Adaptive Trend Following Strategy Based on Momentum Oscillator

Author: ChaoZhang, Date: 2024-11-27 15:03:00Tags:

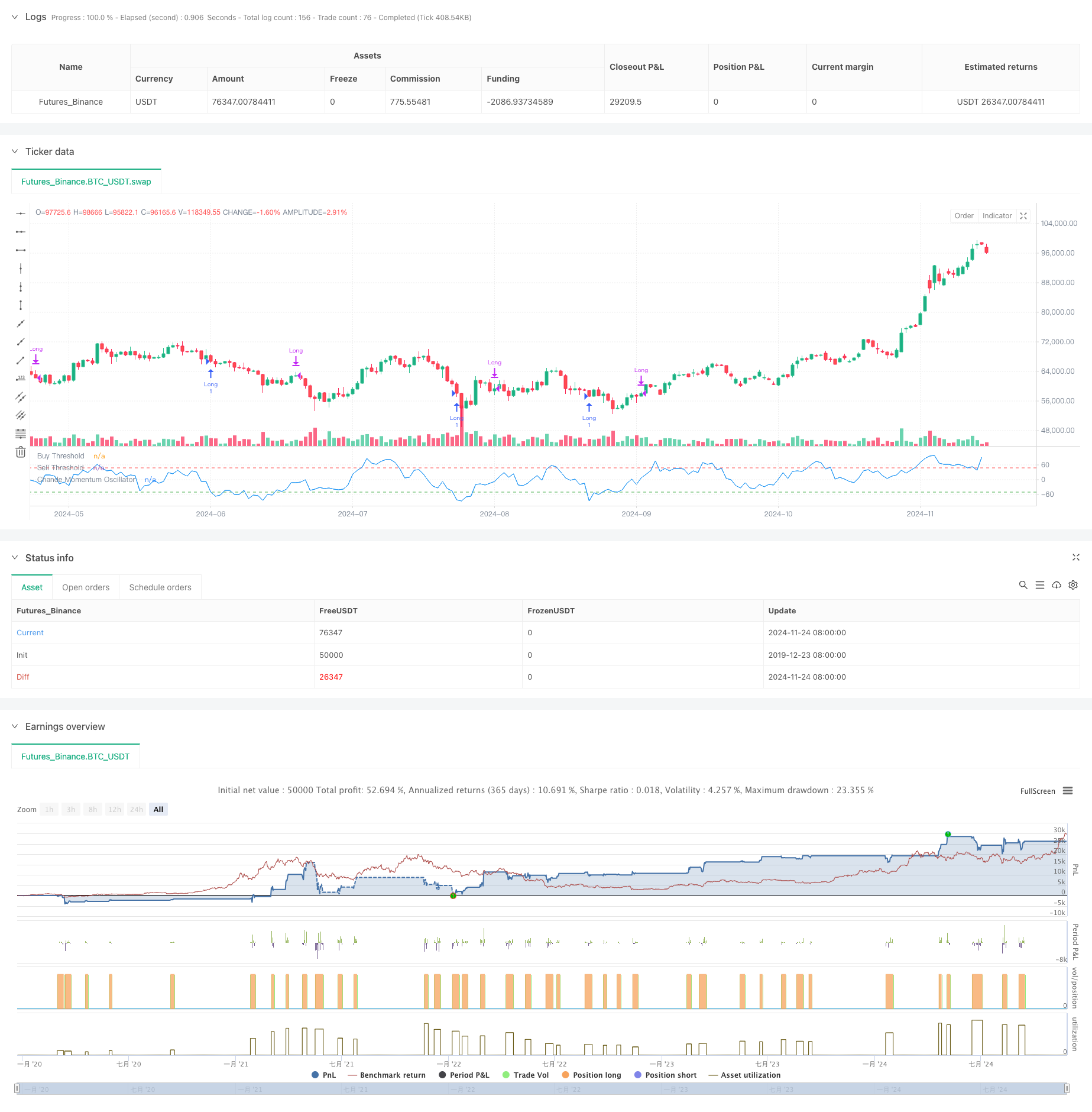

This strategy is a trend-following trading system based on the Chande Momentum Oscillator (CMO). It seeks buying opportunities in oversold regions and selling opportunities in overbought regions, while incorporating position holding time limits for risk management. This approach allows for capturing price reversals while avoiding frequent trading in ranging markets.

Strategy Principles

The core of the strategy uses the CMO indicator to measure market momentum. CMO generates an oscillator ranging from -100 to 100 by calculating the ratio of the difference between upward and downward movements to their sum. The system generates a long signal when CMO falls below -50, indicating an oversold market condition. Positions are closed when CMO exceeds 50 or when the holding period exceeds 5 cycles. This design captures price rebound opportunities while implementing timely profit-taking and stop-loss measures.

Strategy Advantages

- Clear Signals: Uses fixed CMO thresholds (-50 and 50) as trading signals, providing clear entry and exit rules.

- Risk Control: Implements position holding time limits to avoid maintaining unprofitable positions.

- Trend Following: Effectively tracks market trends by entering during oversold conditions and exiting when momentum weakens.

- Simple Calculation: CMO indicator calculation is intuitive and easy to understand and implement.

- Adaptability: Strategy parameters can be adjusted for different market conditions, showing good adaptability.

Strategy Risks

- False Breakout Risk: Frequent false signals may occur in ranging markets.

- Slippage Impact: Actual execution prices may significantly deviate from signal prices in fast markets.

- Parameter Sensitivity: Strategy performance is highly dependent on CMO period and threshold selections.

- Market Condition Dependency: May underperform in markets without clear trends.

- Delay Risk: CMO as a lagging indicator may result in slightly delayed entry and exit timing.

Strategy Optimization Directions

- Dynamic Thresholds: Implement dynamic adjustment of CMO entry and exit thresholds based on market volatility.

- Multiple Timeframes: Introduce CMO indicators from multiple timeframes to improve signal reliability.

- Stop-Loss Optimization: Add trailing stop-loss functionality for better profit protection.

- Position Management: Adjust position sizes based on CMO strength for more refined position control.

- Market Filtering: Add trend filters to only trade in clearly trending markets.

Summary

This momentum-based trend following strategy captures market overbought and oversold opportunities using the CMO indicator. The strategy design is rational, with clear trading rules and risk control mechanisms. While inherent risks exist, optimization can further enhance strategy stability and profitability. The strategy is particularly suitable for highly volatile markets and can achieve good returns during clear trending phases.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Chande Momentum Oscillator Strategy", overlay=false)

// Input for the CMO period

cmoPeriod = input.int(9, minval=1, title="CMO Period")

// Calculate price changes

priceChange = ta.change(close)

// Separate positive and negative changes

up = priceChange > 0 ? priceChange : 0

down = priceChange < 0 ? -priceChange : 0

// Calculate the sum of ups and downs using a rolling window

sumUp = ta.sma(up, cmoPeriod) * cmoPeriod

sumDown = ta.sma(down, cmoPeriod) * cmoPeriod

// Calculate the Chande Momentum Oscillator (CMO)

cmo = 100 * (sumUp - sumDown) / (sumUp + sumDown)

// Define the entry and exit conditions

buyCondition = cmo < -50

sellCondition1 = cmo > 50

sellCondition2 = ta.barssince(buyCondition) >= 5

// Track if we are in a long position

var bool inTrade = false

if (buyCondition and not inTrade)

strategy.entry("Long", strategy.long)

inTrade := true

if (sellCondition1 or sellCondition2)

strategy.close("Long")

inTrade := false

// Plot the Chande Momentum Oscillator

plot(cmo, title="Chande Momentum Oscillator", color=color.blue)

hline(-50, "Buy Threshold", color=color.green)

hline(50, "Sell Threshold", color=color.red)

- Multi-SMA Support Level False Breakout Strategy with ATR Stop-Loss System

- EMA Crossover Strategy with Stop Loss and Take Profit Optimization System

- VWAP-MACD-RSI Multi-Factor Quantitative Trading Strategy

- Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

- Z-Score and Supertrend Based Dynamic Trading Strategy: Long-Short Switching System

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration

- Multi-Period Moving Average Crossover with Volume Analysis System

- Dual Moving Average Momentum Tracking Quantitative Strategy

- Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

- PVT-EMA Trend Crossover Volume-Price Strategy

- MACD-EMA Multi-Period Dynamic Crossover Quantitative Trading System

- MACD Dynamic Oscillation Cross-Prediction Strategy

- VWAP-ATR Dynamic Price Action Trading System

- Dynamic Trend Quantitative Strategy Based on Bollinger Bands and RSI Cross

- Mean Reversion Strategy with Bollinger Bands, RSI and ATR-Based Dynamic Stop-Loss System

- Dynamic Trading Strategy System Based on Parabolic SAR Indicator

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS)

- Advanced Trend Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- ATR Volatility and Moving Average Based Adaptive Trend Following Exit Strategy