Overview

This strategy is a trading system that combines high-low price breakouts, Alpha Trend indicator, and moving average filtering. It aims to capture trend changes when prices break through key levels, while using Alpha Trend and moving averages to filter out false signals and improve trading accuracy. The strategy is applicable to various financial markets, including stocks, forex, and cryptocurrencies.

Strategy Principles

High-Low Price Breakout: The strategy uses a user-defined period (default 20 candles) to determine recent highest and lowest closing prices. Potential trading signals are triggered when the current closing price breaks these levels.

Alpha Trend Indicator: This is a trend-following indicator based on ATR (Average True Range). It identifies the current trend by dynamically adjusting upper and lower levels. An uptrend is recognized when the price is above the Alpha Trend line, and vice versa.

Moving Average Filter: The strategy uses a Simple Moving Average (SMA) as an additional trend filter. Long positions are only considered when the price is above the moving average, and short positions when below.

Trade Signal Generation:

- Buy Signal: Generated when the closing price breaks above the recent high, and is above both the moving average and Alpha Trend line.

- Sell Signal: Generated when the closing price breaks below the recent low, and is below both the moving average and Alpha Trend line.

Risk Management: The strategy incorporates built-in stop-loss and take-profit features. Users can set percentage-based stop-loss and take-profit levels to control risk and reward for each trade.

Strategy Advantages

Multiple Confirmations: By combining price breakouts, Alpha Trend, and moving averages, the strategy effectively reduces false signals and improves trading accuracy.

High Adaptability: The strategy can adapt to different market conditions and volatility, as the Alpha Trend indicator automatically adjusts based on market fluctuations.

Risk Management: Built-in stop-loss and take-profit functions help control risk for each trade, protecting capital safety.

Visualization: The strategy plots various indicators and signals on the chart, allowing traders to visually understand market conditions and potential trading opportunities.

Parameter Optimization: Users can adjust various parameters such as breakout period, moving average length, and ATR multiplier based on different markets and personal preferences.

Strategy Risks

Sideways Market Risk: In range-bound markets without clear trends, the strategy may generate frequent false signals, leading to overtrading and losses.

Slippage Risk: In fast breakouts or highly volatile markets, actual execution prices may differ significantly from expected, affecting strategy performance.

Over-reliance on Historical Data: The strategy makes decisions based on historical price patterns, but past performance does not guarantee future results.

Parameter Sensitivity: Strategy performance may be highly sensitive to parameter settings, and improper parameter selection may lead to suboptimal results.

Trend Reversal Risk: In cases of strong trend reversals, the strategy may not adapt quickly enough, potentially leading to significant losses.

Strategy Optimization Directions

Dynamic Parameter Adjustment: Consider automatically adjusting breakout periods and ATR multipliers based on market volatility to adapt to different market environments.

Volume Confirmation: Incorporating volume factors when generating signals can improve breakout reliability.

Machine Learning Integration: Using machine learning algorithms to optimize parameter selection and signal filtering may improve overall strategy performance.

Multi-Timeframe Analysis: Combining longer and shorter timeframes to confirm trends can reduce false signals and improve trade quality.

Market Sentiment Indicators: Integrating VIX or other market sentiment indicators can help the strategy better judge market environments.

Improved Stop-Loss Methods: Consider using trailing stops or ATR-based dynamic stops to potentially enhance risk management effectiveness.

Trade Frequency Control: Implementing cool-down periods or daily trade limits can prevent overtrading and reduce trading costs.

Conclusion

The High/Low Breakout Strategy with Alpha Trend and Moving Average Filter is a comprehensive trading system that identifies potential trend changes and trading opportunities through a combination of multiple technical indicators. The strategy’s strengths lie in its multi-layered confirmation mechanism and built-in risk management features, allowing it to maintain relatively stable performance across various market conditions. However, users should be aware of the strategy’s limitations in sideways markets and the significant impact of parameter selection on performance.

Through continuous optimization and improvements, such as dynamic parameter adjustment, multi-timeframe analysis, and the introduction of machine learning, this strategy has the potential to become an even more powerful and adaptive trading tool. Finally, it is recommended that traders thoroughly test and optimize strategy parameters in a simulated environment before live trading to ensure it aligns with their risk tolerance and trading objectives.

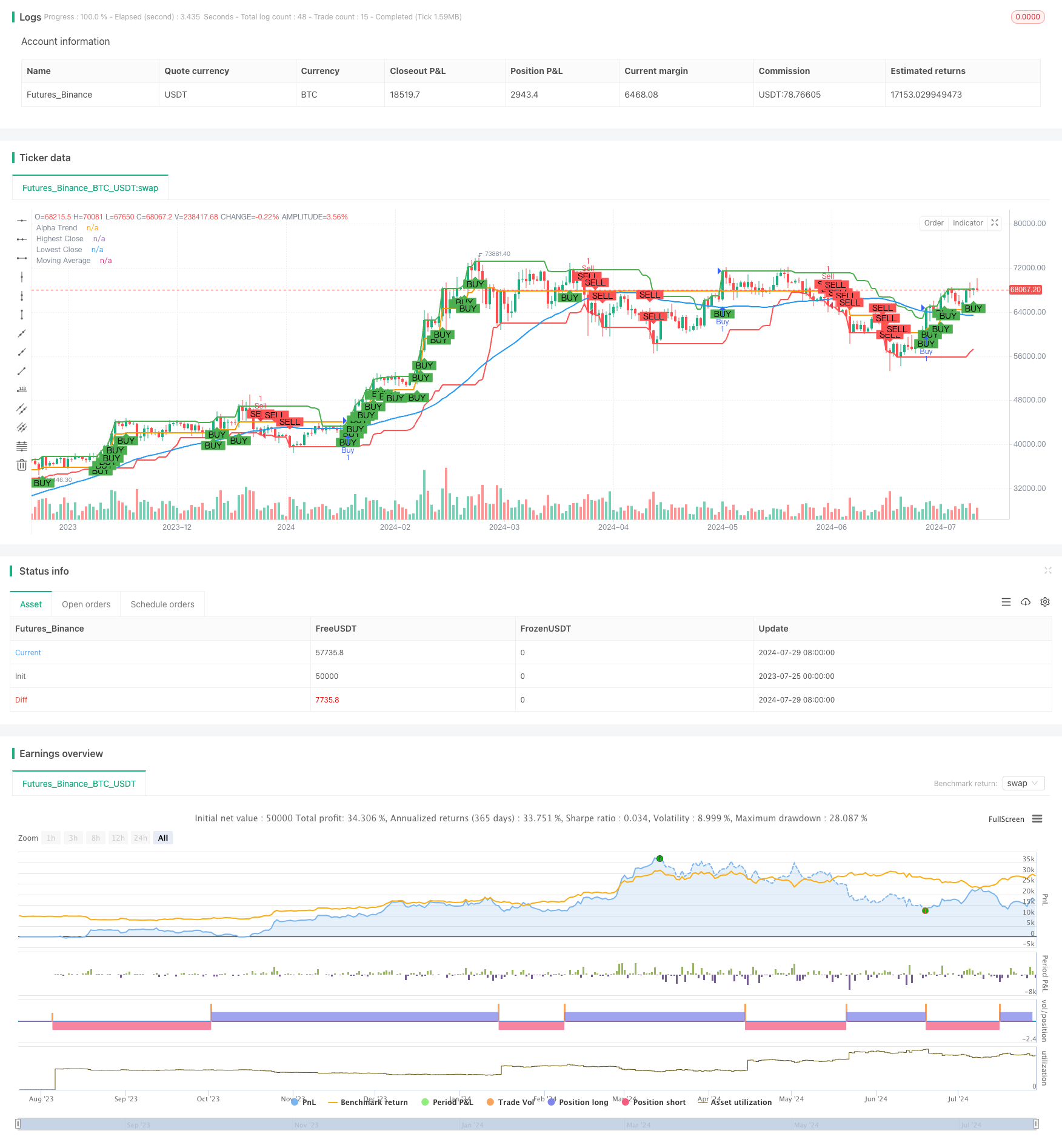

/*backtest

start: 2023-07-25 00:00:00

end: 2024-07-30 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("TRMUS", overlay=true)

// Kullanıcının ayarlayabileceği mum sayısı

length = input.int(20, minval=1, title="Number of Bars")

// Stop Loss ve Take Profit seviyeleri

stopLossPerc = input.float(2.0, title="Stop Loss %", minval=0.0) / 100.0

takeProfitPerc = input.float(4.0, title="Take Profit %", minval=0.0) / 100.0

// Trend filtresi için hareketli ortalama

maLength = input.int(50, minval=1, title="Moving Average Length")

ma = ta.sma(close, maLength)

// ATR ve Alpha Trend parametreleri

lengthATR = input.int(14, minval=1, title="ATR Length")

multiplier = input.float(1.5, minval=0.1, step=0.1, title="Multiplier")

// ATR hesaplaması

atr = ta.atr(lengthATR)

// Alpha Trend hesaplaması

upperLevel = close + (multiplier * atr)

lowerLevel = close - (multiplier * atr)

var float alphaTrend = na

alphaTrend := na(alphaTrend[1]) ? close : (close > lowerLevel[1] ? math.max(alphaTrend[1], lowerLevel) : close < upperLevel[1] ? math.min(alphaTrend[1], upperLevel) : alphaTrend[1])

// Son belirlenen mumun en yüksek ve en düşük kapanış fiyatlarını hesaplayalım

highestClose = ta.highest(close, length)

lowestClose = ta.lowest(close, length)

// Alım ve satım sinyalleri

buySignal = close > highestClose[1] and close[1] <= highestClose[1] and close > ma and close > alphaTrend

sellSignal = close < lowestClose[1] and close[1] >= lowestClose[1] and close < ma and close < alphaTrend

// Alım işlemi

if (buySignal)

strategy.entry("Buy", strategy.long, stop=close * (1 - stopLossPerc), limit=close * (1 + takeProfitPerc))

// Satım işlemi

if (sellSignal)

strategy.entry("Sell", strategy.short, stop=close * (1 + stopLossPerc), limit=close * (1 - takeProfitPerc))

// Grafik üzerine göstergeler ekleyelim

plot(highestClose, color=color.green, linewidth=2, title="Highest Close")

plot(lowestClose, color=color.red, linewidth=2, title="Lowest Close")

plot(ma, color=color.blue, linewidth=2, title="Moving Average")

plot(alphaTrend, color=color.orange, linewidth=2, title="Alpha Trend")

// Alım ve satım sinyalleri için işaretleyiciler ekleyelim

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")