Dual EMA Trend-Following Strategy with Limit Buy Entry

Author: ChaoZhang, Date: 2024-12-11 11:11:32Tags: EMASLTPROI

Overview

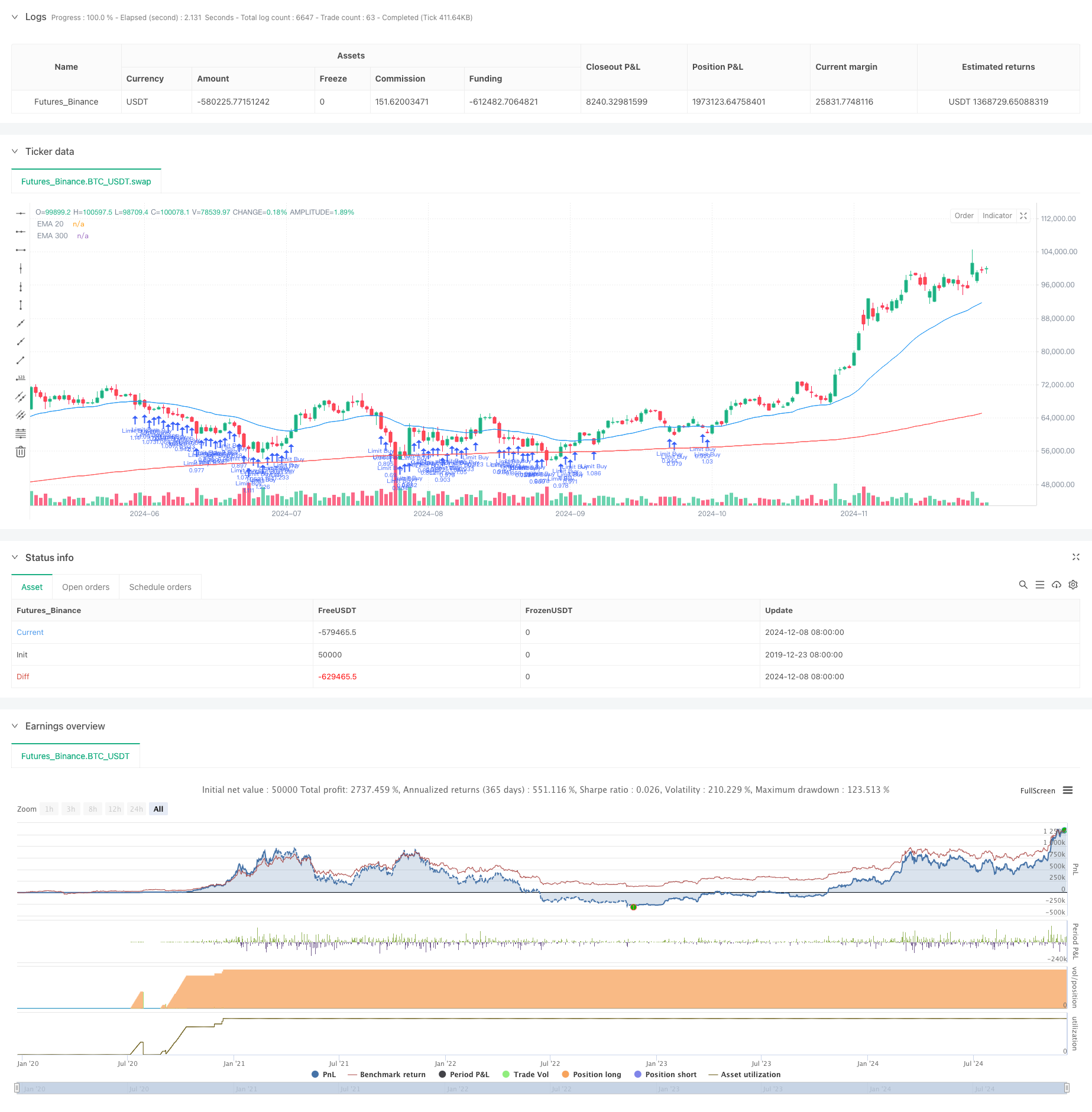

This strategy is a trend-following trading system based on a dual exponential moving average (EMA) framework, implementing limit buy orders at the EMA20 level. It employs a conservative money management approach, utilizing only 10% of account equity per trade and incorporating take-profit and stop-loss levels for risk management. The strategy uses two EMA periods (30 and 300 days) to determine market trends and only seeks entry opportunities during upward trending markets.

Strategy Principles

The core logic of the strategy is based on several key elements: 1. Uses EMA300 as a trend filter, only considering long positions when price is above EMA300, ensuring trade direction aligns with the main trend. 2. Places limit buy orders at the EMA20 level when trend conditions are met, allowing for entries at relatively lower prices during pullbacks to moving average support. 3. Implements fixed percentage-based take-profit and stop-loss levels, defaulting to 10% for profit targets and 5% for stop-losses, maintaining a risk-reward ratio greater than 2:1. 4. Employs position sizing at 10% of account equity, effectively reducing risk exposure per trade through conservative money management.

Strategy Advantages

- Trend Following Characteristics: Effectively identifies and follows market trends by combining long and short-term moving averages, improving trade success rate.

- Comprehensive Risk Control: Implements fixed stop-losses and money management rules to effectively control risk per trade.

- Optimized Entry Prices: Uses limit orders at EMA20 to achieve better entry prices, enhancing overall returns.

- High Automation Level: Fully systematic approach reduces emotional interference in trading decisions.

- Rational Money Management: Uses fixed percentage of account equity for trading, enabling compound growth of capital.

Strategy Risks

- Consolidation Market Risk: Strategy may experience frequent stop-losses during sideways, choppy markets leading to consecutive losses.

- Slippage Risk: Limit orders may not fully execute or experience significant slippage during volatile market conditions.

- Trend Reversal Risk: Despite using long-term moving average as a filter, significant losses may occur during initial trend reversals.

- Capital Efficiency Issues: Conservative money management approach may limit profit potential during strong trending markets.

Strategy Optimization Directions

- Dynamic Stop Levels: Adjust take-profit and stop-loss percentages based on market volatility to improve strategy adaptability.

- Multiple Trend Confirmation: Add supplementary technical indicators like RSI or MACD to enhance entry signal reliability.

- Market Environment Filtering: Incorporate volatility indicators like ATR to adjust strategy parameters or pause trading in different market conditions.

- Money Management Optimization: Consider dynamic position sizing based on account performance, moderately increasing exposure during profitable periods.

- Entry Mechanism Enhancement: Consider implementing a price range around EMA20 to increase execution opportunities.

Summary

This strategy combines a moving average system with strict risk control rules to create a relatively robust trading system. Its core strengths lie in its trend-following characteristics and comprehensive risk management mechanisms, optimizing entry prices through limit orders while maintaining conservative money management. Although the strategy may underperform in ranging markets, the suggested optimization directions can further enhance its stability and profitability. For investors seeking stable returns, this quantitative trading strategy represents a worthy consideration.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Limit Buy at EMA20 (Last 30 Days)", overlay=true)

// Inputs for EMAs

ema20Length = input.int(30, title="EMA 20 Length")

ema300Length = input.int(300, title="EMA 300 Length")

tpPercentage = input.float(10.0, title="Take Profit (%)", step=0.1) / 100

slPercentage = input.float(5.0, title="Stop Loss (%)", step=0.1) / 100 // Stop loss at 15%

// Calculate EMAs

ema20 = ta.ema(close, ema20Length)

ema300 = ta.ema(close, ema300Length)

// Plot EMAs

plot(ema20, color=color.blue, title="EMA 20")

plot(ema300, color=color.red, title="EMA 300")

// Limit backtesting to the last 30 days

startTime = timestamp(year(timenow), month(timenow), dayofmonth(timenow) - 30, 0, 0)

if (time < startTime)

strategy.close_all()

strategy.cancel_all()

// Entry Condition: Price above EMA300

longCondition = close > ema300 and time >= startTime

// Calculate position size (10% of equity)

positionSize = strategy.equity * 0.10 / ema20 // Use EMA20 as the limit price

// Place a limit buy order at EMA20

if (longCondition)

strategy.order("Limit Buy", strategy.long, qty=positionSize, limit=ema20)

// Calculate TP and SL levels

tpPrice = ema20 * (1 + tpPercentage)

slPrice = ema20 * (1 - slPercentage)

// Set take profit and stop loss

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", "Limit Buy", stop=slPrice, limit=tpPrice)

- EMA Crossover Trading Strategy with Dynamic Take Profit and Stop Loss

- Adaptive Trend-Following Trading Strategy: 200 EMA Breakout with Dynamic Risk Management System

- Williams %R Dynamic TP/SL Adjustment Strategy

- EMA Crossover with Dual Take Profit and Stop Loss Strategy

- Adaptive EMA Dynamic Position Break-out Trading Strategy

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Advanced EMA Crossover Strategy: Adaptive Trading System with Dynamic Stop-Loss and Take-Profit Targets

- Multi-Timeframe Exponential Moving Average Crossover Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- EMA/SMA Trend Following with Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

- VWAP Standard Deviation Mean Reversion Trading Strategy

- Dynamic Price Zone Breakout Trading Strategy Based on Support and Resistance Quantitative System

- Multi-Indicator Trend Momentum Crossover Quantitative Strategy

- Advanced Dynamic Trailing Stop with Risk-Reward Targeting Strategy

- Advanced Long-Only Dynamic Trendline Breakout Strategy

- Multi-Level Intelligent Dynamic Trailing Stop Strategy Based on Bollinger Bands and ATR

- Dynamic Dual EMA Crossover Strategy with Adaptive Profit/Loss Control

- Bollinger Bands and RSI Combined Dynamic Trading Strategy

- RSI-ATR Momentum Volatility Combined Trading Strategy

- Multi-Strategy Technical Analysis Trading System

- Multi-Timeframe Combined Candlestick Pattern Recognition Trading Strategy

- Triple Bollinger Bands Touch Trend Following Quantitative Trading Strategy

- Multi-Dimensional Dynamic Breakout Trading System Based on Bollinger Bands and RSI

- RSI Mean Reversion Breakout Strategy

- Dual EMA Crossover Momentum Trend Following Strategy

- Multi-Step ATR Trading Strategy with Dynamic Profit Taking

- Dual Timeframe Dynamic Support Trading System

- Multi-Period Moving Average and RSI Momentum Cross Trend Following Strategy

- Financial Asset MFI-Based Oversold Zone Exit and Signal Averaging System