VWAP Crossover Dynamic Profit Target Trading Strategy

Author: ChaoZhang, Date: 2024-07-30 17:01:49Tags: VWAPMT

Overview

The VWAP Crossover Dynamic Profit Target Trading Strategy is a quantitative trading approach that combines Volume Weighted Average Price (VWAP) crossover signals with a fixed percentage profit target. This strategy utilizes VWAP as a dynamic support and resistance line, entering trades when price crosses the VWAP, and automatically closing positions when a predefined 3% profit target is reached. By integrating trend-following with profit-locking mechanisms, this method aims to capture short-term price movements while securing gains in a timely manner.

Strategy Principles

The core principles of this strategy include the following key elements:

VWAP Calculation: The strategy begins by calculating the 14-period VWAP, which serves as a dynamic benchmark for assessing price trends. VWAP calculation incorporates both price and volume, providing a more accurate reflection of market supply and demand balance.

Entry Signals:

- Long Entry: A buy signal is triggered when the closing price crosses above the VWAP.

- Short Entry: A sell signal is triggered when the closing price crosses below the VWAP.

Profit Targets:

- Long Position Exit: Automatically closes the position when the price reaches 103% of the entry price (3% increase).

- Short Position Exit: Automatically closes the position when the price reaches 97% of the entry price (3% decrease).

Position Management: The strategy allows for multiple positions in different directions, opening new trades with each crossover signal.

Strategy Advantages

Dynamic Support and Resistance: VWAP acts as a dynamic support and resistance line, adapting to market changes and providing more accurate trading signals.

Price-Volume Integration: VWAP incorporates both price and volume information, providing a more comprehensive view of market dynamics.

Automatic Profit Locking: The preset 3% profit target secures gains promptly, preventing profit erosion and enhancing the strategy’s profitability stability.

Bidirectional Trading: The strategy captures both upward and downward market movements, increasing profit opportunities.

Simplicity: The strategy logic is clear and easy to understand, making it suitable for both novice and experienced traders.

Objectivity: Based on well-defined mathematical calculations and rules, the strategy reduces biases introduced by subjective judgment.

Strategy Risks

Frequent Trading: In highly volatile markets, the strategy may generate excessive trading signals, increasing transaction costs.

Limitations of Fixed Profit Targets: The 3% fixed profit target may perform inconsistently across different market environments, sometimes closing positions too early and missing larger trends.

Lack of Stop-Loss Mechanism: The strategy does not incorporate a stop-loss, potentially exposing trades to significant losses in extreme market conditions.

Slippage Impact: In less liquid markets, the strategy may face severe slippage, affecting its actual performance.

Market Condition Dependency: While potentially performing well in trending markets, the strategy may generate frequent false signals in range-bound markets.

Parameter Sensitivity: The VWAP period setting and profit target percentage significantly impact strategy performance, requiring careful optimization.

Strategy Optimization Directions

Dynamic Profit Targets: Consider adjusting profit targets dynamically based on market volatility, for example, using the Average True Range (ATR) to set profit objectives.

Adding Filters: Introduce additional technical indicators such as RSI or MACD as filters to reduce false signals.

Implementing Stop-Loss: Add stop-loss functionality, such as fixed amount, percentage-based, or indicator-based stop-losses, to limit potential losses.

Optimizing VWAP Period: Optimize the VWAP calculation period, possibly considering adaptive periods.

Position Sizing: Implement dynamic position sizing, adjusting trade sizes based on market volatility and account risk.

Time Filtering: Add trading time filters to avoid highly volatile or low liquidity periods.

Multi-Timeframe Analysis: Incorporate longer-term timeframe analysis to improve entry signal reliability.

Drawdown Control: Introduce maximum drawdown control mechanisms, pausing trading when a certain drawdown level is reached.

Conclusion

The VWAP Crossover Dynamic Profit Target Trading Strategy is a quantitative trading method that combines trend following with profit management. By utilizing VWAP as a dynamic reference line and setting fixed profit targets, the strategy aims to capture short-term price movements while securing gains promptly. Although the strategy logic is simple and intuitive, it still faces challenges such as overtrading and limitations of fixed profit targets in practical application. To enhance the strategy’s robustness and adaptability, traders are advised to focus on dynamic parameter adjustment, adding filters, implementing stop-loss mechanisms, and other optimization directions. Simultaneously, thorough backtesting and parameter optimization are crucial for successful strategy implementation. Traders should continuously adjust and optimize strategy parameters based on specific trading instruments and market environments to achieve optimal trading results.

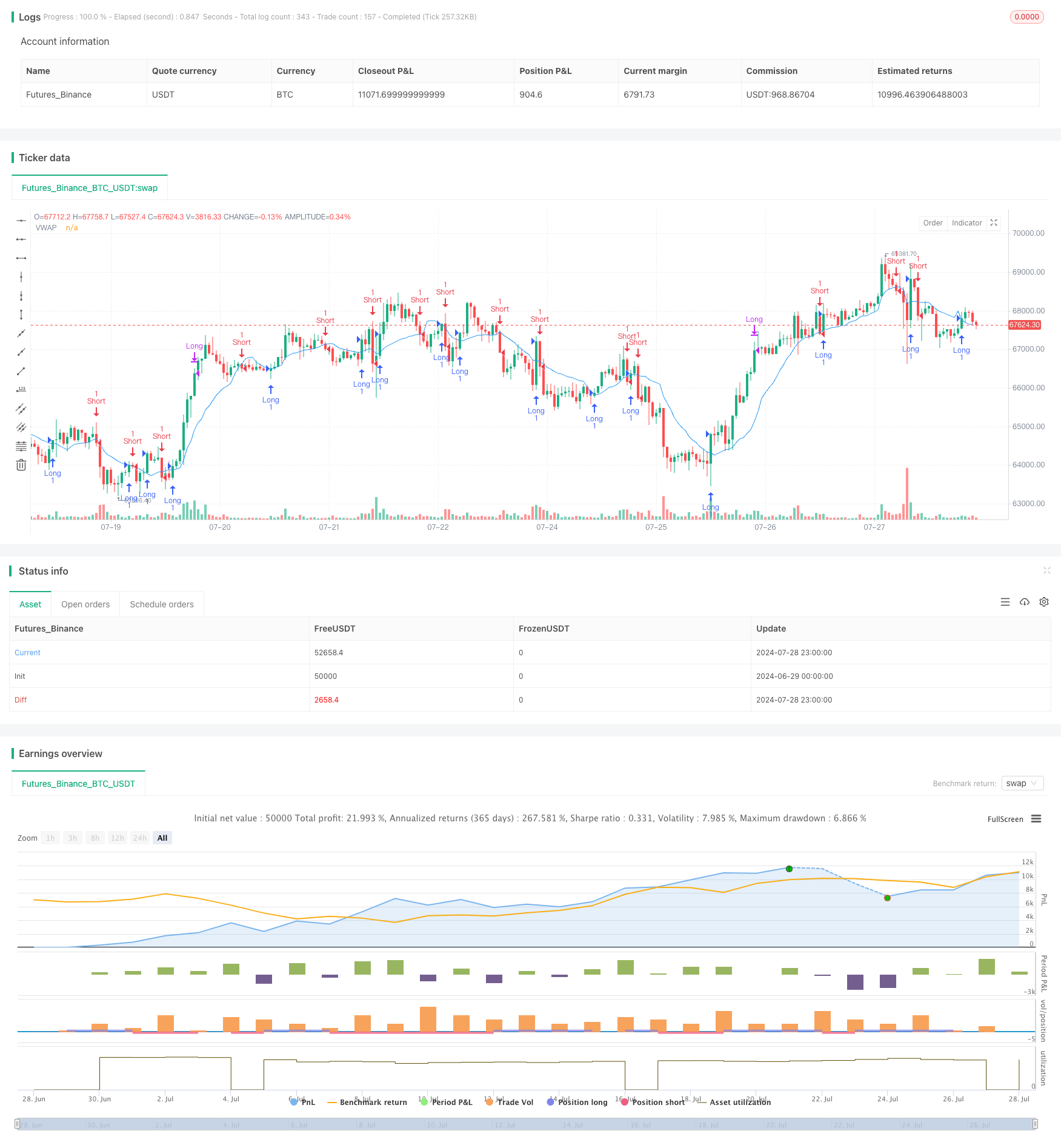

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("VWAP Crossover Strategy with Profit Targets", overlay=true)

// Define the period for calculating VWAP

cumulativePeriod = input(14, "VWAP Calculation Period")

// Calculate the Typical Price for the period

typicalPrice = (high + low + close) / 3

// Calculate Typical Price multiplied by volume

typicalPriceVolume = typicalPrice * volume

// Cumulative sum of Typical Price * Volume

cumulativeTypicalPriceVolume = sum(typicalPriceVolume, cumulativePeriod)

// Cumulative sum of Volume

cumulativeVolume = sum(volume, cumulativePeriod)

// Calculate VWAP

vwapValue = cumulativeTypicalPriceVolume / cumulativeVolume

// Plotting the VWAP on the chart

plot(vwapValue, color=color.blue, title="VWAP")

// Conditions for entering a long position (buy when price crosses above VWAP)

longCondition = crossover(close, vwapValue)

if (longCondition)

strategy.entry("Long", strategy.long)

// Conditions for entering a short position (short when price crosses below VWAP)

shortCondition = crossunder(close, vwapValue)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Setting up a profit target to close the long position

longProfitTarget = strategy.position_avg_price * 1.03

if (strategy.position_size > 0 and close >= longProfitTarget)

strategy.close("Long", comment="Long Profit Target Reached")

// Setting up a profit target to close the short position

shortProfitTarget = strategy.position_avg_price * 0.97

if (strategy.position_size < 0 and close <= shortProfitTarget)

strategy.close("Short", comment="Short Profit Target Reached")

- WaveTrend Oscillator Divergence Strategy

- VWAP Trading Strategy

- VWAP and RSI Crossover Strategy

- VWAP and Super Trend Buy/Sell Strategy

- Multi-Period EMA Crossover with VWAP High Win-Rate Intraday Trading Strategy

- VWAP Standard Deviation Mean Reversion Trading Strategy

- VWAP-ATR Dynamic Price Action Trading System

- Buy and Sell Volume Heatmap with Real-Time Price Strategy

- Multi-Dimensional Trend Following Pyramid Trading Strategy

- VWAP-ATR Trend Following and Price Reversal Strategy

- Multi-Candlestick Pattern Recognition and Trading Strategy

- Multi-EMA Crossover Strategy with Trend Confirmation

- Momentum-Driven EMA-RSI Crossover Strategy

- Multi-Indicator Dynamic Trading Strategy

- Multi-Indicator Intelligent Pyramiding Strategy

- Multi-EMA Crossover Momentum Strategy

- Multi-Order Breakout Trend Following Strategy

- Multi-EMA Crossover with Time Interval Integration Strategy

- Dual Moving Average Crossover Confirmation Strategy with Volume-Price Integration Optimization Model

- Dual Dynamic Indicator Optimization Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Fibonacci Extension and Retracement Channel Breakout Strategy

- Multi-Dimensional Order Flow Analysis and Trading Strategy

- Multi-Moving Average Trend Following and Reversal Pattern Recognition Strategy

- Advanced Composite Moving Average and Market Momentum Trend Capture Strategy

- Advanced Fibonacci Retracement and Volume-Weighted Price Action Trading Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dynamic Position Dual Moving Average Crossover Strategy

- Dynamic Signal Line Trend Following Strategy Combining ATR and Volume

- Multi-Indicator Dynamic Volatility Alert Trading System