Multi-Market Adaptive Multi-Indicator Trend Following Strategy

Author: ChaoZhang, Date: 2024-12-12 15:23:28Tags: CMFDPOROCWMAATR

Overview

This is an adaptive trend following strategy based on multiple technical indicators that automatically adjusts parameters according to different market characteristics. The strategy combines the Chaikin Money Flow (CMF), Detrended Price Oscillator (DPO), and Coppock Curve to capture market trends, with volatility adjustment factors to adapt to different market features. It includes a comprehensive position management and risk control system that dynamically adjusts trading size based on market volatility.

Strategy Principles

The core logic of the strategy is to confirm trend direction and trading timing through multiple indicator cooperation: 1. Uses CMF indicator to measure money flow and judge market sentiment 2. Employs DPO to eliminate long-term trend influence and focus on medium-short term price fluctuations 3. Adopts modified Coppock indicator to capture trend turning points 4. Generates trading signals only when all three indicators confirm 5. Dynamically calculates stop-loss and take-profit levels using ATR 6. Automatically adjusts leverage and volatility parameters based on different market characteristics (stocks, forex, futures)

Strategy Advantages

- Multiple indicator cross-validation effectively filters false signals

- Strong adaptability suitable for different market environments

- Comprehensive position management system with dynamic position sizing based on volatility

- Includes stop-loss and take-profit mechanisms to control risk while protecting profits

- Supports multiple instrument trading for risk diversification

- Clear trading logic that’s easy to maintain and optimize

Strategy Risks

- Multiple indicator system may have lag in fast-moving markets

- Parameter optimization may lead to overfitting

- False signals may occur during market regime changes

- Tight stop-loss settings may result in frequent stops

- Trading costs will impact strategy returns Risk management recommendations:

- Regular parameter validity checks

- Real-time position monitoring

- Proper leverage control

- Maximum drawdown limits

Optimization Directions

- Introduce market volatility state judgment to use different parameter sets in different volatility environments

- Add more market characteristic identification indicators to improve strategy adaptability

- Optimize stop-loss and take-profit mechanisms, consider implementing trailing stops

- Develop automatic parameter optimization system for periodic adjustment

- Add trading cost analysis module

- Implement risk warning mechanism

Summary

This strategy is a comprehensive trend following system that balances returns and risk through multiple indicators and risk control mechanisms. The strategy has strong extensibility with significant room for optimization. It is recommended to start with small scale in live trading, gradually increase trading size, while continuously monitoring strategy performance and adjusting parameters timely.

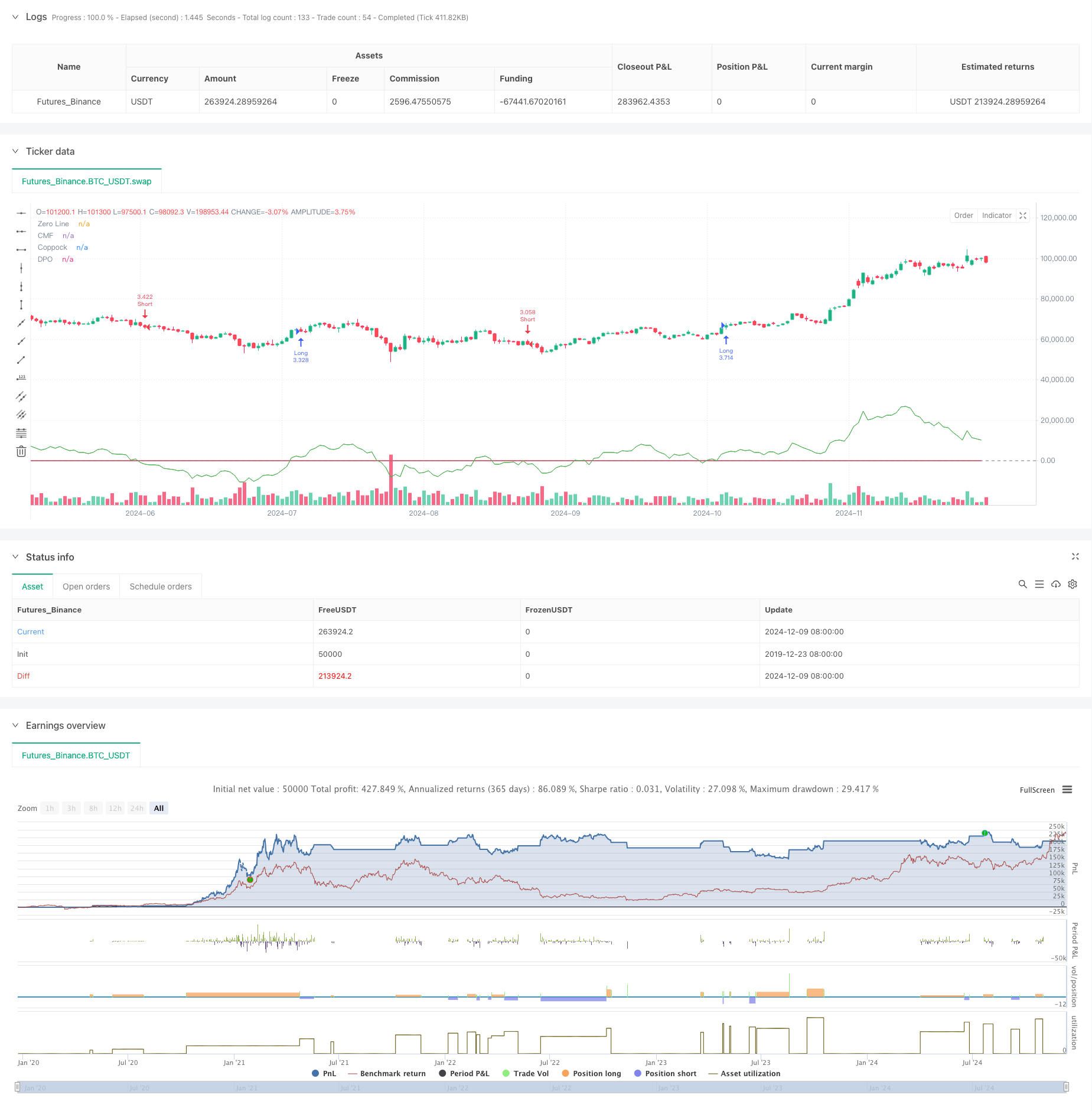

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multi-Market Adaptive Trading Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters

i_market_type = input.string("Crypto", "Market Type", options=["Forex", "Crypto", "Futures"])

i_risk_percent = input.float(1, "Risk Per Trade (%)", minval=0.1, maxval=100, step=0.1)

i_volatility_adjustment = input.float(1.0, "Volatility Adjustment", minval=0.1, maxval=5.0, step=0.1)

i_max_position_size = input.float(5.0, "Max Position Size (%)", minval=1.0, maxval=100.0, step=1.0)

i_max_open_trades = input.int(3, "Max Open Trades", minval=1, maxval=10)

// Indicator Parameters

i_cmf_length = input.int(20, "CMF Length", minval=1)

i_dpo_length = input.int(21, "DPO Length", minval=1)

i_coppock_short = input.int(11, "Coppock Short ROC", minval=1)

i_coppock_long = input.int(14, "Coppock Long ROC", minval=1)

i_coppock_wma = input.int(10, "Coppock WMA", minval=1)

i_atr_length = input.int(14, "ATR Length", minval=1)

// Market-specific Adjustments

volatility_factor = i_market_type == "Forex" ? 0.1 : i_market_type == "Futures" ? 1.5 : 1.0

volatility_factor *= i_volatility_adjustment

leverage = i_market_type == "Forex" ? 100.0 : i_market_type == "Futures" ? 20.0 : 3.0

// Calculate Indicators

mf_multiplier = ((close - low) - (high - close)) / (high - low)

mf_volume = mf_multiplier * volume

cmf = ta.sma(mf_volume, i_cmf_length) / ta.sma(volume, i_cmf_length)

dpo_offset = math.floor(i_dpo_length / 2) + 1

dpo = close - ta.sma(close, i_dpo_length)[dpo_offset]

roc1 = ta.roc(close, i_coppock_short)

roc2 = ta.roc(close, i_coppock_long)

coppock = ta.wma(roc1 + roc2, i_coppock_wma)

atr = ta.atr(i_atr_length)

// Define Entry Conditions

long_condition = cmf > 0 and dpo > 0 and coppock > 0 and ta.crossover(coppock, 0)

short_condition = cmf < 0 and dpo < 0 and coppock < 0 and ta.crossunder(coppock, 0)

// Calculate Position Size

account_size = strategy.equity

risk_amount = math.min(account_size * (i_risk_percent / 100), account_size * (i_max_position_size / 100))

position_size = (risk_amount / (atr * volatility_factor)) * leverage

// Execute Trades

if (long_condition and strategy.opentrades < i_max_open_trades)

sl_price = close - (atr * 2 * volatility_factor)

tp_price = close + (atr * 3 * volatility_factor)

strategy.entry("Long", strategy.long, qty=position_size)

strategy.exit("Long Exit", "Long", stop=sl_price, limit=tp_price)

if (short_condition and strategy.opentrades < i_max_open_trades)

sl_price = close + (atr * 2 * volatility_factor)

tp_price = close - (atr * 3 * volatility_factor)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Short Exit", "Short", stop=sl_price, limit=tp_price)

// Plot Indicators

plot(cmf, color=color.blue, title="CMF")

plot(dpo, color=color.green, title="DPO")

plot(coppock, color=color.red, title="Coppock")

hline(0, "Zero Line", color=color.gray)

// Alerts

alertcondition(long_condition, title="Long Entry", message="Potential Long Entry Signal")

alertcondition(short_condition, title="Short Entry", message="Potential Short Entry Signal")

// // Performance reporting

// if barstate.islastconfirmedhistory

// label.new(bar_index, high, text="Strategy Performance:\nTotal Trades: " + str.tostring(strategy.closedtrades) +

// "\nWin Rate: " + str.tostring(strategy.wintrades / strategy.closedtrades * 100, "#.##") + "%" +

// "\nProfit Factor: " + str.tostring(strategy.grossprofit / strategy.grossloss, "#.##"))

- Super Trend Daily 2.0 BF

- Dynamic Dual Supertrend Volume-Price Strategy

- VWAP-ATR Trend Following and Price Reversal Strategy

- Dynamic Dual-SMA Trend Following Strategy with Smart Risk Management

- SuperJump Turn Back Bollinger Band

- Super Scalper

- ESSMA

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Super Scalper - 5 Min 15 Min

- SuperTrended Moving Averages

- Dynamic ATR-based Trailing Stop Trading Strategy

- Momentum Trend Following MACD-RSI Dual Confirmation Trading Strategy

- Dynamic Pivot Points with Golden Cross Optimization System

- Multi-Indicator Trend Following Strategy with Bollinger Bands and ATR Dynamic Stop Loss

- Dynamic Trend Following ATR Multi-Period Trading Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- Multi-EMA Trend Following Strategy with SMMA Confirmation

- Multi-Indicator Trend Trading System with Momentum Analysis Strategy

- Trend-Following Cloud Momentum Divergence Strategy

- Multi-Indicator Trend Following and Volatility Breakout Strategy

- Dynamic Timing and Position Management Strategy Based on Volatility

- EMA-MACD Composite Strategy for Trend Scalping

- Multi-Technical Indicator Based Trend Following and Momentum Strategy

- High-Frequency Quantitative Session Trading Strategy: Adaptive Dynamic Position Management System Based on Breakout Signals

- Enhanced Bollinger Breakout Quantitative Strategy with Momentum Filter Integration System

- Multi-EMA Crossover Momentum Trend Following Strategy

- Multi-Target Intelligent Volume Momentum Trading Strategy

- Multi-Period Bollinger Bands Touch Trend Reversal Quantitative Trading Strategy

- High-Frequency Breakout Trading Strategy Based on Candlestick Close Direction

- Advanced Dynamic Fibonacci Retracement Trend Quantitative Trading Strategy