Mehrstufige ATR-Handelsstrategie mit dynamischer Gewinnentnahme

Schriftsteller:ChaoZhang, Datum: 2024-12-05 16: 49:57Tags:ATRSMADieMFTPSL- Nein.AATR

Übersicht

Dies ist eine mehrschichtige Handelsstrategie, die adaptiven Durchschnittswertberechnungen (ATR) mit momentumbasierter Trenddetektion integriert. Das charakteristischste Merkmal der Strategie ist ihr einzigartiger 7-stufiger Gewinnmechanismus, der vier ATR-basierte Exit-Level und drei feste Prozentsatz-Level kombiniert. Dieser hybride Ansatz ermöglicht es den Händlern, sich dynamisch an die Marktvolatilität anzupassen und gleichzeitig systematisch Gewinne in Long- und Short-Marktpositionen zu erzielen. Die Strategie bietet eine umfassende Handelslösung durch die Kombination dynamischer ATR-Berechnungen, mehrerer Trendstärke-Detektion und Gewinnmechanismen.

Strategieprinzipien

Die Strategie setzt sich aus mehreren Schlüsselelementen zusammen: 1. Erweiterte Berechnung des realen Bereichs: Messen Sie die Marktvolatilität, indem Sie die wichtigsten Preisbewegungen berücksichtigen. 2. Momentum-Faktor-Integration: Passt ATR anhand der jüngsten Preisbewegungen an, um eine bessere Anpassungsfähigkeit zu gewährleisten. 3. Adaptive ATR-Berechnung: Modifiziert die traditionelle ATR basierend auf dem Impulsfaktor für eine erhöhte Empfindlichkeit in volatilen Perioden. 4. Trendstärke Quantifizierung: Bewertet die Trendstärke durch ausgeklügelte Algorithmen. Sieben-Stufen-Nutzen-Mechanismus: Vier ATR-basierte Ausgangsebenen und drei feste Prozentsatz-Level.

Strategische Vorteile

- Hohe Anpassungsfähigkeit: Durch dynamische ATR-Berechnungen an unterschiedliche Marktbedingungen angepasst.

- Umfassendes Risikomanagement: Ein mehrschichtiger Gewinnmechanismus ermöglicht eine systematische Risikokontrolle.

- Hohe Flexibilität: Funktioniert sowohl auf langen als auch auf kurzen Märkten.

- Einstellbare Parameter: bietet mehrere anpassbare Parameter für verschiedene Handelsstile.

- Systematische Ausführung: klare Ein- und Ausstiegsregeln verringern den emotionalen Handel.

Strategische Risiken

- Parameterempfindlichkeit: Eine unsachgemäße Einstellung der Parameter kann zu Überhandelungen oder verpassten Gelegenheiten führen.

- Abhängigkeit von den Marktbedingungen: Kann in stark volatilen oder variablen Märkten unterdurchschnittlich sein.

- Komplexitätsrisiko: Ein mehrschichtiger Profit-taking-Mechanismus kann die Erfüllungsschwierigkeit erhöhen.

- Schlupfwirkung: Mehrere Gewinnpunkte können durch Schlupfwirkung erheblich beeinträchtigt werden.

- Kapitalbedarf: Für die Durchführung einer mehrschichtigen Gewinnstrategie genügend Kapital erforderlich.

Strategieoptimierungsrichtlinien

- Dynamische Parameteranpassung: Anpassung der Parameter automatisch an die Marktbedingungen.

- Marktumfeldfilterung: Hinzufügen eines Mechanismus zur Identifizierung des Marktumfelds.

- Verbesserung des Risikomanagements: Einführung eines dynamischen Stop-Loss-Mechanismus.

- Ausführungsoptimierung: Vereinfachen Sie den Gewinnmechanismus, um die Auswirkungen von Ausrutschen zu reduzieren.

- Verbesserung des Backtesting-Rahmens: Einbeziehung realistischerer Handelsfaktoren.

Zusammenfassung

Diese Strategie bietet den Händlern ein umfassendes Handelssystem, indem sie adaptiven ATR und mehrschichtige Gewinnspielmechanismen kombiniert. Ihre Stärke liegt in ihrer Fähigkeit, sich an verschiedene Marktbedingungen anzupassen und gleichzeitig das Risiko durch einen systematischen Ansatz zu managen. Obwohl es einige potenzielle Risiken gibt, kann die Strategie durch eine angemessene Optimierung und Risikomanagement zu einem effektiven Handelswerkzeug werden. Ihr innovativer mehrschichtiger Gewinnspielmechanismus eignet sich besonders für Händler, die Gewinne maximieren möchten, während sie die Risikokontrolle beibehalten.

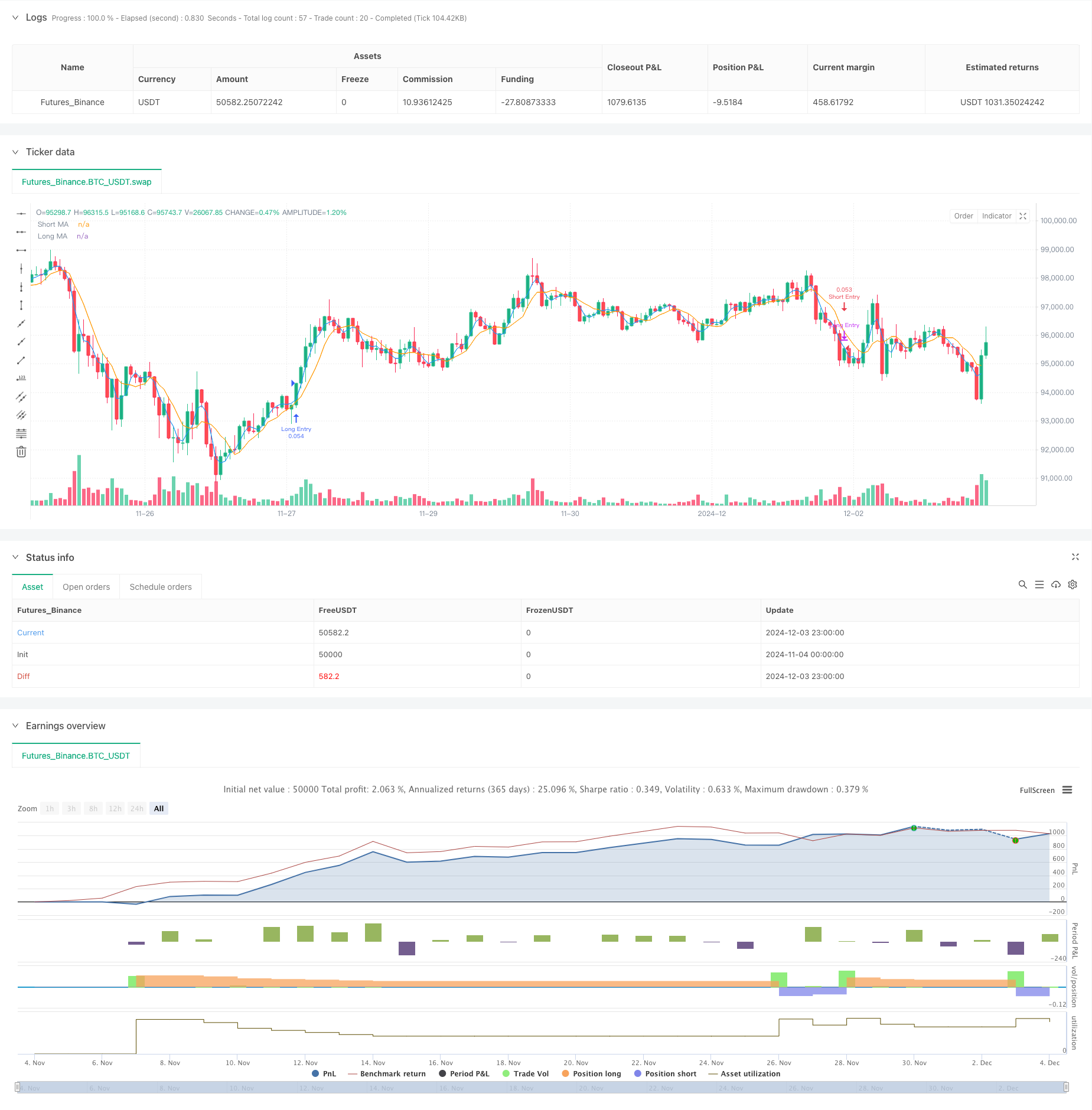

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The SuperATR 7-Step Profit Strategy is a multi-layered trading strategy that combines adaptive ATR and momentum-based trend detection

// with a sophisticated 7-step take-profit mechanism. This approach utilizes four ATR-based exit levels and three fixed percentage levels,

// enabling flexible and dynamic profit-taking in both long and short market positions.

//@version=5

strategy("SuperATR 7-Step Profit - Strategy [presentTrading] ", overlay=true, precision=3, commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1, currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital=10000)

// ————————

// User Inputs

// ————————

short_period = input.int(3, minval=1, title="Short Period")

long_period = input.int(7, minval=1, title="Long Period")

momentum_period = input.int(7, minval=1, title="Momentum Period")

atr_sma_period = input.int(7, minval=1, title="ATR SMA Period for Confirmation")

trend_strength_threshold = input.float(1.618, minval=0.0, title="Trend Strength Threshold", step=0.1)

// ————————

// Take Profit Inputs

// ————————

useMultiStepTP = input.bool(true, title="Enable Multi-Step Take Profit")

// ATR-based Take Profit Inputs

atrLengthTP = input.int(14, minval=1, title="ATR Length for Take Profit")

atrMultiplierTP1 = input.float(2.618, minval=0.1, title="ATR Multiplier for TP Level 1")

atrMultiplierTP2 = input.float(5.0, minval=0.1, title="ATR Multiplier for TP Level 2")

atrMultiplierTP3 = input.float(10.0, minval=0.1, title="ATR Multiplier for TP Level 3")

atrMultiplierTP4 = input.float(13.82, minval=0.1, title="ATR Multiplier for TP Level 4")

// Fixed Percentage Take Profit Inputs

tp_level_percent1 = input.float(3.0, minval=0.1, title="Fixed TP Level 1 (%)")

tp_level_percent2 = input.float(8.0, minval=0.1, title="Fixed TP Level 2 (%)")

tp_level_percent3 = input.float(17.0, minval=0.1, title="Fixed TP Level 3 (%)")

// Take Profit Percentages for Each Level

tp_percent_atr = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each ATR TP Level")

tp_percent_fixed = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each Fixed TP Level")

// —————————————

// Helper Functions

// —————————————

// Function to calculate True Range with enhanced volatility detection

calculate_true_range() =>

prev_close = close[1]

tr1 = high - low

tr2 = math.abs(high - prev_close)

tr3 = math.abs(low - prev_close)

true_range = math.max(tr1, tr2, tr3)

true_range

// ———————————————

// Indicator Calculations

// ———————————————

// Calculate True Range

true_range = calculate_true_range()

// Calculate Momentum Factor

momentum = close - close[momentum_period]

stdev_close = ta.stdev(close, momentum_period)

normalized_momentum = stdev_close != 0 ? (momentum / stdev_close) : 0

momentum_factor = math.abs(normalized_momentum)

// Calculate Short and Long ATRs

short_atr = ta.sma(true_range, short_period)

long_atr = ta.sma(true_range, long_period)

// Calculate Adaptive ATR

adaptive_atr = (short_atr * momentum_factor + long_atr) / (1 + momentum_factor)

// Calculate Trend Strength

price_change = close - close[momentum_period]

atr_multiple = adaptive_atr != 0 ? (price_change / adaptive_atr) : 0

trend_strength = ta.sma(atr_multiple, momentum_period)

// Calculate Moving Averages

short_ma = ta.sma(close, short_period)

long_ma = ta.sma(close, long_period)

// Determine Trend Signal

trend_signal = (short_ma > long_ma and trend_strength > trend_strength_threshold) ? 1 :

(short_ma < long_ma and trend_strength < -trend_strength_threshold) ? -1 : 0

// Calculate Adaptive ATR SMA for Confirmation

adaptive_atr_sma = ta.sma(adaptive_atr, atr_sma_period)

// Determine if Trend is Confirmed with Price Action

trend_confirmed = (trend_signal == 1 and close > short_ma and adaptive_atr > adaptive_atr_sma) or (trend_signal == -1 and close < short_ma and adaptive_atr > adaptive_atr_sma)

// —————————————

// Trading Logic

// —————————————

// Entry Conditions

long_entry = trend_confirmed and trend_signal == 1

short_entry = trend_confirmed and trend_signal == -1

// Exit Conditions

long_exit = strategy.position_size > 0 and short_entry

short_exit = strategy.position_size < 0 and long_entry

// Execute Long Trades

if long_entry

strategy.entry("Long Entry", strategy.long)

if long_exit

strategy.close("Long Entry")

// Execute Short Trades

if short_entry

strategy.entry("Short Entry", strategy.short)

if short_exit

strategy.close("Short Entry")

// ————————————————

// Multi-Step Take Profit Logic

// ————————————————

if useMultiStepTP

// Calculate ATR for Take Profit Levels

atrValueTP = ta.atr(atrLengthTP)

// Long Position Take Profit Levels

if strategy.position_size > 0

// ATR-based Take Profit Prices

tp_priceATR1_long = strategy.position_avg_price + atrMultiplierTP1 * atrValueTP

tp_priceATR2_long = strategy.position_avg_price + atrMultiplierTP2 * atrValueTP

tp_priceATR3_long = strategy.position_avg_price + atrMultiplierTP3 * atrValueTP

tp_priceATR4_long = strategy.position_avg_price + atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_long = strategy.position_avg_price * (1 + tp_level_percent1 / 100)

tp_pricePercent2_long = strategy.position_avg_price * (1 + tp_level_percent2 / 100)

tp_pricePercent3_long = strategy.position_avg_price * (1 + tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_long)

strategy.exit("TP ATR 2 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_long)

strategy.exit("TP ATR 3 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_long)

strategy.exit("TP ATR 4 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_long)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_long)

strategy.exit("TP Percent 2 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_long)

strategy.exit("TP Percent 3 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_long)

// Short Position Take Profit Levels

if strategy.position_size < 0

// ATR-based Take Profit Prices

tp_priceATR1_short = strategy.position_avg_price - atrMultiplierTP1 * atrValueTP

tp_priceATR2_short = strategy.position_avg_price - atrMultiplierTP2 * atrValueTP

tp_priceATR3_short = strategy.position_avg_price - atrMultiplierTP3 * atrValueTP

tp_priceATR4_short = strategy.position_avg_price - atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_short = strategy.position_avg_price * (1 - tp_level_percent1 / 100)

tp_pricePercent2_short = strategy.position_avg_price * (1 - tp_level_percent2 / 100)

tp_pricePercent3_short = strategy.position_avg_price * (1 - tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_short)

strategy.exit("TP ATR 2 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_short)

strategy.exit("TP ATR 3 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_short)

strategy.exit("TP ATR 4 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_short)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_short)

strategy.exit("TP Percent 2 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_short)

strategy.exit("TP Percent 3 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_short)

// ——————————

// Plotting

// ——————————

plot(short_ma, color=color.blue, title="Short MA")

plot(long_ma, color=color.orange, title="Long MA")

// Plot Buy and Sell Signals

//plotshape(long_entry, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, text="Buy")

//plotshape(short_entry, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, text="Sell")

// Optional: Plot Trend Strength for analysis

// Uncomment the lines below to display Trend Strength on a separate chart pane

// plot(trend_strength, title="Trend Strength", color=color.gray)

// hline(trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

// hline(-trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

- Zweifelhafte Querschnittstrategie für gleitende Durchschnitte mit dynamischem Risikomanagement

- Glatte gleitende durchschnittliche Stop Loss & Take Profit-Strategie mit Trendfilter und Ausnahme-Ausgang

- Dynamischer gleitender Durchschnitt und Bollinger-Band-Kreuzstrategie mit festem Stop-Loss-Optimierungsmodell

- Strategie des Modells zur Optimierung der ATR-Fusionsentwicklung

- Anpassungsfähige gleitende Durchschnitts-Kreuzung mit einer Stop-Loss-Strategie

- Multi-Indikator-gefilterte Handelsstrategie mit Bollinger-Bändern und Woodies-CCI

- Trendbreakout-Handelssystem mit gleitendem Durchschnitt (TBMA-Strategie)

- Dynamischer gleitender Durchschnitts-Kreuzungstrend nach einer Strategie mit adaptiven Risikomanagement

- Adaptive quantitative Handelsstrategie mit doppelter gleitender Durchschnittsverknüpfung und Gewinn-/Stop-Loss-Anwendung

- Dynamische Fahrt-Stopp-Doppelziel-Bewegungsdurchschnitt-Kreuzung

- Dynamische Dual-EMA-Crossover-Strategie mit anpassungsfähiger Gewinn-/Verlustkontrolle

- Bollinger-Bänder und RSI kombinierte dynamische Handelsstrategie

- RSI-ATR-Momentums-Volatilität Kombinierte Handelsstrategie

- Doppelte EMA-Trend-Folgende Strategie mit Limit Buy Entry

- Multi-Strategie-Technische Analyse Handelssystem

- Handelsstrategie für die Kombination von Mustererkennungsmodellen für mehrere Zeitrahmen

- Dreifache Bollinger-Bänder treten nach einer quantitativen Handelsstrategie auf

- Mehrdimensionales dynamisches Breakout-Handelssystem auf Basis von Bollinger-Bändern und RSI

- Die RSI-Mittel-Reversions-Breakout-Strategie

- Trend der dynamischen Entwicklung im Dual EMA Crossover nach Strategie

- Doppeltzeitlich dynamisches Handelssystem mit Unterstützung

- Mehrzeitägiger gleitender Durchschnitt und RSI-Momentum Kreuzentwicklung nach Strategie

- Finanzinstrumenten auf Basis von MFI-Überverkaufszonen-Ausgang und Signalvermittlungssystem

- Multi-EMA-Crossover mit Dynamikindikatoren Handelsstrategie

- MACD-KDJ kombinierte Martingale-Pyramiden-Quantitative Handelsstrategie

- Multi-Pattern-Erkennung und Handelsstrategie auf SR-Ebene

- G-Channel und EMA Trendfilter Handelssystem

- Dynamischer Stop-Loss-Mehrzeiten-RSI-Trend nach Strategie

- Dynamisches Handelssystem mit Durchbruch bei Doppel gleitenden Durchschnitten

- Multi-Indikator-Crossover-Momentum-Trend nach Strategie mit optimiertem Take-Profit- und Stop-Loss-System