Dukungan Dinamis Resistensi & Bollinger Bands Strategi lintas multi-indikator

Penulis:ChaoZhang, Tanggal: 2025-01-17 14:24:33Tag:SRBBEMA21PivotSilang

Gambaran umum

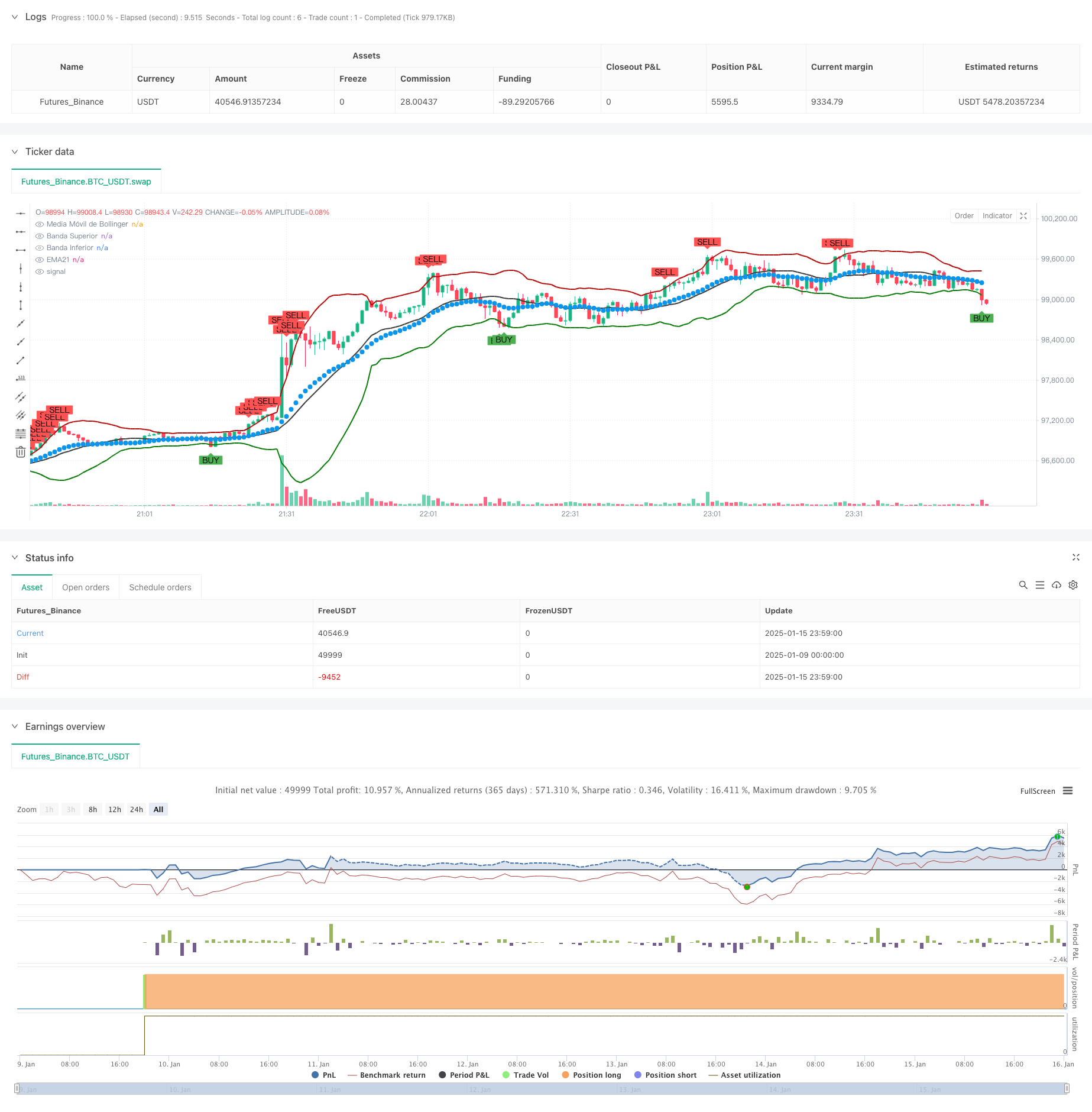

Strategi ini menggabungkan level support/resistance yang dinamis dengan Bollinger Bands dan EMA21 untuk pendekatan perdagangan lintas multi-indikator. Strategi ini mengidentifikasi perpecahan tingkat harga kunci sambil menggunakan crossover indikator teknis untuk membuat keputusan perdagangan. Strategi ini tidak hanya secara dinamis mengidentifikasi level support/resistance penting dalam struktur pasar tetapi juga mengkonfirmasi sinyal perdagangan melalui koordinasi Bollinger Bands dan moving average.

Prinsip Strategi

Strategi ini didasarkan pada beberapa komponen inti: 1. Perhitungan Dukungan/Rintangan Dinamis: Menggunakan metode titik pivot untuk secara dinamis menghitung tingkat dukungan/rintangan pasar, menyaring zona harga efektif melalui lebar saluran dan persyaratan kekuatan minimum. 2. Bollinger Bands: Menggunakan 20 periode, 2 deviasi standar Bollinger Bands untuk menentukan rentang volatilitas harga. 3. EMA21: Berfungsi sebagai garis referensi untuk penilaian tren jangka menengah. 4. Generasi Sinyal Perdagangan: Mengeksekusi perdagangan ketika harga menembus level support/resistance sambil memicu sinyal Bollinger Band secara bersamaan.

Keuntungan Strategi

- Konfirmasi Multidimensional: Meningkatkan keandalan sinyal perdagangan dengan menggabungkan beberapa indikator teknis.

- Adaptasi Dinamis: Tingkat support/resistance menyesuaikan diri secara otomatis dengan perubahan struktur pasar.

- Manajemen Risiko: Bollinger Bands memberikan definisi batas overbought/oversold yang jelas.

- Konfirmasi Tren: EMA21 membantu mengkonfirmasi arah tren jangka menengah.

- Visualisasi: Strategi memberikan umpan balik visual yang jelas untuk analisis dan optimasi.

Risiko Strategi

- Risiko pasar berbelit-belit: Dapat menghasilkan sinyal pecah palsu yang berlebihan di pasar sampingan.

- Risiko Lag: Indikator teknis memiliki keterlambatan perhitungan yang melekat, berpotensi kehilangan titik masuk yang optimal.

- Sensitivitas Parameter: Kinerja strategi sensitif terhadap pengaturan parameter, yang membutuhkan optimasi untuk lingkungan pasar yang berbeda.

- Risiko Pemecahan Palsu: Pemecahan dukungan/resistensi mungkin palsu, membutuhkan konfirmasi dari indikator lain.

Arahan Optimasi

- Masukkan Indikator Volume: Tambahkan analisis volume untuk konfirmasi pecah untuk meningkatkan keandalan sinyal.

- Mengoptimalkan Adaptasi Parameter: Mengembangkan mekanisme penyesuaian parameter adaptif untuk adaptasi lingkungan pasar yang lebih baik.

- Meningkatkan mekanisme stop loss: Merancang strategi stop loss yang lebih komprehensif untuk mengendalikan risiko penarikan.

- Tambahkan Filter Tren: Tingkatkan penilaian kekuatan tren untuk menghindari perdagangan di lingkungan tren yang lemah.

- Optimasi kerangka waktu: Pelajari kombinasi kerangka waktu yang berbeda untuk menemukan konfigurasi yang optimal.

Ringkasan

Strategi ini membangun sistem perdagangan yang relatif lengkap dengan menggabungkan dukungan / resistensi dinamis, Bollinger Bands, dan EMA21. Kekuatannya terletak pada konfirmasi sinyal multidimensi dan adaptasi pasar dinamis, sambil menghadapi tantangan dalam optimasi parameter dan risiko pecah palsu. Melalui optimasi dan peningkatan mekanisme pengendalian risiko secara terus menerus, strategi menunjukkan janji untuk kinerja yang lebih baik dalam perdagangan aktual.

//@version=5

strategy("Support Resistance & Bollinger & EMA21", overlay=true)

// Parámetros de S/R

prd = input.int(defval=10, title='Pivot Period', minval=4, maxval=30, group='Setup')

ppsrc = input.string(defval='High/Low', title='Source', options=['High/Low', 'Close/Open'], group='Setup')

maxnumpp = input.int(defval=20, title='Maximum Number of Pivot', minval=5, maxval=100, group='Setup')

ChannelW = input.int(defval=10, title='Maximum Channel Width %', minval=1, group='Setup')

maxnumsr = input.int(defval=5, title='Maximum Number of S/R', minval=1, maxval=10, group='Setup')

min_strength = input.int(defval=2, title='Minimum Strength', minval=1, maxval=10, group='Setup')

labelloc = input.int(defval=20, title='Label Location', group='Colors', tooltip='Positive numbers reference future bars, negative numbers reference historical bars')

linestyle = input.string(defval='Solid', title='Line Style', options=['Solid', 'Dotted', 'Dashed'], group='Colors')

linewidth = input.int(defval=2, title='Line Width', minval=2, maxval=2, group='Colors')

resistancecolor = input.color(defval=color.black, title='Resistance Color', group='Colors')

supportcolor = input.color(defval=color.black, title='Support Color', group='Colors')

showpp = input(false, title='Show Point Points')

// Parámetros de Bandas de Bollinger y EMA21

periodo_bollinger = input.int(title="Periodo de Bollinger", defval=20)

multiplicador_bollinger = input.float(title="Multiplicador de Bollinger", defval=2.0)

periodo_ema21 = input.int(title="Periodo EMA21", defval=21)

// Cálculo de las Bandas de Bollinger y EMA21

[middle, superior, inferior] = ta.bb(close, periodo_bollinger, multiplicador_bollinger)

ema21 = ta.ema(close, periodo_ema21)

// Ploteo de las Bandas de Bollinger y EMA21

plot(middle, color=color.rgb(60, 60, 60), linewidth=2, title="Media Móvil de Bollinger")

plot(superior, color=color.rgb(184, 11, 8), linewidth=2, title="Banda Superior")

plot(inferior, color=color.rgb(6, 124, 4), linewidth=2, title="Banda Inferior")

plot(ema21, color=color.rgb(6, 150, 240), linewidth=1, style=plot.style_circles, title="EMA21")

// Condiciones para señales de compra y venta

senal_compra = close <= inferior

senal_venta = close >= superior

// Mostrar señales en el gráfico

plotshape(senal_compra, title="Compra", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(senal_venta, title="Venta", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Código de soporte y resistencia

float src1 = ppsrc == 'High/Low' ? high : math.max(close, open)

float src2 = ppsrc == 'High/Low' ? low : math.min(close, open)

float ph = ta.pivothigh(src1, prd, prd)

float pl = ta.pivotlow(src2, prd, prd)

plotshape(ph and showpp, text='H', style=shape.labeldown, color=na, textcolor=color.new(color.red, 0), location=location.abovebar, offset=-prd)

plotshape(pl and showpp, text='L', style=shape.labelup, color=na, textcolor=color.new(color.lime, 0), location=location.belowbar, offset=-prd)

// Calcular ancho máximo del canal S/R

prdhighest = ta.highest(300)

prdlowest = ta.lowest(300)

cwidth = (prdhighest - prdlowest) * ChannelW / 100

var pivotvals = array.new_float(0)

if ph or pl

array.unshift(pivotvals, ph ? ph : pl)

if array.size(pivotvals) > maxnumpp // Limitar el tamaño del array

array.pop(pivotvals)

get_sr_vals(ind) =>

float lo = array.get(pivotvals, ind)

float hi = lo

int numpp = 0

for y = 0 to array.size(pivotvals) - 1 by 1

float cpp = array.get(pivotvals, y)

float wdth = cpp <= lo ? hi - cpp : cpp - lo

if wdth <= cwidth // Ajusta al ancho máximo del canal?

if cpp <= hi

lo := math.min(lo, cpp)

else

hi := math.max(hi, cpp)

numpp += 1

[hi, lo, numpp]

var sr_up_level = array.new_float(0)

var sr_dn_level = array.new_float(0)

sr_strength = array.new_float(0)

find_loc(strength) =>

ret = array.size(sr_strength)

for i = ret > 0 ? array.size(sr_strength) - 1 : na to 0 by 1

if strength <= array.get(sr_strength, i)

break

ret := i

ret

check_sr(hi, lo, strength) =>

ret = true

for i = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

if array.get(sr_up_level, i) >= lo and array.get(sr_up_level, i) <= hi or array.get(sr_dn_level, i) >= lo and array.get(sr_dn_level, i) <= hi

if strength >= array.get(sr_strength, i)

array.remove(sr_strength, i)

array.remove(sr_up_level, i)

array.remove(sr_dn_level, i)

ret

else

ret := false

break

ret

// var sr_lines = array.new_line(11, na)

// var sr_labels = array.new_label(11, na)

// for x = 1 to 10 by 1

// rate = 100 * (label.get_y(array.get(sr_labels, x)) - close) / close

// label.set_text(array.get(sr_labels, x), text=str.tostring(label.get_y(array.get(sr_labels, x))) + '(' + str.tostring(rate, '#.##') + '%)')

// label.set_x(array.get(sr_labels, x), x=bar_index + labelloc)

// label.set_color(array.get(sr_labels, x), color=label.get_y(array.get(sr_labels, x)) >= close ? color.red : color.lime)

// label.set_textcolor(array.get(sr_labels, x), textcolor=label.get_y(array.get(sr_labels, x)) >= close ? color.white : color.black)

// label.set_style(array.get(sr_labels, x), style=label.get_y(array.get(sr_labels, x)) >= close ? label.style_label_down : label.style_label_up)

// line.set_color(array.get(sr_lines, x), color=line.get_y1(array.get(sr_lines, x)) >= close ? resistancecolor : supportcolor)

if ph or pl

// Debido a los nuevos cálculos, eliminar niveles S/R antiguos

array.clear(sr_up_level)

array.clear(sr_dn_level)

array.clear(sr_strength)

// Encontrar zonas S/R

for x = 0 to array.size(pivotvals) - 1 by 1

[hi, lo, strength] = get_sr_vals(x)

if check_sr(hi, lo, strength)

loc = find_loc(strength)

// Si la fuerza está en los primeros maxnumsr sr, entonces insértala en los arrays

if loc < maxnumsr and strength >= min_strength

array.insert(sr_strength, loc, strength)

array.insert(sr_up_level, loc, hi)

array.insert(sr_dn_level, loc, lo)

// Mantener el tamaño de los arrays = 5

if array.size(sr_strength) > maxnumsr

array.pop(sr_strength)

array.pop(sr_up_level)

array.pop(sr_dn_level)

// for x = 1 to 10 by 1

// line.delete(array.get(sr_lines, x))

// label.delete(array.get(sr_labels, x))

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

rate = 100 * (mid - close) / close

// array.set(sr_labels, x + 1, label.new(x=bar_index + labelloc, y=mid, text=str.tostring(mid) + '(' + str.tostring(rate, '#.##') + '%)', color=mid >= close ? color.red : color.lime, textcolor=mid >= close ? color.white : color.black, style=mid >= close ? label.style_label_down : label.style_label_up))

// array.set(sr_lines, x + 1, line.new(x1=bar_index, y1=mid, x2=bar_index - 1, y2=mid, extend=extend.both, color=mid >= close ? resistancecolor : supportcolor, style=line.style_solid, width=2))

f_crossed_over() =>

ret = false

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

if close[1] <= mid and close > mid

ret := true

ret

f_crossed_under() =>

ret = false

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

if close[1] >= mid and close < mid

ret := true

ret

crossed_over = f_crossed_over()

crossed_under = f_crossed_under()

alertcondition(crossed_over, title='Resistance Broken', message='Resistance Broken')

alertcondition(crossed_under, title='Support Broken', message='Support Broken')

alertcondition(crossed_over or crossed_under, title='Support or Resistance Broken', message='Support or Resistance Broken')

// Estrategia de compra y venta basada en el cruce de niveles S/R

if (crossed_over and senal_compra)

strategy.entry("Compra", strategy.long)

if (crossed_under and senal_venta)

strategy.close("Compra")

- Triple Bollinger Bands Mencapai Tren Mengikuti Strategi Perdagangan Kuantitatif

- Pemecahan Dukungan-Resistensi

- Sistem Perdagangan Aksi Harga Dukungan Dinamis Resistensi

- Cloud-Based Bollinger Bands Strategi Tren Kuantitatif Rata-rata Bergerak Ganda

- Bollinger Bands Dinamis Breakout Strategi

- Indikator Dukungan Teknis dan Resistensi Strategi Perdagangan Presisi

- EMA dan Bollinger Bands Breakout Strategy

- Pengembalian bulanan dalam Strategi PineScript

- Titik Pivot Tinggi Rendah Multi Time Frame

- Pivot Berbasis Trailing Maxima & Minima

- Tren Multi-Indikator Mengikuti dengan RSI Strategi Perdagangan Kuantitatif Overbought/Oversold

- Strategi Perdagangan Saluran Harga yang Efisien Berdasarkan Penembusan 15 Menit

- Strategi Breakout Gap Nilai Adil Multi-Timeframe dengan Backtest historis

- Tren QQE yang Dinamis Mengikuti Strategi Perdagangan Kuantitatif Pengelolaan Risiko

- Strategi perdagangan konfirmasi tren ganda berdasarkan rata-rata bergerak dan pola luar bar

- Tren Dinamis Mengikuti Strategi Peningkatan Tiga Kali SuperTrend

- RSI Dynamic Breakout Retracement Strategi Perdagangan

- Strategi Pelacakan Tren T3 Dual yang Dioptimalkan

- Multi-kondisi Donchian Channel Momentum Breakout Strategi

- Strategi Sistem Perdagangan Dinamis Indikator Teknis Multi-Periode

- Multi-Dimensional Ichimoku Cloud Price Breakthrough Trend Konfirmasi Strategi Perdagangan

- Strategi perdagangan yang mengikuti tren RSI saraf dinamis

- Trend Crossover Multi-EMA Mengikuti Strategi Perdagangan Kuantitatif

- Strategi perdagangan RSI yang tumpang tindih dengan indikator multi-level

- Bollinger Bands dan Fibonacci Intraday Trend Mengikuti Strategi

- Tren Dinamis Mengikuti Strategi Saluran Dual Moving Average dengan Sistem Manajemen Risiko

- Trend Multi-Mode Take Profit/Stop Loss Mengikuti Strategi Berdasarkan EMA, Madrid Ribbon dan Donchian Channel

- Multi-Indikator Trend Momentum Trading Strategy: Sistem Trading Kuantitatif yang Dioptimalkan Berdasarkan Bollinger Bands, Fibonacci dan ATR

- Sistem Deteksi Divergensi Harga RSI Dinamis dan Strategi Perdagangan Adaptif

- Tren Multidimensional Mengikuti Strategi Perdagangan Piramida