칼레드 타미의 아벨레네다-스토이코프 전략

저자:차오장, 날짜: 2024-04-30 15:54:23태그:

전반적인 설명

칼레드 타미

전략 원칙

이 전략의 핵심은 다음과 같은 단계를 통해 제안 및 요청 가격을 계산하는 Avellaneda-Stoikov 모델입니다.

- 현재 가격과 이전 가격의 평균인 중간 가격을 계산합니다.

- 중간 가격에서 감마, 시그마, T, 그리고 k를 포함하는 제곱근 항을 빼고 거래 비용을 빼서 입찰 가격을 계산합니다.

- 중간 가격에 감마, 시그마, T, 그리고 k를 포함하는 제곱근 항을 더하고 거래 비용을 더하여 요청 가격을 계산합니다.

- 가격값이 입찰 가격 미만 한계 M보다 낮을 때 구매 신호를 생성합니다. 가격이 청구 가격과 한계 M보다 높을 때 판매 신호를 생성합니다.

전략적 장점

- 이 전략은 아벨레네다-스토이코프 모델에 기반을 두고 있으며, 이는 고전적인 시장 형성 전략이며, 탄탄한 이론적 기초를 가지고 있습니다.

- 이 전략은 거래 비용의 영향을 고려하여 실제 거래 상황에 더 현실적으로 적용됩니다.

- 임계 M를 설정함으로써 전략의 감수성은 다양한 시장 환경에 적응하도록 유연하게 조정될 수 있습니다.

- 전략 논리는 명확하고 이해하기 쉽고 구현하기 쉽습니다.

전략 위험

- 전략의 성능은 감마, 시그마, T, k, M와 같은 매개 변수 선택에 달려 있습니다. 잘못된 매개 변수 설정으로 인해 전략 성능이 떨어질 수 있습니다.

- 이 전략은 시장 유동성의 영향을 고려하지 않습니다. 유동성이 충분하지 않은 경우 예상 가격으로 거래 할 수 없습니다.

- 이 전략은 낮은 거래 지연과 높은 실행 효율을 요구하는 고주파 거래 전략으로 구현하기가 어렵습니다.

전략 최적화 방향

- 기계 학습 알고리즘을 도입하여 다른 시장 조건에 적응하도록 전략 매개 변수를 동적으로 조정합니다.

- 다른 기술 지표 또는 시장 미세 구조 정보를 결합하여 신호의 정확성을 향상시킵니다.

- 거래 수행 알고리즘을 최적화하여 거래 비용을 줄이고 전략 수익을 향상시킵니다.

- 위험 관리 모듈을 도입하는 것을 고려하여 전략 마감 및 위험 노출을 제어합니다.

요약

칼레드 타미

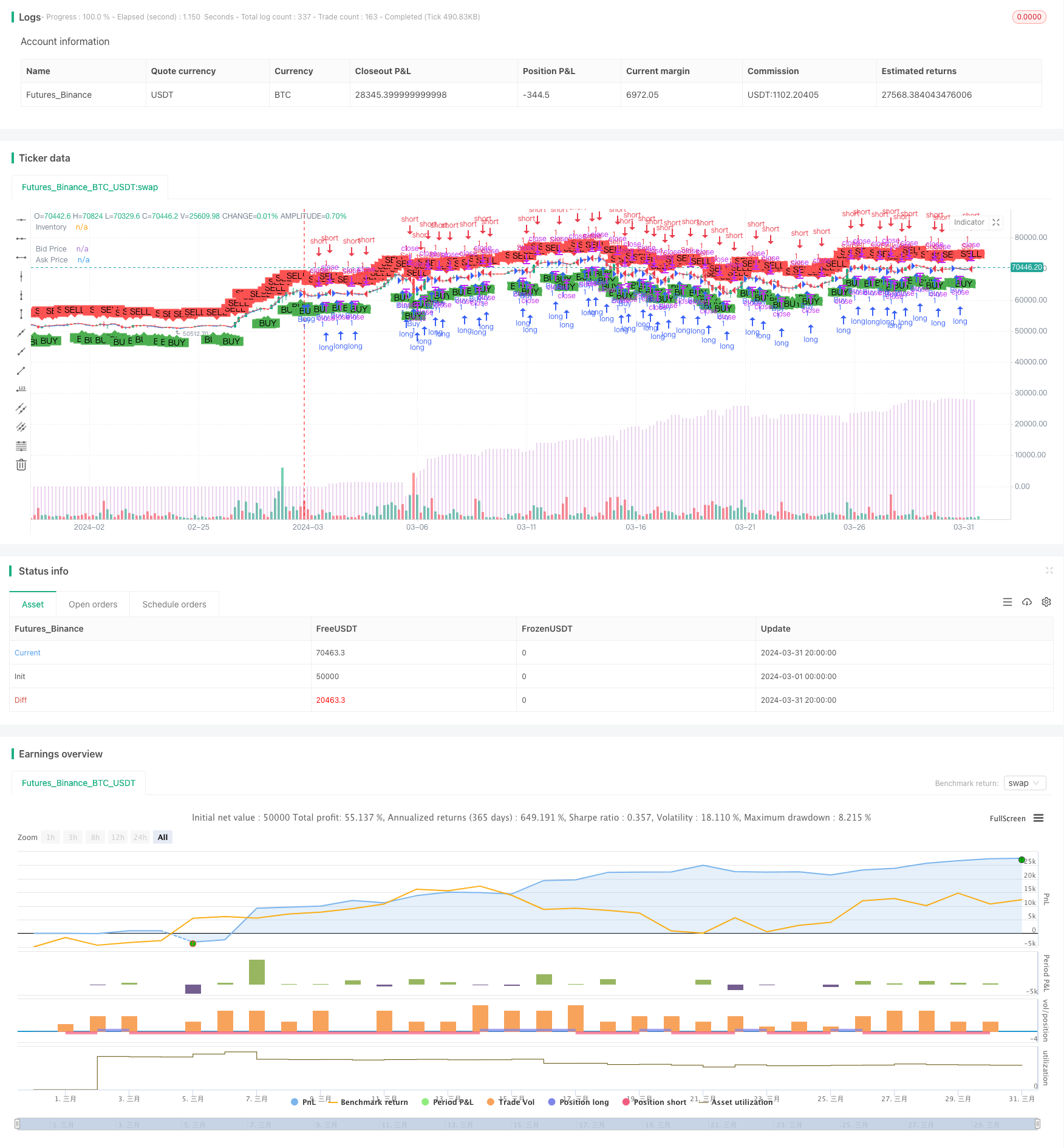

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Khaled Tamim's Avellaneda-Stoikov Strategy", overlay=true)

// Avellaneda-Stoikov model logic

avellanedaStoikov(src, gamma, sigma, T, k, M) =>

midPrice = (src + src[1]) / 2

sqrtTerm = gamma * sigma * sigma * T

// Add 0.1% fee to bid and ask quotes

fee = 0 // 0.1% fee

bidQuote = midPrice - k * sqrtTerm - (midPrice * fee)

askQuote = midPrice + k * sqrtTerm + (midPrice * fee)

longCondition = src < bidQuote - M

shortCondition = src > askQuote + M

[bidQuote, askQuote]

// Define strategy parameters

gamma = input.float(2, title="Gamma")

sigma = input.float(8, title="Sigma")

T = input.float(0.0833, title="T")

k = input.float(5, title="k")

M = input.float(0.5, title="M")

// Calculate signals

[bidQuote, askQuote] = avellanedaStoikov(close, gamma, sigma, T, k, M)

longCondition = close < bidQuote - M

shortCondition = close > askQuote + M

// Plot signals

plotshape(series=longCondition ? low : na, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition ? high : na, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot bid and ask prices

plot(bidQuote, title="Bid Price", color=color.blue, linewidth=1)

plot(askQuote, title="Ask Price", color=color.red, linewidth=1)

// Plot inventory level as bars in a separate graph

plot(strategy.netprofit, title="Inventory", color=color.new(color.purple, 80), style=plot.style_columns)

// Strategy logic

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

더 많은

- 볼링거 밴드 표준 오차 파업 전략

- 스토카스틱 오시레이터 및 이동 평균 전략

- 중추 및 동력 전략

- 트리플 EMA 크로스오버 전략

- 이동 평균 및 RSI 종합 거래 전략

- 기하급수적인 이동평균 크로스오버 레버리지 전략

- 가격 액션, 피라미딩, 5% 수익 목표, 3% 스톱 로스

- 토요일 전환 전략 (주말 필터)

- 볼링거 밴드 이중 표준 오차 필터링 5분 양적 거래 전략

- 피보트 종료와 피보트 역전 전략

- GM-8 & ADX 이중 이동 평균 전략

- 멀티 타임프레임 비트코인, 바이낸스 코인 및 이더리움 풀백 거래 전략

- RSI/MACD/ATR과 함께 강화된 EMA 크로스오버 전략

- 피보나치 골든 비율 리트레이션 구매 전략

- Z-Score 트렌드 전략

- MA99 터치 및 동적 스톱 로스 전략

- 돈치안 브레이크업 거래 전략

- 이치모쿠 선두 스판 B 브레이크업 전략

- EMA의 긴 입장은 위험 관리 전략과 교차합니다

- MACD와 RSI 결합된 장기 거래 전략