Dynamic Mean Reversion and Momentum Strategy

Author: ChaoZhang, Date: 2024-07-30 12:12:27Tags: RSIBBATRMRS

Overview

The Dynamic Mean Reversion and Momentum Strategy is a quantitative trading approach that combines mean reversion and momentum concepts. This strategy utilizes technical indicators such as the Relative Strength Index (RSI), Bollinger Bands (BB), and Average True Range (ATR) to identify overbought and oversold market conditions, capture opportunities for price reversion to the mean, while also considering market momentum to make more robust trading decisions. The strategy also incorporates dynamic stop-loss and take-profit levels to adapt to changes in market volatility.

Strategy Principles

-

Mean Reversion Principle: The strategy uses Bollinger Bands to identify the degree of price deviation from the mean. A long signal is generated when the price touches the lower band and the RSI is in the oversold zone; a short signal is generated when the price touches the upper band and the RSI is in the overbought zone.

-

Momentum Analysis: The RSI indicator is used to assess price momentum. An RSI below 30 is considered oversold, while above 70 is considered overbought. This setup helps confirm the likelihood of price reversals.

-

Dynamic Risk Management: The strategy employs ATR to set dynamic stop-loss and take-profit levels. This approach allows the strategy to adjust risk exposure based on changes in market volatility.

-

Entry and Exit Logic:

- Long Condition: Price below the lower Bollinger Band and RSI below 30

- Short Condition: Price above the upper Bollinger Band and RSI above 70

- Stop-Loss Setting: Entry price plus or minus 2 times ATR

- Take-Profit Setting: Entry price plus or minus 2 times ATR

Strategy Advantages

-

Multiple Confirmation Mechanism: Combining Bollinger Bands and RSI for trade signal confirmation reduces the risk of false breakouts.

-

Adaptation to Market Volatility: Dynamic adjustment of stop-loss and take-profit levels through ATR enables the strategy to better adapt to different market conditions.

-

Balanced Trading Perspective: Considering both mean reversion and momentum factors provides a more comprehensive market analysis.

-

Integrated Risk Management: Built-in stop-loss and take-profit mechanisms help control risk for each trade.

-

Flexibility: Strategy parameters can be optimized and adjusted for different markets and time frames.

Strategy Risks

-

False Signal Risk: In ranging markets, frequent false signals may lead to overtrading.

-

Performance in Trending Markets: Mean reversion strategies may frequently encounter stop-losses in strong trending markets.

-

Parameter Sensitivity: Strategy performance may be highly sensitive to RSI, Bollinger Bands, and ATR parameter settings.

-

Slippage and Liquidity Risk: In highly volatile or illiquid markets, significant slippage issues may arise.

-

Systematic Risk: Relying solely on technical indicators may overlook the impact of fundamental factors on the market.

Strategy Optimization Directions

-

Introduce Trend Filters: Add indicators like moving averages or MACD to identify broader trend directions and avoid counter-trend trading in strong trends.

-

Optimize Parameter Selection: Conduct backtests across different time periods and market environments to find optimal parameter combinations.

-

Incorporate Volume Analysis: Integrate volume indicators such as OBV or CMF to enhance signal reliability.

-

Improve Risk Management: Consider using a percentage risk model instead of fixed ATR multiples to better control risk for each trade.

-

Add Time Filters: Introduce trading time window restrictions to avoid periods of high volatility or low liquidity.

-

Consider Fundamental Factors: Incorporate consideration of important economic data or events into the strategy to improve comprehensiveness.

Conclusion

The Dynamic Mean Reversion and Momentum Strategy is a comprehensive trading system that combines multiple technical analysis concepts. Through the synergy of Bollinger Bands, RSI, and ATR, this strategy aims to capture trading opportunities in price fluctuations while providing dynamic risk management mechanisms. While the strategy demonstrates certain advantages, such as reliability in signal confirmation and adaptability to market volatility, it still faces potential risks like false signals and parameter sensitivity.

To further enhance the strategy’s robustness and performance, considerations can be made to introduce trend filters, optimize parameter selection, and incorporate volume analysis. Additionally, integrating fundamental analysis and more refined risk management methods can help the strategy maintain competitiveness across different market environments.

Overall, this strategy provides traders with an interesting starting point that has the potential to evolve into a reliable trading system through continuous optimization and adjustment. However, in practical application, traders need to carefully evaluate the strategy’s performance under different market conditions and make appropriate adjustments based on individual risk tolerance and trading objectives.

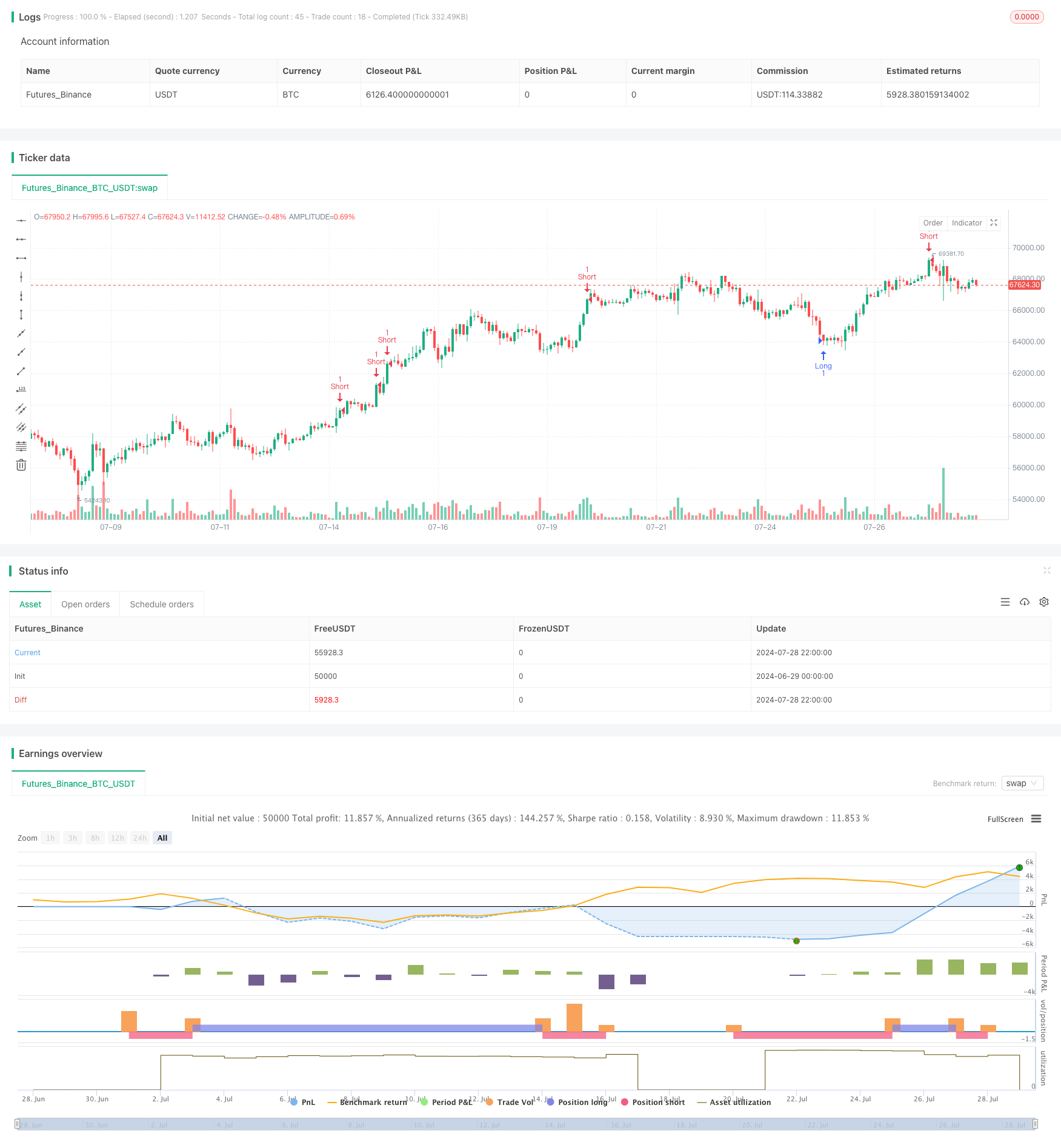

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © baranbay

//@version=5

strategy("BARONES - Mean Reversion and Momentum Strategy", overlay=true)

// İndikatör parametreleri

rsi_length = input.int(14, title="RSI Length")

rsi_overbought = input.int(70, title="RSI Overbought Level")

rsi_oversold = input.int(30, title="RSI Oversold Level")

bb_length = input.int(20, title="Bollinger Bands Length")

bb_mult = input.float(2.0, title="Bollinger Bands Multiplier")

// RSI ve Bollinger Bantları hesaplama

rsi = ta.rsi(close, rsi_length)

basis = ta.sma(close, bb_length)

dev = bb_mult * ta.stdev(close, bb_length)

upper = basis + dev

lower = basis - dev

// Giriş ve çıkış sinyalleri

if (close < lower and rsi < rsi_oversold)

strategy.entry("Long", strategy.long)

if (close > upper and rsi > rsi_overbought)

strategy.entry("Short", strategy.short)

// Dinamik stop-loss seviyeleri (ATR kullanarak)

atr_length = input.int(14, title="ATR Length")

atr = ta.atr(atr_length)

stop_loss_long = close - 2 * atr

take_profit_long = close + 2 * atr

stop_loss_short = close + 2 * atr

take_profit_short = close - 2 * atr

// Kar ve zarar durdurma seviyeleri

strategy.exit("Take Profit/Stop Loss", "Long", limit=take_profit_long, stop=stop_loss_long)

strategy.exit("Take Profit/Stop Loss", "Short", limit=take_profit_short, stop=stop_loss_short)

- RSI-Bollinger Bands Integration Strategy: A Dynamic Self-Adaptive Multi-Indicator Trading System

- Multi-Indicator Intelligent Pyramiding Strategy

- Mean Reversion Strategy with Bollinger Bands, RSI and ATR-Based Dynamic Stop-Loss System

- High-Precision RSI and Bollinger Bands Breakout Strategy with Optimized Risk-Reward Ratio

- Reverse Volatility Breakout Strategy

- VWAP and RSI Dynamic Bollinger Bands Take Profit and Stop Loss Strategy

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Enhanced Bollinger Breakout Quantitative Strategy with Momentum Filter Integration System

- Big Red Candle Breakout Buy Strategy

- Dynamic Signal Line Trend Following Strategy Combining ATR and Volume

- Multi-Indicator Dynamic Volatility Alert Trading System

- Dynamic Trend-Following Trading Strategy Based on Gann Angles

- VWAP-ATR Trend Following and Price Reversal Strategy

- Bollinger Bands RSI Neutral Market Quantitative Trading Strategy

- Multi-Level Oversold Oscillator Buy Strategy

- Adaptive Trend Following Strategy Combining AlphaTrend and KAMA with Risk Management

- Dual Indicator Cross-Confirmation Momentum Volume Quantitative Trading Strategy

- Dynamic Trend Following Strategy - Multi-Indicator Integrated Momentum Analysis System

- Multi-EMA and Supertrend Crossover Strategy

- Dual EMA Dynamic Trend Capture Trading System

- Multi-Confirmation Reversal Buy Strategy

- Enhanced Dual EMA Pullback Breakout Trading Strategy

- Multi-Timeframe Exponential Moving Average Crossover Strategy

- Multi-Period Dynamic Channel Crossover Strategy

- Comprehensive Price Gap Short-Term Trend Capture Strategy

- Multi-Stochastic Oscillation and Momentum Analysis System

- Multi-Timeframe Moving Average and RSI Trend Trading Strategy

- Multi-Period Moving Average Crossover Trend Following Strategy

- Three-Week High-Low Momentum Trading Strategy