移动平均线交叉策略

Author: ChaoZhang, Date: 2024-06-03 11:25:43Tags: SMAMA

概述

本文介绍了一种基于移动平均线交叉原理的量化交易策略。该策略通过比较价格与移动平均线的关系,判断多空方向,同时设置止盈止损点位来控制风险。策略代码使用Pine Script编写,整合了Dhan交易平台的API,可以实现策略信号的自动化交易。

策略原理

该策略的核心是移动平均线,通过计算一定周期内收盘价的简单移动平均值作为趋势判断依据。当价格上穿均线时产生做多信号,下穿则产生做空信号。同时,使用exrem函数过滤连续重复信号,提高信号质量。策略会根据当前持仓方向和价格与均线的位置关系,设置相应的止盈止损价位,控制每笔交易的风险和收益。

策略优势

移动平均线交叉是一种简单易用的趋势跟踪方法,可以有效捕捉市场的中长期趋势。通过合理设置参数,该策略可以在趋势行情中获得稳定收益。止盈止损的设置有利于控制回撤,提高风险收益比。策略代码逻辑清晰,使用了函数模块化,可读性和扩展性强。此外,策略整合Dhan平台API,实现了信号的自动化下单交易,提高了执行效率。

策略风险

移动平均线本质上是滞后指标,在市场转折时,信号可能出现延迟,导致错失最佳交易时机或产生虚假信号。参数设置不当会影响策略表现,需要根据不同市场特点和周期进行优化。固定百分比止盈止损可能无法适应市场波动率的变化,也存在参数设置不当带来损失的风险。

策略优化方向

- 可以尝试使用多个不同周期均线组合来提高信号可靠性,如双均线、三均线交叉等。

- 对止盈止损的设置可以进一步优化,如根据ATR等波动率指标动态调整,或者采用追踪止损策略。

- 可以加入更多过滤条件,如价格突破重要支撑阻力位、交易量变化等,提高信号质量。

- 在实盘应用中,需要做好策略的回测验证和资金管理,控制单笔交易风险和总体回撤。

总结

移动平均线交叉策略是一种简单实用的量化交易策略,通过趋势跟踪和止盈止损控制,可以在趋势行情中获利。但策略本身存在一定局限性,需要根据市场特点和风险偏好进行优化和改进。在实际应用中,还需要注意严格执行纪律,控制好风险。策略编程可以借助Pine Script等专业语言,整合交易平台API,实现策略的自动化执行。

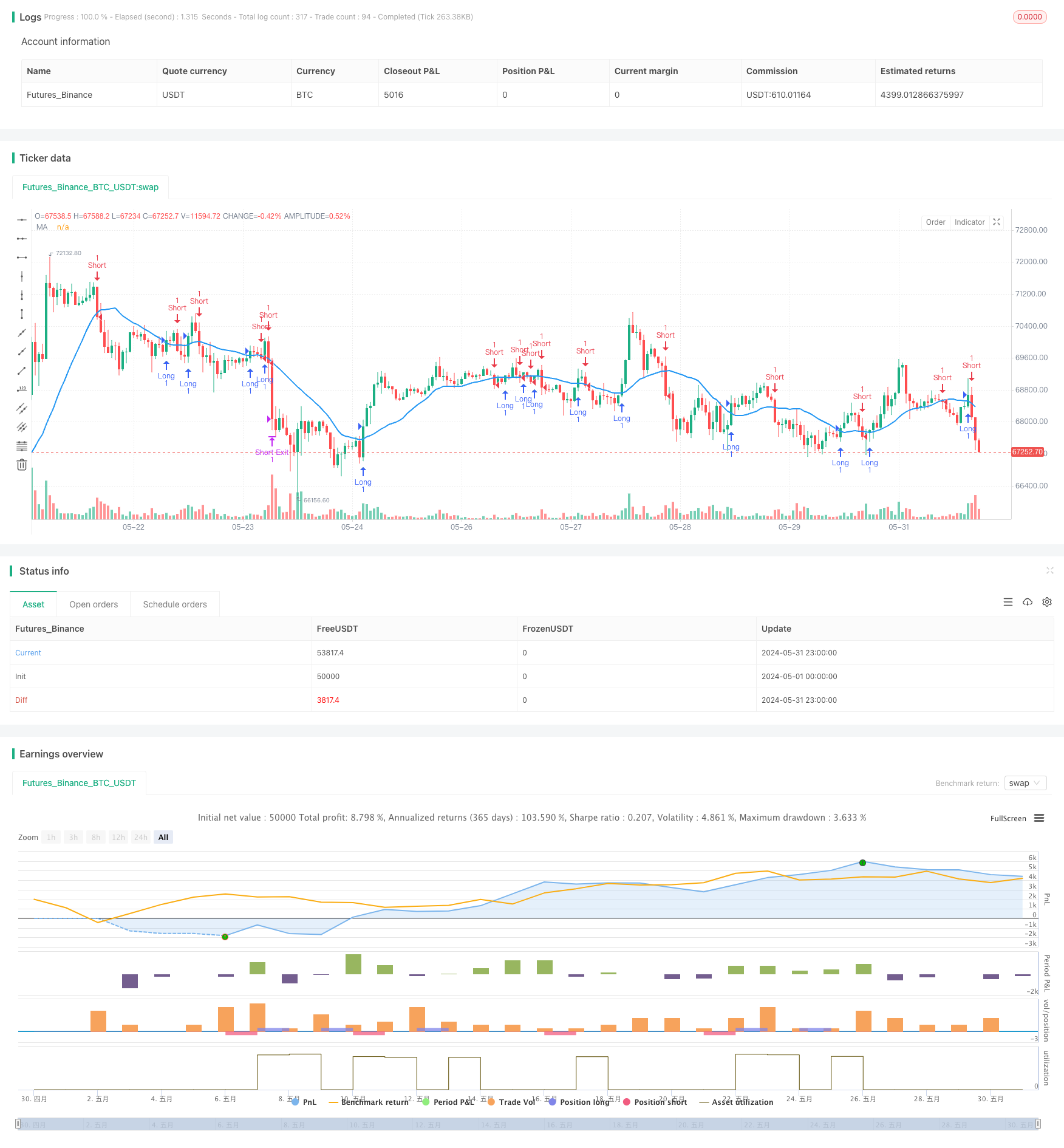

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © syam-mohan-vs @ T7 - wwww.t7wealth.com www.t7trade.com

//This is an educational code done to describe the fundemantals of pine scritpting language and integration with Indian discount broker Dhan. This strategy is not tested or recommended for live trading.

//@version=5

strategy("Pine & Dhan - Moving Average Crossover Strategy", overlay=true)

//Remove excess signals

exrem(condition1, condition2) =>

temp = false

temp := na(temp[1]) ? false : not temp[1] and condition1 ? true : temp[1] and condition2 ? false : temp[1]

ta.change(temp) == true ? true : false

// Define MA period

ma_period = input(20, title = "MA Length")

// Define target and stop loss levels

target_percentage = input.float(title="Target Profit (%)", defval=2.0)

stop_loss_percentage = input.float(title="Stop Loss (%)", defval=1.0)

// Calculate the MA

ma = ta.sma(close, ma_period)

// Entry conditions

long_entry = close >= ma

short_entry = close < ma

// Calculate target and stop loss prices

target_price = long_entry ? strategy.position_avg_price + (close * (target_percentage / 100)) : strategy.position_avg_price - (close * (target_percentage / 100))

stop_loss_price = short_entry ? strategy.position_avg_price + (close * (stop_loss_percentage/ 100)) : strategy.position_avg_price - (close * (stop_loss_percentage / 100))

long_entry := exrem(long_entry,short_entry)

short_entry := exrem(short_entry,long_entry)

// Plot the MA

plot(ma, color=color.blue, linewidth=2, title="MA")

// Plot the entry and exit signals

plotshape(long_entry, style=shape.arrowup, color=color.green, size=size.small,location = location.belowbar)

plotshape(short_entry, style=shape.arrowdown, color=color.red, size=size.small,location = location.abovebar)

//Find absolute value of positon size to exit position properly

size = math.abs(strategy.position_size)

//Replace these four JSON strings with those generated from user Dhan account

long_msg = '{"secret":"C0B2u","alertType":"multi_leg_order","order_legs":[{"transactionType":"B","orderType":"MKT","quantity":"1","exchange":"NSE","symbol":"NIFTY1!","instrument":"FUT","productType":"I","sort_order":"1","price":"0"}]}'

long_exit_msg = '{"secret":"C0B2u","alertType":"multi_leg_order","order_legs":[{"transactionType":"S","orderType":"MKT","quantity":"1","exchange":"NSE","symbol":"NIFTY1!","instrument":"FUT","productType":"M","sort_order":"1","price":"0"}]}'

short_msg = '{"secret":"C0B2u","alertType":"multi_leg_order","order_legs":[{"transactionType":"S","orderType":"MKT","quantity":"1","exchange":"NSE","symbol":"NIFTY1!","instrument":"FUT","productType":"M","sort_order":"1","price":"0"}]}'

short_exit_msg = '{"secret":"C0B2u","alertType":"multi_leg_order","order_legs":[{"transactionType":"B","orderType":"MKT","quantity":"1","exchange":"NSE","symbol":"NIFTY1!","instrument":"FUT","productType":"M","sort_order":"1","price":"0"}]}'

// Submit orders based on signals

if(strategy.position_size == 0)

if long_entry

strategy.order("Long", strategy.long,alert_message=long_msg)

if short_entry

strategy.order("Short", strategy.short,alert_message=short_msg)

if(strategy.position_size > 0)

if(short_entry)

strategy.order("Short", strategy.short, qty = size, alert_message=short_msg)

else

strategy.exit("Long Exit", from_entry="Long", qty = size, stop=stop_loss_price, limit= target_price, alert_message=long_exit_msg)

if(strategy.position_size < 0)

if(long_entry)

strategy.order("Long", strategy.long, qty = size, alert_message=long_msg)

else

strategy.exit("Short Exit", from_entry="Short", qty = size, stop=stop_loss_price, limit= target_price, alert_message=short_exit_msg)

相关内容

- 均线,简单移动平均线,均线斜率,追踪止损,重新进场

- 双均线交叉动态持仓策略

- 移动平均交叉策略

- SMA双均线交易策略

- 基于多均线的趋势交易策略

- 趋势捕捉策略

- 双均线交叉自适应参数择时交易策略

- 基于双均线交叉的移动平均线策略

- 双均线动量交易策略:基于时间优化的趋势跟踪系统

- 多重移动平均与随机震荡交叉量化策略

更多内容

- MACD与R:R比率日内限制收敛策略

- 星光移动平均交叉策略

- 百分比阈值量化交易策略

- 基于双均线交叉的移动平均线策略

- MACD与Supertrend组合策略

- 基于量价信号和烛台模式的买卖策略

- SMA趋势跟踪策略

- EMA与布林带突破策略

- 基于CDC行动区的ATR止盈止损交易机器人策略

- 基于连续K线动态网格自适应均线动态止损策略

- 趋势跟随与动量过滤相结合的交易策略

- RSI与线性回归通道交易策略

- 双重Vegas通道波动性调整SuperTrend量化交易策略

- EMA与RSI交叉策略

- 移动平均聚合动量云策略

- 双均线交叉止盈止损策略

- TEMA双均线交叉策略

- 多时间尺度SMA趋势跟踪与动态止损策略

- Bollinger Bands准确入场和风险控制策略

- 基于波动率和动量指标的波林格带+RSI+随机RSI策略