Dynamic ATR Trend Following Strategy Based on Support Breakout

Author: ChaoZhang, Date: 2024-12-12 17:26:00Tags: ATREMASMC

Overview

This is a dynamic ATR trend following strategy based on support breakout. The strategy incorporates EMA system, ATR volatility indicator, and Smart Money Concept (SMC) to capture market trends. It achieves effective risk management through dynamic position sizing and stop-loss/take-profit placement.

Strategy Principle

The strategy is built on several core components: 1. Uses 50 and 200-period EMA system to confirm market trend direction 2. Utilizes ATR indicator to dynamically adjust stop-loss and profit targets 3. Analyzes Order Blocks and Imbalance Zones to find optimal entry points 4. Automatically calculates position size based on account risk percentage 5. Determines market consolidation by observing price range of last 20 candles

Strategy Advantages

- Comprehensive risk management through dynamic calculation

- Reliable trend identification system that avoids consolidation markets

- Reasonable stop-loss and take-profit settings with 1:3 risk-reward ratio

- Adapts well to different market conditions

- Clear code structure that’s easy to maintain and optimize

Strategy Risks

- EMA indicators have inherent lag, potentially delaying entry points

- May generate false signals in highly volatile markets

- Strategy depends on trend continuation, may underperform in ranging markets

- Wide stop-loss placement may lead to larger losses in certain situations

Optimization Directions

- Incorporate volume-price relationship analysis to improve trend identification

- Add market sentiment indicators to optimize entry timing

- Consider multiple timeframe analysis to enhance system stability

- Refine Order Block and Imbalance Zone identification criteria

- Optimize stop-loss method, consider implementing trailing stops

Summary

This strategy is a comprehensive trend following system that achieves trading stability through proper risk management and multiple signal confirmation. Despite some lag in signals, it represents a reliable trading system overall. It’s recommended to conduct thorough backtesting before live implementation and optimize parameters according to specific trading instruments and market conditions.

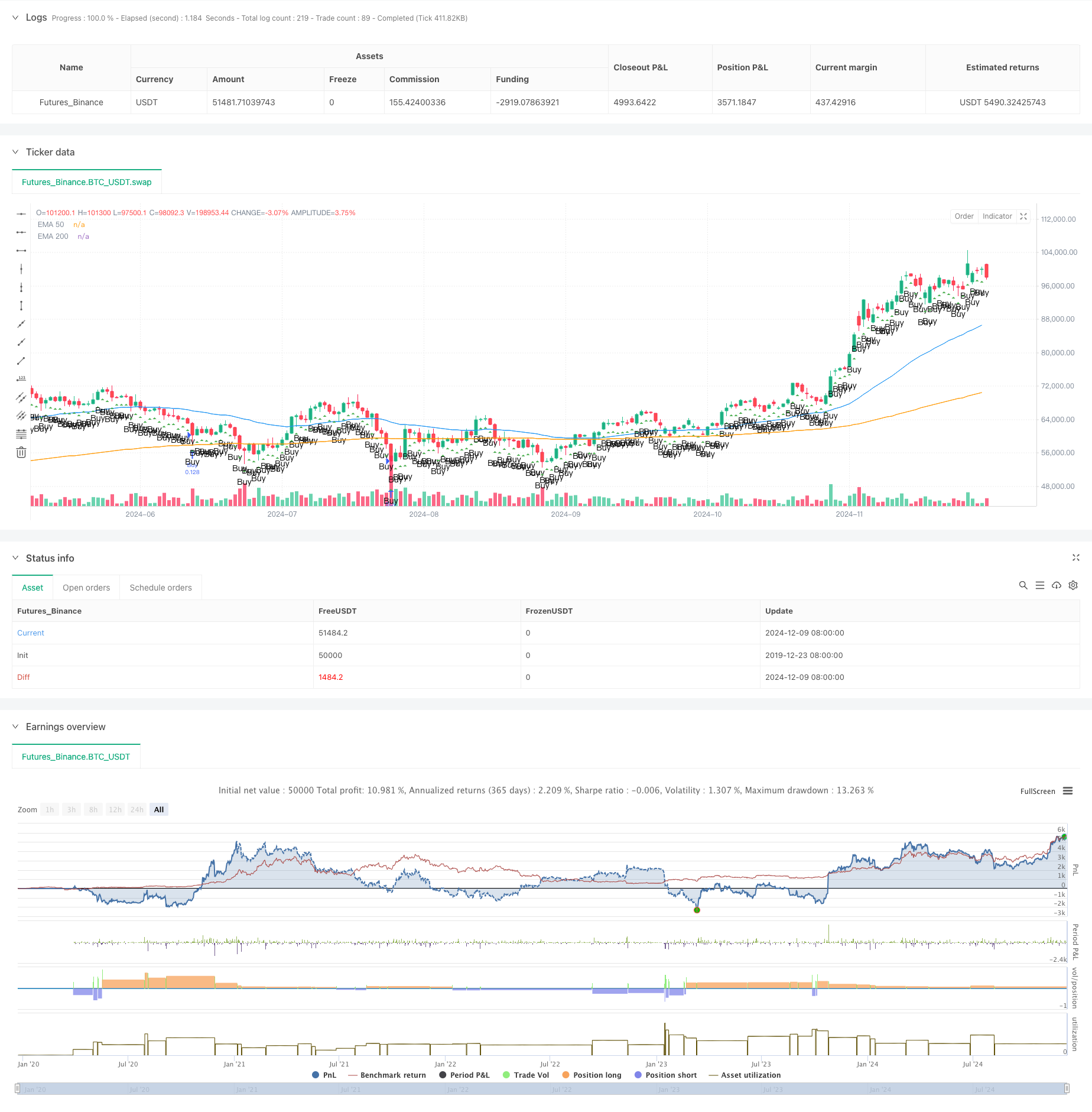

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// TradingView Pine Script strategy for Smart Money Concept (SMC)

//@version=5

strategy("Smart Money Concept Strategy", overlay=true, default_qty_type=strategy.fixed, default_qty_value=100)

// === Input Parameters ===

input_risk_percentage = input.float(1, title="Risk Percentage", step=0.1)

input_atr_length = input.int(14, title="ATR Length")

input_ema_short = input.int(50, title="EMA Short")

input_ema_long = input.int(200, title="EMA Long")

// === Calculations ===

atr = ta.atr(input_atr_length)

ema_short = ta.ema(close, input_ema_short)

ema_long = ta.ema(close, input_ema_long)

// === Utility Functions ===

// Identify Order Blocks

is_order_block(price, direction) =>

((high[1] > high[2] and low[1] > low[2] and direction == 1) or (high[1] < high[2] and low[1] < low[2] and direction == -1))

// Identify Imbalance Zones

is_imbalance() =>

range_high = high[1]

range_low = low[1]

range_high > close and range_low < close

// Calculate Lot Size Based on Risk

calculate_lot_size(stop_loss_points, account_balance) =>

risk_amount = account_balance * (input_risk_percentage / 100)

lot_size = risk_amount / (stop_loss_points * syminfo.pointvalue)

lot_size

// Determine if Market is Consolidating

is_consolidating() =>

(ta.highest(high, 20) - ta.lowest(low, 20)) / atr < 2

// === Visual Enhancements ===

// Plot Order Blocks

// if is_order_block(close, 1)

// line.new(x1=bar_index[1], y1=low[1], x2=bar_index, y2=low[1], color=color.green, width=2, extend=extend.right)

// if is_order_block(close, -1)

// line.new(x1=bar_index[1], y1=high[1], x2=bar_index, y2=high[1], color=color.red, width=2, extend=extend.right)

// Highlight Imbalance Zones

// if is_imbalance()

// box.new(left=bar_index[1], top=high[1], right=bar_index, bottom=low[1], bgcolor=color.new(color.orange, 80))

// === Logic for Trend Confirmation ===

is_bullish_trend = ema_short > ema_long

is_bearish_trend = ema_short < ema_long

// === Entry Logic ===

account_balance = strategy.equity

if not is_consolidating()

if is_bullish_trend

stop_loss = close - atr * 2

take_profit = close + (math.abs(close - (close - atr * 2)) * 3)

stop_loss_points = math.abs(close - stop_loss) / syminfo.pointvalue

lot_size = calculate_lot_size(stop_loss_points, account_balance)

strategy.entry("Buy", strategy.long, qty=lot_size)

strategy.exit("TP/SL", "Buy", stop=stop_loss, limit=take_profit)

if is_bearish_trend

stop_loss = close + atr * 2

take_profit = close - (math.abs(close - (close + atr * 2)) * 3)

stop_loss_points = math.abs(close - stop_loss) / syminfo.pointvalue

lot_size = calculate_lot_size(stop_loss_points, account_balance)

strategy.entry("Sell", strategy.short, qty=lot_size)

strategy.exit("TP/SL", "Sell", stop=stop_loss, limit=take_profit)

// === Plotting Indicators ===

plot(ema_short, color=color.blue, title="EMA 50")

plot(ema_long, color=color.orange, title="EMA 200")

plotshape(series=is_bullish_trend and not is_consolidating(), style=shape.triangleup, location=location.belowbar, color=color.green, text="Buy")

plotshape(series=is_bearish_trend and not is_consolidating(), style=shape.triangledown, location=location.abovebar, color=color.red, text="Sell")

- Enhanced Multi-Indicator Momentum Trading Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- K Consecutive Candles Bull Bear Strategy

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- Multi-EMA Cross with Oscillator and Dynamic Support/Resistance Trading Strategy

- Keltner Channels EMA ATR Strategy

- SMC & EMA Strategy with P&L Projections

- ATR and EMA-based Dynamic Take Profit and Stop Loss Adaptive Strategy

- EMA Dynamic Trend Following Trading Strategy

- Triple EMA Crossover Strategy

- Dual Momentum Breakthrough Confirmation Quantitative Trading Strategy

- MACD-RSI Trend Momentum Cross Strategy with Risk Management Model

- Multi-Period EMA Crossover with RSI Momentum and ATR Volatility Based Trend Following Strategy

- Dual EMA Crossover Strategy with Smart Risk-Reward Control

- Multi-Moving Average Trend Following Strategy - Long-term Investment Signal System Based on EMA and SMA Indicators

- Historical High Breakthrough with Monthly Moving Average Filter Trend Following Strategy

- Multi-Equilibrium Price Trend Following and Reversal Trading Strategy

- Dynamic Volatility Index (VIDYA) with ATR Trend-Following Reversal Strategy

- Multi-Indicator Adaptive Trading Strategy Based on RSI, MACD and Volume

- Price Pattern Based Double Bottom and Top Automated Trading Strategy

- Multiple Moving Average and Stochastic Oscillator Crossover Quantitative Strategy

- Adaptive Trend Following and Reversal Detection Strategy: A Quantitative Trading System Based on ZigZag and Aroon Indicators

- Multi-Indicator Synergistic Trading Strategy with Bollinger Bands, Fibonacci, MACD and RSI

- Mean Reversion Bollinger Band Dollar-Cost Averaging Investment Strategy

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Multi-Timeframe Trend Dynamic ATR Tracking Strategy

- Moving Average Crossover with RSI Trend Momentum Tracking Strategy

- Dynamic ATR-based Trailing Stop Trading Strategy

- Momentum Trend Following MACD-RSI Dual Confirmation Trading Strategy

- Dynamic Pivot Points with Golden Cross Optimization System