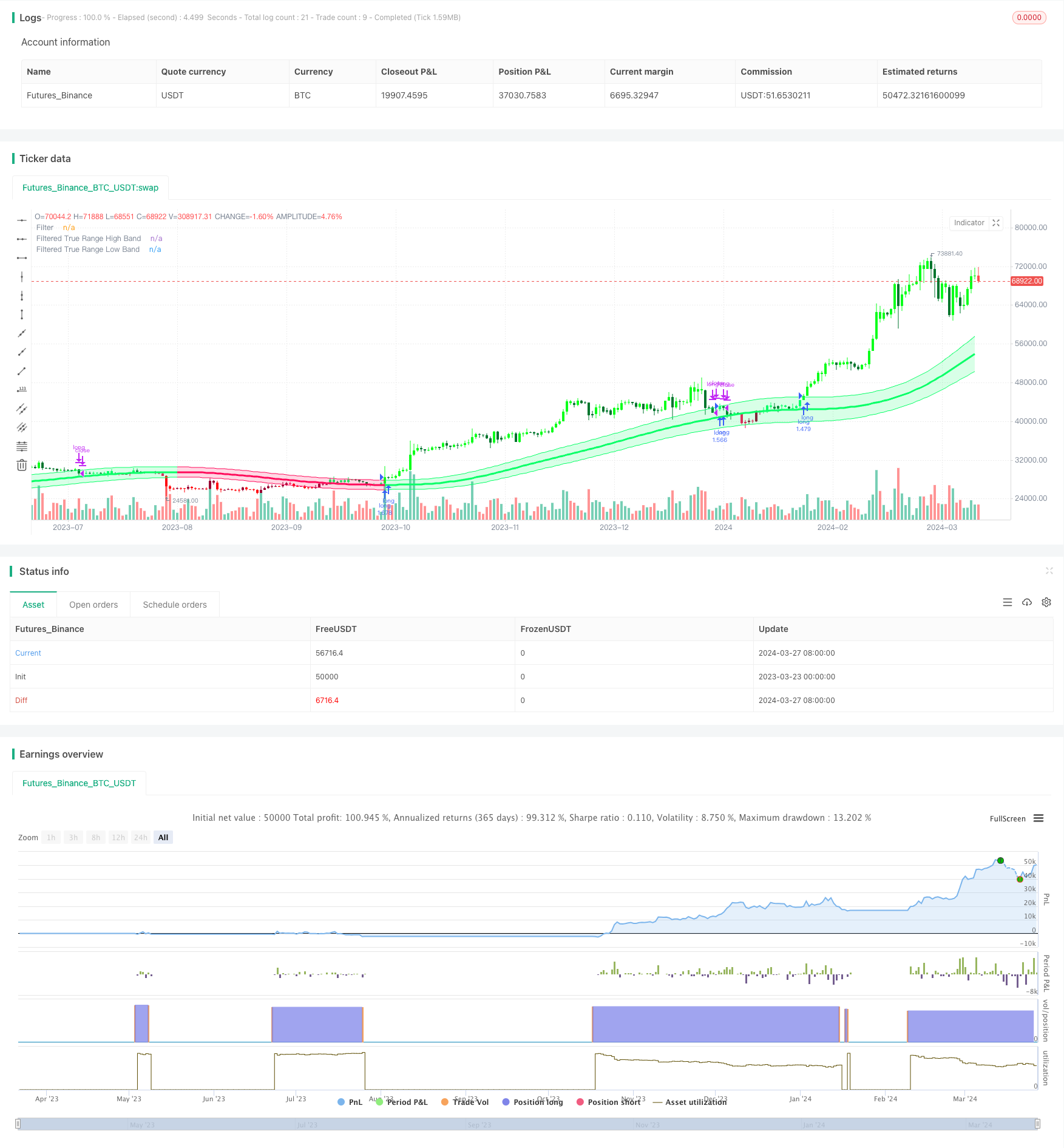

/*backtest

start: 2023-03-23 00:00:00

end: 2024-03-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Gaussian Channel Strategy v2.0", overlay=true, calc_on_every_tick=false, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Gaussian Channel Indicaor - courtesy of @DonovanWall

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Date condition inputs

startDate = input(timestamp("1 January 2018 00:00 +0000"), "Date Start", group="Main Algo Settings")

endDate = input(timestamp("1 January 2060 00:00 +0000"), "Date Start", group="Main Algo Settings")

timeCondition = true

// This study is an experiment utilizing the Ehlers Gaussian Filter technique combined with lag reduction techniques and true range to analyze trend activity.

// Gaussian filters, as Ehlers explains it, are simply exponential moving averages applied multiple times.

// First, beta and alpha are calculated based on the sampling period and number of poles specified. The maximum number of poles available in this script is 9.

// Next, the data being analyzed is given a truncation option for reduced lag, which can be enabled with "Reduced Lag Mode".

// Then the alpha and source values are used to calculate the filter and filtered true range of the dataset.

// Filtered true range with a specified multiplier is then added to and subtracted from the filter, generating a channel.

// Lastly, a one pole filter with a N pole alpha is averaged with the filter to generate a faster filter, which can be enabled with "Fast Response Mode".

// Custom bar colors are included.

// Note: Both the sampling period and number of poles directly affect how much lag the indicator has, and how smooth the output is.

// Larger inputs will result in smoother outputs with increased lag, and smaller inputs will have noisier outputs with reduced lag.

// For the best results, I recommend not setting the sampling period any lower than the number of poles + 1. Going lower truncates the equation.

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Updates:

// Huge shoutout to @e2e4mfck for taking the time to improve the calculation method!

// -> migrated to v4

// -> pi is now calculated using trig identities rather than being explicitly defined.

// -> The filter calculations are now organized into functions rather than being individually defined.

// -> Revamped color scheme.

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Functions - courtesy of @e2e4mfck

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Filter function

f_filt9x (_a, _s, _i) =>

int _m2 = 0, int _m3 = 0, int _m4 = 0, int _m5 = 0, int _m6 = 0,

int _m7 = 0, int _m8 = 0, int _m9 = 0, float _f = .0, _x = (1 - _a)

// Weights.

// Initial weight _m1 is a pole number and equal to _i

_m2 := _i == 9 ? 36 : _i == 8 ? 28 : _i == 7 ? 21 : _i == 6 ? 15 : _i == 5 ? 10 : _i == 4 ? 6 : _i == 3 ? 3 : _i == 2 ? 1 : 0

_m3 := _i == 9 ? 84 : _i == 8 ? 56 : _i == 7 ? 35 : _i == 6 ? 20 : _i == 5 ? 10 : _i == 4 ? 4 : _i == 3 ? 1 : 0

_m4 := _i == 9 ? 126 : _i == 8 ? 70 : _i == 7 ? 35 : _i == 6 ? 15 : _i == 5 ? 5 : _i == 4 ? 1 : 0

_m5 := _i == 9 ? 126 : _i == 8 ? 56 : _i == 7 ? 21 : _i == 6 ? 6 : _i == 5 ? 1 : 0

_m6 := _i == 9 ? 84 : _i == 8 ? 28 : _i == 7 ? 7 : _i == 6 ? 1 : 0

_m7 := _i == 9 ? 36 : _i == 8 ? 8 : _i == 7 ? 1 : 0

_m8 := _i == 9 ? 9 : _i == 8 ? 1 : 0

_m9 := _i == 9 ? 1 : 0

// filter

_f := math.pow(_a, _i) * nz(_s) +

_i * _x * nz(_f[1]) - (_i >= 2 ?

_m2 * math.pow(_x, 2) * nz(_f[2]) : 0) + (_i >= 3 ?

_m3 * math.pow(_x, 3) * nz(_f[3]) : 0) - (_i >= 4 ?

_m4 * math.pow(_x, 4) * nz(_f[4]) : 0) + (_i >= 5 ?

_m5 * math.pow(_x, 5) * nz(_f[5]) : 0) - (_i >= 6 ?

_m6 * math.pow(_x, 6) * nz(_f[6]) : 0) + (_i >= 7 ?

_m7 * math.pow(_x, 7) * nz(_f[7]) : 0) - (_i >= 8 ?

_m8 * math.pow(_x, 8) * nz(_f[8]) : 0) + (_i == 9 ?

_m9 * math.pow(_x, 9) * nz(_f[9]) : 0)

// 9 var declaration fun

f_pole (_a, _s, _i) =>

_f1 = f_filt9x(_a, _s, 1), _f2 = (_i >= 2 ? f_filt9x(_a, _s, 2) : 0), _f3 = (_i >= 3 ? f_filt9x(_a, _s, 3) : 0)

_f4 = (_i >= 4 ? f_filt9x(_a, _s, 4) : 0), _f5 = (_i >= 5 ? f_filt9x(_a, _s, 5) : 0), _f6 = (_i >= 6 ? f_filt9x(_a, _s, 6) : 0)

_f7 = (_i >= 2 ? f_filt9x(_a, _s, 7) : 0), _f8 = (_i >= 8 ? f_filt9x(_a, _s, 8) : 0), _f9 = (_i == 9 ? f_filt9x(_a, _s, 9) : 0)

_fn = _i == 1 ? _f1 : _i == 2 ? _f2 : _i == 3 ? _f3 :

_i == 4 ? _f4 : _i == 5 ? _f5 : _i == 6 ? _f6 :

_i == 7 ? _f7 : _i == 8 ? _f8 : _i == 9 ? _f9 : na

[_fn, _f1]

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Inputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Source

src = input(defval=hlc3, title="Source")

// Poles

int N = input.int(defval=4, title="Poles", minval=1, maxval=9)

// Period

int per = input.int(defval=144, title="Sampling Period", minval=2)

// True Range Multiplier

float mult = input.float(defval=1.414, title="Filtered True Range Multiplier", minval=0)

// Lag Reduction

bool modeLag = input.bool(defval=false, title="Reduced Lag Mode")

bool modeFast = input.bool(defval=false, title="Fast Response Mode")

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Definitions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Beta and Alpha Components

beta = (1 - math.cos(4*math.asin(1)/per)) / (math.pow(1.414, 2/N) - 1)

alpha = - beta + math.sqrt(math.pow(beta, 2) + 2*beta)

// Lag

lag = (per - 1)/(2*N)

// Data

srcdata = modeLag ? src + (src - src[lag]) : src

trdata = modeLag ? ta.tr(true) + (ta.tr(true) - ta.tr(true)[lag]) : ta.tr(true)

// Filtered Values

[filtn, filt1] = f_pole(alpha, srcdata, N)

[filtntr, filt1tr] = f_pole(alpha, trdata, N)

// Lag Reduction

filt = modeFast ? (filtn + filt1)/2 : filtn

filttr = modeFast ? (filtntr + filt1tr)/2 : filtntr

// Bands

hband = filt + filttr*mult

lband = filt - filttr*mult

// Colors

color1 = #0aff68

color2 = #00752d

color3 = #ff0a5a

color4 = #990032

fcolor = filt > filt[1] ? #0aff68 : filt < filt[1] ? #ff0a5a : #cccccc

barcolor = (src > src[1]) and (src > filt) and (src < hband) ? #0aff68 : (src > src[1]) and (src >= hband) ? #0aff1b : (src <= src[1]) and (src > filt) ? #00752d :

(src < src[1]) and (src < filt) and (src > lband) ? #ff0a5a : (src < src[1]) and (src <= lband) ? #ff0a11 : (src >= src[1]) and (src < filt) ? #990032 : #cccccc

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Outputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

// Filter Plot

filtplot = plot(filt, title="Filter", color=fcolor, linewidth=3)

// Band Plots

hbandplot = plot(hband, title="Filtered True Range High Band", color=fcolor)

lbandplot = plot(lband, title="Filtered True Range Low Band", color=fcolor)

// Channel Fill

fill(hbandplot, lbandplot, title="Channel Fill", color=color.new(fcolor, 80))

// Bar Color

barcolor(barcolor)

longCondition = ta.crossover(close, hband) and timeCondition

closeAllCondition = ta.crossunder(close, hband) and timeCondition

if longCondition

strategy.entry("long", strategy.long)

if closeAllCondition

strategy.close("long")

- Trend jangka pendek yang dapat diskalakan berdasarkan rata-rata bergerak ganda dan RSI mengikuti strategi

- Strategi Perdagangan Momentum Dual Range Filter

- VWAP Moving Average Crossover dengan Strategi Stop Loss dan Take Profit ATR Dinamis

- Strategi ambang dinamis adaptif seri waktu berdasarkan data ekuitas

- Strategi Penembusan Sesi Asia Tinggi Rendah

- Trader Tren Marcus dengan Panah dan Alerts Strategy

- EMA Dual Moving Average Crossover Trend Mengikuti Strategi

- Strategi Crossover Rata-rata Bergerak

- RSI Momentum Strategy dengan Manual TP dan SL

- EMA RSI Trend-Following dan Momentum Strategy

- Strategi Perdagangan Frekuensi Tinggi Menggabungkan Bollinger Bands dan DCA

- Trend Indeks Kekuatan Relatif yang Dimodifikasi Mengikuti Strategi

- Strategi Breakout Bullish intraday

- EMA-MACD-SuperTrend-ADX-ATR Strategi Sinyal Perdagangan Multi-Indikator

- Strategi Garis Posisi Variabel Mengikuti Tren

- Strategi Kombinasi Supertrend dan Bollinger Bands

- Tren MACD Mengikuti Strategi

- Strategi Crossover Rata-rata Bergerak Ganda EMA

- Strategi Scalping XAUUSD 1 Menit

- Vektor Candle-based Channel Breakout dan Custom ChoCH Strategy