MACD Dynamic Oscillation Cross-Prediction Strategy

Author: ChaoZhang, Date: 2024-11-27 14:54:02Tags: MACDEMASMAROC

Overview

This strategy bases trading decisions on the dynamic characteristics of the MACD (Moving Average Convergence Divergence) indicator. The core approach focuses on observing changes in the MACD histogram to predict potential golden and death crosses, allowing for early position establishment. The strategy goes beyond traditional MACD crossover signals by emphasizing the dynamic characteristics of the histogram to obtain better entry timing.

Strategy Principles

The strategy employs a modified MACD indicator system, incorporating the difference between fast (EMA12) and slow (EMA26) moving averages, along with a 2-period signal line. The core trading logic is based on several key points:

- Calculating histogram rate of change (hist_change) to judge trend dynamics

- Anticipating golden cross signals by entering long positions when the histogram is negative and shows an upward trend for three consecutive periods

- Anticipating death cross signals by closing positions when the histogram is positive and shows a downward trend for three consecutive periods

- Implementing a time filtering mechanism to trade only within specified time ranges

Strategy Advantages

- Strong Signal Prediction: Anticipates potential crossover signals by observing histogram dynamics, improving entry timing

- Reasonable Risk Control: Incorporates 0.1% commission and 3-point slippage, reflecting realistic trading conditions

- Flexible Capital Management: Uses percentage-based position sizing relative to account equity for effective risk control

- Excellent Visualization: Uses color-coded histograms and arrow markers for trade signals, facilitating analysis

Strategy Risks

- False Breakout Risk: Frequent false signals may occur in ranging markets

- Lag Risk: Despite predictive mechanisms, MACD retains some inherent lag

- Market Environment Dependency: Strategy performs better in trending markets, potentially underperforming in ranging conditions

- Parameter Sensitivity: Strategy performance is highly dependent on fast and slow line period settings

Optimization Directions

- Market Environment Filtering: Add trend identification indicators to adjust trading parameters based on market conditions

- Position Management Enhancement: Implement dynamic position sizing based on signal strength

- Stop Loss Implementation: Add trailing or fixed stop losses to control drawdown

- Signal Confirmation Enhancement: Incorporate additional technical indicators for cross-validation

- Parameter Optimization: Implement adaptive parameters that adjust based on market conditions

Summary

This strategy innovatively utilizes the dynamic characteristics of the MACD histogram to improve upon traditional MACD trading systems. The predictive mechanism provides earlier entry signals, while strict trading conditions and risk control measures ensure strategy stability. With further optimization and refinement, this strategy shows promise for improved performance in actual trading conditions.

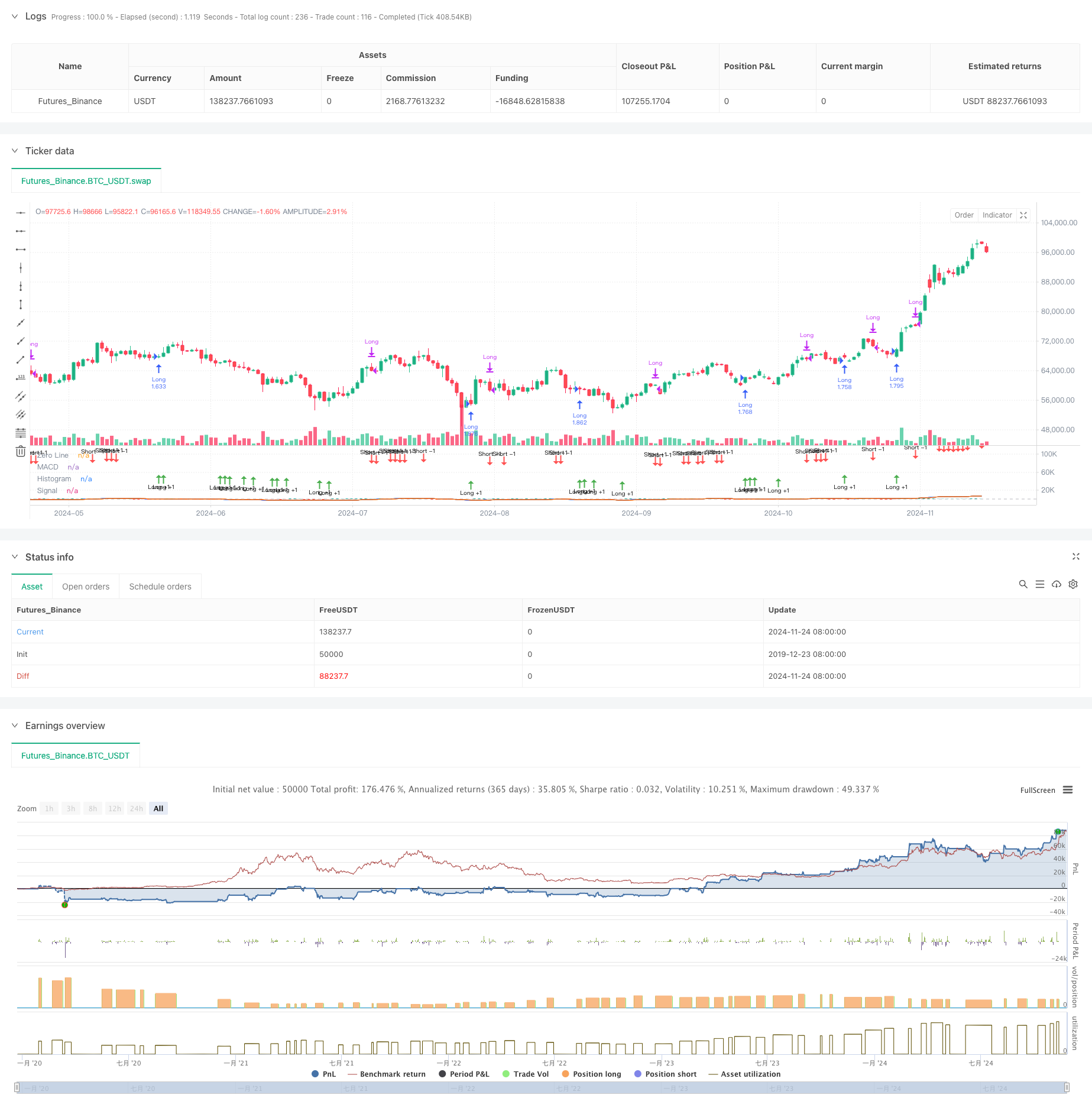

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Demo GPT - Moving Average Convergence Divergence", shorttitle="MACD", commission_type=strategy.commission.percent, commission_value=0.1, slippage=3, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Getting inputs

fast_length = input(title="Fast Length", defval=12)

slow_length = input(title="Slow Length", defval=26)

src = input(title="Source", defval=close)

signal_length = input.int(title="Signal Smoothing", minval=1, maxval=50, defval=2) // Set smoothing line to 2

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"])

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"])

// Date inputs

start_date = input(title="Start Date", defval=timestamp("2018-01-01T00:00:00"))

end_date = input(title="End Date", defval=timestamp("2069-12-31T23:59:59"))

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

// Strategy logic

isInDateRange = true

// Calculate the rate of change of the histogram

hist_change = hist - hist[1]

// Anticipate a bullish crossover: histogram is negative, increasing, and approaching zero

anticipate_long = isInDateRange and hist < 0 and hist_change > 0 and hist > hist[1] and hist > hist[2]

// Anticipate an exit (bearish crossover): histogram is positive, decreasing, and approaching zero

anticipate_exit = isInDateRange and hist > 0 and hist_change < 0 and hist < hist[1] and hist < hist[2]

if anticipate_long

strategy.entry("Long", strategy.long)

if anticipate_exit

strategy.close("Long")

// Plotting

hline(0, "Zero Line", color=color.new(#787B86, 50))

plot(hist, title="Histogram", style=plot.style_columns, color=(hist >= 0 ? (hist > hist[1] ? #26A69A : #B2DFDB) : (hist < hist[1] ? #FF5252 : #FFCDD2)))

plot(macd, title="MACD", color=#2962FF)

plot(signal, title="Signal", color=#FF6D00)

// Plotting arrows when anticipating the crossover

plotshape(anticipate_long, title="Long +1", location=location.belowbar, color=color.green, style=shape.arrowup, size=size.tiny, text="Long +1")

plotshape(anticipate_exit, title="Short -1", location=location.abovebar, color=color.red, style=shape.arrowdown, size=size.tiny, text="Short -1")

- K's Reversal Indicator I

- CM MACD Custom Indicator - Multiple Time Frame - V2

- Dual MACD Trend Confirmation Trading System

- ZeroLag MACD Long Short Strategy

- Zero Lag MACD Dual Crossover Trading Strategy - High-Frequency Trading Based on Short-Term Trend Capture

- Moving Average Crossover + MACD Slow Line Momentum Strategy

- MACD Multi-Interval Dynamic Stop-Loss and Take-Profit Trading System

- MACD and Martingale Combination Strategy for Optimized Long Trading

- Dual Moving Average MACD Crossover Date-Adjustable Quantitative Trading Strategy

- MACD BB Breakout Strategy

- Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

- Z-Score and Supertrend Based Dynamic Trading Strategy: Long-Short Switching System

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration

- Multi-Period Moving Average Crossover with Volume Analysis System

- Dual Moving Average Momentum Tracking Quantitative Strategy

- Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

- Adaptive Trend Following Strategy Based on Momentum Oscillator

- PVT-EMA Trend Crossover Volume-Price Strategy

- MACD-EMA Multi-Period Dynamic Crossover Quantitative Trading System

- VWAP-ATR Dynamic Price Action Trading System

- Dynamic Trend Quantitative Strategy Based on Bollinger Bands and RSI Cross

- Mean Reversion Strategy with Bollinger Bands, RSI and ATR-Based Dynamic Stop-Loss System

- Dynamic Trading Strategy System Based on Parabolic SAR Indicator

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS)

- Advanced Trend Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- ATR Volatility and Moving Average Based Adaptive Trend Following Exit Strategy

- Dual EMA Momentum Trend Trading Strategy with Full Body Candle Signal System

- Dual Timeframe Supertrend with RSI Optimization System

- Dual Moving Average Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit System