Reversal Trading Strategy Based on Moving Average Range

Author: ChaoZhang, Date: 2024-01-25 14:16:28Tags:

Overview

This strategy is named “Moving Average Range Reversal”. It identifies market reversal opportunities by calculating crossovers between moving averages of different timeframes and takes appropriate long/short positions.

Strategy Logic

The strategy computes 3 moving averages simultaneously:

- Fast MA (flenght): Reflecting latest price changes

- Slow MA (llenght): Reflecting mid-term price trends

- Slowest MA (sslenght): Reflecting long-term price tendencies

When fast MA crosses above slow MA, it signals a short-term trend reversal to bullish. When fast MA crosses below slow MA, it signals a short-term reversal to bearish.

To avoid false signals, a 4th MA is introduced as the long-term filter (tlenght). Only above this filter long signals are considered. Only below this filter short signals are considered.

The specific trading rules are:

When fast MA crosses above slow MA, and slow MA also crosses above slowest MA (short-term bullish), while price is above the long-term filter, go long. When fast MA crosses below slow MA, close long position.

When fast MA crosses below slow MA, and slow MA also crosses below slowest MA (short-term bearish), while price is below the long-term filter, go short. When fast MA crosses above slow MA, close short position.

Advantage Analysis

The advantages of this strategy include:

- Utilizing multiple timeframes to identify trend changes more precisely and reduce false signals.

- Long-term filter avoids mispositioned trades before major trend reversal.

- Simple and clear rules, easy to understand and automate.

- Reversal strategies benefit from positive bias in returns and profits.

- Good backtest results in simulated live trading regarding returns and profit factor.

Risk Analysis

The risks of the strategy include:

- MA strategies are sensitive to parameters. Different parameters lead to different results.

- False breakout of reversal signals may cause losses.

- Prolonged sideways may nullify profits from repeated reversals.

- Price may reverse and accelerate with strength, failing timely stop loss.

Solutions:

- Optimize parameters to find best combination.

- Increase signal confirmation time to avoid false signals.

- Expand stop loss range to control loss amount.

Optimization Directions

The strategy can be improved in the following aspects:

- Test more parameter sets to find optimum values.

- Add volume filter to avoid false signals in low volume conditions.

- Incorporate other indicators to confirm entry signals.

- Implement dynamic adjustment of stop loss for better exit control.

- Optimize risk management for tighter risk control.

Conclusion

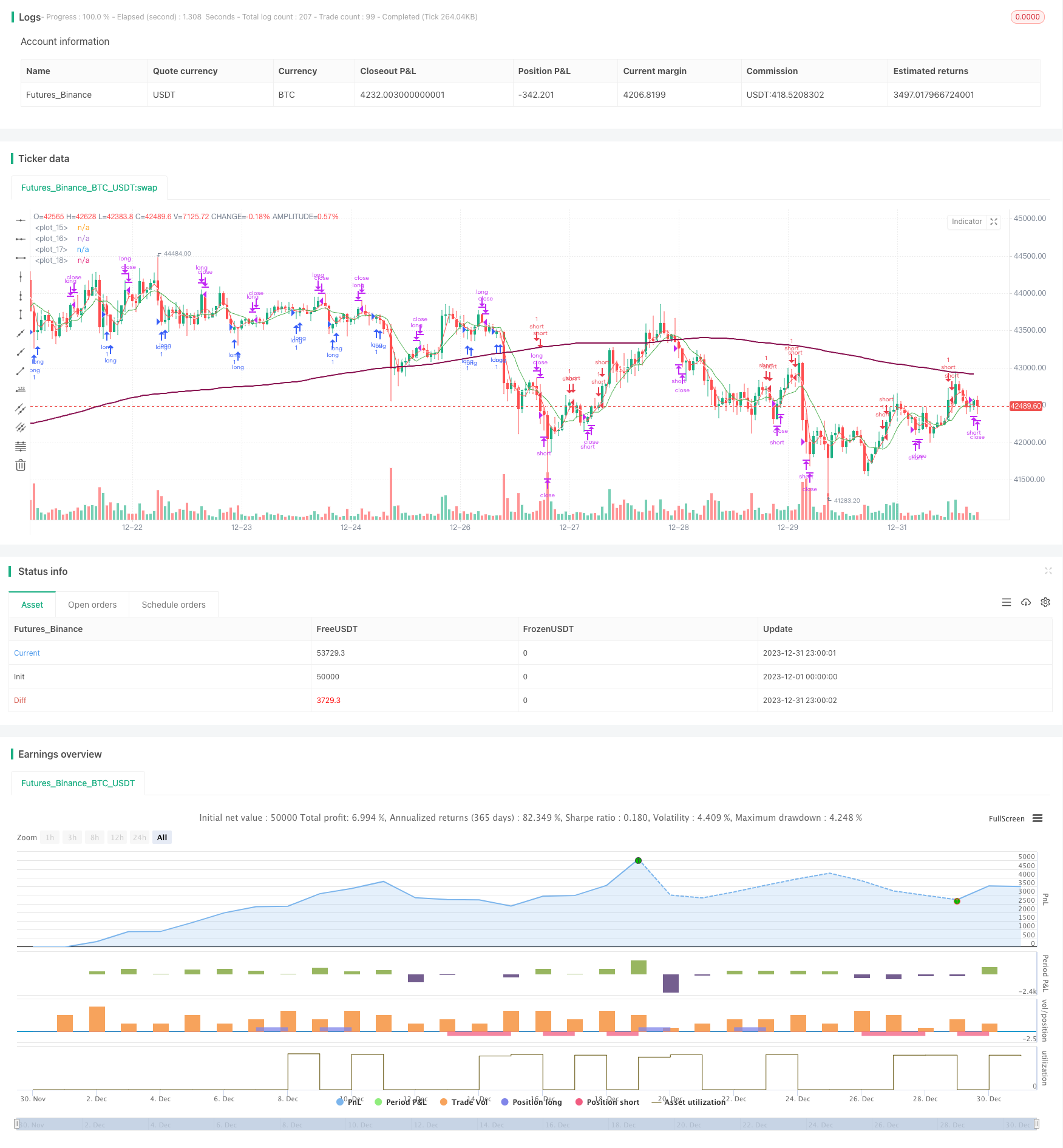

This strategy trades market reversals identified by MA crossovers, with direction guidance from the long-term filter. It effectively captures opportunities at turning points. The positive backtest results show good profitability for live application. Further optimizations on parameters, signal filtering, stop loss etc. can make the strategy more robust for practical use.

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average Trap", overlay=true)

flenght = input.int(title="Fast MA Period", minval=1, maxval=2000, defval=3)

llenght = input.int(title="Slower MA Period", minval=1, maxval=2000, defval=5)

sslenght = input.int(title="Slowest MA Period", minval=1, maxval=2000, defval=8)

tlenght = input.int(title="Trend Filter MA Period", minval=1, maxval=2000, defval=200)

ssma = ta.sma(close, sslenght)

fma = ta.sma(close, flenght)

sma = ta.sma(close, llenght)

tma = ta.sma(close, tlenght)

plot(fma, color=color.red)

plot(sma, color=color.white)

plot(ssma, color=color.green)

plot(tma, color=color.maroon, linewidth=2)

short = (fma > sma and sma > ssma) and close < tma

long = (fma < sma and sma < ssma) and close > tma

closeshort = fma < sma and sma < ssma

closelong = fma > sma and sma > ssma

if long

strategy.entry("long", strategy.long)

if closelong

strategy.close("long")

if short

strategy.entry("short", strategy.short)

if closeshort

strategy.close("short")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

- Origix Ashi Strategy Based on Smoothed Moving Average

- BlackBit Trader XO Macro Trend Scanner Strategy

- Crude Oil ADX Trend Following Strategy

- MT-Coordination Trading Strategy

- Combo Strategy of Double Factors Reversal and Improved Price Volume Trend

- Trend Angle Moving Average Crossover Strategy

- This strategy makes trading decisions based on the trend of MACD Histogram

- Momentum Oscillator & 123 Pattern Strategy

- Backtesting Strategy Based on Fisher Transform Indicator

- Oscillation Spectrum Moving Average Trading Strategy

- Kalman Filter Based Trend Tracking Strategy

- Seasonal Reversal Intertemporal Trading Strategy

- Dual Exponential Moving Average Crossover Algorithmic Trading Strategy

- Quantitative Trading Strategy with Multiple Factors

- Lagging Span 2 Line Tracking Trading Strategy

- EMA and MACD Based BTC Trading Strategy

- Intelligent Trailing Stop Loss Strategy

- Adaptive Volatility Breakout

- Momentum Finding Strategy

- Piercing Pin Bar Reversal Strategy