概述

该策略是一个基于MACD和KDJ指标的马丁格尔交易系统,结合了金字塔式加仓和动态止盈止损机制。策略通过指标交叉判断入场时机,利用马丁格尔理论进行仓位管理,在趋势行情中通过金字塔式加仓来提升收益。策略设计了完整的风险控制体系,包括总仓位控制、动态止损和回撤控制等多重保护机制。

策略原理

策略的核心逻辑包含四个关键要素:入场信号、加仓机制、止盈止损和风险控制。入场信号基于MACD线与信号线的交叉以及KDJ指标中%K与%D线的交叉共振;加仓机制采用马丁格尔理论,通过乘数因子动态调整加仓量,最多支持10次加仓;止盈采用追踪止盈方式,动态调整止盈价位;止损设置了固定止损和追踪止损双重保护。策略通过参数化设计,支持灵活调整各项指标参数、仓位控制参数和风险控制参数。

策略优势

- 信号系统可靠性高:结合MACD趋势指标和KDJ摆动指标,能有效过滤虚假信号

- 仓位管理科学合理:马丁格尔系统能在逆势中通过加仓降低持仓成本

- 风险控制完善:多重止损机制和仓位限制,有效控制风险

- 收益结构优化:金字塔式加仓能在趋势行情中获得更好收益

- 参数灵活可调:支持根据不同市场特征优化调整策略参数

策略风险

- 市场风险:在震荡市场中可能频繁触发加仓导致亏损扩大

- 仓位风险:马丁格尔系统可能导致仓位过重

- 流动性风险:大资金使用该策略可能面临流动性不足问题

- 系统风险:参数优化过度可能导致策略过拟合

策略优化方向

- 信号系统优化:可引入波动率指标,在高波动率环境下调整信号敏感度

- 仓位管理优化:设计动态乘数因子,根据市场环境自适应调整

- 风险控制优化:增加回撤控制模块,在大幅回撤时降低仓位

- 参数优化:引入机器学习方法,实现参数自适应调整

总结

该策略通过结合经典技术指标和先进的仓位管理方法,构建了一个完整的量化交易系统。策略的核心优势在于信号可靠性和风险控制的完备性,同时通过参数化设计保持了较强的适应性。虽然存在一定的固有风险,但通过持续优化和完善,策略有望在不同市场环境下保持稳定的表现。

策略源码

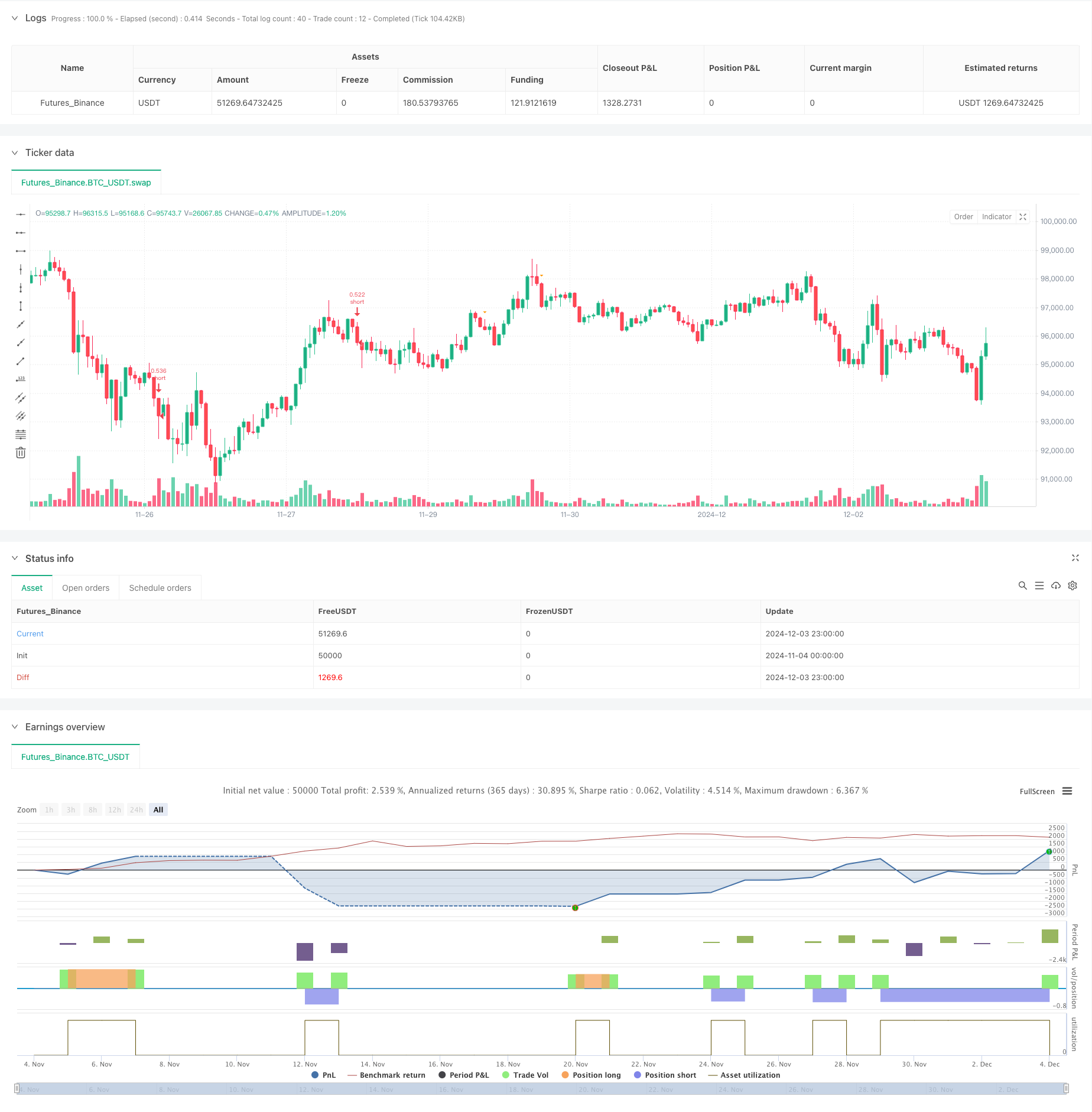

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © aaronxu567

//@version=5

strategy("MACD and KDJ Opening Conditions with Pyramiding and Exit", overlay=true) // pyramiding

// Setting

initialOrder = input.float(50000.0, title="Initial Order")

initialOrderSize = initialOrder/close

//initialOrderSize = input.float(1.0, title="Initial Order Size") // Initial Order Size

macdFastLength = input.int(9, title="MACD Fast Length") // MACD Setting

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing")

kdjLength = input.int(14, title="KDJ Length")

kdjSmoothK = input.int(3, title="KDJ Smooth K")

kdjSmoothD = input.int(3, title="KDJ Smooth D")

enableLong = input.bool(true, title="Enable Long Trades")

enableShort = input.bool(true, title="Enable Short Trades")

// Additions Setting

maxAdditions = input.int(5, title="Max Additions", minval=1, maxval=10) // Max Additions

addPositionPercent = input.float(1.0, title="Add Position Percent", minval=0.1, maxval=10) // Add Conditions

reboundPercent = input.float(0.5, title="Rebound Percent (%)", minval=0.1, maxval=10) // Rebound

addMultiplier = input.float(1.0, title="Add Multiplier", minval=0.1, maxval=10) //

// Stop Setting

takeProfitTrigger = input.float(2.0, title="Take Profit Trigger (%)", minval=0.1, maxval=10) //

trailingStopPercent = input.float(0.3, title="Trailing Stop (%)", minval=0.1, maxval=10) //

stopLossPercent = input.float(6.0, title="Stop Loss Percent", minval=0.1, maxval=10) //

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

// KDJ Calculation

k = ta.sma(ta.stoch(close, high, low, kdjLength), kdjSmoothK)

d = ta.sma(k, kdjSmoothD)

j = 3 * k - 2 * d

// Long Conditions

enterLongCondition = enableLong and ta.crossover(macdLine, signalLine) and ta.crossover(k, d)

// Short Conditions

enterShortCondition = enableShort and ta.crossunder(macdLine, signalLine) and ta.crossunder(k, d)

// Records

var float entryPriceLong = na

var int additionsLong = 0 // 记录多仓加仓次数

var float nextAddPriceLong = na // 多仓下次加仓触发价格

var float lowestPriceLong = na // 多头的最低价格

var bool longPending = false // 多头加仓待定标记

var float entryPriceShort = na

var int additionsShort = 0 // 记录空仓加仓次数

var float nextAddPriceShort = na // 空仓下次加仓触发价格

var float highestPriceShort = na // 空头的最高价格

var bool shortPending = false // 空头加仓待定标记

var bool plotEntryLong = false

var bool plotAddLong = false

var bool plotEntryShort = false

var bool plotAddShort = false

// Open Long

if (enterLongCondition and strategy.opentrades == 0)

strategy.entry("long", strategy.long, qty=initialOrderSize,comment = 'Long')

entryPriceLong := close

nextAddPriceLong := close * (1 - addPositionPercent / 100)

additionsLong := 0

lowestPriceLong := na

longPending := false

plotEntryLong := true

// Add Long

if (strategy.position_size > 0 and additionsLong < maxAdditions)

// Conditions Checking

if (close < nextAddPriceLong) and not longPending

lowestPriceLong := close

longPending := true

if (longPending)

// Rebound Checking

if (close > lowestPriceLong * (1 + reboundPercent / 100))

// Record Price

float addQty = initialOrderSize*math.pow(addMultiplier,additionsLong+1)

strategy.entry("long", strategy.long, qty=addQty,comment = 'Add Long')

additionsLong += 1

longPending := false

nextAddPriceLong := math.min(nextAddPriceLong, close) * (1 - addPositionPercent / 100) // Price Updates

plotAddLong := true

else

lowestPriceLong := math.min(lowestPriceLong, close)

// Open Short

if (enterShortCondition and strategy.opentrades == 0)

strategy.entry("short", strategy.short, qty=initialOrderSize,comment = 'Short')

entryPriceShort := close

nextAddPriceShort := close * (1 + addPositionPercent / 100)

additionsShort := 0

highestPriceShort := na

shortPending := false

plotEntryShort := true

// add Short

if (strategy.position_size < 0 and additionsShort < maxAdditions)

// Conditions Checking

if (close > nextAddPriceShort) and not shortPending

highestPriceShort := close

shortPending := true

if (shortPending)

// rebound Checking

if (close < highestPriceShort * (1 - reboundPercent / 100))

// Record Price

float addQty = initialOrderSize*math.pow(addMultiplier,additionsShort+1)

strategy.entry("short", strategy.short, qty=addQty,comment = "Add Short")

additionsShort += 1

shortPending := false

nextAddPriceShort := math.max(nextAddPriceShort, close) * (1 + addPositionPercent / 100) // Price Updates

plotAddShort := true

else

highestPriceShort := math.max(highestPriceShort, close)

// Take Profit or Stop Loss

if (strategy.position_size != 0)

float stopLossLevel = strategy.position_avg_price * (strategy.position_size > 0 ? (1 - stopLossPercent / 100) : (1 + stopLossPercent / 100))

float trailOffset = strategy.position_avg_price * (trailingStopPercent / 100) / syminfo.mintick

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", from_entry="long", stop=stopLossLevel, trail_price=strategy.position_avg_price * (1 + takeProfitTrigger / 100), trail_offset=trailOffset)

else

strategy.exit("Take Profit/Stop Loss", from_entry="short", stop=stopLossLevel, trail_price=strategy.position_avg_price * (1 - takeProfitTrigger / 100), trail_offset=trailOffset)

// Plot

plotshape(series=plotEntryLong, location=location.belowbar, color=color.blue, style=shape.triangleup, size=size.small, title="Long Signal")

plotshape(series=plotAddLong, location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small, title="Add Long Signal")

plotshape(series=plotEntryShort, location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small, title="Short Signal")

plotshape(series=plotAddShort, location=location.abovebar, color=color.orange, style=shape.triangledown, size=size.small, title="Add Short Signal")

// Plot Clear

plotEntryLong := false

plotAddLong := false

plotEntryShort := false

plotAddShort := false

// // table

// var infoTable = table.new(position=position.top_right,columns = 2,rows = 6,bgcolor=color.yellow,frame_color = color.white,frame_width = 1,border_width = 1,border_color = color.black)

// if barstate.isfirst

// t1="Open Price"

// t2="Avg Price"

// t3="Additions"

// t4='Next Add Price'

// t5="Take Profit"

// t6="Stop Loss"

// table.cell(infoTable, column = 0, row = 0,text=t1 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 1,text=t2 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 2,text=t3 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 3,text=t4 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 4,text=t5 ,text_size=size.auto)

// table.cell(infoTable, column = 0, row = 5,text=t6 ,text_size=size.auto)

// if barstate.isconfirmed and strategy.position_size!=0

// ps=strategy.position_size

// pos_avg=strategy.position_avg_price

// opt=strategy.opentrades

// t1=str.tostring(strategy.opentrades.entry_price(0),format.mintick)

// t2=str.tostring(pos_avg,format.mintick)

// t3=str.tostring(opt>1?(opt-1):0)

// t4=str.tostring(ps>0?nextAddPriceLong:nextAddPriceShort,format.mintick)

// t5=str.tostring(pos_avg*(1+(ps>0?1:-1)*takeProfitTrigger*0.01),format.mintick)

// t6=str.tostring(pos_avg*(1+(ps>0?-1:1)*stopLossPercent*0.01),format.mintick)

// table.cell(infoTable, column = 1, row = 0,text=t1 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 1,text=t2 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 2,text=t3 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 3,text=t4 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 4,text=t5 ,text_size=size.auto)

// table.cell(infoTable, column = 1, row = 5,text=t6 ,text_size=size.auto)

相关推荐

- 多重均线与随机指标结合的趋势跟踪交易策略

- Nifty50三分钟开盘价突破策略

- 艾略特波浪理论4-9脉冲波自动检测交易策略

- 10SMA与MACD双重趋势跟踪交易策略

- Midas Mk. II - Ultimate Crypto Swing

- 星光移动平均交叉策略

- 多周期技术分析与市场情绪结合的交易策略

- 均线交叉+MACD慢线动量策略

- 多重指标趋势交易系统结合动量分析策略

- CM MACD Custom Indicator - Multiple Time Frame - V2

更多内容

- 多周期组合K线形态识别交易策略

- 三重触及布林带趋势跟踪量化交易策略

- 基于布林带和RSI的多维度动态突破交易系统

- RSI均值回归突破策略

- 双均线交叉动量趋势跟踪策略 (EMA Crossover Momentum Trend Following Strategy)

- 多层级 ATR 动态获利交易策略

- 双重时间框架动态支撑位交易系统

- 多周期均线与RSI动量交叉趋势跟踪策略

- 基于MFI指标的金融资产超卖区域退出及信号平均系统

- 多重均线交叉配合动量指标交易策略

- 多重形态识别与SR分位交易策略

- G通道与EMA趋势过滤交易系统

- 动态止损倍数多周期RSI趋势跟踪策略

- 双均线动态突破交易系统(Dynamic Dual Moving Average Breakthrough Trading System)

- 多指标交叉动量趋势跟踪策略结合止盈止损优化系统

- 三角形突破结合RSI动量策略

- 五均线RSI趋势跟踪动态通道交易系统

- 自适应权重趋势跟踪策略(VIDYA多指标组合系统)

- 增强型双重枢轴点反转交易策略

- AO多层量化趋势增强型策略