Multi-Dimensional Order Flow Analysis and Trading Strategy

Author: ChaoZhang, Date: 2024-07-30 16:32:52Tags: OBLOBTA

Overview

The Multi-Dimensional Order Flow Analysis and Trading Strategy is a quantitative trading approach based on the concept of Order Blocks. This strategy aims to capture significant price support and resistance areas by identifying potential order blocks in the market, which then inform trading decisions. The core of the strategy lies in using historical price data to recognize areas where large buy or sell orders may exist and trading around these zones. This method is designed to enhance trading accuracy and profitability while mitigating risks.

Strategy Principles

Order Block Identification:

- The strategy employs an adjustable lookback period (default 5 periods) to analyze price movements.

- Potential order blocks are identified by comparing current prices with historical highs and lows.

- A threshold multiplier (default 1.0) is used to determine the significance of price movements.

Multi-Period Analysis:

- Calculates the highest high and lowest low within the specified lookback period.

- Compares current closing prices with historical prices to identify breakout movements.

Long and Short Signal Generation:

- Bullish Order Block: Current low is below the historical low, and the closing price is above the historical close multiplied by the threshold.

- Bearish Order Block: Current high is above the historical high, and the closing price is below the historical close divided by the threshold.

Trade Execution:

- Opens a long position when a bullish order block is identified.

- Opens a short position when a bearish order block is identified.

- Closes positions when opposite signals appear.

Strategy Advantages

Market Depth Insight: By analyzing order blocks, the strategy provides insight into market structure and potential large-scale trading activities, aiding in more accurate price movement predictions.

High Adaptability: Strategy parameters are adjustable, making it applicable to various market environments and trading instruments.

Risk Management: Trading near key support and resistance levels allows for better risk control.

Automated Execution: The strategy can be programmed for fully automated trading, reducing emotional interference.

Multi-Dimensional Analysis: Combines price, volume, and historical data for a more comprehensive analysis, enhancing the reliability of trading decisions.

Strategy Risks

False Breakout Risk: In highly volatile markets, there’s a risk of misidentifying order blocks, leading to incorrect trading signals.

Parameter Sensitivity: Strategy performance heavily depends on the choice of lookback period and threshold, with improper settings potentially leading to overtrading or missed opportunities.

Changing Market Conditions: The effectiveness of the order block strategy may decrease in strongly trending or highly volatile markets.

Slippage and Liquidity Risk: In less liquid markets, it may be challenging to execute trades at ideal price levels.

Technology Dependence: The automated nature of the strategy makes it susceptible to technical glitches or data errors.

Strategy Optimization Directions

Dynamic Parameter Adjustment: Implement adaptive lookback periods and thresholds to suit different market conditions.

Multi-Indicator Integration: Combine other technical indicators (e.g., moving averages, RSI) to confirm order block signals and improve accuracy.

Market Sentiment Analysis: Incorporate market sentiment data, such as options implied volatility, to enhance the strategy’s predictive power.

Risk Management Enhancement: Introduce dynamic stop-loss and profit targets, adjusting position sizes based on market volatility.

Machine Learning Integration: Utilize machine learning algorithms to optimize parameter selection and signal generation processes.

Backtesting and Optimization: Conduct extensive historical data backtests to find optimal parameter combinations and trading rules.

Order Flow Analysis: Integrate more detailed order flow data for more precise identification of significant order blocks.

Conclusion

The Multi-Dimensional Order Flow Analysis and Trading Strategy is an innovative quantitative trading method that identifies high-probability trading opportunities through in-depth analysis of market structure and order flow. The core strength of this strategy lies in its ability to provide insights into deeper market dynamics and its precision in trading near key price levels. However, successful implementation of the strategy requires careful parameter selection and continuous optimization. By combining other technical analysis tools, introducing dynamic parameter adjustments, and integrating more data dimensions, this strategy has the potential to become a powerful trading system. Future development should focus on improving the strategy’s adaptability, accuracy, and risk management capabilities to maintain competitiveness in ever-changing market environments.

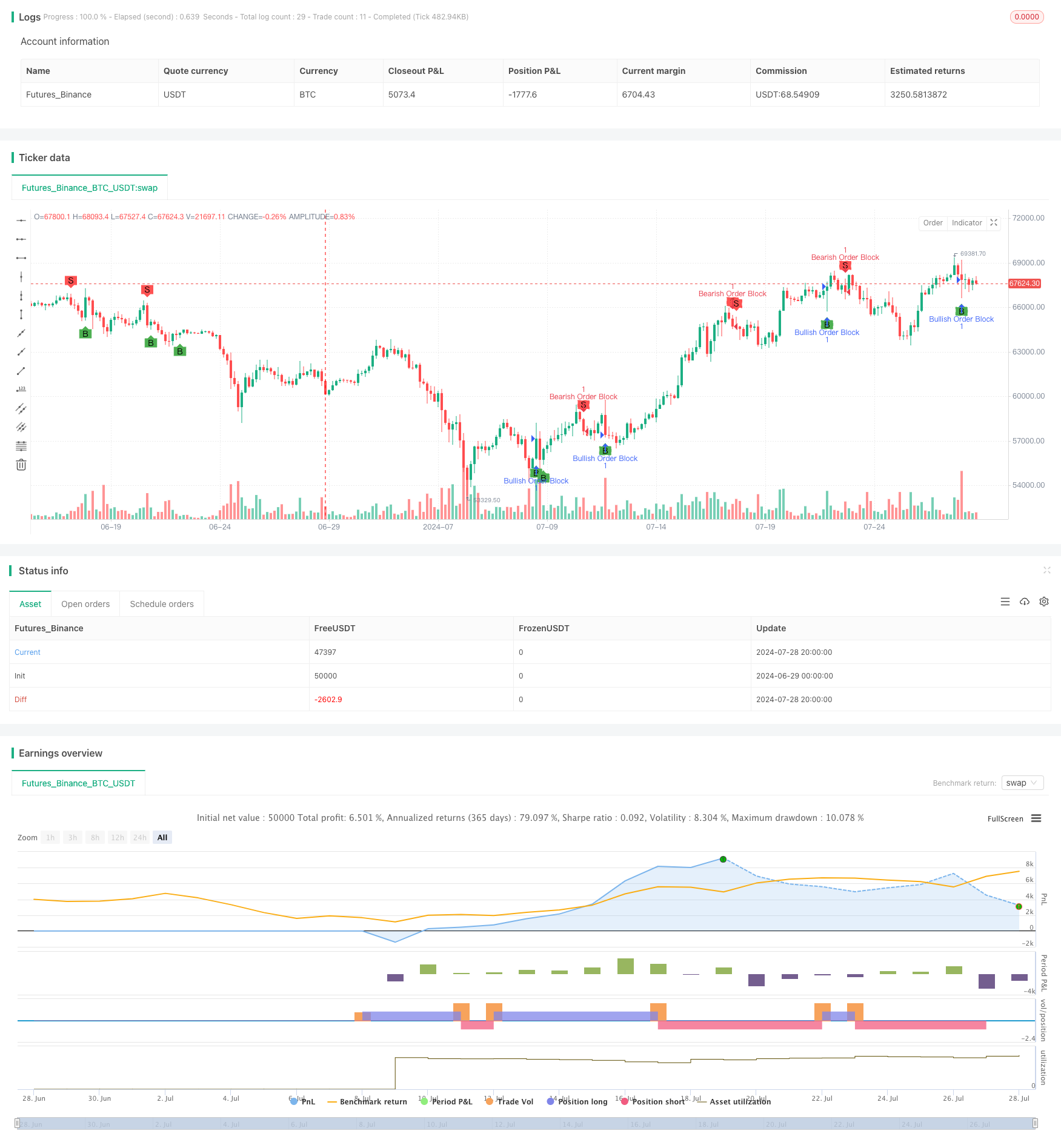

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Order Block Trading Strategy", overlay=true)

// Parameters for order block identification

len = input.int(5, title="Lookback Length", minval=1)

threshold = input.float(1.0, title="Threshold Multiplier", minval=0.1)

// Identify potential order blocks

highs = ta.highest(high, len)

lows = ta.lowest(low, len)

bullish_order_block = (low < lows[len] and close > close[len] * threshold)

bearish_order_block = (high > highs[len] and close < close[len] * threshold)

// Plot bullish order blocks

bullish_marker = bullish_order_block ? 1 : na

plotshape(series=bullish_marker, location=location.belowbar, color=color.green, style=shape.labelup, text="B")

// Plot bearish order blocks

bearish_marker = bearish_order_block ? 1 : na

plotshape(series=bearish_marker, location=location.abovebar, color=color.red, style=shape.labeldown, text="S")

// Strategy entry conditions

if (bullish_order_block)

strategy.entry("Bullish Order Block", strategy.long)

if (bearish_order_block)

strategy.entry("Bearish Order Block", strategy.short)

// Strategy exit conditions

if (strategy.position_size > 0 and bearish_order_block)

strategy.close("Bullish Order Block")

if (strategy.position_size < 0 and bullish_order_block)

strategy.close("Bearish Order Block")

- Confirmed SMA Crossover Momentum Strategy

- Price Relationship-based Arbitrage Trading Strategy Between Two Markets

- Dual EMA Dynamic Trend Capture Trading System

- Multi-Timeframe Trend Following and Order Block Quantitative Trading Strategy

- Multi-EMA Crossover with Time Interval Integration Strategy

- EMA, RSI, TA, Multi-Indicator Trading Strategy

- CDC Action Zone Trading Bot Strategy with ATR for Take Profit and Stop Loss

- MACD-RSI Dynamic Crossover Quantitative Trading System

- Multi-Period Fractal Breakout Order Block Adaptive Trading Strategy

- Multi-Technical Indicator Based Mean Reversion and Trend Following Strategy

- Multi-Indicator Dynamic Trading Strategy

- Multi-Indicator Intelligent Pyramiding Strategy

- Multi-EMA Crossover Momentum Strategy

- Multi-Order Breakout Trend Following Strategy

- Multi-EMA Crossover with Time Interval Integration Strategy

- Dual Moving Average Crossover Confirmation Strategy with Volume-Price Integration Optimization Model

- Dual Dynamic Indicator Optimization Strategy

- VWAP Crossover Dynamic Profit Target Trading Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Fibonacci Extension and Retracement Channel Breakout Strategy

- Multi-Moving Average Trend Following and Reversal Pattern Recognition Strategy

- Advanced Composite Moving Average and Market Momentum Trend Capture Strategy

- Advanced Fibonacci Retracement and Volume-Weighted Price Action Trading Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dynamic Position Dual Moving Average Crossover Strategy

- Dynamic Signal Line Trend Following Strategy Combining ATR and Volume

- Multi-Indicator Dynamic Volatility Alert Trading System

- Dynamic Trend-Following Trading Strategy Based on Gann Angles

- VWAP-ATR Trend Following and Price Reversal Strategy

- Bollinger Bands RSI Neutral Market Quantitative Trading Strategy