Dynamic Low-Price Entry and Stop-Loss Strategy Based on RSI

Author: ChaoZhang, Date: 2024-07-29 13:22:37Tags: RSI

Overview

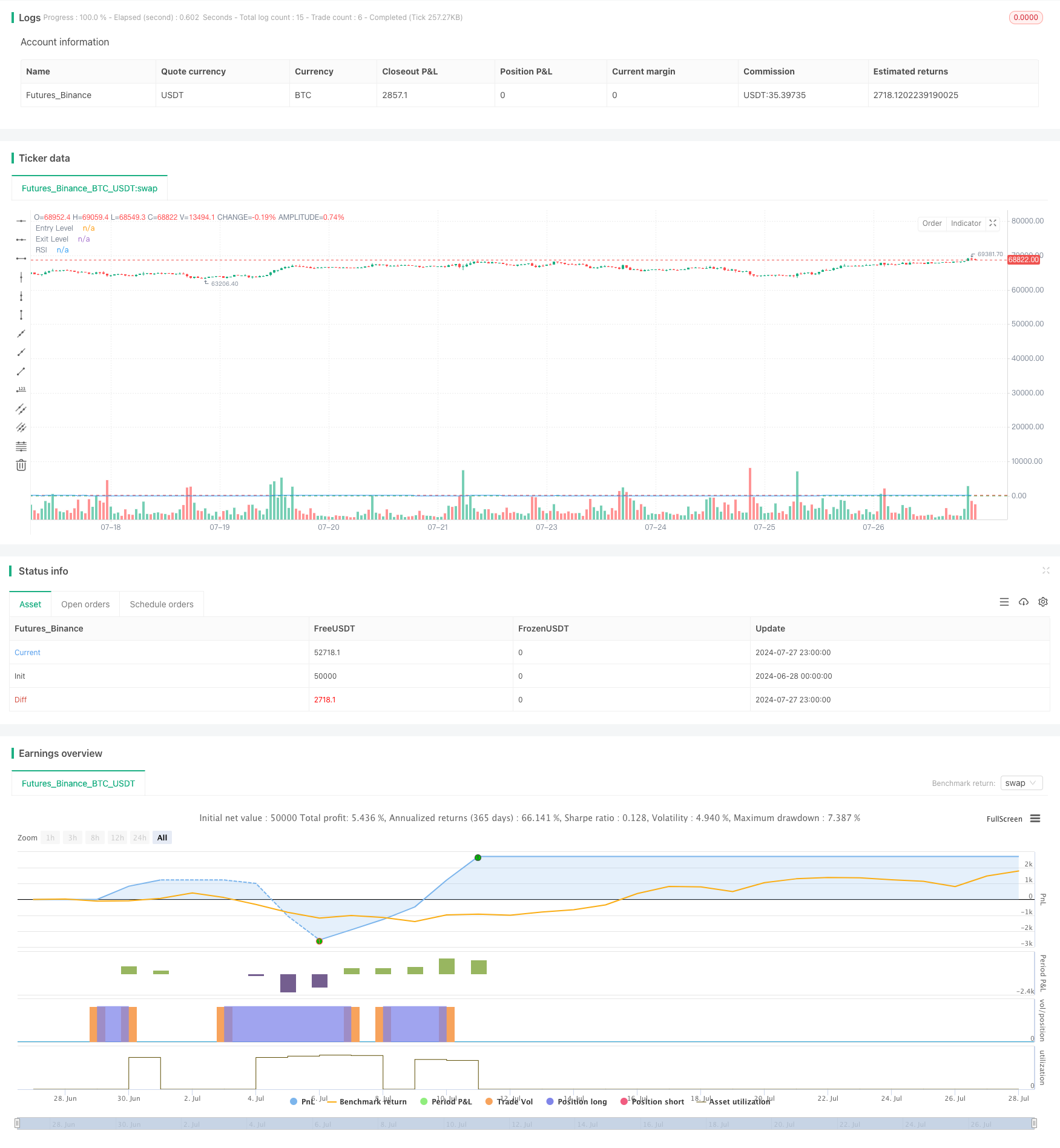

This strategy is a trading system based on the Relative Strength Index (RSI), specifically designed for certain markets. It utilizes the oversold and overbought zones of the RSI indicator to determine entry and exit points, while incorporating a dynamic stop-loss mechanism to control risk. The core idea of this strategy is to enter long positions when the market is oversold and exit when the RSI rises to the overbought zone or reaches a preset maximum loss percentage.

Strategy Principles

-

Entry Condition: The strategy opens a long position when the RSI value falls below the set entry threshold (default 24). It uses the daily low price to calculate RSI, rather than the commonly used closing price, which may make the strategy more sensitive to market lows.

-

Exit Conditions: The strategy has two exit conditions: a) When the RSI value exceeds the set exit threshold (default 72), indicating potential market overbought, the position is closed. b) When the loss percentage exceeds the preset maximum loss tolerance (default 20%), it triggers a stop-loss closure.

-

Position Management: The strategy defaults to using 10% of the account’s total value as the fund amount for each trade.

-

RSI Calculation: RSI is calculated using a 14-day period, but based on the low price rather than the traditional closing price.

Strategy Advantages

-

Dynamic Entry: By using RSI lows as entry signals, the strategy can capture potential rebound opportunities when the market is oversold.

-

Risk Control: Combines both technical indicator (RSI) and percentage stop-loss exit mechanisms, allowing for timely profit-taking when the market turns and controlling losses when the trend is unfavorable.

-

Flexibility: The strategy allows users to customize the RSI calculation period, entry and exit thresholds, and maximum loss percentage, which can be adjusted according to different market characteristics.

-

Using Low Price for RSI Calculation: This non-traditional RSI calculation method may be more likely to capture extreme market lows, favoring entry at lower price positions.

-

Simplicity and Clarity: The strategy logic is relatively simple, easy to understand and implement, while also being convenient for subsequent optimization and expansion.

Strategy Risks

-

False Breakout Risk: In highly volatile markets, RSI may frequently trigger entry signals, leading to multiple trades being initiated and quickly stopped out.

-

Insufficient Trend Following: The strategy mainly relies on RSI reversal signals, which may lead to premature closing of positions in strong trend markets, missing out on larger profit opportunities.

-

Fixed Percentage Stop-Loss: Although a stop-loss mechanism is set, a fixed percentage stop-loss may not be suitable for all market conditions, potentially being too loose or too tight in certain situations.

-

Single Indicator Dependence: The strategy relies solely on the RSI indicator, lacking verification from other technical indicators or fundamental factors, which may increase the risk of misjudgment.

-

Specific Market Limitations: The strategy is designed for specific markets and may not be applicable to other types of financial products or markets.

Strategy Optimization Directions

-

Multi-Indicator Combination: Consider introducing other technical indicators such as moving averages, Bollinger Bands, etc., to be used in conjunction with RSI to improve signal reliability.

-

Adaptive Parameters: Develop a mechanism to automatically adjust the RSI calculation period and entry/exit thresholds based on market volatility, making the strategy more adaptive.

-

Dynamic Stop-Loss: Change the fixed percentage stop-loss to a trailing stop-loss or ATR (Average True Range) stop-loss, which may better adapt to different market volatility situations.

-

Position Management Optimization: Consider dynamically adjusting the fund ratio for each trade based on RSI strength or market volatility, rather than fixed at 10%.

-

Add Trend Filtering: Introduce a trend judgment mechanism, such as using long-term moving averages, to avoid premature closing of positions in strong upward trends.

-

Time Filtering: Add trading time window restrictions to avoid trading during periods of low market volatility or poor liquidity.

-

Backtesting and Optimization: Conduct extensive parameter optimization and backtesting of the strategy to find the best parameter combinations under different market conditions.

Conclusion

This RSI-based dynamic low-price entry and stop-loss strategy provides a concise and effective trading method. By leveraging RSI’s oversold and overbought signals combined with a dynamic stop-loss mechanism, the strategy aims to capture market lows while controlling risk. Its unique feature lies in using the low price to calculate RSI, which may make the strategy more sensitive to market bottoms.

However, the strategy also has some limitations, such as over-reliance on a single indicator and potential premature closing of positions. To improve the strategy’s robustness and adaptability, consider introducing multi-indicator verification, adaptive parameters, dynamic stop-loss, and other optimization directions. Meanwhile, in-depth backtesting and parameter optimization for different market characteristics are also necessary.

Overall, this strategy provides traders with a good starting point that can be further customized and improved based on personal trading styles and target market characteristics. In practical application, it is recommended that traders carefully evaluate the strategy’s performance under different market environments and combine it with other analysis tools and risk management techniques to enhance the overall effectiveness of the strategy.

//@version=5

strategy("Simple RSI Strategy with Low as Source", overlay=true)

// Input parameters

rsiLength = input.int(14, title="RSI Length")

rsiEntryLevel = input.int(24, title="RSI Entry Level")

rsiExitLevel = input.int(72, title="RSI Exit Level")

lossTolerance = input.float(20.0, title="Max Loss %")

// Calculating RSI using the low price

rsi = ta.rsi(low, rsiLength)

// Entry condition

longCondition = rsi < rsiEntryLevel

if (longCondition)

strategy.entry("Long", strategy.long)

// Recording the entry price

var float entryPrice = na

if (longCondition)

entryPrice := low

// Exit conditions

percentFromEntry = 100 * (close - entryPrice) / entryPrice

exitCondition1 = rsi > rsiExitLevel

exitCondition2 = percentFromEntry <= -lossTolerance

if (exitCondition1 or exitCondition2)

strategy.close("Long")

// Plotting

plot(rsi, "RSI", color=color.blue)

hline(rsiEntryLevel, "Entry Level", color=color.green)

hline(rsiExitLevel, "Exit Level", color=color.red)

- Multi-Technical Indicator Fusion Trend Following Quantitative Trading Strategy

- Multi-Technical Indicator Momentum-MA Trend Following Strategy

- Dual Technical Indicator Momentum Reversal Trading Strategy with Risk Management System

- Multi-Timeframe Quantitative Trading Strategy Based on EMA-Smoothed RSI and ATR Dynamic Stop-Loss/Take-Profit

- Multi-Timeframe Candlestick Pattern Trading Strategy

- Multi-Timeframe Supertrend Dynamic Trend Trading Algorithm

- Z-Score Normalized Linear Signal Quantitative Trading Strategy

- Multi-EMA Cross with Volume-Price Momentum Trading Strategy

- Multi-Period Price Level Breakout Trend Trading System Based on Key Price Levels

- Advanced Fibonacci Retracement Trend-Following and Reversal Trading Strategy

- Mean Reversion Bollinger Bands Trading Strategy with Rational Return Signal

- High-Frequency Flip Percentage Tracking Momentum Strategy

- SMI and Pivot Point Momentum Crossover Strategy

- Support and Resistance Strategy with Dynamic Risk Management System

- RSI-Bollinger Bands Integration Strategy: A Dynamic Self-Adaptive Multi-Indicator Trading System

- Multi-Timeframe Trend Following and Order Block Quantitative Trading Strategy

- Technical Support and Resistance Indicator Precision Trading Strategy

- Multi-Moving Average Crossover Trend Following Strategy with Volatility Filter

- MACD Crossover Momentum Strategy with Dynamic Take Profit and Stop Loss Optimization

- Big Red Candle Breakout Buy Strategy

- Adaptive Multi-Moving Average Crossover Dynamic Trading Strategy

- Cloud Momentum Crossover Strategy with Moving Averages and Volume Confirmation

- ATR-RSI Enhanced Trend Following Trading System

- Multi-Indicator Trend Following Strategy: Integrating SuperTrend, EMA, and Risk Management

- Multi-EMA Crossover Trend Following Strategy

- Enhanced Multi-Indicator Momentum Trading Strategy

- Bollinger Bands and RSI Crossover Trading Strategy

- Confirmed SMA Crossover Momentum Strategy

- 44 SMA and 9 EMA Crossover Strategy with RSI Filter and TP/SL

- 4-Hour Timeframe Engulfing Pattern Trading Strategy with Dynamic Take Profit and Stop Loss Optimization

- Dynamic Keltner Channel Momentum Reversal Strategy