概要

この戦略は,複数の移動平均 ((VWMA),平均方向性指数 ((ADX) および動向指標 ((DMI) を利用して,ビットコイン市場における多角的な機会を捕捉する.価格の動量,トレンドの方向,取引量などの複数の技術指標を組み合わせて,この戦略は,上昇傾向が強く,十分な動量を持つエントリースポットを見つけ,リスクを厳しく管理することを目的としている.

戦略原則

- 9日と14日のVWMAを使用して多頭トレンドを判断し,短期平均線が長期平均線を穿越すると多頭信号が生じます.

- 89日間の最高値と最低値VWMAから構成された自律平均線をトレンドフィルターとして導入し,閉盘価格または開盤価格が平均線より高い場合にのみポジションを開設することを考慮する.

- ADXとDMIの指標でトレンドの強さを確認する.ADXが18より大きく,+DIと-DIの差が15より大きい場合にのみ,トレンドは十分に強いと考えられる.

- 取引量の百分数関数を用いて,取引量が60%~95%の範囲にあるバーラインをフィルターし,取引量が過度に低い時期を避けます.

- セットストップは,前K線高点の0.96~0.99倍にあり,時間枠の拡大に伴い減退し,リスクを制御する.

- 既定の保持時間に達するか,価格が自調平均線を下回ったときに平仓.

優位分析

- 複数の技術指標を組み合わせて,トレンド,動力,取引量などの複数の次元から市場の状態を評価することで,信号はより信頼性が高くなります.

- 適応均線と取引量フィルタリングの仕組みは,偽信号を効果的にフィルタリングし,無効取引を減らすことができます.

- 厳格なストップ・ロスの設定とポジション保持時間の制限により,戦略のリスクの限界が大きく低下した.

- コードがモジュール化され,読みやすさとメンテナンス性が向上し,さらなる最適化と拡張を容易にする.

リスク分析

- この戦略は,市場が揺れ動いている時やトレンドが不明であるときに,偽の信号を多く生み出す可能性があります.

- ストップは比較的近い位置にあり,市場の変動が大きいときにストップを早めに誘発し,損失を拡大させる可能性がある.

- “ブラック・スウェン”の事件は,マクロ経済状況や重大事件の考慮が欠けているため,無効になる可能性があります.

- パラメータ設定は比較的固定で,自己適応性の欠如があり,異なる市場環境でパフォーマンスが不安定である可能性があります.

最適化の方向

- RSI,ブリン帯など,市場環境を描写できる指標を導入し,信号の信頼性を向上させる.

- 異なる市場の変動状況に対応するためにATRまたはパーセンテージ・ストップを使用するなど,ストップ・ポジションのダイナミック・最適化.

- マクロ経済データと情緒分析を組み合わせて,戦略のリスク管理モジュールを強化する.

- 機械学習アルゴリズムを使用してパラメータを自動的に最適化し,戦略の適応性と安定性を向上させる.

要約する

VWMA-ADXビットコイン多頭戦略は,価格動向,動量,取引量などの複数の技術指標を総合的に考慮することにより,ビットコイン市場における上昇の機会をより効果的に捕捉することができる.同時に,厳格なリスク管理措置と明確な平仓条件により,この戦略のリスクはより良く管理される.しかし,この戦略には,市場環境の変化への適応性の欠如,および最適化されるべき損失停止戦略などのいくつかの制限があります.将来,信号の信頼性,リスク管理,パラメータ最適化などの側面からスタートして,戦略の安定性と収益性をさらに向上させることができます.全体的に,VWMA-ADXビットコイン多頭戦略は,投資家に動量と傾向に基づく体系的な取引方法を提供し,価値を探求し,さらに改善します.

ストラテジーソースコード

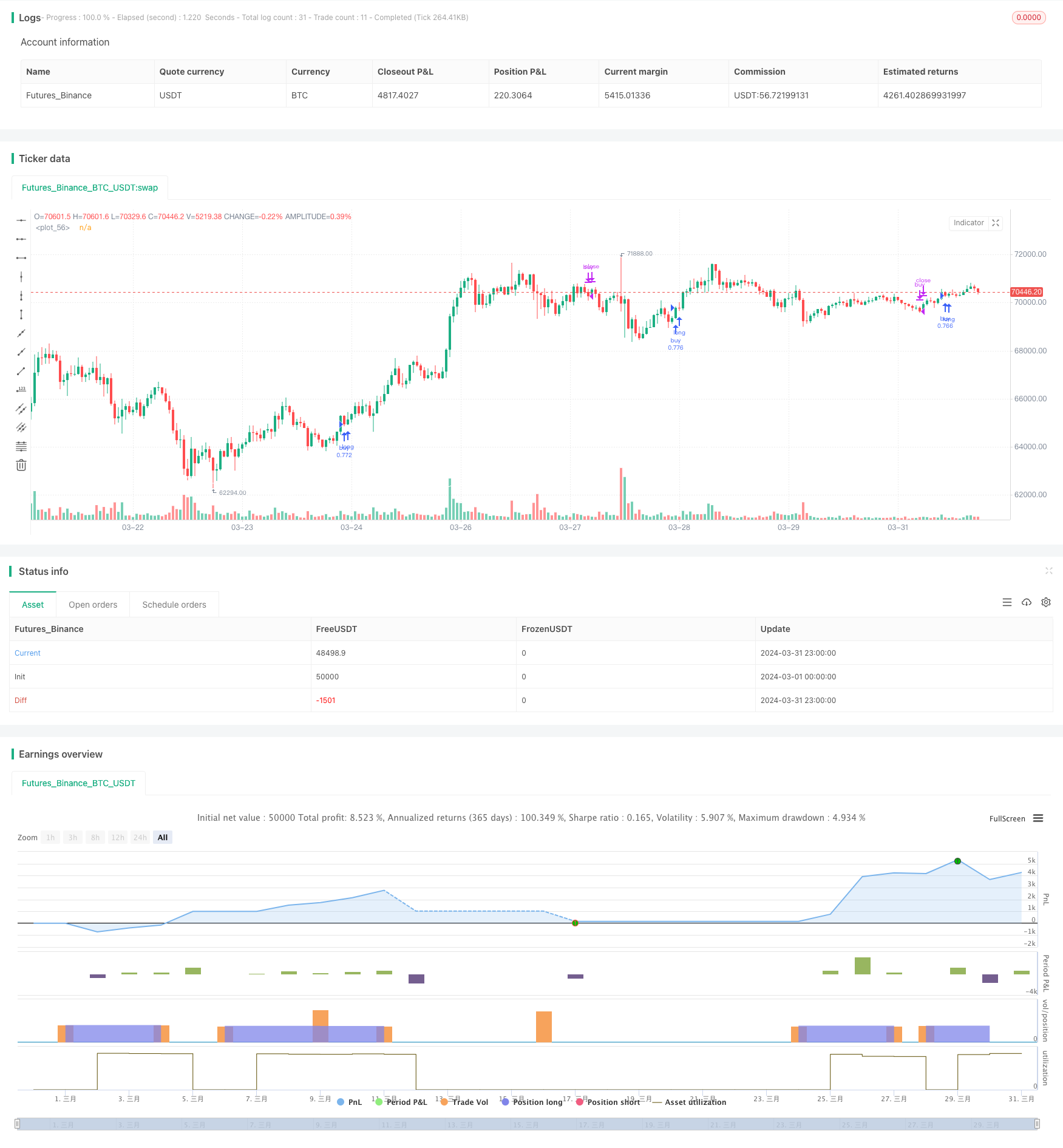

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Q_D_Nam_N_96

//@version=5

strategy("Long BTC Strategy", overlay=true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100, initial_capital = 1000, currency = currency.USD)

Volume_Quartile(vol) =>

qvol1 = ta.percentile_linear_interpolation(vol, 60,15)

qvol2 = ta.percentile_linear_interpolation(vol, 60,95)

vol > qvol1 and vol < qvol2

smma(src, length) =>

smma = 0.0

smma := na(smma[1]) ? ta.sma(src, length) : (smma[1] * (length - 1) + src) / length

smma

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"RMA" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

"HMA" => ta.hma(source, length)

"SMMA" => smma(source, length)

DMI(len, lensig) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / trur)+11

minus = fixnan(100 * ta.rma(minusDM, len) / trur)-11

sum = plus + minus

adx = 100 * ta.vwma(math.abs(plus - minus-11) / (sum == 0 ? 1 : sum), lensig)

[adx, plus, minus]

cond1 = Volume_Quartile(volume*hlcc4)

ma1 = ma(close,9, "VWMA")

// plot(ma1, color = color.blue)

ma2 = ma(close,14, "VWMA")

// plot(ma2, color = color.orange)

n = switch timeframe.period

"240" => 0.997

=> 0.995

ma3 = (0.1*ma(ta.highest(close,89),89, "VWMA") +

0.9*ma(ta.lowest(close,89),89, "VWMA"))*n

plot(ma3, color = color.white)

[adx, plus, minus] = DMI(7, 10)

cond2 = adx > 18 and plus - math.abs(minus) > 15

var int count = 0

if barstate.isconfirmed and strategy.position_size != 0

count += 1

else

count := 0

p_roc = 0

if timeframe.period == '240'

p_roc := 14

else

p_roc := 10

longCondition = ta.crossover(ma1, ma2) and (close > open ? close > ma3 : open > ma3) and ((ma3 - ma3[1])*100/ma3[1] >= -0.2) and ((close-close[p_roc])*100/close[p_roc] > -2.0)

float alpha = 0.0

float sl_src = high[1]

if (longCondition and cond1 and cond2 and strategy.position_size == 0)

strategy.entry("buy", strategy.long)

if timeframe.period == '240'

alpha := 0.96

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+5, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '30'

alpha := 0.985

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '45'

alpha := 0.985

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '60'

alpha := 0.98

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '120'

alpha := 0.97

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == '180'

alpha := 0.96

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else if timeframe.period == 'D'

alpha := 0.95

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

else

alpha := 0.93

strategy.exit("exit-buy","buy", stop = sl_src*alpha)

// line.new(bar_index, sl_src*alpha, bar_index+20, sl_src*alpha, width = 2, color = color.white)

period = switch timeframe.period

"240" => 90

"180" => 59

"120" => 35

"30" => 64

"45" => 40

"60" => 66

"D" => 22

=> 64

if (count > period or close < ma3)

strategy.close('buy', immediately = true)