概述

这是一个基于ATR(平均真实波幅)波动带和移动平均线的趋势跟踪策略。该策略利用ATR指标动态调整止盈止损位置,通过移动平均线判断市场趋势方向,实现对趋势的把握和风险的控制。策略的核心在于使用ATR波动带作为动态的退出机制,这使得策略能够根据市场波动性的变化自适应地调整持仓退出点位。

策略原理

策略主要包含三个核心部分: 1. ATR波动带的计算:使用14周期的ATR指标,通过将当前收盘价加减2倍ATR值来构建上下波动带。 2. 移动平均线系统:采用50周期简单移动平均线(SMA)作为趋势判断的基准。 3. 交易信号生成: - 入场信号:当价格向上穿越移动平均线时,开始做多。 - 退出信号:当价格触及上方ATR波动带或下方ATR波动带时,平仓退出。

该策略通过将趋势跟踪与波动率管理相结合,既能捕捉市场趋势,又能根据市场波动性的变化动态调整风险敞口。

策略优势

- 自适应性强:ATR指标能够根据市场波动率的变化自动调整止盈止损位置,使策略具有良好的市场适应性。

- 风险控制合理:通过设定ATR倍数,可以有效控制每笔交易的风险敞口。

- 趋势把握稳健:结合移动平均线,能够较好地识别市场趋势方向。

- 参数设置灵活:可以通过调整ATR周期、倍数和均线周期来适应不同市场环境。

- 执行逻辑清晰:入场和出场条件明确,避免了主观判断带来的干扰。

策略风险

- 震荡市场风险:在横盘震荡市场中可能产生频繁的假信号,导致过多交易成本。

- 滑点风险:在市场剧烈波动时,实际成交价格可能与理论价格存在较大偏差。

- 趋势反转风险:当市场趋势突然反转时,可能无法及时止损。

- 参数优化风险:不同市场环境下最优参数可能存在显著差异。

策略优化方向

引入趋势强度过滤:

- 可以添加ADX或DMI等趋势强度指标,过滤弱趋势环境下的交易信号。

- 在强趋势环境下调整ATR倍数,以获取更大的利润空间。

完善仓位管理:

- 根据ATR值动态调整持仓规模。

- 实现分批建仓和减仓机制。

增加市场环境识别:

- 引入波动率周期分析。

- 添加市场形态识别模块。

优化出场机制:

- 实现动态利润保护。

- 添加时间止损机制。

总结

该策略通过结合ATR波动带和移动平均线,构建了一个自适应性强、风险可控的趋势跟踪系统。策略的核心优势在于能够根据市场波动性的变化动态调整风险控制位置,同时通过移动平均线来把握市场趋势方向。虽然存在一些固有的风险,但通过提出的优化方向,可以进一步提升策略的稳定性和盈利能力。这是一个具有实践价值的策略框架,适合在实盘交易中进行深入研究和应用。

策略源码

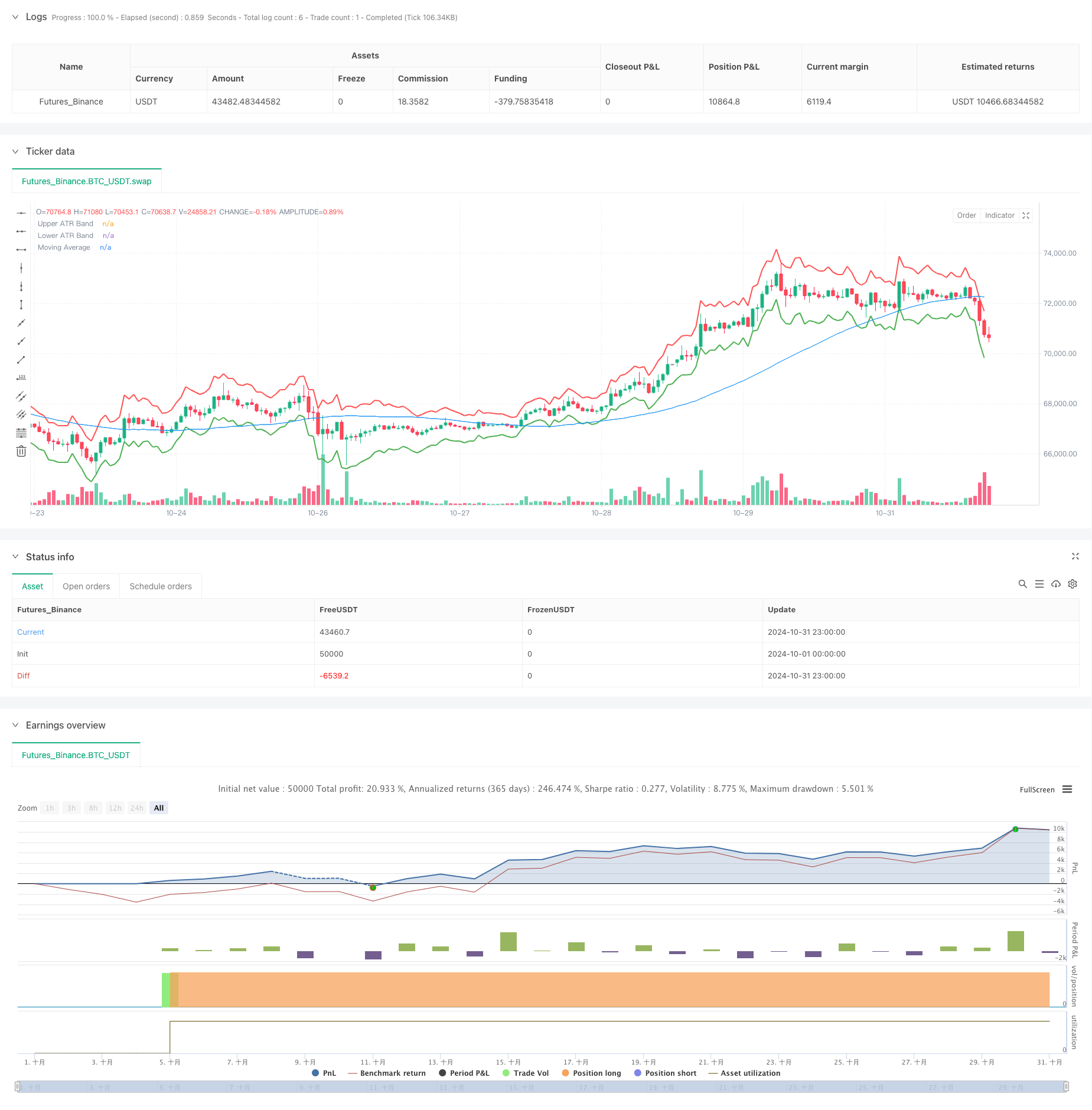

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ATR Band Exit Strategy", overlay=true)

// Define input parameters

atrLength = input(14, title="ATR Length")

atrMultiplier = input(2.0, title="ATR Multiplier")

maLength = input(50, title="Moving Average Length")

// Calculate ATR and moving average

atrValue = ta.atr(atrLength)

maValue = ta.sma(close, maLength)

// Calculate upper and lower ATR bands

upperBand = close + atrMultiplier * atrValue

lowerBand = close - atrMultiplier * atrValue

// Plot ATR bands

plot(upperBand, title="Upper ATR Band", color=color.red, linewidth=2)

plot(lowerBand, title="Lower ATR Band", color=color.green, linewidth=2)

// Entry condition (for demonstration: long if price above moving average)

longCondition = ta.crossover(close, maValue)

if (longCondition)

strategy.entry("Long", strategy.long)

// Exit conditions (exit if price crosses the upper or lower ATR bands)

if (close >= upperBand)

strategy.close("Long", comment="Exit on Upper ATR Band")

if (close <= lowerBand)

strategy.close("Long", comment="Exit on Lower ATR Band")

// Optional: Plot the moving average for reference

plot(maValue, title="Moving Average", color=color.blue)

相关推荐