CVDは量的な取引戦略から遠ざかります

作者: リン・ハーンチャオチャン開催日:2024年3月15日 16時47分47秒タグ:

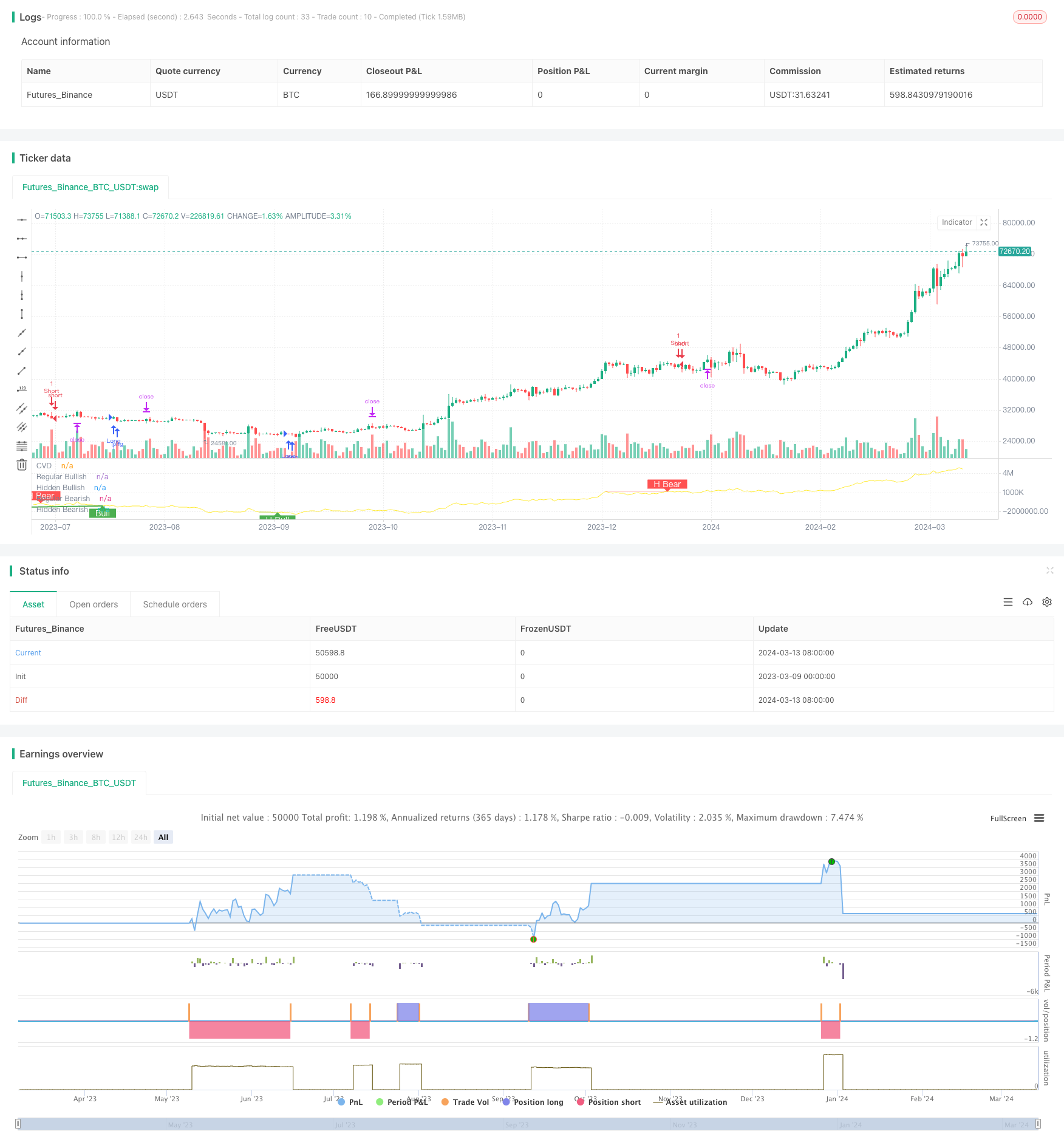

戦略の概要: このCVDデバイド量化取引戦略は,CVD指標と価格形成デバイドを活用して潜在的なトレンド逆転信号を捕捉する.この戦略は,CVD指標を計算し,価格との比較によって,上向きか下向きのデバイドが形成されているかどうかを判断する.デバイド信号が発生すると,この戦略は多額または空調を設定する.同時に,移動ストップ損失と固定百分比ストップを活用してリスクを制御し,利益をロックする.この戦略は,複数のポジションのピラミッド上向きを同時にサポートする.

戦略原理: 1.CVD指標を計算する:CVD指標とその移動平均線を計算する. 2. 偏差を識別する:CVD指標の高低点と価格の高低点を比較して,偏差が形成されているかどうかを判断する. - 常識的な看板の逆転: 価格の革新は低く,しかしCVD指標はより高い低点を形成する - 隠された見方: 価格革新は高いが,CVD指標は低い低点を形成する - 常識的な低迷から逸脱: 価格革新は高いが,CVD指標は低い高点を形成する - 隠された低迷:価格革新が低く,しかしCVD指標はより高い高点を形成する 3. ポジション開設: 異動信号が認識されたとき,異動タイプに応じて,ポジション開設を多にするか空にする. 4.ストップ損失停止策:移動停止損失と固定パーセント停止策を使用する.停止損失価格は,開始価格×停止損失百分比で計算され,停止損失価格は,開始価格×停止損失百分比で計算される. 5. ピラミッド上場: 戦略は最大3ポジションのピラミッド上場を許可する.

戦略的な利点:

1. 傾向逆転信号:CVD逆転は,傾向逆転の機会を捉えるのに役立つ効果的な傾向逆転信号である.

2.トレンド継続信号:隠された逸脱はトレンド継続信号として機能し,トレンドの中で戦略を正しい方向に保つのに役立ちます.

3. リスク管理: 移動停止損失と固定百分比

戦略的リスク: 信号の有効性: 信号の誤差は完全には信頼性がないため,時には誤った信号が出る. 2. パラメータ配置: 策略結果はパラメータ設定に敏感で,異なるパラメータが異なる結果をもたらす可能性があります. 3. ストップダーススリップポイント: 激烈な市場において,ストップダースオーダーは,既定価格で取引できない可能性があり,追加のリスクをもたらす. 4. 取引費: 頻繁に平衡する取引は,戦略的利益に影響を与える高い取引費をもたらす可能性があります.

優化方向: 1. ダイナミックパラメータ最適化: 異なる市場状況に適応するパラメータを採用し,信号の有効性を向上させる. 2. 他の指標と組み合わせ: RSI,MACDなどの他の技術指標と組み合わせることで,信号の信頼性が向上します. 3. 改善された止損抑制: 追跡止損,波動率止損などのより高度な止損抑制戦略を採用する. 4. ポジションサイズ管理: 市場変動や口座資金などの動的調整によるポジションサイズ.

概要:

CVDデビエーション量化取引戦略は,CVD指標と価格のデビエーションを捕捉し,潜在的なトレンド逆転機会を識別する.同時に,移動停止損失と固定百分比の

/*backtest

start: 2023-03-09 00:00:00

end: 2024-03-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//@ mmattman

//Thank you to @ contrerae and Tradingview each for parts of the code to make

//this indicator and matching strategy and also theCrypster for the clean concise TP/SL code.

// indicator(title="CVD Divergence Indicator 1", shorttitle='CVD Div1', format=format.price, timeframe="", timeframe_gaps=true)

strategy("CVD Divergence Strategy.1.mm", shorttitle = 'CVD Div Str 1', overlay=false)

//..................................................................................................................

// Inputs

periodMa = input.int(title='MA Length', minval=1, defval=20)

plotMa = input(title='Plot MA?', defval=false)

// Calculations (Bull & Bear Balance Indicator by Vadim Gimelfarb)

iff_1 = close[1] < open ? math.max(high - close[1], close - low) : math.max(high - open, close - low)

iff_2 = close[1] > open ? high - low : math.max(open - close[1], high - low)

iff_3 = close[1] < open ? math.max(high - close[1], close - low) : high - open

iff_4 = close[1] > open ? high - low : math.max(open - close[1], high - low)

iff_5 = close[1] < open ? math.max(open - close[1], high - low) : high - low

iff_6 = close[1] > open ? math.max(high - open, close - low) : iff_5

iff_7 = high - close < close - low ? iff_4 : iff_6

iff_8 = high - close > close - low ? iff_3 : iff_7

iff_9 = close > open ? iff_2 : iff_8

bullPower = close < open ? iff_1 : iff_9

iff_10 = close[1] > open ? math.max(close[1] - open, high - low) : high - low

iff_11 = close[1] > open ? math.max(close[1] - low, high - close) : math.max(open - low, high - close)

iff_12 = close[1] > open ? math.max(close[1] - open, high - low) : high - low

iff_13 = close[1] > open ? math.max(close[1] - low, high - close) : open - low

iff_14 = close[1] < open ? math.max(open - low, high - close) : high - low

iff_15 = close[1] > open ? math.max(close[1] - open, high - low) : iff_14

iff_16 = high - close < close - low ? iff_13 : iff_15

iff_17 = high - close > close - low ? iff_12 : iff_16

iff_18 = close > open ? iff_11 : iff_17

bearPower = close < open ? iff_10 : iff_18

// Calculations (Bull & Bear Pressure Volume)

bullVolume = bullPower / (bullPower + bearPower) * volume

bearVolume = bearPower / (bullPower + bearPower) * volume

// Calculations Delta

delta = bullVolume - bearVolume

cvd = ta.cum(delta)

cvdMa = ta.sma(cvd, periodMa)

// Plotting

customColor = cvd > cvdMa ? color.new(color.teal, 50) : color.new(color.red, 50)

plotRef1 = plot(cvd, style=plot.style_line, linewidth=1, color=color.new(color.yellow, 0), title='CVD')

plotRef2 = plot(plotMa ? cvdMa : na, style=plot.style_line, linewidth=1, color=color.new(color.white, 0), title='CVD MA')

fill(plotRef1, plotRef2, color=customColor)

//..................................................................................................................

// len = input.int(title="RSI Period", minval=1, defval=14)

// src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=3)

lbL = input(title="Pivot Lookback Left", defval=7)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=true)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = cvd

// plot(osc, title="CVD", linewidth=2, color=#2962FF)

// hline(50, title="Middle Line", color=#787B86, linestyle=hline.style_dotted)

// obLevel = hline(70, title="Overbought", color=#787B86, linestyle=hline.style_dotted)

// osLevel = hline(30, title="Oversold", color=#787B86, linestyle=hline.style_dotted)

// fill(obLevel, osLevel, title="Background", color=color.rgb(33, 150, 243, 90))

plFound = na(ta.pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(ta.pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = ta.barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < ta.valuewhen(plFound, low[lbR], 1)

bullCondAlert = priceLL and oscHL and plFound

bullCond = plotBull and bullCondAlert

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor)

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < ta.valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > ta.valuewhen(plFound, low[lbR], 1)

hiddenBullCondAlert = priceHL and oscLL and plFound

hiddenBullCond = plotHiddenBull and hiddenBullCondAlert

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor)

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > ta.valuewhen(phFound, high[lbR], 1)

bearCondAlert = priceHH and oscLH and phFound

bearCond = plotBear and bearCondAlert

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor)

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > ta.valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < ta.valuewhen(phFound, high[lbR], 1)

hiddenBearCondAlert = priceLH and oscHH and phFound

hiddenBearCond = plotHiddenBear and hiddenBearCondAlert

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor)

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor

)

// alertcondition(bullCondAlert, title='Regular Bullish CVD Divergence', message="Found a new Regular Bullish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar")

// alertcondition(hiddenBullCondAlert, title='Hidden Bullish CVD Divergence', message='Found a new Hidden Bullish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

// alertcondition(bearCondAlert, title='Regular Bearish CVD Divergence', message='Found a new Regular Bearish Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

// alertcondition(hiddenBearCondAlert, title='Hidden Bearisn CVD Divergence', message='Found a new Hidden Bearisn Divergence, `Pivot Lookback Right` number of bars to the left of the current bar')

le = bullCondAlert or hiddenBullCondAlert

se = bearCondAlert or hiddenBearCondAlert

ltp = se

stp = le

// Check if the entry conditions for a long position are met

if (le) //and (close > ema200)

strategy.entry("Long", strategy.long, comment="EL")

// Check if the entry conditions for a short position are met

if (se) //and (close < ema200)

strategy.entry("Short", strategy.short, comment="ES")

// Close long position if exit condition is met

if (ltp) // or (close < ema200)

strategy.close("Long", comment="XL")

// Close short position if exit condition is met

if (stp) //or (close > ema200)

strategy.close("Short", comment="XS")

// The Fixed Percent Stop Loss Code

// User Options to Change Inputs (%)

stopPer = input.float(5.0, title='Stop Loss %') / 100

takePer = input.float(10.0, title='Take Profit %') / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

if strategy.position_size > 0

strategy.exit("Close Long", "Long", stop=longStop, limit=longTake)

if strategy.position_size < 0

strategy.exit("Close Short", "Short", stop=shortStop, limit=shortTake)

- 動的多均線とMACDをベースにしたXAUUSD取引戦略

- 2つの移動平均線交差点に基づく量化取引戦略

- EMA 200 交差量トレンド戦略

- RSI ダイナミックストップ・ダスト・ストップ・

戦略 - 地方震動傾向の認識戦略

- 9EMA動向ポジションに基づく5分間の双閉価格強突破戦略

- 多空間の自律的なダイナミックグリッド戦略に基づいた

- 平均的な真波幅と相対強弱指数に基づいたチャンドラー出場戦略

- 高低の自動予測と取引戦略

- 日内

の反転型多頭戦略 - ブリン・バンドと相対的な強弱指数の組み合わせの戦略

- 均衡する動力指数戦略

- AIのトレンド予測取引戦略

- TrendHunter w/MF 多時間枠のトレンド戦略

- ブリン・ベルトとフィボナッチの復旧戦略

- RSIとMACDを交差する戦略に基づいています

- 双等線交差に基づく取引戦略

- ダイナミックRSI 双均線売買戦略

- 多指数移動平均線取引戦略

- RSIをベースに取引戦略を貫く