Multi-Period SuperTrend Dynamic Trading Strategy

Author: ChaoZhang, Date: 2024-12-11 15:59:54Tags: ATR

Overview

This strategy is an automated trading system based on the SuperTrend indicator, generating trading signals by analyzing price crossovers with the SuperTrend line. The strategy employs fixed ATR period and multiplier parameters, combining price crossover direction with the SuperTrend line to determine market trends, achieving an organic integration of trend following and capital management.

Strategy Principle

The core of the strategy utilizes the SuperTrend indicator, which is constructed based on the ATR (Average True Range) volatility indicator. Specific implementation includes: 1. Setting ATR period to 10 and multiplier to 2.0 for calculating the SuperTrend line 2. Generating long signals when closing price crosses above the SuperTrend line 3. Generating short signals when closing price crosses below the SuperTrend line 4. Using SuperTrend line as trailing stop-loss during position holding for dynamic risk control

Strategy Advantages

- Strong trend following capability: SuperTrend indicator effectively identifies market trends, helping the strategy profit in major trend directions

- Comprehensive risk control: Employs trailing stop-loss mechanism for effective profit locking and drawdown control

- Simple and stable parameters: Only requires setting ATR period and multiplier parameters, reducing over-optimization risk

- Wide adaptability: Applicable to different markets and time periods with good universality

- Clear signals: Trading signals are distinct, easy to execute and backtest

Strategy Risks

- Choppy market risk: Prone to frequent trading in sideways markets, leading to excessive losses

- Slippage impact: May face significant slippage in fast markets, affecting strategy performance

- False breakout risk: Market may exhibit false breakouts, leading to incorrect signals

- Parameter sensitivity: ATR parameter selection affects strategy performance, requiring careful setting

Strategy Optimization Directions

- Multi-period optimization: Combine SuperTrend signals from multiple timeframes to improve signal reliability

- Volatility adaptation: Dynamically adjust ATR multiplier based on market volatility to enhance adaptability

- Volume confirmation: Incorporate volume indicators to filter false breakout signals

- Stop-loss mechanism optimization: Set additional stop-loss conditions at key price levels

- Trend strength integration: Add trend strength filters to reduce trading in choppy markets

Summary

This is a well-structured and logically rigorous trend-following strategy. Through the dynamic characteristics of the SuperTrend indicator, it achieves unity in trend capture and risk control. The strategy demonstrates strong practicality and extensibility, and through appropriate parameter settings and implementation of optimization directions, it shows promise for stable performance in live trading.

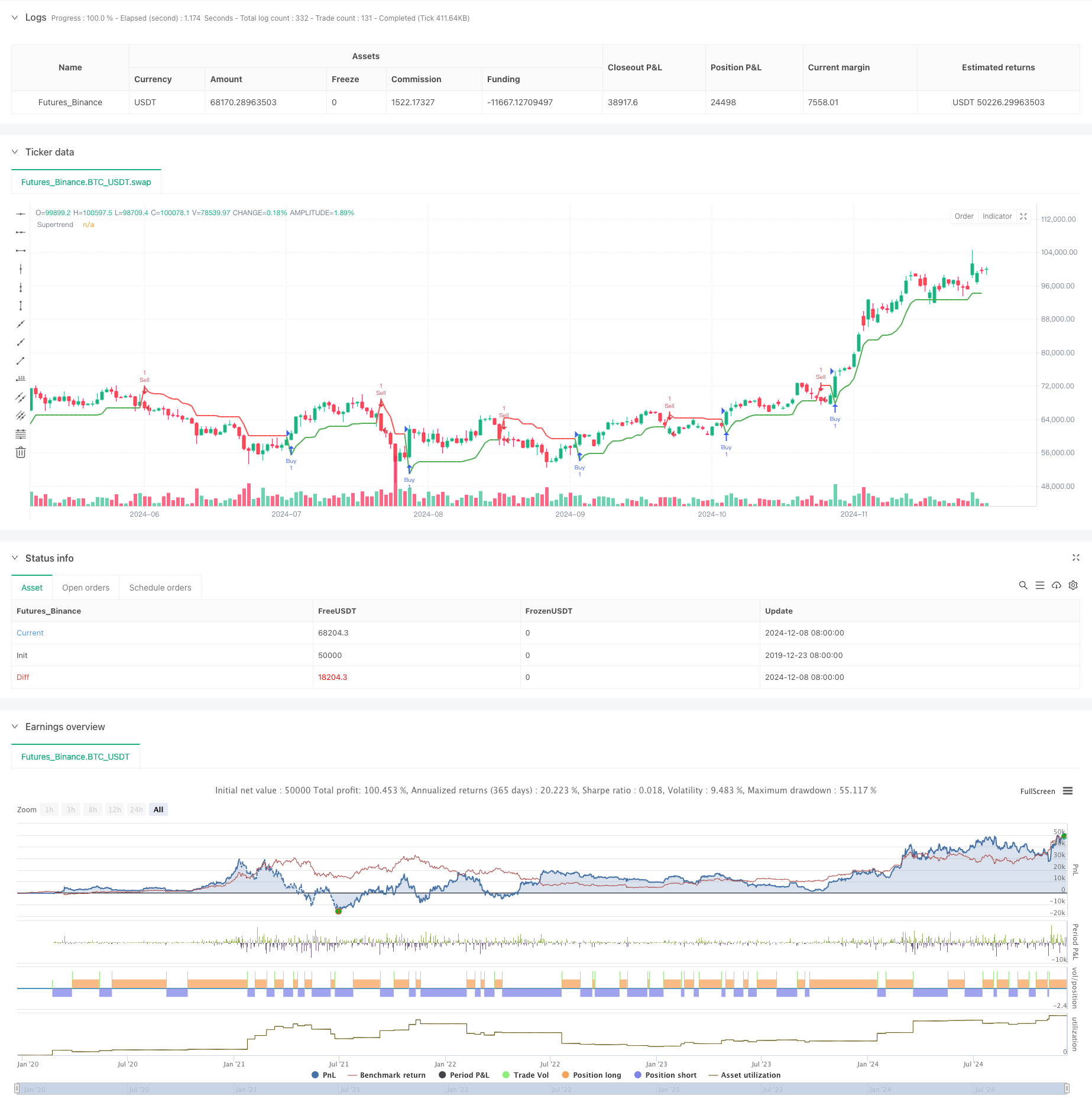

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Commodity KIng", overlay=true)

// Supertrend Parameters

atr_period = 10 // Fixed ATR Period

atr_multiplier = 2.0 // Fixed ATR Multiplier

// Calculate Supertrend

[supertrend, direction] = ta.supertrend(atr_multiplier, atr_period)

// Plot Supertrend with reversed colors

plot(supertrend, color=direction > 0 ? color.red : color.green, title="Supertrend", linewidth=2)

// Buy and Sell Conditions

longCondition = ta.crossover(close, supertrend) // Buy when price crosses above Supertrend

shortCondition = ta.crossunder(close, supertrend) // Sell when price crosses below Supertrend

// Execute Buy and Sell Orders

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

// Exit Conditions

if (shortCondition)

strategy.close("Buy") // Close long position if price crosses below Supertrend

if (longCondition)

strategy.close("Sell") // Close short position if price crosses above Supertrend

// Alerts

if (longCondition)

alert("Buy Signal: " + str.tostring(close), alert.freq_once_per_bar)

if (shortCondition)

alert("Sell Signal: " + str.tostring(close), alert.freq_once_per_bar)

- Multi-level Indicator Overlapping RSI Trading Strategy

- Multi-Indicator Trend Momentum Trading Strategy: An Optimized Quantitative Trading System Based on Bollinger Bands, Fibonacci and ATR

- Triple Bottom Rebound Momentum Breakthrough Strategy

- Enhanced Price-Volume Trend Momentum Strategy

- Dual EMA Pullback Trading System with ATR-Based Dynamic Stop-Loss Optimization

- Multi-Period Bollinger Bands Trend Breakout Strategy with Volatility Risk Control Model

- Dynamic Support and Resistance Adaptive Pivot Trading Strategy

- Multi-Period Supertrend Dynamic Pyramiding Trading Strategy

- Dynamic Volatility-Driven High-Frequency EMA Crossover Quantitative Strategy

- Multi-Timeframe Quantitative Trading Strategy Based on EMA-Smoothed RSI and ATR Dynamic Stop-Loss/Take-Profit

- Adaptive Fibonacci Bollinger Bands Strategy Analysis

- Advanced EMA Momentum Trend Trading Strategy

- Multi-MA Trend Intensity Trading Strategy - A Flexible Smart Trading System Based on MA Deviation

- Volume-Weighted Dual Trend Detection System

- Multi-Factor Counter-Trend Trading Strategy

- Enhanced Momentum Oscillator and Stochastic Divergence Quantitative Trading Strategy

- Multi-Timeframe Fibonacci Retracement with Trend Breakout Trading Strategy

- Multi-Indicator Trend Following Strategy with Profit Optimization

- Fractal Breakout Momentum Trading Strategy with Take Profit Optimization

- Adaptive Mean-Reversion Trading Strategy Based on Chande Momentum Oscillator

- MACD-Supertrend Dual Confirmation Trend Following Trading Strategy

- Multi-Timeframe EMA with Fibonacci Retracement and Pivot Points Trading Strategy

- Multi-Timeframe Dynamic Stop-Loss EMA-Squeeze Trading Strategy

- MACD and Linear Regression Dual Signal Intelligent Trading Strategy

- Multi-EMA Trend Following Trading Strategy

- Multi-Timeframe Smoothed Heikin Ashi Trend Following Quantitative Trading System

- Dynamic RSI Oscillator Polynomial Fitting Indicator Trend Quantitative Trading Strategy

- Daily Range Breakout Single-Direction Trading Strategy

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

- EMA/SMA Trend Following with Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

- VWAP Standard Deviation Mean Reversion Trading Strategy