概述

该策略是一个基于价格分型理论的趋势跟踪交易系统,通过识别市场中的顶底分型结构,结合固定点数的触发条件和止盈设置,实现自动化交易。策略核心是在底分型上方设置多单入场点,顶分型下方设置空单入场点,同时配合相应的止盈点位进行风险控制。

策略原理

策略的核心逻辑包含以下几个关键步骤: 1. 分型识别:通过比较连续三根K线的高低点来识别顶底分型。当中间K线的低点低于两侧K线时形成底分型;当中间K线的高点高于两侧K线时形成顶分型。 2. 入场条件:在识别到底分型后,在其上方107个点位设置多单触发价格;在识别到顶分型后,在其下方107个点位设置空单触发价格。 3. 止盈设置:开仓后在入场价格的基础上设置相同点数(107点)的止盈位。 4. 持仓管理:系统会持续跟踪最新的分型位置,并相应更新入场触发价格。

策略优势

- 客观性强:策略基于明确的数学定义来识别市场结构,避免了主观判断带来的偏差。

- 风险可控:采用固定点数的止盈设置,让每笔交易的盈利目标明确且风险可控。

- 适应性好:策略可以在不同的市场环境下运行,特别适合波动性较大的市场。

- 自动化程度高:整个交易过程从信号识别到执行都是自动化的,减少了人为干预。

策略风险

- 假突破风险:市场可能出现短期突破后立即反转的情况,导致止损出场。

- 震荡市风险:在横盘震荡市场中,频繁的顶底分型可能导致过多的交易信号。

- 固定点数风险:使用固定的入场和止盈点数可能不适合所有市场环境。

- 滑点风险:在高波动性市场中,可能面临严重的滑点问题。

策略优化方向

- 动态点数优化:可以根据市场波动率动态调整入场触发点数和止盈点数。

- 趋势过滤:增加趋势判断指标,只在主趋势方向开仓。

- 市场环境识别:添加市场环境判断机制,在不同市场状态下采用不同的参数设置。

- 仓位管理优化:引入动态仓位管理系统,根据账户净值和市场风险度调整开仓量。

总结

该策略通过结合分型理论和动量突破思想,构建了一个完整的交易系统。策略的优势在于其客观性和自动化程度高,但也存在一定的市场环境适应性问题。通过增加动态参数调整和市场环境识别等优化措施,可以进一步提升策略的稳定性和盈利能力。在实盘交易中,建议投资者根据自身风险承受能力和资金规模来调整参数设置。

策略源码

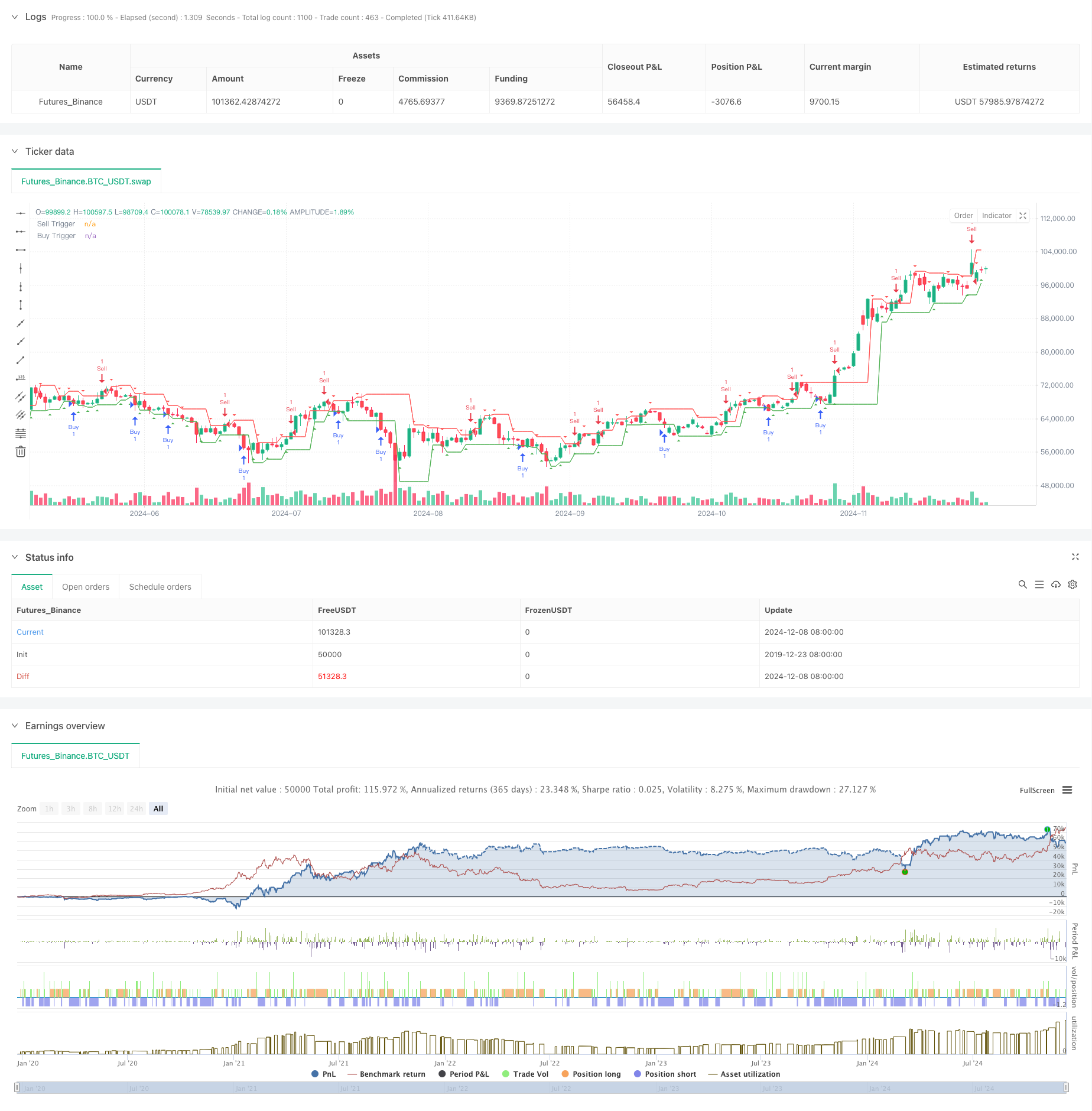

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fractal Buy/Sell Strategy with 107 Pips Target", overlay=true)

// 输入参数

trigger_pips = input.int(107, title="Entry Distance (Pips)") // 入场点距离底分型或顶分型的距离

take_profit_pips = input.int(107, title="Take Profit (Pips)") // 止盈点数

pip_value = syminfo.mintick * 10 // 点值(每点等于多少价格单位)

// 计算分型

is_bottom_fractal = low[1] < low[2] and low[1] < low[0] // 判断是否为底分型

is_top_fractal = high[1] > high[2] and high[1] > high[0] // 判断是否为顶分型

// 存储分型位置

var float last_bottom_fractal = na

var float last_top_fractal = na

// 更新分型值

if is_bottom_fractal

last_bottom_fractal := low[1]

if is_top_fractal

last_top_fractal := high[1]

// 计算开盘价格

bottom_trigger_price = na(last_bottom_fractal) ? na : last_bottom_fractal + trigger_pips * pip_value

top_trigger_price = na(last_top_fractal) ? na : last_top_fractal - trigger_pips * pip_value

// 交易逻辑:底分型多单和顶分型空单

if not na(last_bottom_fractal)

if close <= bottom_trigger_price

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit", from_entry="Buy", limit=bottom_trigger_price + take_profit_pips * pip_value)

if not na(last_top_fractal)

if close >= top_trigger_price

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit", from_entry="Sell", limit=top_trigger_price - take_profit_pips * pip_value)

// 绘制分型和触发价格

plotshape(series=is_bottom_fractal, style=shape.triangleup, location=location.belowbar, color=color.green, title="Bottom Fractal")

plotshape(series=is_top_fractal, style=shape.triangledown, location=location.abovebar, color=color.red, title="Top Fractal")

plot(bottom_trigger_price, title="Buy Trigger", color=color.green, linewidth=1)

plot(top_trigger_price, title="Sell Trigger", color=color.red, linewidth=1)

相关推荐