EMAとMACDに基づくBTC取引戦略

作者: リン・ハーンチャオチャン, 日付: 2024-01-25 12:54:16タグ:

概要

この戦略は,短期BTC取引のためのEMA差とMACD指標に基づいた複合戦略である.EMAとMACDからの信号を組み合わせ,特定の条件下で購入および販売信号を生成する.

戦略の論理

差がマイナスで

利点分析

- 複合指標を使用し,より信頼性の高い信号

- 短期取引に適した短期的なパラメータを採用します

- リスク制御のためにストップ・ロストと収益設定を行っています.

リスク分析

- ストップ・ロスは,巨大な市場の変動中に破られる可能性があります.

- パラメータは異なる市場環境に最適化する必要があります

- 効果は異なるコインや取引所でテストする必要があります

オプティマイゼーションの方向性

- BTCの変動に合わせて EMA と MACD パラメータを最適化

- 資本効率を向上させるために,ポジションサイズとピラミッド戦略を追加する

- リスクを減らすため,ストップ・ロスのストップ・ロスのようにストップ・ロスの方法を追加します.

- 異なる取引所とコインに対するテスト効果

結論

この戦略は,EMAとMACDの両方の指標の強みを統合し,複合信号を使用して誤った信号を効果的にフィルタリングする.最適化されたパラメータとポジション戦略により,安定したリターンを達成することができます.しかし,ストップロスのヒットなどのリスクは注意を払い,さらなるテストと改善が必要です.

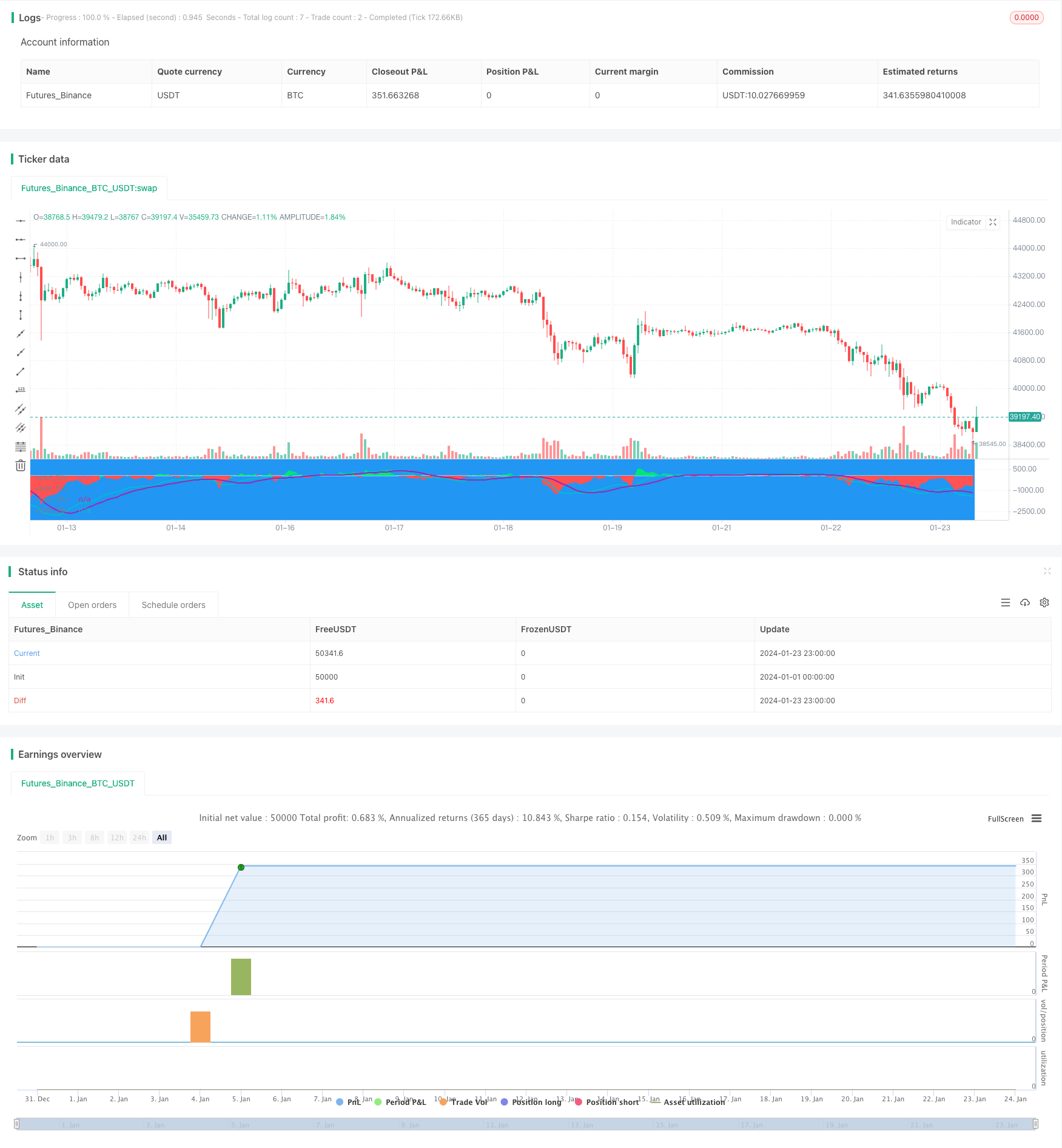

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("EMA50Diff & MACD Strategy", overlay=false)

EMA = input(18, step=1)

MACDfast = input(12)

MACDslow = input(26)

EMADiffThreshold = input(8)

MACDThreshold = input(80)

TargetValidityThreshold = input(65, step=5)

Target = input(120, step=5)

StopLoss = input(650, step=5)

ema = ema(close, EMA)

hl = plot(0, color=white, linewidth=1)

diff = close - ema

clr = color(blue, transp=100)

if diff>0

clr := lime

else

if diff<0

clr := red

fastMA = ema(close, MACDfast)

slowMA = ema(close, MACDslow)

macd = (fastMA - slowMA)*3

signal = sma(macd, 9)

plot(macd, color=aqua, linewidth=2)

plot(signal, color=purple, linewidth=2)

macdlong = macd<-MACDThreshold and signal<-MACDThreshold and crossover(macd, signal)

macdshort = macd>MACDThreshold and signal>MACDThreshold and crossunder(macd, signal)

position = 0.0

position := nz(strategy.position_size, 0.0)

long = (position < 0 and close < strategy.position_avg_price - TargetValidityThreshold and macdlong) or

(position == 0.0 and diff < -EMADiffThreshold and diff > diff[1] and diff[1] < diff[2] and macdlong)

short = (position > 0 and close > strategy.position_avg_price + TargetValidityThreshold and macdshort) or

(position == 0.0 and diff > EMADiffThreshold and diff < diff[1] and diff[1] > diff[2] and macdshort)

amount = (strategy.equity / close) //- ((strategy.equity / close / 10)%10)

bgclr = color(blue, transp=100) //#0c0c0c

if long

strategy.entry("long", strategy.long, amount)

bgclr := green

if short

strategy.entry("short", strategy.short, amount)

bgclr := maroon

bgcolor(bgclr, transp=20)

strategy.close("long", when=close>strategy.position_avg_price + Target)

strategy.close("short", when=close<strategy.position_avg_price - Target)

strategy.exit("STOPLOSS", "long", stop=strategy.position_avg_price - StopLoss)

strategy.exit("STOPLOSS", "short", stop=strategy.position_avg_price + StopLoss)

//plotshape(long, style=shape.labelup, location=location.bottom, color=green)

//plotshape(short, style=shape.labeldown, location=location.top, color=red)

pl = plot(diff, style=histogram, color=clr)

fill(hl, pl, color=clr)

もっと

- この戦略は,MACDヒストグラムのトレンドに基づいて取引の決定を下します.

- モメントオシレーター&123 パターン戦略

- フィッシャー変換指標に基づくバックテスト戦略

- 振動スペクトル移動平均取引戦略

- 移動平均範囲に基づく逆転取引戦略

- カルマンフィルターに基づくトレンド追跡戦略

- 季節性逆転 期間間取引戦略

- 二重指数関数移動平均クロスオーバーアルゴリズム取引戦略

- 多因子を持つ量的な取引戦略

- インテリジェント トレイリング ストップ ロス 戦略

- アダプティブ・ボラティリティ・ブレイク

- ピアスピンバー逆転戦略

- RSI インディケーターに基づくニフティ取引戦略

- RSI と EMA ベース トレンド フォロー 戦略

- トレンド確認追跡戦略

- RSI 差異指標戦略

- モメントム・ムービング・平均 konsolidiation 戦略

- トレンドフィルターに基づくQQEクロスオーバー取引戦略