MACD and Linear Regression Dual Signal Intelligent Trading Strategy

Author: ChaoZhang, Date: 2024-12-11 15:46:20Tags: MACDLRSWMATEMAEMASMA

Overview

This strategy is an intelligent trading system that combines MACD (Moving Average Convergence Divergence) and Linear Regression Slope (LRS). It optimizes MACD calculation through multiple moving average methods and incorporates linear regression analysis to enhance signal reliability. The strategy allows traders to flexibly choose between single or dual indicator combinations for generating trading signals and includes stop-loss and take-profit mechanisms for risk control.

Strategy Principles

The strategy’s core lies in capturing market trends through optimized MACD and linear regression indicators. The MACD component utilizes a combination of SMA, EMA, WMA, and TEMA calculations to enhance price trend sensitivity. The linear regression component evaluates trend direction and strength through regression line slope and position analysis. Buy signals can be generated based on MACD crossovers, linear regression uptrends, or a combination of both. Similarly, sell signals can be flexibly configured. The strategy includes percentage-based stop-loss and take-profit settings for effective risk-reward management.

Strategy Advantages

- Indicator combination flexibility: Ability to choose between single or dual indicators based on market conditions

- Enhanced MACD calculation: Improved trend identification through multiple moving average methods

- Objective trend confirmation: Statistically supported trend judgment through linear regression

- Comprehensive risk management: Integrated stop-loss and take-profit mechanisms

- Strong parameter adaptability: Key parameters can be optimized for different market characteristics

Strategy Risks

- Parameter sensitivity: Different market environments may require frequent parameter adjustments

- Signal delay: Moving average indicators have inherent lag

- Ineffective in ranging markets: May generate false signals in sideways markets

- Opportunity cost of dual confirmation: Strict dual-indicator confirmation may miss some good trading opportunities

Strategy Optimization Directions

- Add market environment recognition: Introduce volatility indicators to distinguish between trending and ranging markets

- Dynamic parameter adjustment: Automatically adjust MACD and linear regression parameters based on market conditions

- Optimize stop-loss and take-profit: Implement dynamic levels based on market volatility

- Incorporate volume analysis: Integrate volume indicators to improve signal reliability

- Include timeframe analysis: Consider multiple timeframe confirmation to enhance trading accuracy

Summary

This strategy creates a flexible and reliable trading system by combining improved versions of classic indicators with statistical methods. Its modular design allows traders to adjust strategy parameters and signal confirmation mechanisms according to different market environments. Through continuous optimization and improvement, the strategy shows promise for maintaining stable performance across various market conditions.

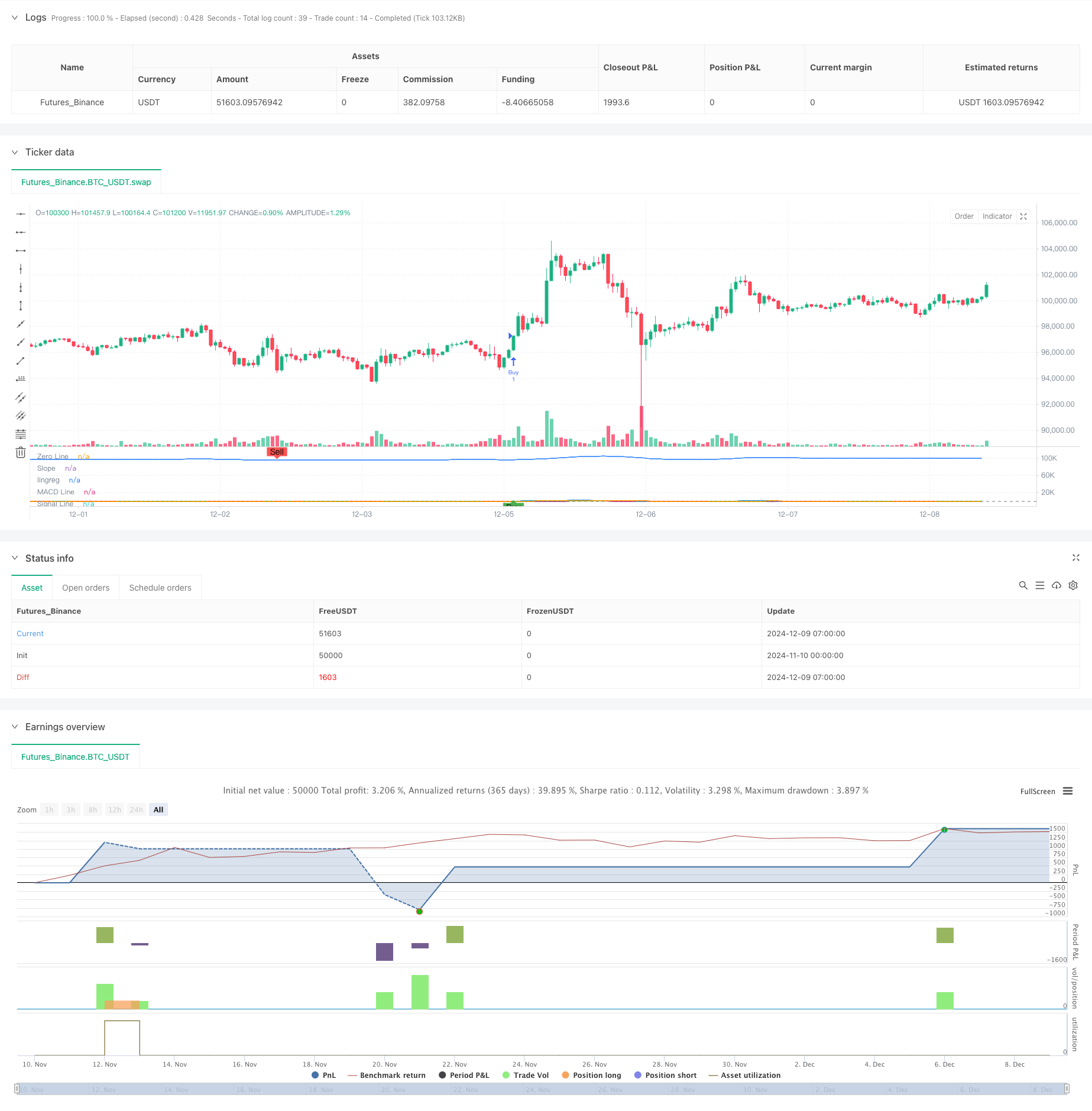

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy('SIMPLIFIED MACD & LRS Backtest by NHBProd', overlay=false)

// Function to calculate TEMA (Triple Exponential Moving Average)

tema(src, length) =>

ema1 = ta.ema(src, length)

ema2 = ta.ema(ema1, length)

ema3 = ta.ema(ema2, length)

3 * (ema1 - ema2) + ema3

// MACD Calculation Function

macdfx(src, fast_length, slow_length, signal_length, method) =>

fast_ma = method == 'SMA' ? ta.sma(src, fast_length) :

method == 'EMA' ? ta.ema(src, fast_length) :

method == 'WMA' ? ta.wma(src, fast_length) :

tema(src, fast_length)

slow_ma = method == 'SMA' ? ta.sma(src, slow_length) :

method == 'EMA' ? ta.ema(src, slow_length) :

method == 'WMA' ? ta.wma(src, slow_length) :

tema(src, slow_length)

macd = fast_ma - slow_ma

signal = method == 'SMA' ? ta.sma(macd, signal_length) :

method == 'EMA' ? ta.ema(macd, signal_length) :

method == 'WMA' ? ta.wma(macd, signal_length) :

tema(macd, signal_length)

hist = macd - signal

[macd, signal, hist]

// MACD Inputs

useMACD = input(true, title="Use MACD for Signals")

src = input(close, title="MACD Source")

fastp = input(12, title="MACD Fast Length")

slowp = input(26, title="MACD Slow Length")

signalp = input(9, title="MACD Signal Length")

macdMethod = input.string('EMA', title='MACD Method', options=['EMA', 'SMA', 'WMA', 'TEMA'])

// MACD Calculation

[macd, signal, hist] = macdfx(src, fastp, slowp, signalp, macdMethod)

// Linear Regression Inputs

useLR = input(true, title="Use Linear Regression for Signals")

lrLength = input(24, title="Linear Regression Length")

lrSource = input(close, title="Linear Regression Source")

lrSignalSelector = input.string('Rising Linear', title='Signal Selector', options=['Price Above Linear', 'Rising Linear', 'Both'])

// Linear Regression Calculation

linReg = ta.linreg(lrSource, lrLength, 0)

linRegPrev = ta.linreg(lrSource, lrLength, 1)

slope = linReg - linRegPrev

// Linear Regression Buy Signal

lrBuySignal = lrSignalSelector == 'Price Above Linear' ? (close > linReg) :

lrSignalSelector == 'Rising Linear' ? (slope > 0 and slope > slope[1]) :

lrSignalSelector == 'Both' ? (close > linReg and slope > 0) : false

// MACD Crossover Signals

macdCrossover = ta.crossover(macd, signal)

// Buy Signals based on user choices

macdSignal = useMACD and macdCrossover

lrSignal = useLR and lrBuySignal

// Buy condition: Use AND condition if both are selected, OR condition if only one is selected

buySignal = (useMACD and useLR) ? (macdSignal and lrSignal) : (macdSignal or lrSignal)

// Plot MACD

hline(0, title="Zero Line", color=color.gray)

plot(macd, color=color.blue, title="MACD Line", linewidth=2)

plot(signal, color=color.orange, title="Signal Line", linewidth=2)

plot(hist, color=hist >= 0 ? color.green : color.red, style=plot.style_columns, title="MACD Histogram")

// Plot Linear Regression Line and Slope

plot(slope, color=slope > 0 ? color.purple : color.red, title="Slope", linewidth=2)

plot(linReg,title="lingreg")

// Signal Plot for Visualization

plotshape(buySignal, style=shape.labelup, location=location.bottom, color=color.new(color.green, 0), title="Buy Signal", text="Buy")

// Sell Signals for Exiting Long Positions

macdCrossunder = ta.crossunder(macd, signal) // MACD Crossunder for Sell Signal

lrSellSignal = lrSignalSelector == 'Price Above Linear' ? (close < linReg) :

lrSignalSelector == 'Rising Linear' ? (slope < 0 and slope < slope[1]) :

lrSignalSelector == 'Both' ? (close < linReg and slope < 0) : false

// User Input for Exit Signals: Select indicators to use for exiting trades

useMACDSell = input(true, title="Use MACD for Exit Signals")

useLRSell = input(true, title="Use Linear Regression for Exit Signals")

// Sell condition: Use AND condition if both are selected to trigger a sell at the same time, OR condition if only one is selected

sellSignal = (useMACDSell and useLRSell) ? (macdCrossunder and lrSellSignal) :

(useMACDSell ? macdCrossunder : false) or

(useLRSell ? lrSellSignal : false)

// Plot Sell Signals for Visualization (for exits, not short trades)

plotshape(sellSignal, style=shape.labeldown, location=location.top, color=color.new(color.red, 0), title="Sell Signal", text="Sell")

// Alerts

alertcondition(buySignal, title="Buy Signal", message="Buy signal detected!")

alertcondition(sellSignal, title="Sell Signal", message="Sell signal detected!")

// Take Profit and Stop Loss Inputs

takeProfit = input.float(10.0, title="Take Profit (%)") // Take Profit in percentage

stopLoss = input.float(0.10, title="Stop Loss (%)") // Stop Loss in percentage

// Backtest Date Range

startDate = input(timestamp("2024-01-01 00:00"), title="Start Date")

endDate = input(timestamp("2025-12-12 00:00"), title="End Date")

inBacktestPeriod = true

// Entry Rules (Only Long Entries)

if (buySignal and inBacktestPeriod)

strategy.entry("Buy", strategy.long)

// Exit Rules (Only for Long Positions)

strategy.exit("Exit Buy", from_entry="Buy", limit=close * (1 + takeProfit / 100), stop=close * (1 - stopLoss / 100))

// Exit Long Position Based on Sell Signals

if (sellSignal and inBacktestPeriod)

strategy.close("Buy", comment="Exit Signal")

- Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

- Smarter MACD

- Enhanced EMA/WMA Crossover Strategy with Comprehensive Exit Conditions

- Dual Moving Average Crossover Strategy

- Momentum-based ZigZag

- 2 Moving Average Color Direction Detection

- OCC Strategy R5.1

- Multi-Indicator Adaptive Trading Strategy Based on RSI, MACD and Volume

- Multi-Indicator Synergistic Trading Strategy with Bollinger Bands, Fibonacci, MACD and RSI

- RedK Dual VADER with Energy Bars

- Multi-Factor Counter-Trend Trading Strategy

- Enhanced Momentum Oscillator and Stochastic Divergence Quantitative Trading Strategy

- Multi-Timeframe Fibonacci Retracement with Trend Breakout Trading Strategy

- Multi-Indicator Trend Following Strategy with Profit Optimization

- Fractal Breakout Momentum Trading Strategy with Take Profit Optimization

- Adaptive Mean-Reversion Trading Strategy Based on Chande Momentum Oscillator

- MACD-Supertrend Dual Confirmation Trend Following Trading Strategy

- Multi-Period SuperTrend Dynamic Trading Strategy

- Multi-Timeframe EMA with Fibonacci Retracement and Pivot Points Trading Strategy

- Multi-Timeframe Dynamic Stop-Loss EMA-Squeeze Trading Strategy

- Multi-EMA Trend Following Trading Strategy

- Multi-Timeframe Smoothed Heikin Ashi Trend Following Quantitative Trading System

- Dynamic RSI Oscillator Polynomial Fitting Indicator Trend Quantitative Trading Strategy

- Daily Range Breakout Single-Direction Trading Strategy

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

- EMA/SMA Trend Following with Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

- VWAP Standard Deviation Mean Reversion Trading Strategy

- Dynamic Price Zone Breakout Trading Strategy Based on Support and Resistance Quantitative System

- Multi-Indicator Trend Momentum Crossover Quantitative Strategy

- Advanced Dynamic Trailing Stop with Risk-Reward Targeting Strategy