概述

该策略基于 Ichimoku 云指标中的领先 Span B 线,当价格突破领先 Span B 线时产生交易信号。当价格向上突破领先 Span B 线时,产生买入信号;当价格向下突破领先 Span B 线时,产生卖出信号。该策略利用了 Ichimoku 云指标中领先 Span B 线对未来价格趋势的预测能力,通过及时捕捉价格突破领先 Span B 线的时机,以期获得良好的交易机会。

策略原理

- 计算 Ichimoku 云指标中的转折线(Tenkan-sen)、基准线(Kijun-sen)、领先 Span A 线(Senkou Span A)和领先 Span B 线(Senkou Span B)。

- 当收盘价向上突破领先 Span B 线时,产生买入信号,开仓做多。

- 当收盘价向下突破领先 Span B 线时,产生卖出信号,平仓。

- 在图表上标记买入和卖出信号,以便直观观察。

策略优势

- 该策略基于 Ichimoku 云指标,能够综合考虑多个时间维度的价格信息,提供更全面的市场分析。

- 利用领先 Span B 线对未来价格走势的预测能力,捕捉趋势性机会。

- 策略逻辑简单清晰,易于理解和实现。

- 通过图表标记买卖信号,方便交易者直观把握交易时机。

策略风险

- 该策略依赖于单一指标,可能面临指标失效的风险。

- 在震荡市场中,频繁的价格突破可能导致交易信号过多,增加交易成本。

- 策略未设置止损,面临潜在的大额损失风险。

策略优化方向

- 结合其他技术指标或价格行为特征,对交易信号进行进一步确认,提高信号可靠性。

- 引入仓位管理和风险控制机制,如设置合理的止损止盈,控制单笔交易风险。

- 对策略参数进行优化,如调整 Ichimoku 云指标的计算周期,以适应不同市场状况。

- 考虑交易成本因素,设置适当的信号过滤机制,减少频繁交易。

总结

Ichimoku Leading Span B 突破策略是一个基于 Ichimoku 云指标中领先 Span B 线的交易策略。通过捕捉价格突破领先 Span B 线的时机,以期获得趋势性交易机会。该策略优点是逻辑简单,易于实现,能够综合考虑多时间维度的价格信息。但同时也面临单一指标失效、频繁交易和缺乏风控等潜在风险。因此,在实际应用中,需要结合其他指标、优化参数设置、引入风控措施等方面进行优化,以提升策略的稳健性和盈利能力。

策略源码

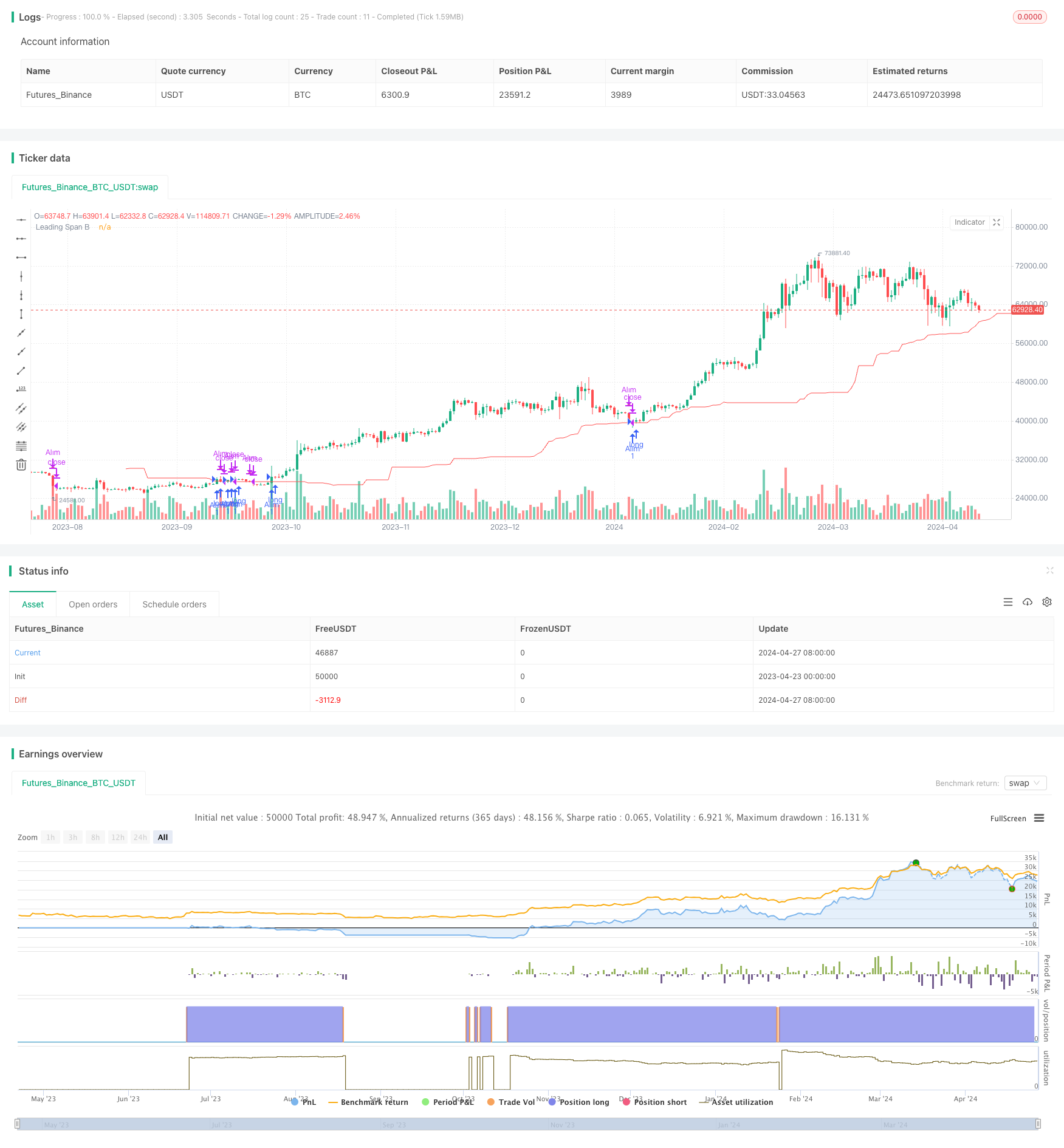

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Leading Span B Alım/Satım Stratejisi", overlay=true)

// Ichimoku göstergesi parametreleri

conversionPeriods = input(9, title="Dönüşüm Periyodu")

basePeriods = input(26, title="Taban Periyodu")

laggingSpan2Periods = input(52, title="Gecikme Span 2 Periyodu")

displacement = input(26, title="Kaydırma")

// Ichimoku hesaplama

tenkanSen = (ta.highest(high, conversionPeriods) + ta.lowest(low, conversionPeriods)) / 2

kijunSen = (ta.highest(high, basePeriods) + ta.lowest(low, basePeriods)) / 2

senkouSpanA = (tenkanSen + kijunSen) / 2

senkouSpanB = (ta.highest(high, laggingSpan2Periods) + ta.lowest(low, laggingSpan2Periods)) / 2

// Leading Span B'nin grafiğe çizilmesi

plot(senkouSpanB, color=color.red, title="Leading Span B", offset=displacement)

// Alım sinyali: Fiyat Leading Span B'yi yukarı keserse

buy_signal = ta.crossover(close, senkouSpanB[displacement])

if (buy_signal)

strategy.entry("Alım", strategy.long)

// Satım sinyali: Fiyat Leading Span B'yi aşağı keserse

sell_signal = ta.crossunder(close, senkouSpanB[displacement])

if (sell_signal)

strategy.close("Alım")

// Sinyalleri grafik üzerinde gösterme

plotshape(series=buy_signal, title="Alım Sinyali", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=sell_signal, title="Satım Sinyali", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

相关推荐