概述

本策略是一个结合了简单移动平均线(SMA)和相对强弱指标(RSI)的趋势跟踪交易系统。它主要利用200周期SMA来识别上升趋势,并使用RSI作为过滤器来优化入场时机。该策略还包含了止盈和止损机制,以控制风险并锁定利润。

策略原理

该策略的核心逻辑包括以下几个关键元素:

趋势识别:使用200周期SMA作为长期趋势的指标。当价格上穿并保持在SMA之上时,被视为潜在的上升趋势。

入场确认:要求价格在SMA之上保持至少30个连续周期(分钟),以确保趋势的稳定性。

RSI过滤:使用14周期的RSI指标,只有当RSI低于30(超卖区域)时才允许入场,这有助于捕捉潜在的反弹机会。

风险管理:设置0.5%的止损水平,以限制单笔交易的最大损失。

利润目标:设置2%的止盈水平,以在达到预期收益时自动平仓。

策略执行流程如下: - 当价格上穿200SMA并保持30个周期以上,同时RSI低于30时,开仓做多。 - 持仓期间,如果价格达到入场价格的102%(止盈)或跌破入场价格的99.5%(止损),则自动平仓。 - 平仓后,系统重置并等待下一个符合条件的入场机会。

策略优势

趋势跟踪:利用长期SMA捕捉主要趋势,有助于在强劲的上升行情中获利。

入场优化:要求价格在SMA之上保持30个周期,有助于过滤掉虚假突破,提高入场质量。

反转捕捉:结合RSI超卖条件,有助于在趋势初期捕捉潜在的反弹机会。

风险控制:设置明确的止损水平,有效限制了每笔交易的最大风险。

利润锁定:预设的止盈水平确保在达到预期收益时自动锁定利润。

客观性:策略规则明确,减少了主观判断带来的情绪影响。

可量化:策略参数可以通过历史数据进行回测和优化。

策略风险

假突破:在横盘或震荡市场中,可能会出现频繁的假突破,导致连续止损。

滞后性:SMA作为滞后指标,可能在趋势初期错过一些机会,或在趋势结束时仍保持仓位。

RSI限制:严格的RSI条件可能会错过一些良好的入场机会,特别是在强势上涨中。

固定止盈止损:预设的百分比可能不适用于所有市场条件,在波动性较大的市场中可能会过早触发。

单一方向:策略仅做多,无法在下跌行情中获利。

参数敏感性:策略性能可能对SMA周期、确认周期和RSI设置等参数变化敏感。

市场适应性:策略可能在某些特定市场或时间框架下表现良好,但不一定适用于所有情况。

策略优化方向

动态止盈止损:考虑使用ATR(平均真实波幅)来设置动态的止盈止损水平,以适应不同的市场波动情况。

多周期确认:引入多个时间框架的确认机制,如同时满足日线和小时线的条件才入场,以提高信号可靠性。

趋势强度过滤:加入ADX(平均趋向指标)来衡量趋势强度,只在强趋势中入场。

波动率调整:根据市场波动率动态调整参数,如在低波动期增加确认周期,高波动期减少确认周期。

加入做空机制:在价格跌破SMA且RSI超买时考虑做空,使策略能够在双向行情中获利。

优化RSI使用:考虑使用RSI背离或结合其他指标(如MACD)来增强入场信号的可靠性。

引入成交量确认:加入成交量分析,确保突破或反转得到足够的成交量支持。

时间过滤:加入时间过滤器,避免在已知的低流动性时段交易。

资金管理优化:实现动态的仓位管理,根据账户规模和市场波动调整每笔交易的风险敞口。

增加指标组合:考虑结合布林带、斐波那契回撤等其他技术指标,构建更全面的交易系统。

总结

“双均线趋势跟踪策略与RSI过滤器”是一个结合了趋势跟踪和动量反转思想的量化交易策略。通过利用200周期SMA识别长期趋势,并结合RSI超卖条件优化入场时机,该策略旨在捕捉强劲上升趋势中的潜在反弹机会。内置的止盈止损机制有助于控制风险并锁定利润,使其成为一个相对全面的交易系统。

然而,该策略也存在一些局限性,如可能受到假突破的影响、仅限于做多交易等。为了进一步提高策略的稳健性和适应性,建议考虑引入动态止盈止损、多周期确认、趋势强度过滤等优化措施。此外,加入做空机制和优化资金管理策略也可能显著提升系统的整体性能。

总的来说,这个策略为趋势跟踪和动量交易提供了一个良好的起点。通过持续的回测、优化和实盘验证,交易者可以根据特定的市场环境和个人风险偏好,进一步完善和定制这个策略,以达到更好的交易效果。

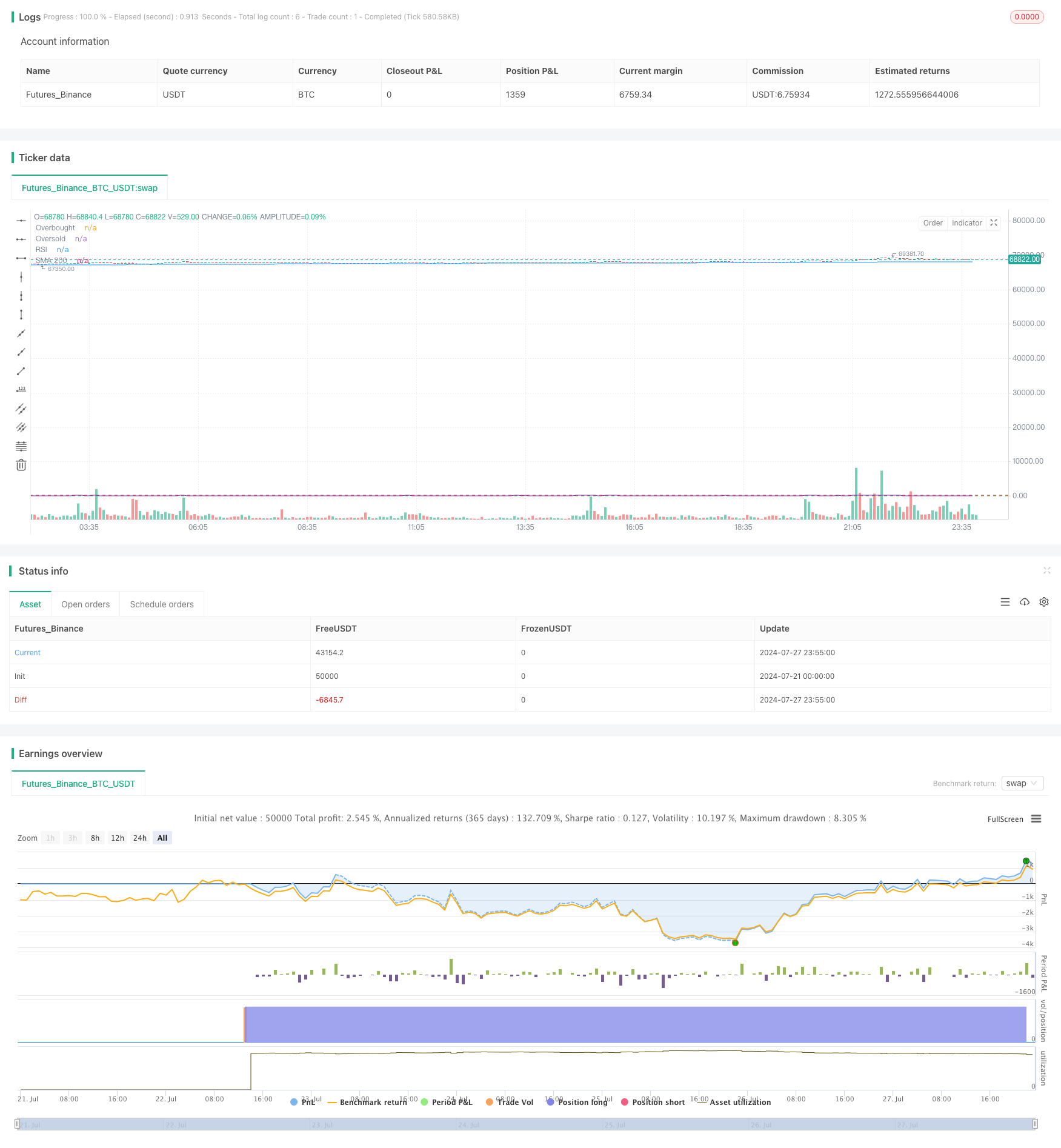

/*backtest

start: 2024-07-21 00:00:00

end: 2024-07-28 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SMA 200 with RSI Filter", overlay=true)

// Inputs

smaLength = input.int(200, title="SMA Length")

confirmBars = input.int(30, title="Confirmation Bars (30 minutes)")

takeProfitPerc = input.float(2.0, title="Take Profit (%)", step=0.1) / 100

stopLossPerc = input.float(0.5, title="Stop Loss (%)", step=0.1) / 100

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

// Calculate SMA

sma = ta.sma(close, smaLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Buy condition

priceAboveSMA = close > sma

aboveSMAcount = ta.barssince(priceAboveSMA == false)

rsiCondition = rsi < rsiOversold

enterLongCondition = priceAboveSMA and aboveSMAcount >= confirmBars and rsiCondition

// Track entry price for calculating take profit and stop loss levels

var float entryPrice = na

if (enterLongCondition and na(entryPrice))

entryPrice := close

// Ensure the entryPrice is only set when a position is opened

if (strategy.opentrades == 0)

entryPrice := na

takeProfitLevel = entryPrice * (1 + takeProfitPerc)

stopLossLevel = entryPrice * (1 - stopLossPerc)

// Exit conditions

takeProfitCondition = close >= takeProfitLevel

stopLossCondition = close <= stopLossLevel

// Plot SMA and RSI

plot(sma, title="SMA 200", color=color.blue)

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.purple)

// Plot shapes for entries and exits

plotshape(series=enterLongCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=takeProfitCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="TP")

plotshape(series=stopLossCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="SL")

// Strategy entry and exit

if (enterLongCondition)

strategy.entry("Long", strategy.long, comment="SMA200LE")

if (takeProfitCondition or stopLossCondition)

strategy.close("Long", when=takeProfitCondition or stopLossCondition)

// Reset entry price after position is closed

if (strategy.position_size == 0)

entryPrice := na