KNN-Based Adaptive Parametric Trend Following Strategy

Author: ChaoZhang, Date: 2024-11-29 10:54:49Tags: MAKNNSMA

Overview

This strategy is an adaptive parametric trend following system based on the K-Nearest Neighbors (KNN) machine learning algorithm. The strategy dynamically adjusts trend following parameters through the KNN algorithm and generates trading signals in combination with moving averages. The system can automatically adjust strategy parameters based on changes in market conditions, improving strategy adaptability and stability. This strategy combines machine learning methods to optimize traditional trend following strategies, representing a fusion of technology and innovation in quantitative investment.

Strategy Principle

The core principle of the strategy is to analyze historical price data using the KNN algorithm and predict price trends by calculating the similarity between current market conditions and historical data. The specific implementation steps are:

- Set observation window size and K value, collect historical price data to form feature vectors

- Calculate Euclidean distance between current price sequence and historical data

- Select K most similar historical price sequences as neighbor samples

- Analyze subsequent price movements of these K neighbor samples

- Generate trading signals based on average price changes of neighbor samples combined with moving averages When the average price change of K neighbor samples is positive and current price is above the moving average, the system generates long signals; otherwise, it generates short signals.

Strategy Advantages

- Strong adaptability: KNN algorithm can automatically adjust parameters based on market environment changes

- Multi-dimensional analysis: Combines machine learning algorithms and technical indicators for more comprehensive market analysis

- Reasonable risk control: Uses moving averages as auxiliary confirmation to reduce impact of false signals

- Clear computational logic: Strategy execution process is transparent and easy to understand and optimize

- Flexible parameters: K value and window size can be adjusted according to different market environments

Strategy Risks

- High computational complexity: KNN algorithm requires calculating large amounts of historical data

- Parameter sensitivity: Choice of K value and window size significantly impacts strategy performance

- Market environment dependence: Reference value of historical similarity may decrease in volatile markets

- Overfitting risk: Over-reliance on historical data may lead to strategy overfitting

- Delay risk: Signal lag may exist due to need for sufficient historical data collection

Strategy Optimization Directions

- Feature Engineering Optimization:

- Add more technical indicators as features

- Introduce market sentiment indicators

- Optimize feature standardization methods

- Algorithm Efficiency Improvement:

- Optimize nearest neighbor search using KD-trees

- Implement parallel computing

- Optimize data storage and access methods

- Risk Control Enhancement:

- Add stop-loss and take-profit mechanisms

- Introduce volatility filters

- Design dynamic position management system

- Parameter Optimization Solutions:

- Implement adaptive K value selection

- Dynamically adjust observation window size

- Optimize moving average periods

- Signal Generation Mechanism Improvement:

- Introduce signal strength scoring system

- Design signal confirmation mechanism

- Optimize entry and exit timing

Summary

This strategy innovatively applies the KNN algorithm to trend following trading, optimizing traditional technical analysis strategies through machine learning methods. The strategy possesses strong adaptability and flexibility, capable of dynamically adjusting parameters based on market conditions. Although risks such as high computational complexity and parameter sensitivity exist, the strategy still has good application value through reasonable optimization and risk control measures. It is recommended that investors adjust parameters according to market characteristics and combine other analysis methods for trading decisions in practical applications.

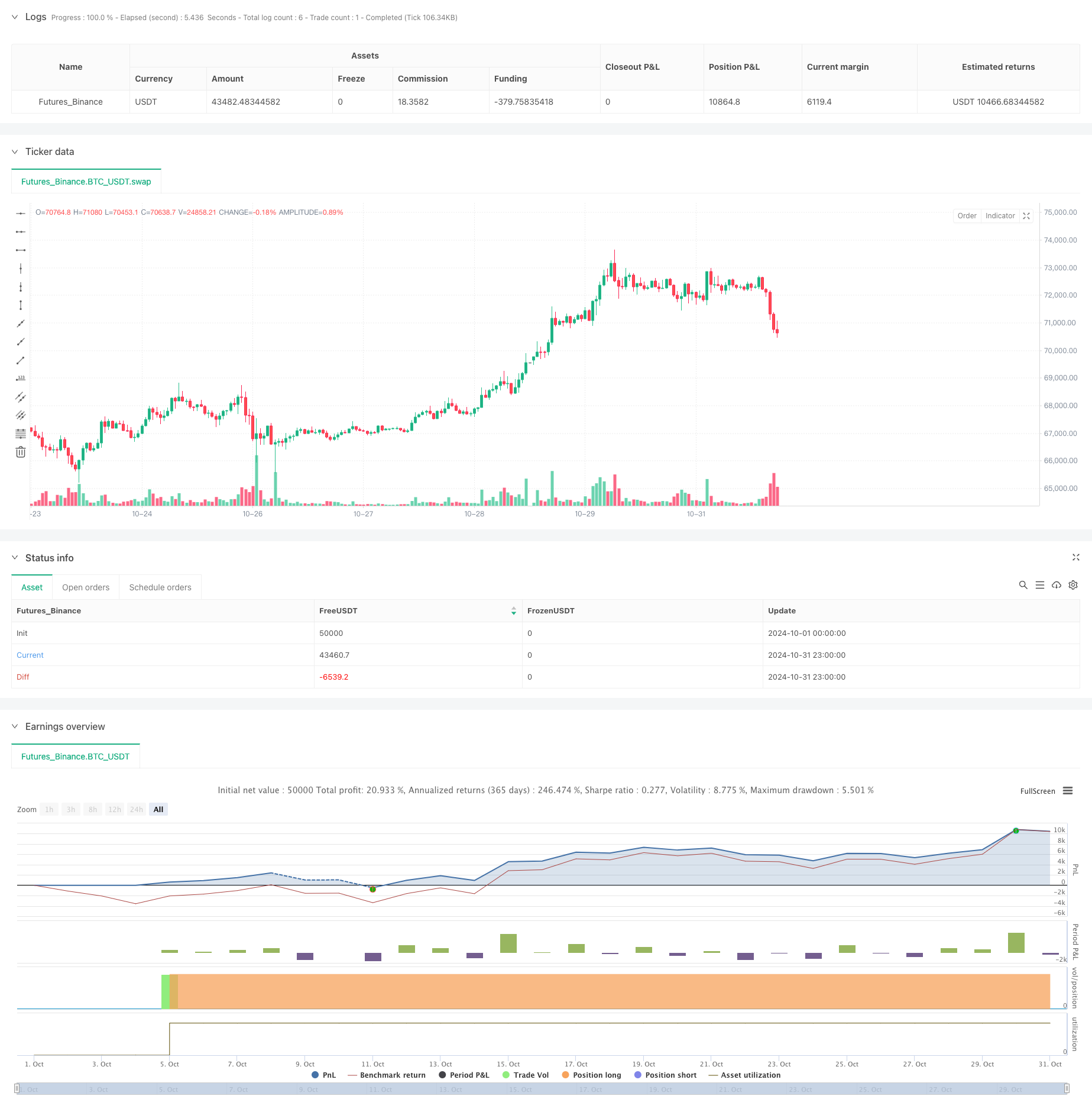

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Trend Following Strategy with KNN", overlay=true,commission_value=0.03,currency='USD', commission_type=strategy.commission.percent,default_qty_type=strategy.cash)

// Input parameters

k = input.int(5, title="K (Number of Neighbors)", minval=1) // Number of neighbors for KNN algorithm

window_size = input.int(20, title="Window Size", minval=1) // Window size for feature vector calculation

ma_length = input.int(50, title="MA Length", minval=1) // Length of the moving average

// Calculate moving average

ma = ta.sma(close, ma_length)

// Initialize variables

var float[] features = na

var float[] distances = na

var int[] nearest_neighbors = na

if bar_index >= window_size - 1 // Ensure there is enough historical data

features := array.new_float(0) // Keep only the current window data

for i = 0 to window_size - 1

array.push(features, close[i])

// Calculate distances

distances := array.new_float(0) // Clear the array for each calculation

for i = 0 to window_size - 1 // Calculate the distance between the current price and all prices in the window

var float distance = 0.0

for j = 0 to window_size - 1

distance += math.pow(close[j] - array.get(features, j), 2)

distance := math.sqrt(distance)

array.push(distances, distance)

// Find the nearest neighbors

if array.size(distances) > 0 and array.size(distances) >= k

nearest_neighbors := array.new_int(0)

for i = 0 to k - 1

var int min_index = -1

var float min_distance = na

for j = 0 to array.size(distances) - 1

if na(min_distance) or array.get(distances, j) < min_distance

min_index := j

min_distance := array.get(distances, j)

if min_index != -1

array.push(nearest_neighbors, min_index)

array.remove(distances, min_index) // Remove the processed neighbor

// Calculate the average price change of the neighbors

var float average_change = 0.0

if array.size(nearest_neighbors) > 0

for i = 0 to array.size(nearest_neighbors) - 1

var int index = array.get(nearest_neighbors, i)

// Ensure index + 1 is within range

if index + 1 < bar_index

average_change += (close[index] - close[index + 1])

average_change := average_change / array.size(nearest_neighbors)

// Generate trading signals

if average_change > 0 and close > ma

strategy.entry("Long", strategy.long)

else if average_change < 0 and close < ma

strategy.entry("Short", strategy.short)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- SMA Dual Moving Average Trading Strategy

- Adaptive Risk Management Strategy Based on Dual Moving Average Golden Cross

- Moving Average Crossover Strategy Based on Dual Moving Averages

- MA Cross Strategy

- MA,SMA Dual Moving Average Crossover Strategy

- Moving Average Crossover with Multiple Take Profits Strategy

- Moving Average Crossover Strategy

- Dual Moving Average Crossover Strategy

- Cloud Momentum Crossover Strategy with Moving Averages and Volume Confirmation

- Dual EMA Crossover Trend Following Strategy with Risk Management and Time Filtering System

- Double Smoothed Moving Average Trend Following Strategy - Based on Modified Heikin-Ashi

- MACD Multi-Interval Dynamic Stop-Loss and Take-Profit Trading System

- Dynamic Trading System with Stochastic RSI and Candlestick Confirmation

- Dual Moving Average Trend Following Strategy with ATR-Based Risk Management System

- Multi-Technical Indicator Dynamic Adaptive Trading Strategy (MTDAT)

- Adaptive FVG Detection and MA Trend Trading Strategy with Dynamic Resistance

- Multi-Frequency Momentum Reversal Quantitative Strategy System

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Dynamic Dual-SMA Trend Following Strategy with Smart Risk Management

- Multi-Period Trend Following Trading System Based on EMA Volatility Bands

- Random bidding generator for the retesting system

- Multi-Timeframe EMA Cross High-Win Rate Trend Following Strategy (Advanced)

- Adaptive Range Volatility Trend Following Trading Strategy

- Dual Moving Average Trend Following Trading System with Risk-Reward Ratio Optimization Strategy

- Moving Average Crossover and Candlestick Pattern Smart Timing Strategy

- Dynamic Dual Moving Average Crossover Quantitative Trading Strategy

- Bollinger Bands and RSI Combined Trading Strategy

- Multi-EMA Trend Following Strategy with Dynamic ATR Targets

- Elder's Force Index Quantitative Trading Strategy Based on Standard Deviation and Moving Averages