概述

本策略是一个基于超级趋势指标的动态优化交易系统,结合了自适应真实波幅(ATR)来调整止损和获利水平。该策略利用超级趋势指标的方向变化来确定入场信号,同时采用动态的止损和获利水平来管理风险和锁定利润。策略的核心在于其灵活性和适应性,能够根据市场波动性自动调整关键参数。

策略原理

超级趋势指标:使用输入的因子和ATR周期计算超级趋势指标。这个指标用于确定市场趋势方向。

入场信号:当超级趋势指标的方向发生变化时,策略会触发入场信号。方向由负变正时进入多头,由正变负时进入空头。

动态风险管理:

- 止损水平:使用ATR值乘以用户定义的乘数来设置动态止损。

- 获利水平:同样使用ATR值乘以另一个用户定义的乘数来设置动态获利目标。

仓位管理:策略使用账户净值的固定百分比(15%)来确定每次交易的规模。

退出逻辑:当价格达到动态设置的止损或获利水平时,策略会自动平仓。

策略优势

适应性强:通过使用ATR来调整止损和获利水平,策略能够适应不同的市场波动状况。

风险管理优化:动态止损和获利水平有助于在波动性较大时提供更好的保护,在波动性较小时允许更大的利润空间。

趋势跟踪:超级趋势指标有助于捕捉中长期趋势,提高策略的盈利潜力。

灵活性:用户可以通过调整输入参数来优化策略,以适应不同的市场条件和个人风险偏好。

自动化:策略可以在TradingView平台上自动执行,减少了人为情绪干扰。

策略风险

过度交易:在震荡市场中,超级趋势指标可能频繁变向,导致过多的交易和手续费损失。

滑点风险:在快速市场中,实际执行价格可能与信号价格有显著差异。

资金管理风险:固定使用账户15%的资金可能在某些情况下过于激进。

参数敏感性:策略性能可能对输入参数的选择高度敏感,不当的参数设置可能导致表现不佳。

市场条件变化:策略在趋势市场中表现可能优于震荡市场,市场状态的变化可能影响策略表现。

策略优化方向

市场状态过滤:引入市场状态识别机制,如波动率指标或趋势强度指标,以在不同市场环境下调整策略行为。

动态仓位管理:根据市场波动性和当前账户表现动态调整交易规模,而不是固定使用15%的账户资金。

多时间框架分析:整合更长时间周期的趋势分析,以提高入场信号的质量和减少假突破。

优化退出机制:考虑引入移动止损或基于波动率的动态调整止损,以更好地锁定利润。

参数优化:使用历史数据进行参数优化,找到在不同市场周期中表现稳定的参数组合。

增加过滤条件:结合其他技术指标或基本面数据,提高入场信号的准确性。

总结

动态优化超级趋势交易策略是一个灵活且具有适应性的系统,通过结合超级趋势指标和动态风险管理,旨在捕捉市场趋势并优化风险回报比。其核心优势在于能够根据市场波动性自动调整关键参数,提高了策略在不同市场环境下的适应性。然而,用户需要注意潜在的过度交易风险和参数敏感性问题。通过进一步优化,如引入市场状态过滤、动态仓位管理和多时间框架分析,该策略有潜力成为一个更加稳健和盈利的交易系统。在实盘交易中应用时,建议进行充分的回测和前向测试,并根据个人风险承受能力谨慎调整参数。

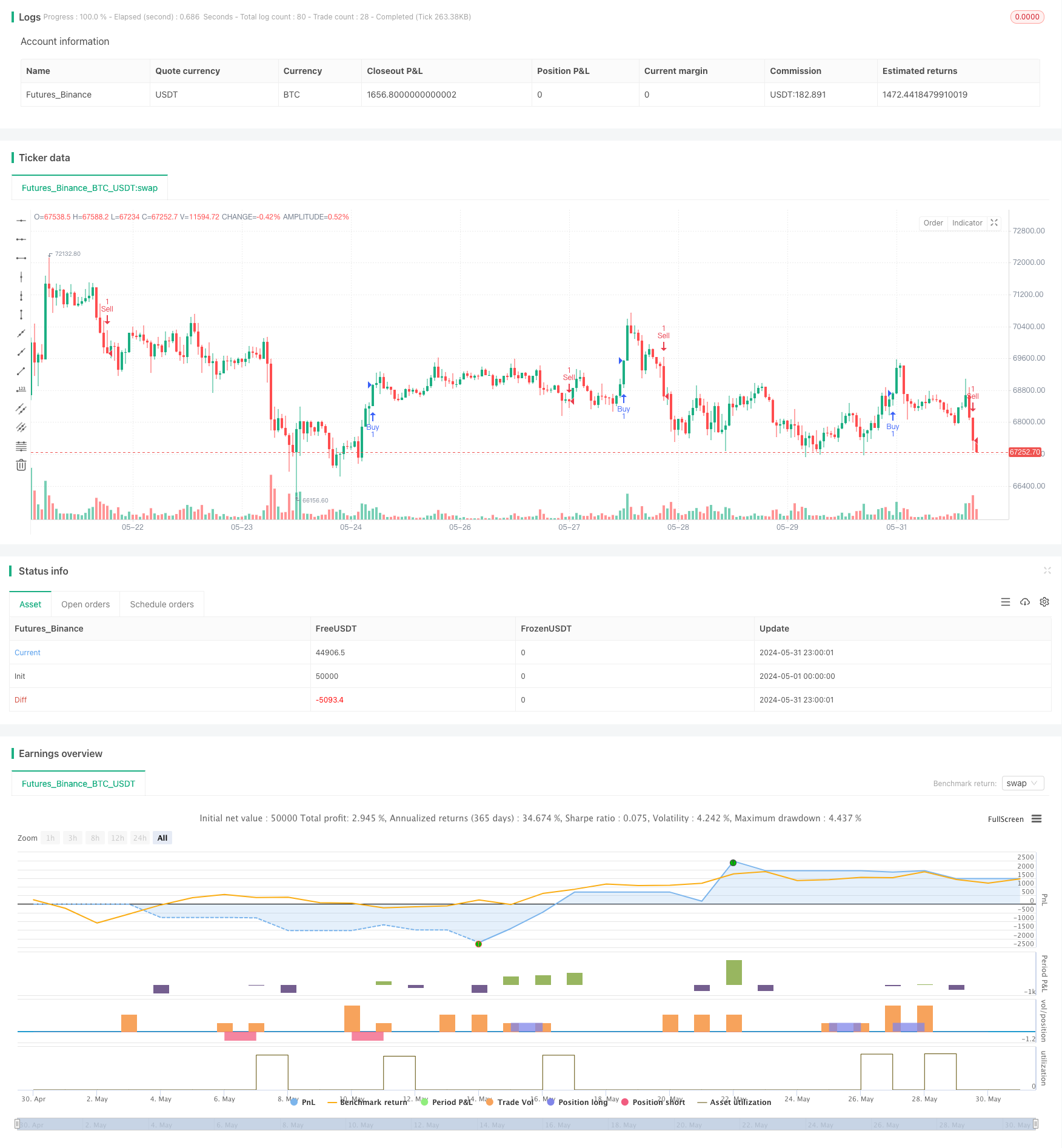

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Supertrend Strategy", overlay=true)

// Input parameters

atrPeriod = input(14, "ATR Length")

factor = input.float(3.0, "Factor", step=0.1, minval=1.0, maxval=10.0)

// Calculate Supertrend

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

// Entry conditions

if ta.change(direction) < 0

strategy.entry("Buy", strategy.long)

if ta.change(direction) > 0

strategy.entry("Sell", strategy.short)

// Define stop loss and take profit levels (adjust dynamically)

stopLossMultiplier = input.float(1.0, "Stop Loss Multiplier", step=0.1, minval=0.5, maxval=5.0)

takeProfitMultiplier = input.float(2.0, "Take Profit Multiplier", step=0.1, minval=1.0, maxval=5.0)

stopLoss = ta.atr(atrPeriod) * stopLossMultiplier

takeProfit = ta.atr(atrPeriod) * takeProfitMultiplier

// Exit logic

if strategy.opentrades > 0

if strategy.position_size > 0

strategy.exit("Take Profit/Stop Loss", "Buy", stop=close - stopLoss, limit=close + takeProfit)

else if strategy.position_size < 0

strategy.exit("Take Profit/Stop Loss", "Sell", stop=close + stopLoss, limit=close - takeProfit)

// Optional: Plot equity curve

// plot(strategy.equity, title="Equity", color=color.green, linewidth=2, style=plot.style_area)